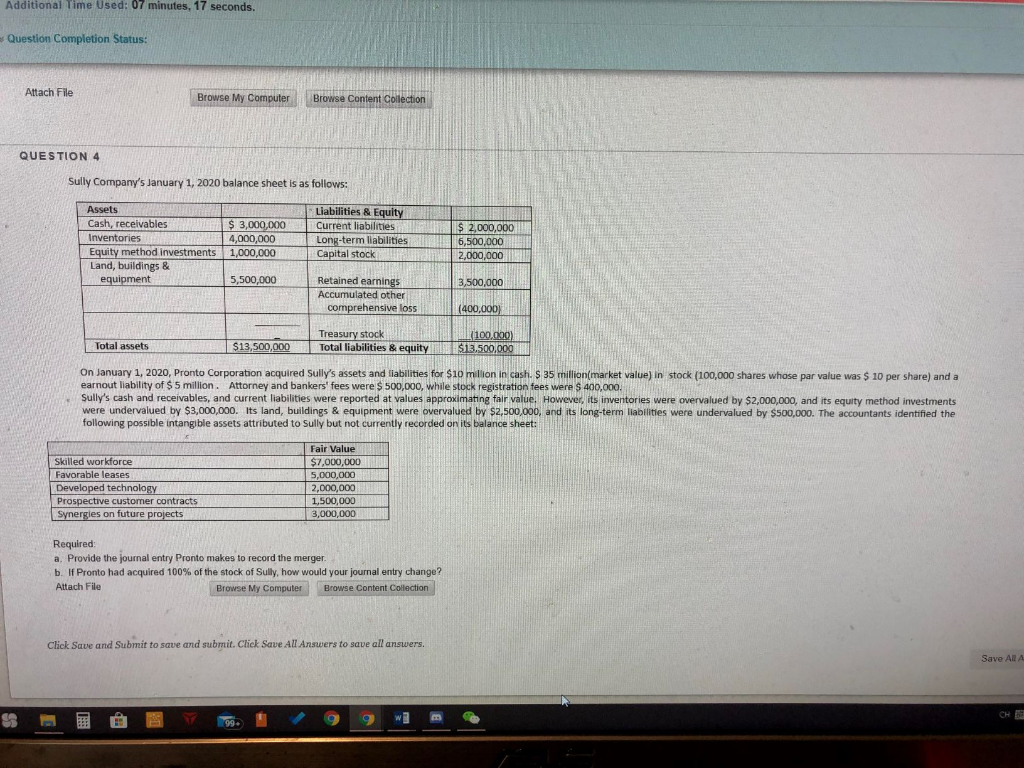

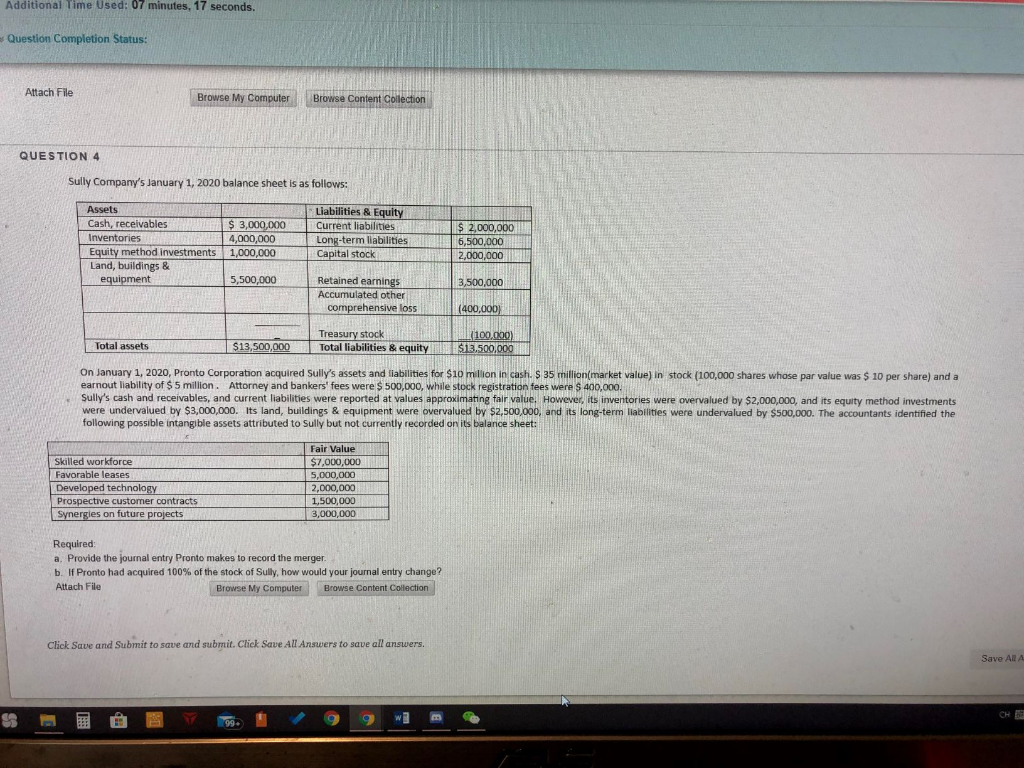

Additional time Used: 07 minutes, 17 seconds. Question Completion Status: Attach File Browse My Computer Browse Content Collection QUESTION 4 Sully Company's January 1, 2020 balance sheet is as follows: Assets Cash, receivables Inventories Equity method investments Land, buildings & equipment $ 3,000,000 4,000,000 1,000,000 Liabilities & Equity Current liabilities Long-term liabilities Capital stock $ 2,000,000 6,500,000 2,000,000 5,500,000 3,500,000 Retained earnings Accumulated other comprehensive loss (400,000) Total assets $13,500,000 Treasury stock Total liabilities & equity (100.000) $13,500,000 On January 1, 2020, Pronto Corporation acquired Sully's assets and liabilities for $10 million in cash. $ 35 million market value in stock (100,000 shares whose par value was $ 10 per share) and a earnout liability of $ 5 million. Attorney and bankers' fees were $ 500,000, while stock registration fees were $ 400,000 Sully's cash and receivables, and current liabilities were reported at values approximating fair value. However, its inventories were overvalued by $2,000,000, and its equity method investments were undervalued by $3,000,000. Its land, buildings & equipment were overvalued by $2,500,000, and its long-term liabilities were undervalued by $500,000. The accountants identified the following possible intangible assets attributed to Sully but not currently recorded on it balance sheet: Skilled workforce Favorable leases RHINE Developed technology Prospective customer contracts Synergies