Additional Resources

Additional Resources

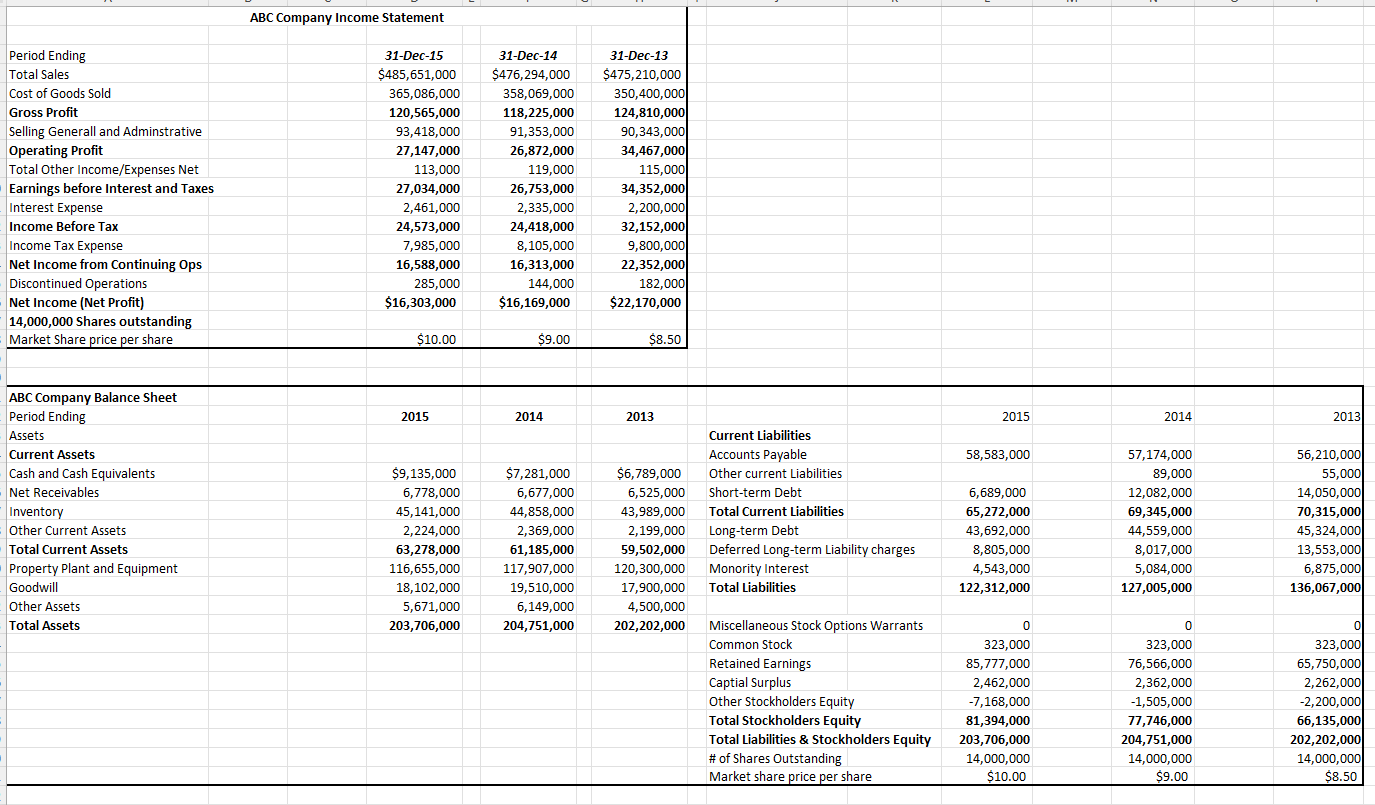

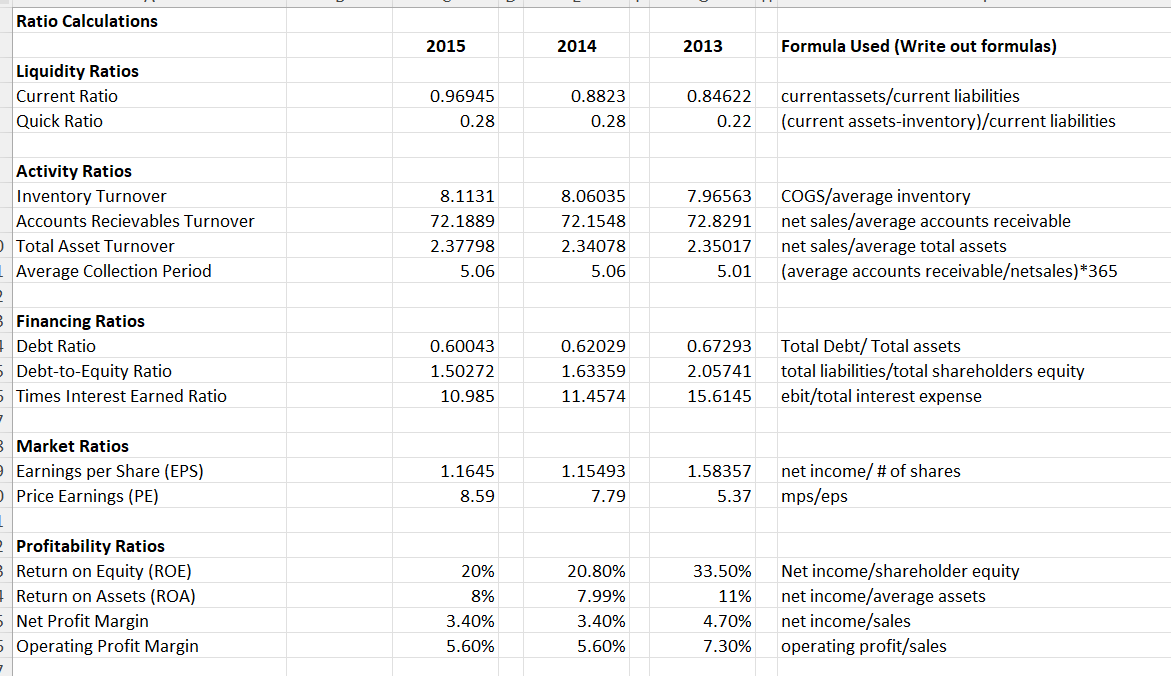

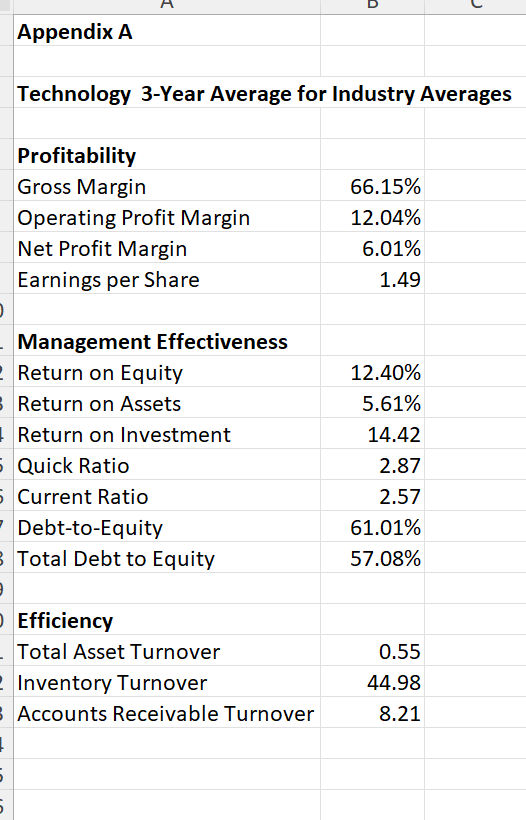

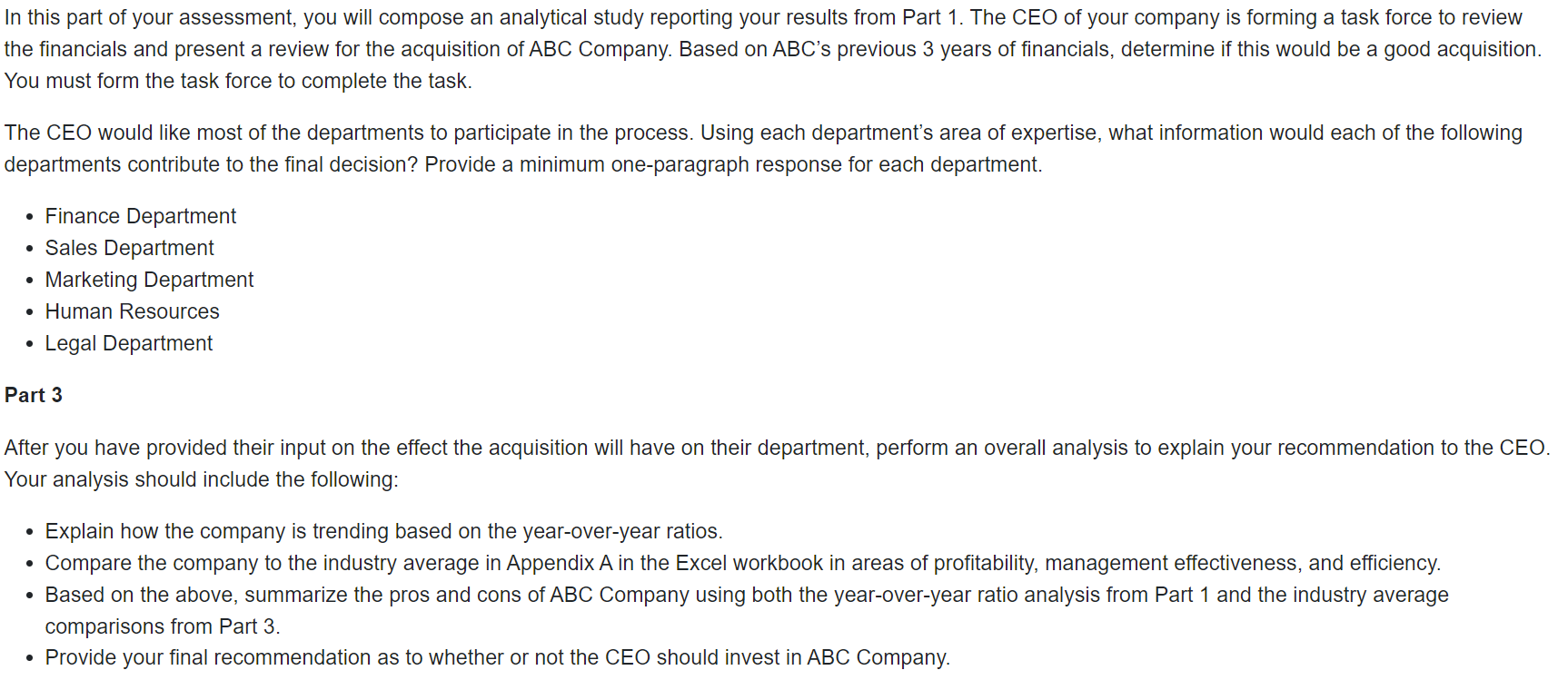

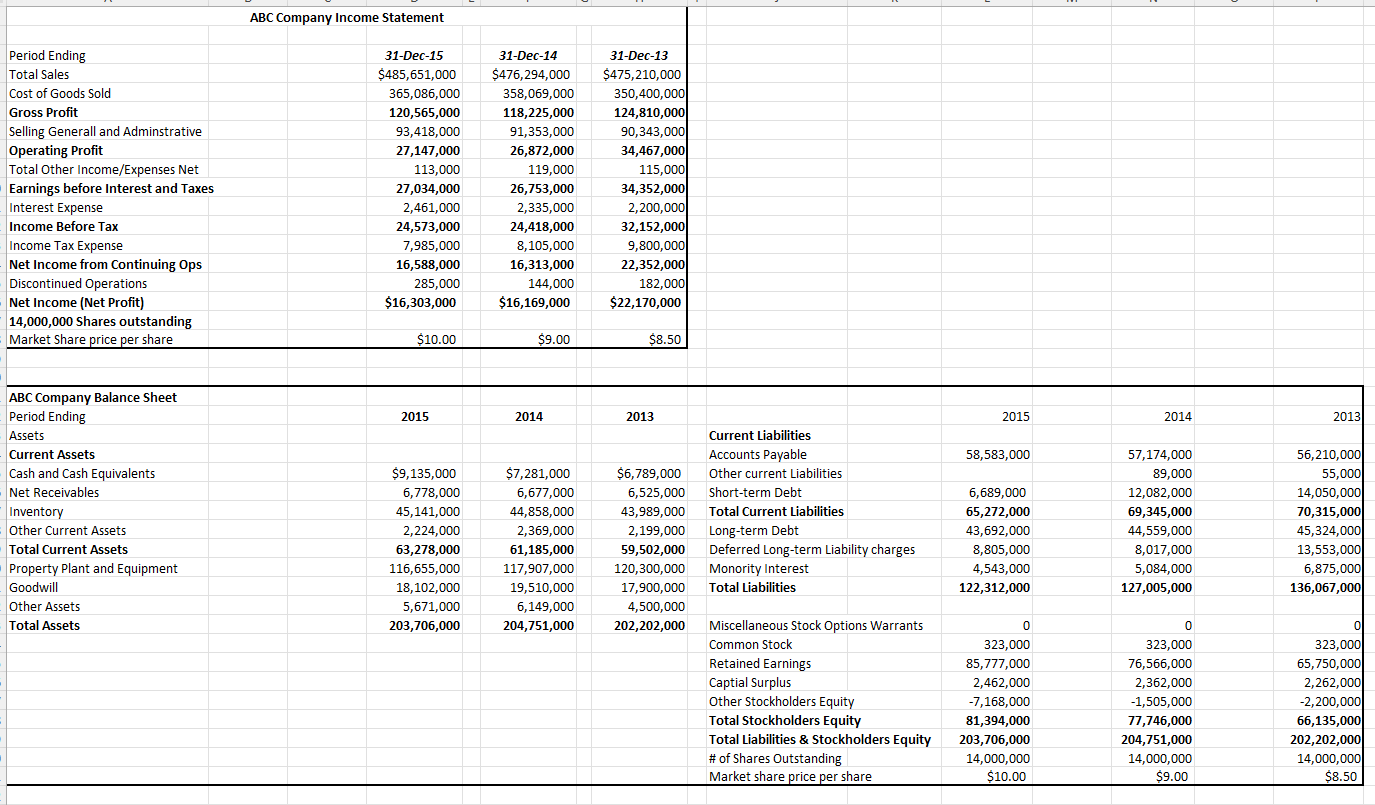

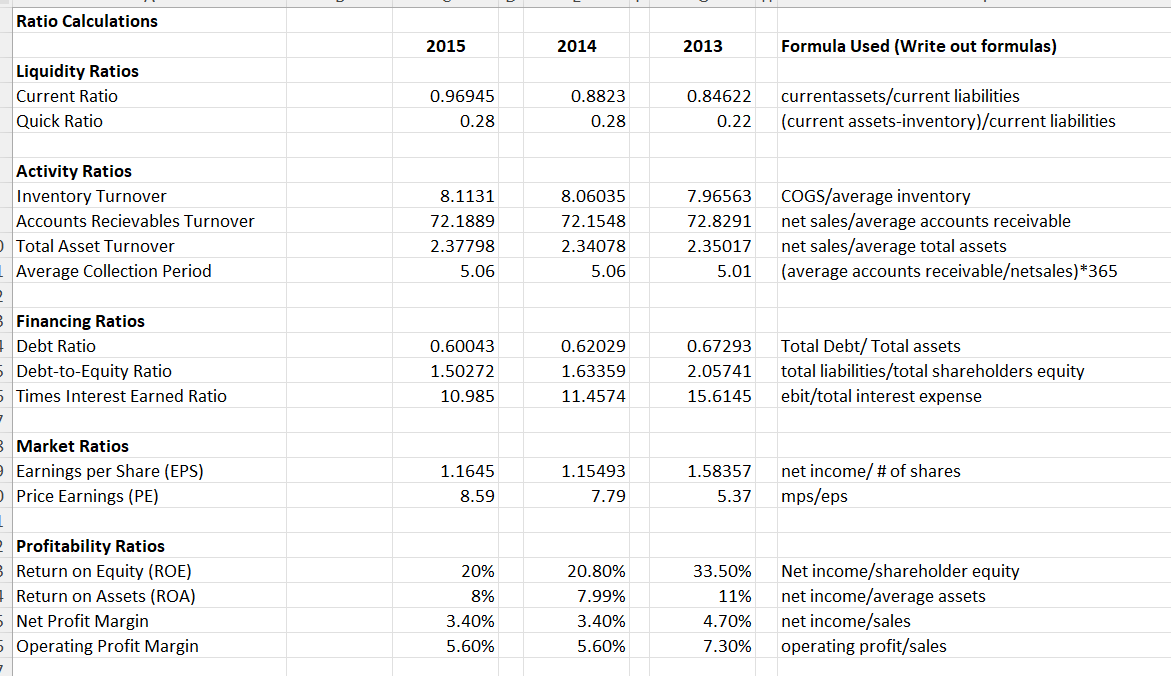

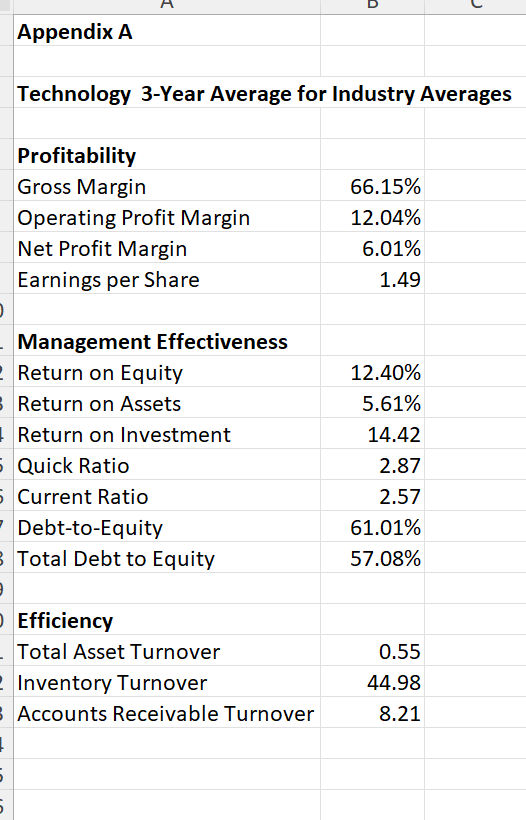

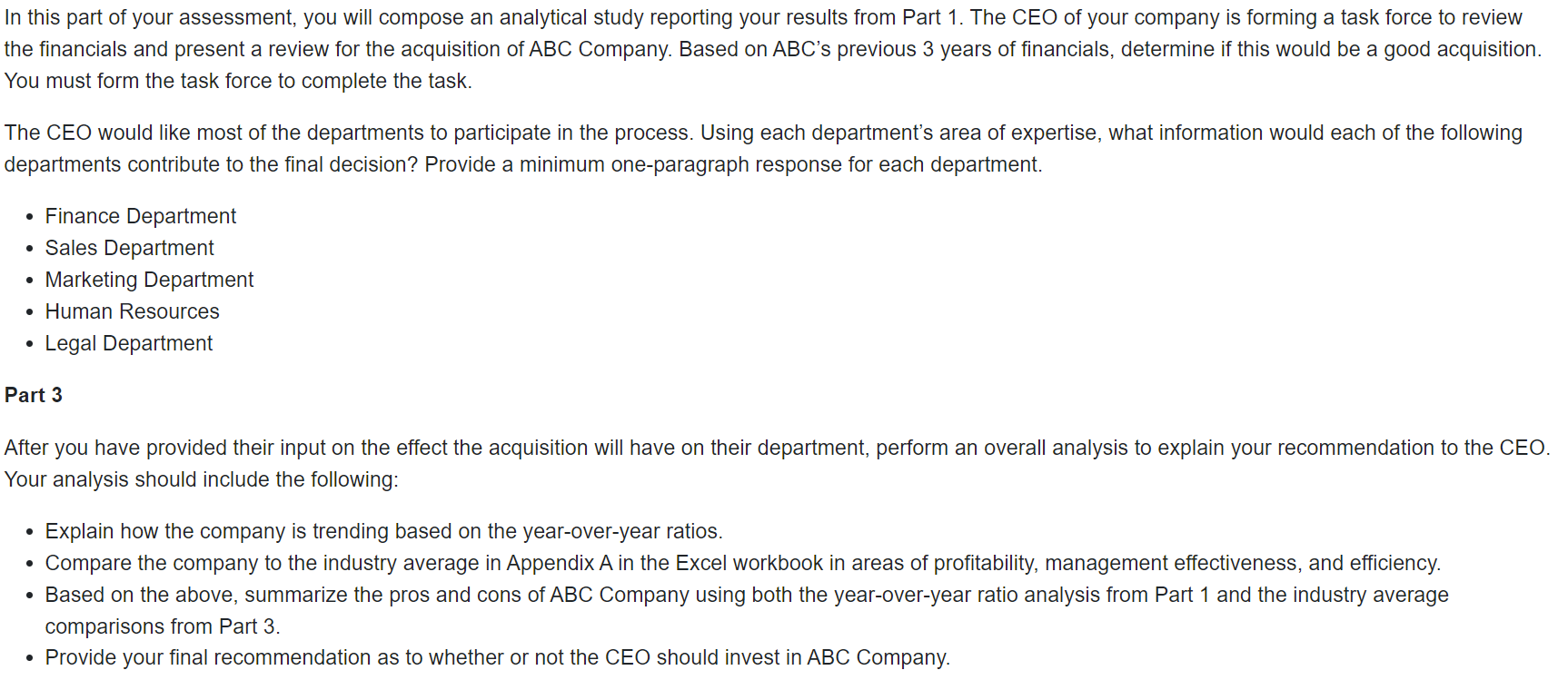

In this part of your assessment, you will compose an analytical study reporting your results from Part 1. The CEO of your company is forming a task force to review the financials and present a review for the acquisition of ABC Company. Based on ABC's previous 3 years of financials, determine if this would be a good acquisition. You must form the task force to complete the task. The CEO would like most of the departments to participate in the process. Using each department's area of expertise, what information would each of the following departments contribute to the final decision? Provide a minimum one-paragraph response for each department. Finance Department Sales Department Marketing Department Human Resources Legal Department Part 3 After you have provided their input on the effect the acquisition will have on their department, perform an overall analysis to explain your recommendation to the CEO. Your analysis should include the following: Explain how the company is trending based on the year-over-year ratios. Compare