Question

Additional notes 1. The company received cash proceeds of R57 000 from the disposal equipment that had a cost of R60 000. 2. Dividends of

Additional notes 1. The company received cash proceeds of R57 000 from the disposal equipment that had a cost of R60 000.

2. Dividends of R100 000 were paid out during the year.

Required: 3.1 Prepare the companys Statement of Cash flows for the year ended 31 December 2022. Employ the direct method of computing cash flows from operating activities.

3.2 Discuss the most notable differences between direct and indirect cash flow reporting.

3.3 List any two (3) adjustments for non-operating expenses that accountants normally make to determine cash flows in operating activities.

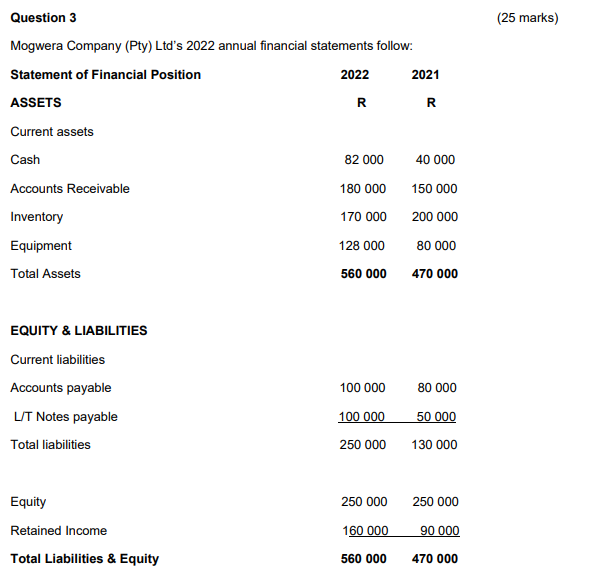

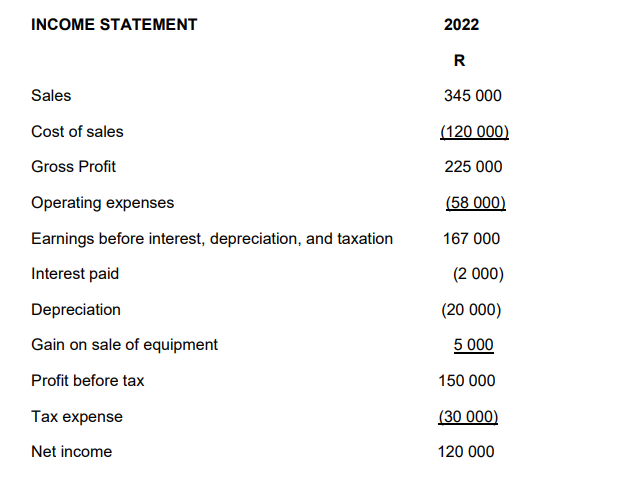

Question 3 (25 marks) Mogwera Company (Pty) Ltd's 2022 annual financial statements follow: Statement of Financial Position ASSETS Current assets Cash Accounts Receivable Inventory Equipment Total Assets EQUITY \& LIABILITIES Current liabilities Accounts payable L/T Notes payable Total liabilities Equity Retained Income Total Liabilities \& Equity 2022 R 82000 180000 170000 128000 560000 2021 R 40000 150000 200000 80000 470000 \begin{tabular}{rr} 100000 & 80000 \\ 100000 & 50000 \\ \hline 250000 & 130000 \end{tabular} 250000250000 16000090000 560000470000 \begin{tabular}{lr} INCOME STATEMENT & \multicolumn{2}{l}{R} \\ & R22 \\ Sales & 345000 \\ Cost of sales & (120000) \\ Gross Profit & 225000 \\ Operating expenses & (58000) \\ Earnings before interest, depreciation, and taxation & 167000 \\ Interest paid & (2000) \\ Depreciation & (20000) \\ Gain on sale of equipment & 5000 \\ Profit before tax & 150000 \\ Tax expense & (30000) \\ Net income & 120000 \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started