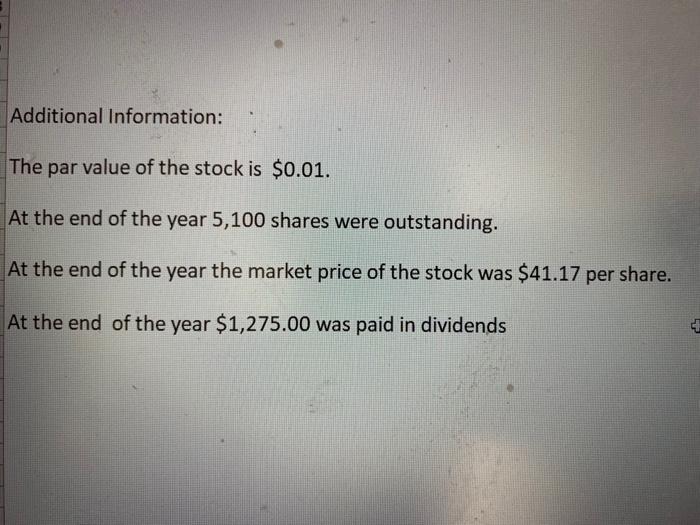

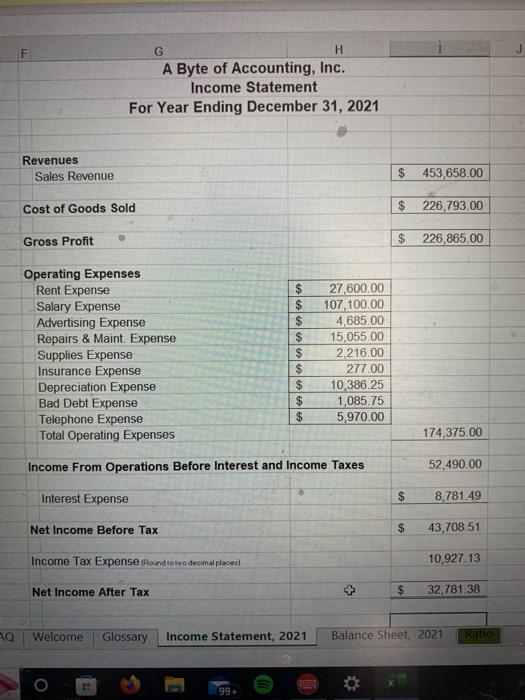

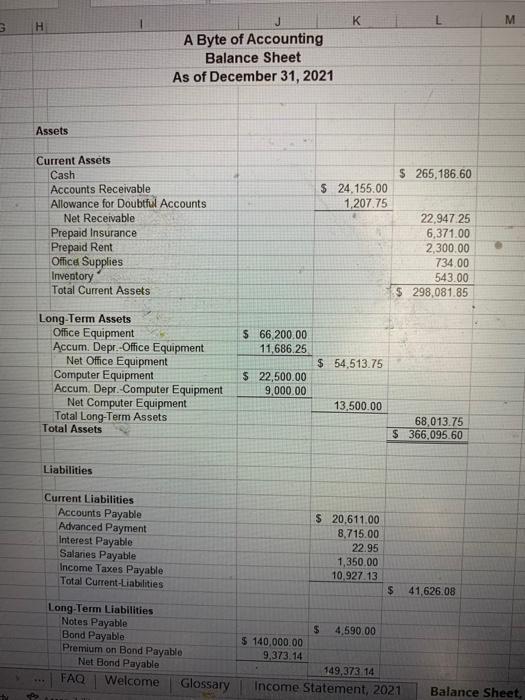

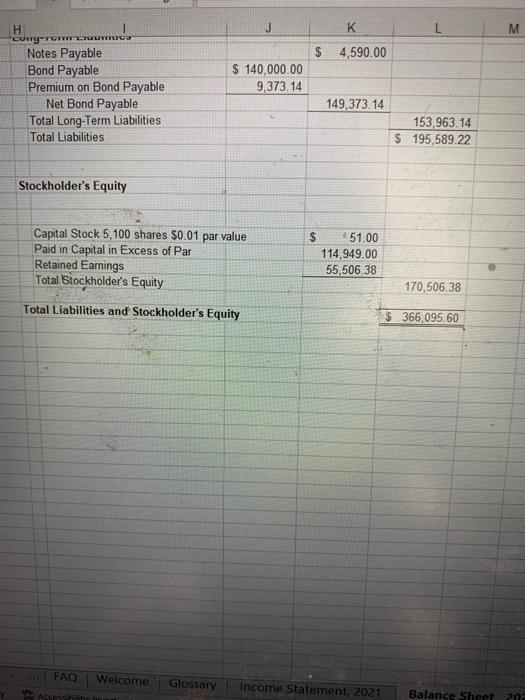

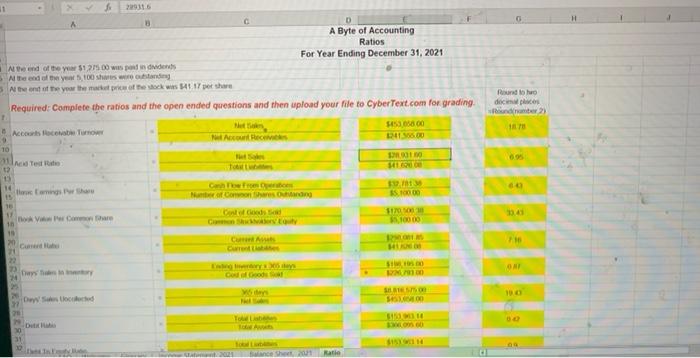

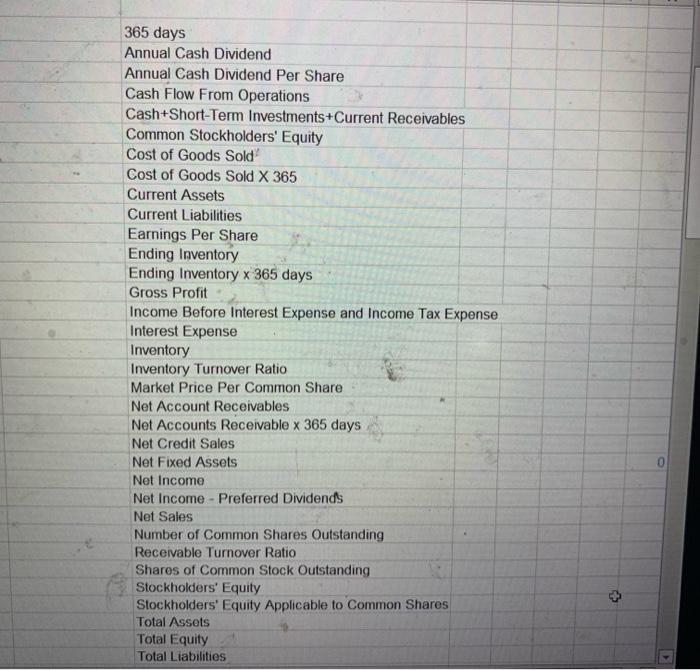

Additional Information: The par value of the stock is $0.01. At the end of the year 5,100 shares were outstanding. At the end of the year the market price of the stock was $41.17 per share. At the end of the year $1,275.00 was paid in dividends Notes Payable Bond Payable Premium on Bond Payable Net Bond Payable Total Long-Term Liabilities Total Liabilities \begin{tabular}{|l|l|} \multicolumn{1}{|c|}{149,373.14} \\ & 153,963.14 \\ \hline & $195,589.22 \\ \hline \end{tabular} Stockholder's Equity Capital Stock 5,100 shares $0.01 par value Paid in Capital in Excess of Par Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity $366,095,60 Divisend Ywels 365days Annual Cash Dividend Annual Cash Dividend Per Share Cash Flow From Operations Cash+Short-Term Investments+Current Receivables Common Stockholders' Equity Cost of Goods Sold Cost of Goods Sold X 365 Current Assets Current Liabilities Earnings Per Share Ending Inventory Ending Inventory 365 days Gross Profit Income Before Interest Expense and Income Tax Expense Interest Expense Inventory \begin{tabular}{l} Inventory Turnover Ratio \\ Market Price Per Common Share \\ Net Account Receivables \\ Net Accounts Receivable x 365 days \\ Net Credit Sales \\ Net Fixed Assets \\ Net Income \\ Net Income - Preferred Dividends \\ \hline \end{tabular} Net Sales Number of Common Shares Outstanding Receivable Turnover Ratio Shares of Common Stock