the company to the industry average in Appendix A in the Excel workbook in areas of profitability, management effectiveness, and efficiency. Based on the above, summarize the pros and cons of ABC Company using both the year-over-year ratio analysis from Part 1 and the industry average comparisons from Part 3. Provide your final recommendation as to whether or not the CEO should invest in ABC Company. ABC Company Income Statement Period Ending Total Sales Cost of Goods Sold Gross Profit Selling Generall and Adminstrative Operating Profit Total Other Income/Expenses Net Earnings before Interest and Taxes Interest Expense Income Before Tax Income Tax Expense Net Income from Continuing Ops Discontinued Operations Net Income (Net Profit) 14,000,000 Shares outstanding Market Share price per share 31-Dec-15 $485,651,000 365,086,000 120,565,000 93,418,000 27,147,000 113,000 27,034,000 2,461,000 24,573,000 7,985,000 16,588,000 285,000 $16,303,000 31-Dec-14 $476,294,000 358,069,000 118,225,000 91,353,000 26,872,000 119,000 26,753,000 2,335,000 24,418,000 8,105,000 16,313,000 144,000 $16,169,000 31-Dec-13 $475,210,000 350,400,000 124,810,000 90,343,000 34,467,000 115,000 34,352,000 2,200,000 32,152,000 9,800,000 22,352,000 182,000 $22,170,000 $10.00 $9.00 $8.50 2015 2014 2013 2015 2014 2013 58,583,000 ABC Company Balance Sheet Period Ending Assets Current Assets Cash and Cash Equivalents Net