Additional notes below are required reading:

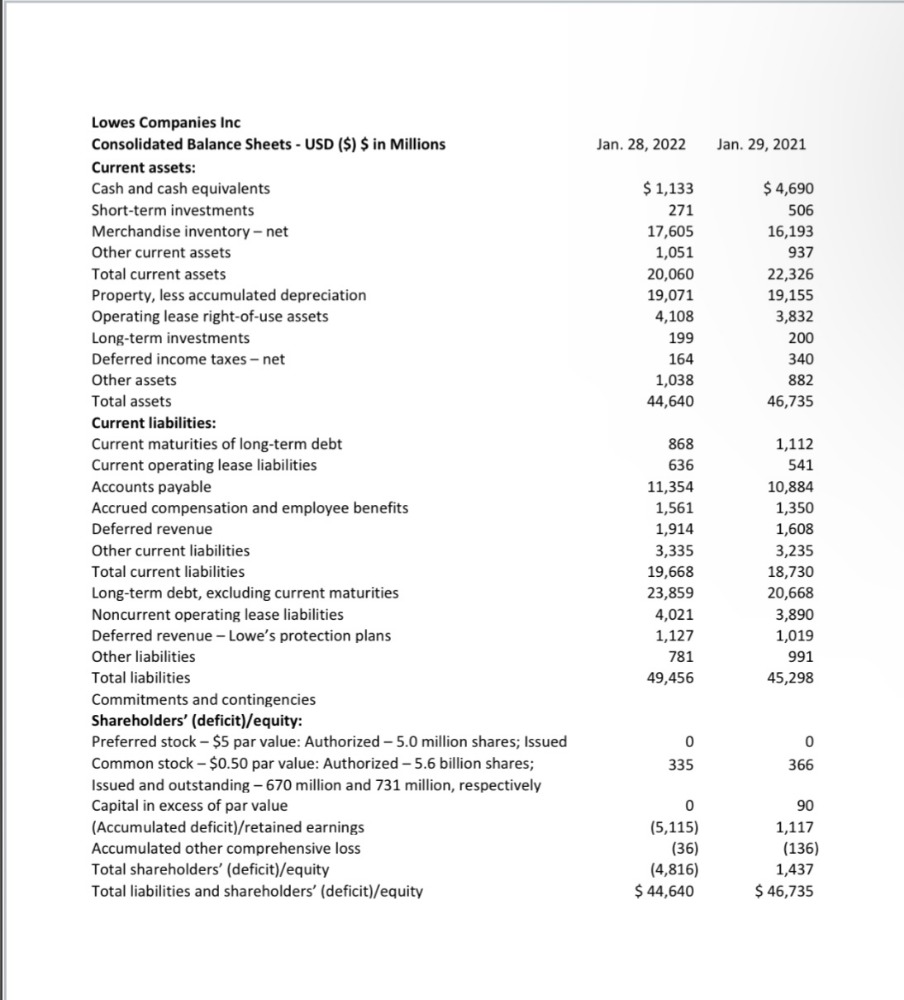

- Current Ratio and Acid Test answers are rounded to two decimals.

- Use percentages (with two decimal places) for Debt Ratio, Equity Ratio, Debt to Equity Ratio and Profit Margin answers.

- Lowe's Companies, Inc does not have Accounts Receivables or Trade Receivables therefore use zero in calculation that includes receivables.

