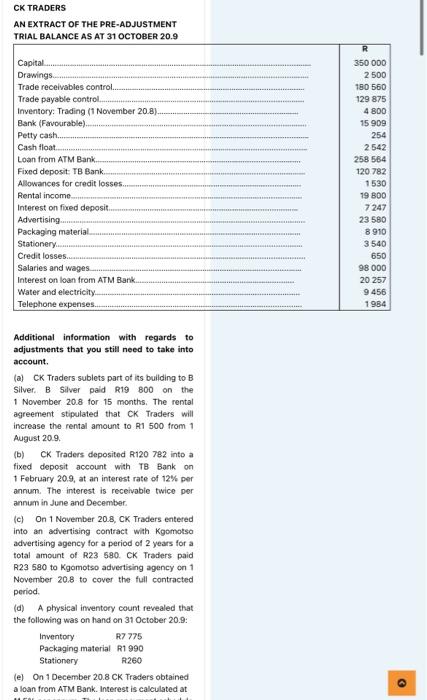

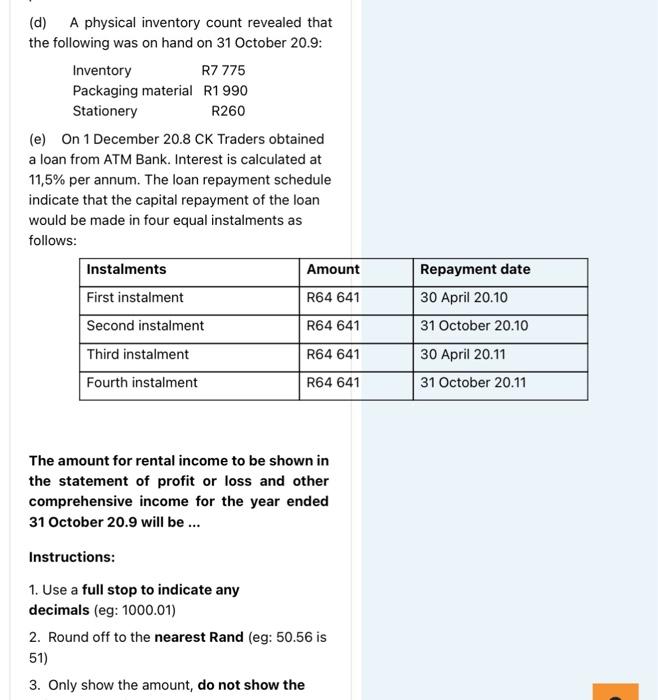

Additional information with regards to adjustments that you still need to take into account. (a) CK. Traders sublets part ot its building to B Silver. B Silver paid R19 800 on the 1 November 20.8 for 15 months, The rental agreement stipulated that CK Traders will increase the rental amount to R1 500 from 1 August 20.9. (b) CK Traders deposited R120 782 into a fixed deposit account with TB Bank on 1 February 20.9 , at an interest rate of 12% per annum. The interest is recelvable twice per annum in June and December. (c) On 1 November 20.8, CK Traders entered into an advertising contract with Kgomotso advertising agency for a period of 2 years for a total amount of R23 580. CK Traders paid R23 580 to Kgomotso advertising agency on 1 November 20.8 to cover the full contracted period. (d) A physical inventory count revealed that the following was on hand on 31 Oetober 20.9: ImventoryPackagingmaterialStationeryR7775R1990A260 (e) On 1 December 20.8 CK Traders obtained a loan from ATM Bank. Interest is calculated at (d) A physical inventory count revealed that the following was on hand on 31 October 20.9: (e) On 1 December 20.8CK Traders obtained a loan from ATM Bank. Interest is calculated at 11,5% per annum. The loan repayment schedule indicate that the capital repayment of the loan would be made in four equal instalments as follows: The amount for rental income to be shown in the statement of profit or loss and other comprehensive income for the year ended 31 October 20.9 will be ... Instructions: 1. Use a full stop to indicate any decimals (eg: 1000.01) 2. Round off to the nearest Rand (eg: 50.56 is 51) 3. Only show the amount, do not show the Additional information with regards to adjustments that you still need to take into account. (a) CK. Traders sublets part ot its building to B Silver. B Silver paid R19 800 on the 1 November 20.8 for 15 months, The rental agreement stipulated that CK Traders will increase the rental amount to R1 500 from 1 August 20.9. (b) CK Traders deposited R120 782 into a fixed deposit account with TB Bank on 1 February 20.9 , at an interest rate of 12% per annum. The interest is recelvable twice per annum in June and December. (c) On 1 November 20.8, CK Traders entered into an advertising contract with Kgomotso advertising agency for a period of 2 years for a total amount of R23 580. CK Traders paid R23 580 to Kgomotso advertising agency on 1 November 20.8 to cover the full contracted period. (d) A physical inventory count revealed that the following was on hand on 31 Oetober 20.9: ImventoryPackagingmaterialStationeryR7775R1990A260 (e) On 1 December 20.8 CK Traders obtained a loan from ATM Bank. Interest is calculated at (d) A physical inventory count revealed that the following was on hand on 31 October 20.9: (e) On 1 December 20.8CK Traders obtained a loan from ATM Bank. Interest is calculated at 11,5% per annum. The loan repayment schedule indicate that the capital repayment of the loan would be made in four equal instalments as follows: The amount for rental income to be shown in the statement of profit or loss and other comprehensive income for the year ended 31 October 20.9 will be ... Instructions: 1. Use a full stop to indicate any decimals (eg: 1000.01) 2. Round off to the nearest Rand (eg: 50.56 is 51) 3. Only show the amount, do not show the