Receivables Inventory Other Current Assets Total Current Assets Property Plant and Equipment Goodwill Other Assets Total Assets $9,135,000 6,778,000 45,141,000 2,224,000 63,278,000 116,655,000 18,102,000 5,671,000 203,706,000 $7,281,000 6,677,000 44,858,000 2,369,000 61,185,000 117,907,000 19,510,000 6,149,000 204,751,000 $6,789,000 6,525,000 43,989,000 2,199,000 59,502,000 120,300,000 17,900,000 4,500,000 202,202,000 Current Liabilities Accounts Payable Other current Liabilities Short-term Debt Total Current Liabilities Long-term Debt Deferred Long-term Liability charges Monority Interest Total Liabilities 6,689,000 65,272,000 43,692,000 8,805,000 4,543,000 122,312,000 57,174,000 89,000 12,082,000 69,345,000 44,559,000 8,017,000 5,084,000 127,005,000 56,210,000 55,000 14,050,000 70,315,000 45,324,000 13,553,000 6,875,000 136,067,000 Miscellaneous Stock Options Warrants Common Stock Retained Earnings Captial Surplus Other Stockholders Equity Total Stockholders Equity Total Liabilities & Stockholders Equity # of Shares Outstanding Market share price per share 0 323,000 85,777,000 2,462,000 -7,168,000 81,394,000 203,706,000 14,000,000 $10.00 0 323,000 76,566,000 2,362,000 -1,505,000 77,746,000 204,751,000 14,000,000 $9.00 323,000 65,750,000 2,262,000 -2,200,000 66,135,000 202,202,000 14,000,000 $8.50 Ratio Calculations 2015 2014 2013 Formula Used (Write out formulas) Liquidity Ratios Current Ratio