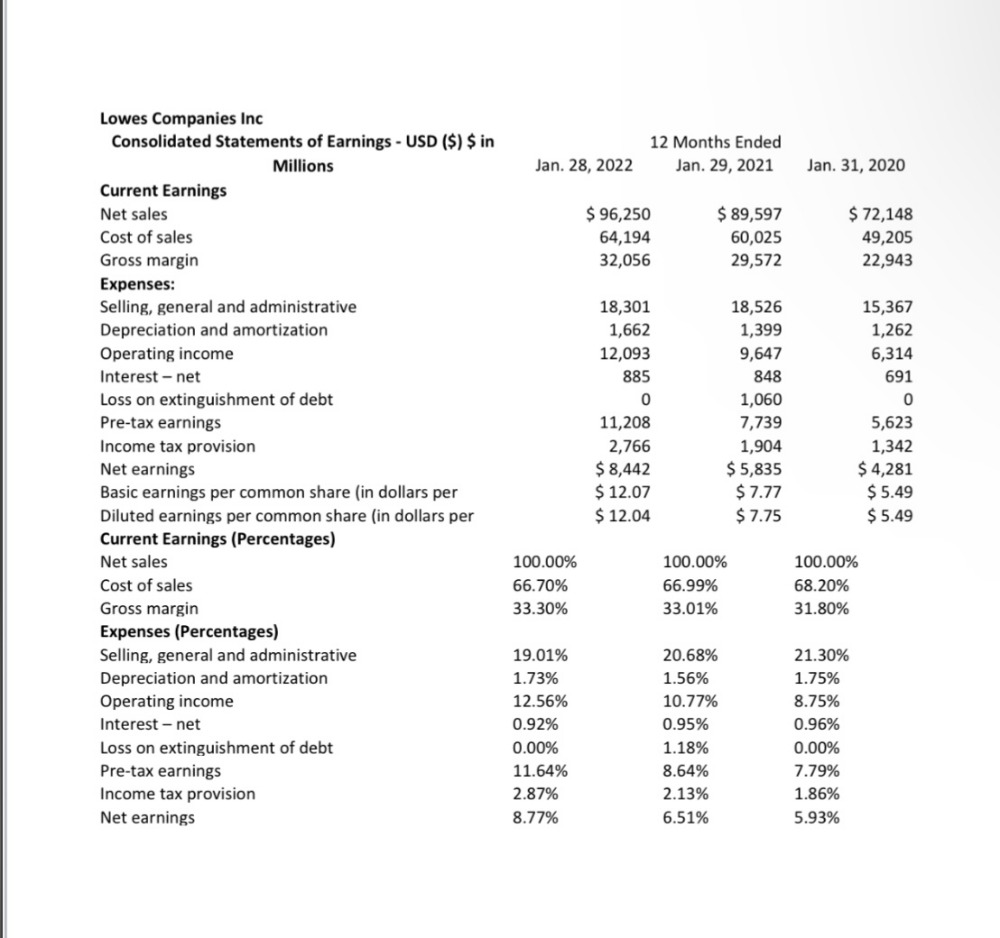

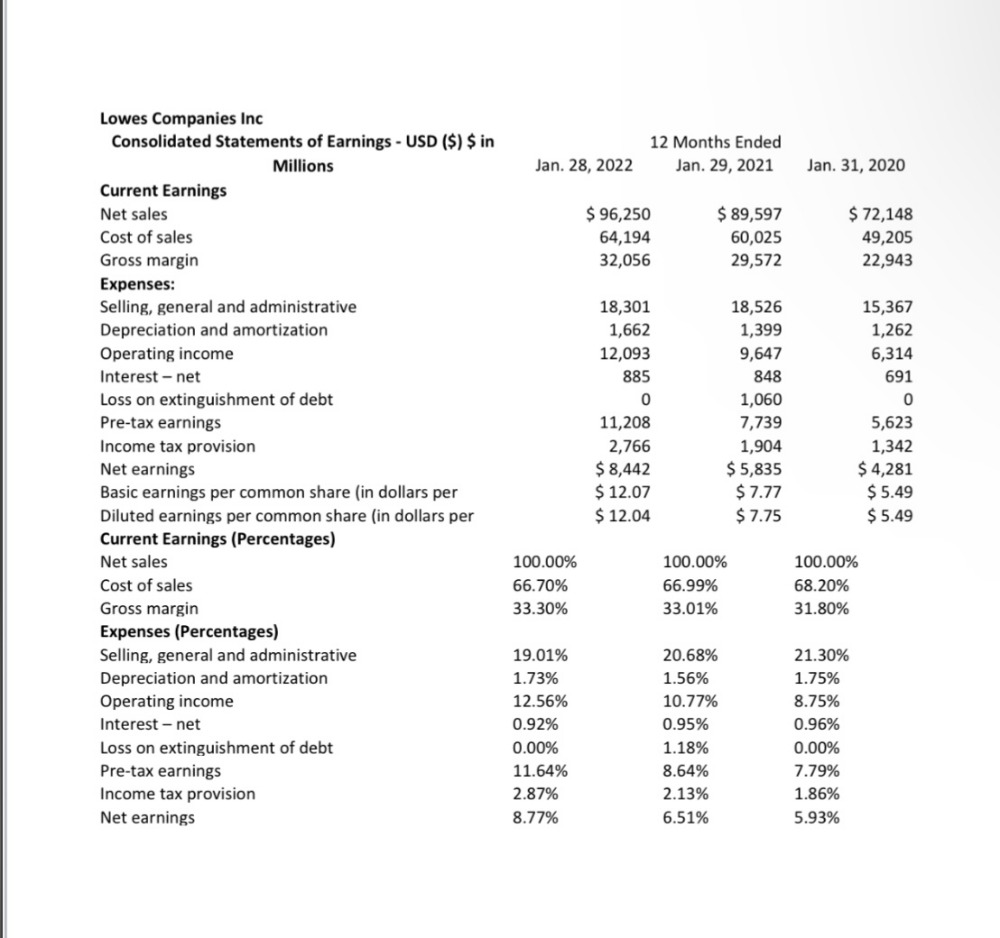

- Net income is called Net earnings on Consolidated Statement of Earnings report.

