Question

Additional information: 1. Equipment originally purchased for 30,000 with a useful life of 10 years with no residual value been used for 7 years sold

Additional information:

1. Equipment originally purchased for €30,000 with a useful life of 10 years with no residual value

been used for 7 years sold in 2012. Depreciation using the straight-line method.

2. Depreciation and amortization expenses are included in Operating Expenses.

3. Barca did not record an impairment loss/bad debt expense as long as

in 2012.

4. The 2012 dividend was given in cash.

5. During the year, the company acquired a number of equipment. Part of the equipment, worth

€24,000, acquired in exchange for 2,000 shares of common stock. The rest, obtained through

cash purchases.

Task:

(a) Prepare a Statement of Cash Flows using the direct method. (17.5 points)

(b) Prepare a Statement of Cash Flows using the indirect method for Activities

Operation only.

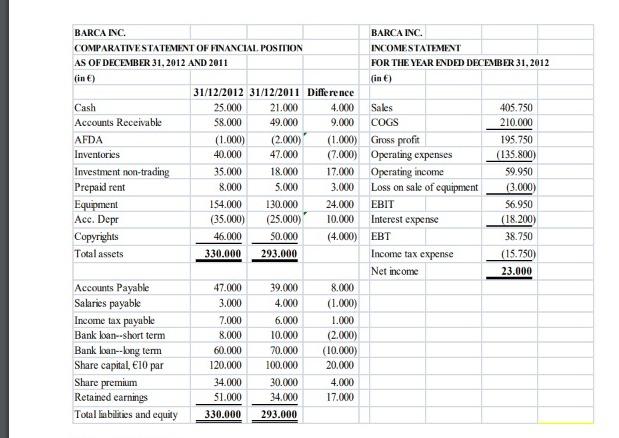

BARCA INC. COMPARATIVE STATEMENT OF FINANCIAL POSITION AS OF DECEMBER 31, 2012 AND 2011 (in ) Cash Accounts Receivable AFDA Inventories Investment non-trading Prepaid rent Equipment Acc. Depr Copyrights Total assets Accounts Payable Salaries payable Income tax payable Bank loan-short term Bank loan--long term Share capital, 10 par Share premium Retained earnings Total liabilities and equity 31/12/2012 31/12/2011 Difference 25.000 21.000 58.000 49.000 (1.000) (2.000) 40.000 47.000 35.000 8.000 154.000 (35.000) 46.000 330.000 47.000 3.000 7.000 8.000 60.000 120.000 34.000 51.000 330.000 18.000 5.000 39.000 4.000 6.000 10.000 70.000 100.000 4.000 9.000 130.000 24.000 (25.000) 10.000 50.000 (4.000) 293.000 30.000 34.000 293.000 17.000 3.000 (1.000) Gross profit (7.000) Operating expenses Operating income Loss on sale of equipment EBIT Interest expense EBT 8.000 (1.000) 1.000 (2.000) (10.000) 20.000 BARCA INC. INCOME STATEMENT 4.000 17.000 FOR THE YEAR ENDED DECEMBER 31, 2012 (in ) Sales COGS Income tax expense Net income 405.750 210.000 195.750 (135.800) 59.950 (3.000) 56.950 (18.200) 38.750 (15.750) 23.000

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To solve for the Statement of Cash Flows using both the direct and indirect methods we need to analyze the given financial statements the Comparative Statement of Financial Position Balance Sheet as o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started