Outstanding Stockholders' Equity Stockholders' Equity Applicable to Common Shares Total Assets Total Equity Total Liabilities Additional Information: The par value of the stock is $0.01. At the end of the year 5,100 shares were outstanding. At the end of the year the market price of the stock was $41.17 per share. At the end of the year $1,275.00 was paid in dividends Notes Payable Bond Payable Premium on Bond Payable Net Bond Payable Total Long-Term Liabilities Total Liabilities \begin{tabular}{|l|l|} \multicolumn{1}{|c|}{149,373.14} \\ & 153,963.14 \\ \hline & $195,589.22 \\ \hline \end{tabular} Stockholder's Equity Capital Stock 5,100 shares $0.01 par value Paid in Capital in Excess of Par Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity $366,095,60 Divisend Ywels 365days Annual Cash Dividend Annual Cash Dividend Per Share Cash Flow From Operations Cash+Short-Term Investments+Current Receivables Common Stockholders' Equity Cost of Goods Sold Cost of Goods Sold X 365 Current Assets Current Liabilities Earnings Per Share Ending Inventory Ending Inventory 365 days Gross Profit Income Before Interest Expense and Income Tax Expense Interest Expense Inventory \begin{tabular}{l} Inventory Turnover Ratio \\ Market Price Per Common Share \\ Net Account Receivables \\ Net Accounts Receivable x 365 days \\ Net Credit Sales \\ Net Fixed Assets \\ Net Income \\ Net Income - Preferred Dividends \\ \hline \end{tabular} Net Sales Number of Common Shares Outstanding Receivable Turnover Ratio Shares of Common Stock Outstanding Stockholders' Equity Stockholders' Equity Applicable to Common Shares Total Assets Total Equity Total Liabilities