- Use Basic earnings per common share for Earnings per share.

- You will need to do an online search for market price per common share. The market price is the price the stock was selling for on report year end dates. Stock symbol is LOW

Submit completed Financial Statement Ratios for Lowe's Companies, Inc. for JANUARY 28TH, 2022

| Worksheet Financial Statement Ratios Lowe's Companies, Inc Jan. 28, 2022 |

|---|

| | | Jan. 28, 2022 | Answer format: |

| Current Ratio | Current Assets / Current Liabilities | | Round decimal to two places |

| | Current Assets | | |

| | Current Liabilities | | |

| | | | |

| Acid Test | (Cash + ST Investments + Current Receivables)/Current Liabilities | | Round decimal to two places |

| | Cash | | |

| | ST Investments | | |

| | Trade Receivables | | |

| | Current Liabilities | | |

| | | | |

| Debt Ratio | Total Liabilities/Total Assets | | Answer as percentage with two decimal places |

| | Total Liabilities | | |

| | Total Assets | | |

| | | | |

| Equity Ratio | Total Equity/Total Assets | | Answer as percentage with two decimal places |

| | Total Equity | | |

| Total Assets | | |

| | | | |

| Debt to Equity Ratio | Total Liabilities/Total Equity | | Answer as percentage with two decimal places |

| | Total Liabilities | | |

| Total Equity | | |

| | | | |

| Profit Margin | Net Income/Net Sales | | Answer as percentage with two decimal places |

| | Net Income | | |

| Net Sales | | |

| | | | |

| Earnings per Share (from the income statement) | Net Income/weighted average # of shares outstanding | | |

| | Net Income | | |

| | Weighted average # of shares outstanding | | |

| | | | |

| Price-Earnings Ratio | Market price per common share/Earnings per share | | |

| Market price available online | Market price per common share | | Provide date of your market price |