Quick Ratio 0.96945 0.28 0.8823 0.28 0.84622 0.22 currentassets/current liabilities (current assets-inventory)/current liabilities Activity Ratios Inventory Turnover Accounts Recievables Turnover Total Asset Turnover Average Collection Period 8.1131 72.1889 2.37798 5.06 8.06035 72.1548 2.34078 5.06 7.96563 72.8291 2.35017 5.01 COGS/average inventory net sales/average accounts receivable net sales/average total assets (average accounts receivableetsales)*365 Financing Ratios Debt Ratio Debt-to-Equity Ratio 5 Times Interest Earned Ratio 0.60043 1.50272 10.985 0.62029 1.63359 11.4574 0.67293 2.05741 15.6145 Total Debt/ Total assets total liabilities/total shareholders equity ebit/total interest expense B Market Ratios Earnings per Share (EPS) Price Earnings (PE) 1.1645 8.59 1.15493 7.79 1.58357 5.37 net income/ # of shares mps/eps Profitability Ratios Return on Equity (ROE) Return on Assets (ROA) Net Profit Margin Operating Profit Margin 20% 8% 3.40% 5.60% 20.80% 7.99% 3.40% 33.50% 11% 4.70% 7.30% Net income/shareholder equity net income/average assets net income/sales operating profit/sales 5.60% D Appendix A Technology 3-Year Average for Industry Averages Profitability Gross Margin Operating Profit Margin Net Profit Margin Earnings per Share 66.15% 12.04% 6.01% 1.49 Management Effectiveness - Return on Equity Return on Assets Return on Investment 5 Quick Ratio 5 Current Ratio Debt-to-Equity Total Debt to Equity 12.40% 5.61% 14.42 2.87 2.57 61.01% 57.08% Efficiency Total Asset Turnover - Inventory Turnover Accounts Receivable Turnover . 