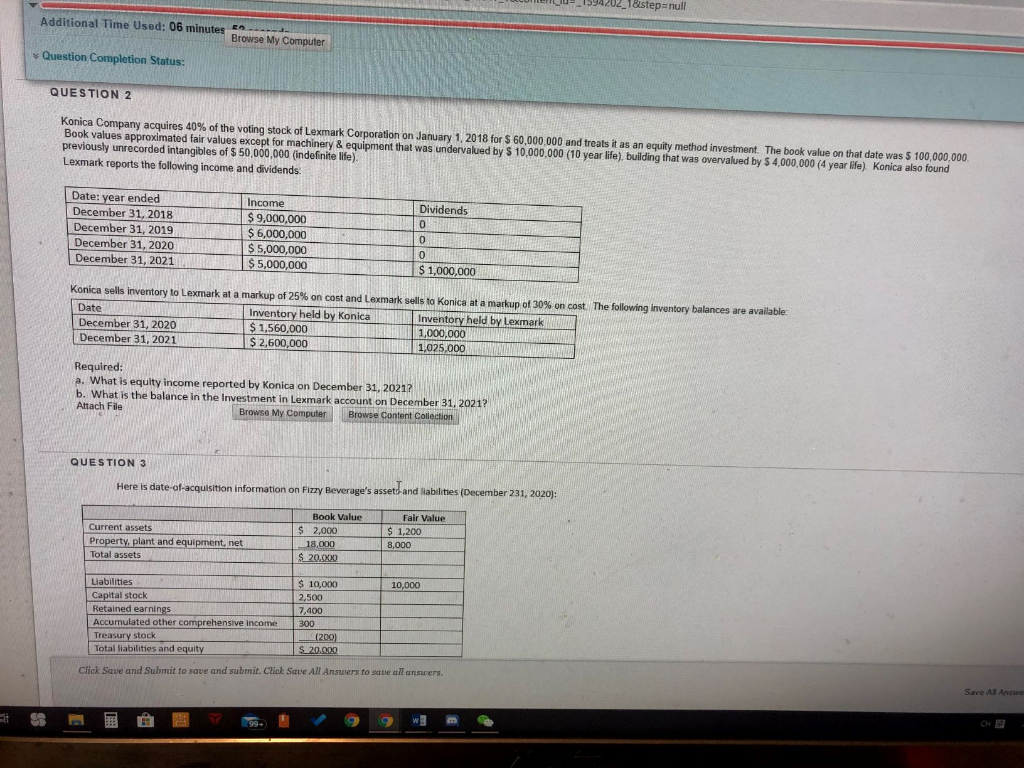

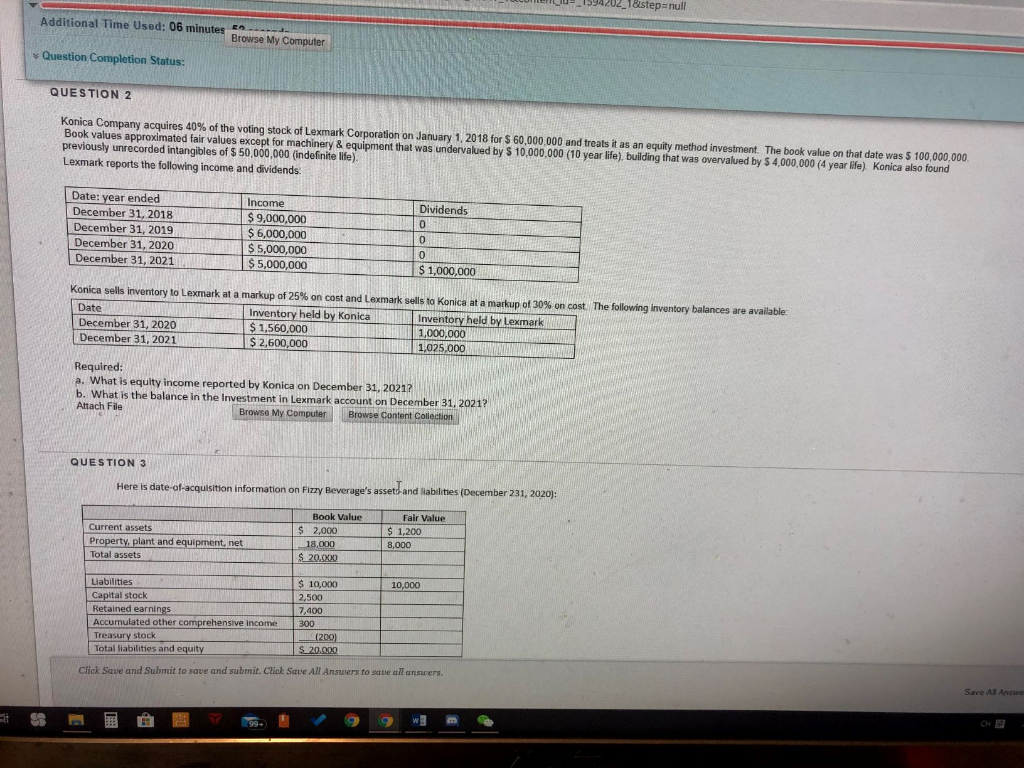

Additional Time Used: 06 minutes Browse My Computer Question Completion Status: QUESTION 2 Konica Company acquires 40% of the voting stock of Lexmark Corporation on January 1, 2018 for $ 60,000,000 and treats it as an equity method investment. The book value on that date was $ 100,000,000 Book values approximated fair values except for machinery & equipment that was undervalued by S 10,000,000 (10 year life), building that was overvalued by $4,000,000 (4 year life). Konica also found previously unrecorded intangibles of $ 50,000,000 (indefinite life). Lexmark reports the following income and dividends. Dividends Date: year ended December 31, 2018 December 31, 2019 December 31, 2020 December 31, 2021 Income $ 9,000,000 $ 6,000,000 $ 5,000,000 $ 5,000,000 $ 1,000,000 Konica selis inventory to Lexmark at a markup of 25% on cost and Lexmark sells to Konica at a markup of 30% on cost. The following Inventory balances are available Date Inventory held by Konica Inventory held by Lexmark December 31, 2020 $ 1,560,000 1,000,000 December 31, 2021 $ 2,600,000 1,025,000 Required: a. What is equity Income reported by Konica on December 31, 2021? b. What is the balance in the Investment in Lexmark account on December 31, 202.12 Attach File Browse My Computer Browse Content Collectia QUESTION 3 Here is date of acquisition information on Fizzy Beverage's assets and abilities (December 231, 2020: Fair Value $ 1,200 8,000 Current assets Property, plant and equipment, net Total assets Book Value $ 2,000 18,000 $ 20.000 $ 10,000 10,000 Liabilities Capital stock Retained earnings Accumulated other comprehensive income Treasury stock Total liabilities and equity 7,400 300 1200) $ 20.000 Save Al Click Save and submit to save and submit. Click