| | Earnings per share | | |

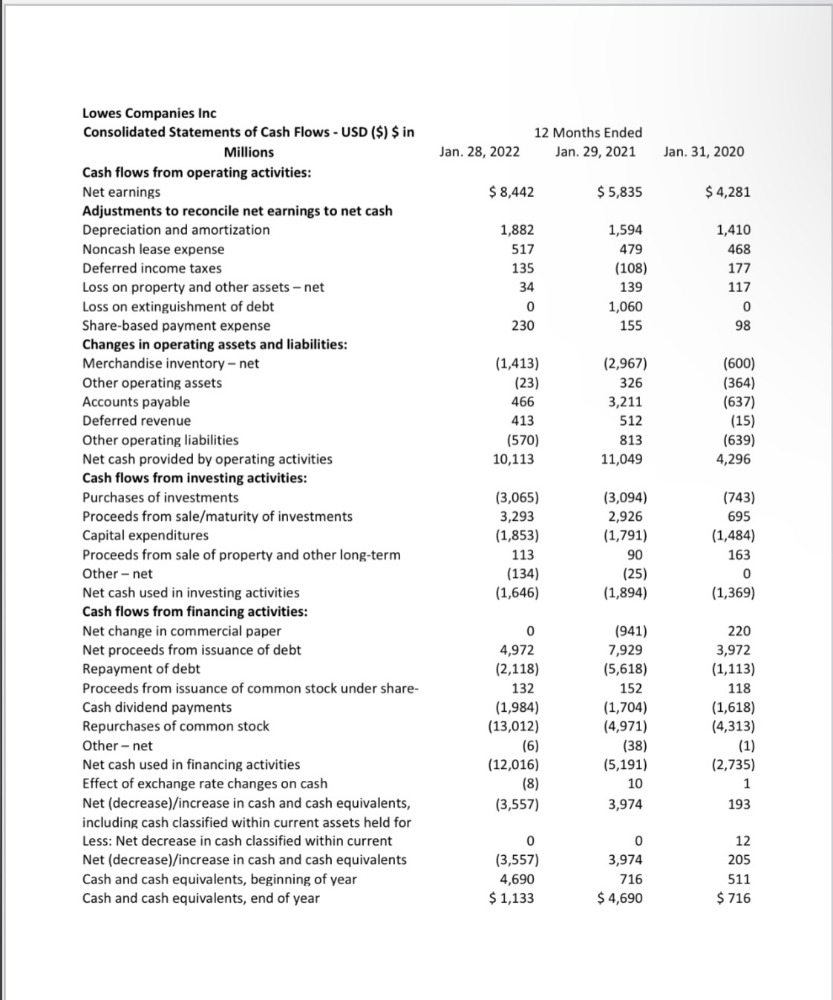

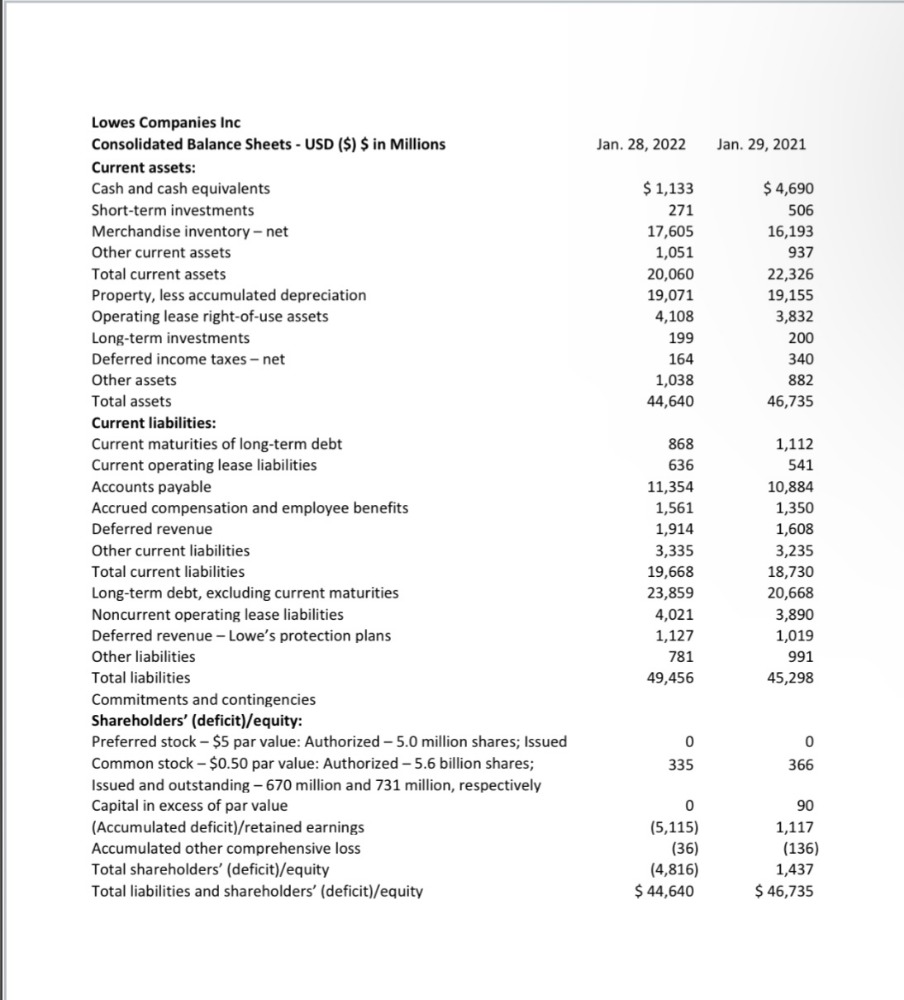

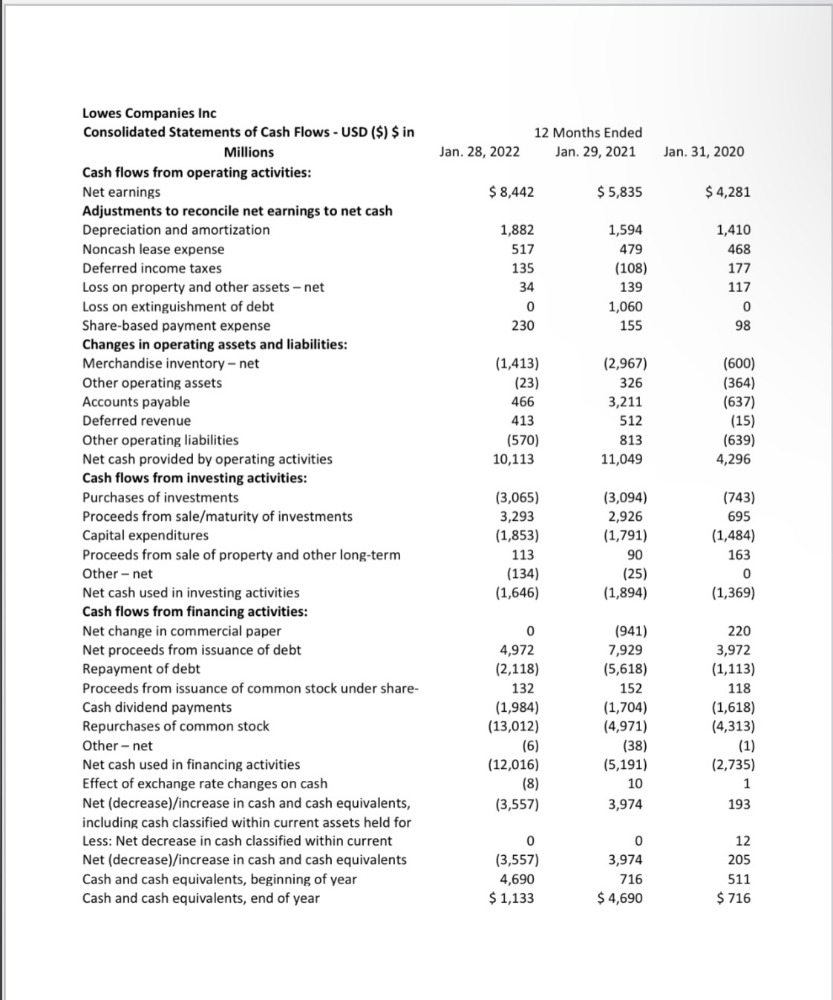

\begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|l|}{ Lowes Companies Inc } \\ \hline Consolidated Statements of Earnings - USD ($)$ in & & 12 Months Ended & \\ \hline Millions & Jan. 28, 2022 & Jan. 29, 2021 & Jan. 31,2020 \\ \hline Current Earnings & & & \\ \hline Net sales & $96,250 & $89,597 & $72,148 \\ \hline Cost of sales & 64,194 & 60,025 & 49,205 \\ \hline Gross margin & 32,056 & 29,572 & 22,943 \\ \hline Expenses: & & & \\ \hline Selling, general and administrative & 18,301 & 18,526 & 15,367 \\ \hline Depreciation and amortization & 1,662 & 1,399 & 1,262 \\ \hline Operating income & 12,093 & 9,647 & 6,314 \\ \hline Interest - net & 885 & 848 & 691 \\ \hline Loss on extinguishment of debt & 0 & 1,060 & 0 \\ \hline Pre-tax earnings & 11,208 & 7,739 & 5,623 \\ \hline Income tax provision & 2,766 & 1,904 & 1,342 \\ \hline Net earnings & $8,442 & $5,835 & $4,281 \\ \hline Basic earnings per common share (in dollars per & $12.07 & $7.77 & $5.49 \\ \hline Diluted earnings per common share (in dollars per & $12.04 & $7.75 & $5.49 \\ \hline Current Earnings (Percentages) & & & \\ \hline Net sales & 100.00% & 100.00% & 100.00% \\ \hline Cost of sales & 66.70% & 66.99% & 68.20% \\ \hline Gross margin & 33.30% & 33.01% & 31.80% \\ \hline Expenses (Percentages) & & & \\ \hline Selling, general and administrative & 19.01% & 20.68% & 21.30% \\ \hline Depreciation and amortization & 1.73% & 1.56% & 1.75% \\ \hline Operating income & 12.56% & 10.77% & 8.75% \\ \hline Interest - net & 0.92% & 0.95% & 0.96% \\ \hline Loss on extinguishment of debt & 0.00% & 1.18% & 0.00% \\ \hline Pre-tax earnings & 11.64% & 8.64% & 7.79% \\ \hline Income tax provision & 2.87% & 2.13% & 1.86% \\ \hline Net earnings & 8.77% & 6.51% & 5.93% \\ \hline \end{tabular} Lowes Companies Inc