5 5 0.55 44.98 8.21 In this part of your assessment, you will compose an analytical study reporting your results from Part 1. The CEO of your company is forming a task force to review the financials and present a review for the acquisition of ABC Company. Based on ABC's previous 3 years of financials, determine if this would be a good acquisition. You must form the task force to complete the task. The CEO would like most of the departments to participate in the process. Using each department's area of expertise, what information would each of the following departments contribute to the final decision? Provide a minimum one-paragraph response for each department. Finance Department Sales Department Marketing Department Human Resources Legal Department Part 3 After you have provided their input on the effect the acquisition will have on their department, perform an overall analysis to explain your recommendation to the CEO. Your analysis should include the following: Explain how the company is trending based on the year-over-year ratios. Compare the company to the industry average in Appendix A in the Excel workbook in areas of profitability, management effectiveness, and efficiency. Based on the above, summarize the pros and cons of ABC Company using both the year-over-year ratio analysis from Part 1 and the industry average comparisons from Part 3. Provide your final recommendation as to whether or not the CEO should invest in ABC Company. ABC Company Income Statement Period Ending Total Sales Cost of Goods Sold Gross Profit Selling Generall and Adminstrative Operating Profit Total Other Income/Expenses Net Earnings before Interest and Taxes Interest Expense Income Before Tax Income Tax Expense Net Income from Continuing Ops Discontinued Operations Net Income (Net Profit) 14,000,000 Shares outstanding Market Share price per share 31-Dec-15 $485,651,000 365,086,000 120,565,000 93,418,000 27,147,000 113,000 27,034,000 2,461,000 24,573,000 7,985,000 16,588,000 285,000 $16,303,000 31-Dec-14 $476,294,000 358,069,000 118,225,000 91,353,000 26,872,000 119,000 26,753,000 2,335,000 24,418,000 8,105,000 16,313,000 144,000 $16,169,000 31-Dec-13 $475,210,000 350,400,000 124,810,000 90,343,000 34,467,000 115,000 34,352,000 2,200,000 32,152,000 9,800,000 22,352,000 182,000 $22,170,000 $10.00 $9.00 $8.50 2015 2014 2013 2015 2014 2013 58,583,000 ABC Company Balance Sheet Period Ending Assets Current Assets Cash and Cash Equivalents Net Receivables Inventory Other Current Assets Total Current Assets Property Plant and Equipment Goodwill Other Assets Total Assets $9,135,000 6,778,000 45,141,000 2,224,000 63,278,000 116,655,000 18,102,000 5,671,000 