Save All Answers to save all answers Additional Time Used: 06 minutes Browse My Computer Question Completion Status: QUESTION 2 Konica Company acquires 40% of the voting stock of Lexmark Corporation on January 1, 2018 for $ 60,000,000 and treats it as an equity method investment. The book value on that date was $ 100,000,000 Book values approximated fair values except for machinery & equipment that was undervalued by S 10,000,000 (10 year life), building that was overvalued by $4,000,000 (4 year life). Konica also found previously unrecorded intangibles of $ 50,000,000 (indefinite life). Lexmark reports the following income and dividends. Dividends Date: year ended December 31, 2018 December 31, 2019 December 31, 2020 December 31, 2021 Income $ 9,000,000 $ 6,000,000 $ 5,000,000 $ 5,000,000 $ 1,000,000 Konica selis inventory to Lexmark at a markup of 25% on cost and Lexmark sells to Konica at a markup of 30% on cost. The following Inventory balances are available Date Inventory held by Konica Inventory held by Lexmark December 31, 2020 $ 1,560,000 1,000,000 December 31, 2021 $ 2,600,000 1,025,000 Required: a. What is equity Income reported by Konica on December 31, 2021? b. What is the balance in the Investment in Lexmark account on December 31, 202.12 Attach File Browse My Computer Browse Content Collectia QUESTION 3 Here is date of acquisition information on Fizzy Beverage's assets and abilities (December 231, 2020: Fair Value $ 1,200 8,000 Current assets Property, plant and equipment, net Total assets Book Value $ 2,000 18,000 $ 20.000 $ 10,000 10,000 Liabilities Capital stock Retained earnings Accumulated other comprehensive income Treasury stock Total liabilities and equity 7,400 300 1200) $ 20.000 Save Al Click Save and submit to save and submit. Click Save All Answers to save all answers