Consolidated Balance Sheets - USD (\$) \$ in Millions Jan. 28, 2022 Jan. 29, 2021 Current assets: Cash and cash equivalents Short-term investments $1,133 $4,690 Merchandise inventory - net Other current assets Total current assets Property, less accumulated depreciation Operating lease right-of-use assets Long-term investments Deferred income taxes - net Other assets Total assets Current liabilities: Current maturities of long-term debt Current operating lease liabilities Accounts payable Accrued compensation and employee benefits Deferred revenue Other current liabilities Total current liabilities Long-term debt, excluding current maturities Noncurrent operating lease liabilities Deferred revenue - Lowe's protection plans Other liabilities Total liabilities \begin{tabular}{rr} 271 & 506 \\ 17,605 & 16,193 \\ 1,051 & 937 \\ 20,060 & 22,326 \\ 19,071 & 19,155 \\ 4,108 & 3,832 \\ 199 & 200 \\ 164 & 340 \\ 1,038 & 882 \\ 44,640 & 46,735 \end{tabular} Commitments and contingencies Shareholders' (deficit)/equity: Preferred stock - \$5 par value: Authorized - 5.0 million shares; Issued Common stock $0.50 par value: Authorized -5.6 billion shares; \begin{tabular}{rr} 868 & 1,112 \\ 636 & 541 \\ 11,354 & 10,884 \\ 1,561 & 1,350 \\ 1,914 & 1,608 \\ 3,335 & 3,235 \\ 19,668 & 18,730 \\ 23,859 & 20,668 \\ 4,021 & 3,890 \\ 1,127 & 1,019 \\ 781 & 991 \\ 49,456 & 45,298 \end{tabular} Issued and outstanding - 670 million and 731 million, respectively Capital in excess of par value (Accumulated deficit)/retained earnings Accumulated other comprehensive loss Total shareholders' (deficit)/equity Total liabilities and shareholders' (deficit)/equity \begin{tabular}{rr} 0 & 0 \\ 335 & 366 \\ & \\ 0 & 90 \\ (5,115) & 1,117 \\ (36) & (136) \\ (4,816) & 1,437 \\ 44,640 & $46,735 \end{tabular} Lowes Companies Inc Consolidated Statements of Cash Flows - USD (\$) \$ in Millions Cash flows from operating activities: Net earnings Adjustments to