203,706,000 $7,281,000 6,677,000 44,858,000 2,369,000 61,185,000 117,907,000 19,510,000 6,149,000 204,751,000 $6,789,000 6,525,000 43,989,000 2,199,000 59,502,000 120,300,000 17,900,000 4,500,000 202,202,000 Current Liabilities Accounts Payable Other current Liabilities Short-term Debt Total Current Liabilities Long-term Debt Deferred Long-term Liability charges Monority Interest Total Liabilities 6,689,000 65,272,000 43,692,000 8,805,000 4,543,000 122,312,000 57,174,000 89,000 12,082,000 69,345,000 44,559,000 8,017,000 5,084,000 127,005,000 56,210,000 55,000 14,050,000 70,315,000 45,324,000 13,553,000 6,875,000 136,067,000 Miscellaneous Stock Options Warrants Common Stock Retained Earnings Captial Surplus Other Stockholders Equity Total Stockholders Equity Total Liabilities & Stockholders Equity # of Shares Outstanding Market share price per share 0 323,000 85,777,000 2,462,000 -7,168,000 81,394,000 203,706,000 14,000,000 $10.00 0 323,000 76,566,000 2,362,000 -1,505,000 77,746,000 204,751,000 14,000,000 $9.00 323,000 65,750,000 2,262,000 -2,200,000 66,135,000 202,202,000 14,000,000 $8.50 Ratio Calculations 2015 2014 2013 Formula Used (Write out formulas) Liquidity Ratios Current Ratio Quick Ratio 0.96945 0.28 0.8823 0.28 0.84622 0.22 currentassets/current liabilities (current assets-inventory)/current liabilities Activity Ratios Inventory Turnover Accounts Recievables Turnover Total Asset