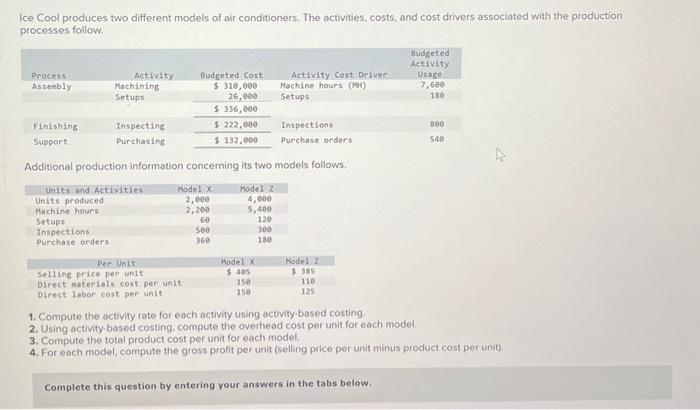

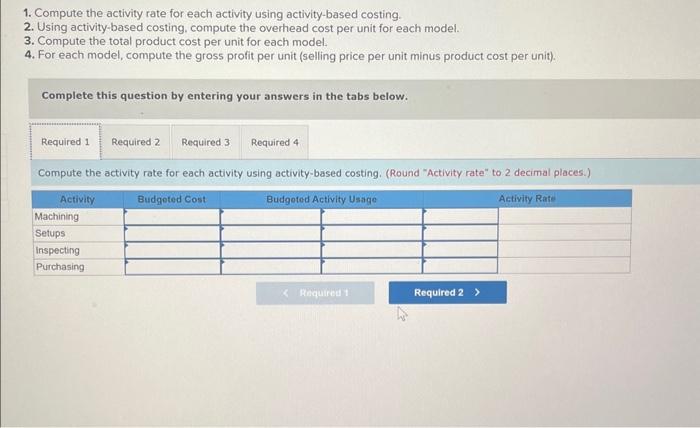

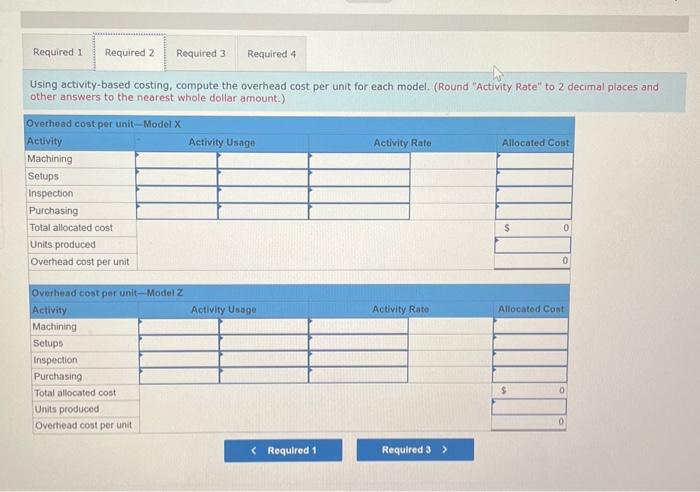

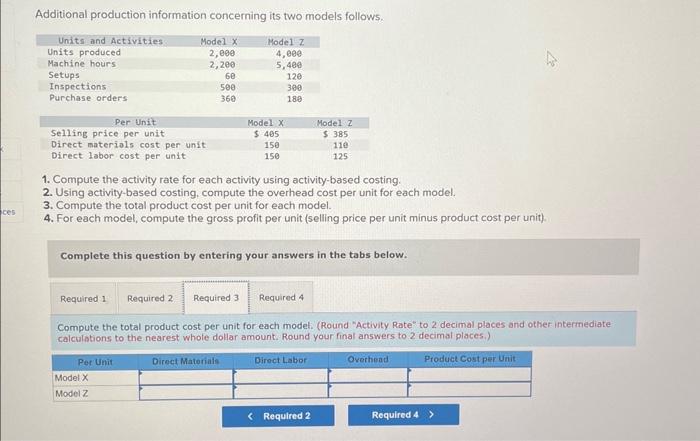

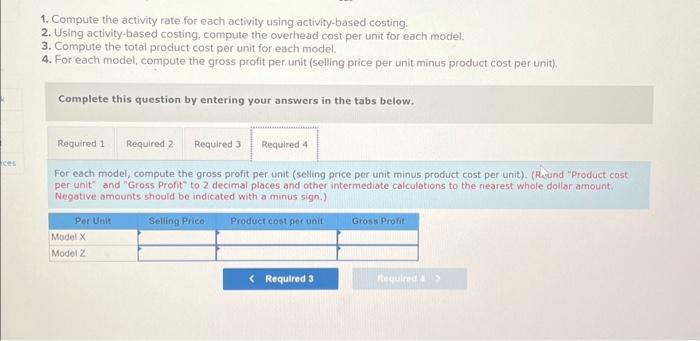

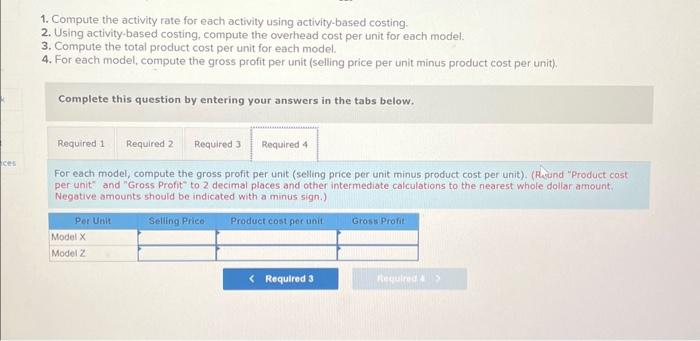

Additional production information concerning its two models follows. 1. Compute the activity rate for each activity using activity-based costing. 2. Using activity-based costing, compute the overhead cost per unit for each model. 3. Compute the total product cost per unit for each model. 4. For each model, compute the gross profit per unit (selling price per unit minus product cost per unit). Complete this question by entering your answers in the tabs below. Compute the total product cost per unit for each modet. (Round "Activity Rate" to 2 decimal places and other intermediate calculations to the nearest whole dollar amount. Round your final answers to 2 decimal places.) 1. Compute the activity rate for each activity using activity-based costing. 2. Using activity-based costing, compute the overhead cost per unit for each model. 3. Compute the total product cost per unit for each model. 4. For each model, compute the gross profit per unit (selling price per unit minus product cost per unit). Complete this question by entering your answers in the tabs below. For each model, compute the gross profit per unit (selling price per unit minus product cost per unit). (Alvind "Product cost per unit" and "Gross Profit" to 2 decimal places and other intermediate calculations to the nearest whole doliar amount. Negative amounts should be indicated with a minus sign.) 1. Compute the activity rate for each activity using activity-based costing. 2. Using activity-based costing, compute the overhead cost per unit for each model. 