reconcile net earnings to net cash Depreciation and amortization Noncash lease expense Deferred income taxes Loss on property and other assets - net Loss on extinguishment of debt Share-based payment expense Changes in operating assets and liabilities: Merchandise inventory - net Other operating assets Accounts payable Deferred revenue Other operating liabilities Net cash provided by operating activities Cash flows from investing activities: Purchases of investments Proceeds from sale/maturity of investments Capital expenditures Proceeds from sale of property and other long-term Other - net Net cash used in investing activities Cash flows from financing activities: Net change in commercial paper Net proceeds from issuance of debt Repayment of debt Proceeds from issuance of common stock under share- Cash dividend payments Repurchases of common stock Other - net Net cash used in financing activities Effect of exchange rate changes on cash Net (decrease)/increase in cash and cash equivalents, including cash classified within current assets held for Less: Net decrease in cash classified within current Net (decrease)/increase in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year Jan. 28, 2022 12 Months Ended Jan. 29, 2021 Jan. 31, 2020 $8,442 $5,835 $4,281 1,882 517 1,594 1,410 468 177 117 0 98 \begin{tabular}{rr} (1,413) & (2,967) \\ (23) & 326 \\ 466 & 3,211 \\ 413 & 512 \\ (570) & 813 \\ 10,113 & 11,049 \end{tabular} (600) (364) (637) (15) (639) 4,296 (3,065) (3,094) (743) 3,293 2,926 695 (1,853) (1,791) (1,484) 113 90 163 (134) (25) 0 (1,646) (1,894) (1,369) \begin{tabular}{rrr} 0 & (941) & 220 \\ 4,972 & 7,929 & 3,972 \\ (2,118) & (5,618) & (1,113) \\ 132 & 152 & 118 \\ (1,984) & (1,704) & (1,618) \\ (13,012) & (4,971) & (4,313) \\ (6) & (38) & (1) \\ (12,016) & (5,191) & (2,735) \\ (8) & 10 & 1 \\ (3,557) & 3,974 & 193 \\ 0 & & \\ (3,557) & 3,974 & 12 \\ 4,690 & 716 & 511 \\ $1,133 & $4,690 & $716 \end{tabular}