Turnover Average Collection Period 8.1131 72.1889 2.37798 5.06 8.06035 72.1548 2.34078 5.06 7.96563 72.8291 2.35017 5.01 COGS/average inventory net sales/average accounts receivable net sales/average total assets (average accounts receivableetsales)*365 Financing Ratios Debt Ratio Debt-to-Equity Ratio 5 Times Interest Earned Ratio 0.60043 1.50272 10.985 0.62029 1.63359 11.4574 0.67293 2.05741 15.6145 Total Debt/ Total assets total liabilities/total shareholders equity ebit/total interest expense B Market Ratios Earnings per Share (EPS) Price Earnings (PE) 1.1645 8.59 1.15493 7.79 1.58357 5.37 net income/ # of shares mps/eps Profitability Ratios Return on Equity (ROE) Return on Assets (ROA) Net Profit Margin Operating Profit Margin 20% 8% 3.40% 5.60% 20.80% 7.99% 3.40% 33.50% 11% 4.70% 7.30% Net income/shareholder equity net income/average assets net income/sales operating profit/sales 5.60% D Appendix A Technology 3-Year Average for Industry Averages Profitability Gross Margin Operating Profit Margin Net Profit Margin Earnings per Share 66.15% 12.04% 6.01% 1.49 Management Effectiveness - Return on Equity Return on Assets Return on Investment 5 Quick Ratio 5 Current Ratio Debt-to-Equity Total Debt to Equity 12.40% 5.61% 14.42 2.87 2.57 61.01% 57.08% Efficiency Total Asset Turnover - Inventory Turnover Accounts Receivable Turnover . 5 5 0.55 44.98 8.21

Additional Resources

Additional Resources