3. Compute the total product cost per unit for each model. 4. For each model, compute the gross profit per unit (selling price per unit minus product cost per unit). Complete this question by entering your answers in the tabs below. For each model, compute the gross profit per unit (selling price per unit minus product cost per unit). (Alvind "Product cost per unit" and "Gross Profit" to 2 decimal places and other intermediate calculations to the nearest whole doliar amount. Negative amounts should be indicated with a minus sign.) 1. Compute the activity rate for each activity using activity-based costing. 2. Using activity-based costing, compute the overhead cost per unit for each model. 3. Compute the total product cost per unit for each model. 4. For each model, compute the gross profit per unit (selling price per unit minus product cost per unit). Complete this question by entering your answers in the tabs below. Compute the activity rate for each activity using activity-based costing. (Round "Activity rate" to 2 decimal places.) Using activity-based costing, compute the overhead cost per unit for each model. (Round "Activity Rate" to 2 decimal places and other answers to the nearest whole dollar amount.) Ice Cool produces two different models of air conditioners. The activities, costs, and cost drivers associated with the production processes follow. Additional production information concerning its two models follows. 1. Compute the octivity rate for each activity using activity based costing. 2. Using octivity-based costing, compute the overhead cost per unit for each model. 3. Compute the total product cost per unit for each model. 4. For each model, compute the gross profit per unit (selling price per unit minus product cost per unit). Complete this question by entering your answers in the tabs below