on future projects Fair Value $7,000,000 5,000,000 2,000,000 1,500,000 3.000.000 Required: a. Provide the journal entry Pronto makes to record the merger. b. If Pronto had acquired 100% of the stock of Sully, how would your journal entry change? Attach File Browse My Computer Browse Content Collection Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save AIA Additional time Used: 07 minutes, 17 seconds. Question Completion Status: Attach File Browse My Computer Browse Content Collection QUESTION 4 Sully Company's January 1, 2020 balance sheet is as follows: Assets Cash, receivables Inventories Equity method investments Land, buildings & equipment $ 3,000,000 4,000,000 1,000,000 Liabilities & Equity Current liabilities Long-term liabilities Capital stock $ 2,000,000 6,500,000 2,000,000 5,500,000 3,500,000 Retained earnings Accumulated other comprehensive loss (400,000) Total assets $13,500,000 Treasury stock Total liabilities & equity (100.000) $13,500,000 On January 1, 2020, Pronto Corporation acquired Sully's assets and liabilities for $10 million in cash. $ 35 million market value in stock (100,000 shares whose par value was $ 10 per share) and a earnout liability of $ 5 million. Attorney and bankers' fees were $ 500,000, while stock registration fees were $ 400,000 Sully's cash and receivables, and current liabilities were reported at values approximating fair value. However, its inventories were overvalued by $2,000,000, and its equity method investments were undervalued by $3,000,000. Its land, buildings & equipment were overvalued by $2,500,000, and its long-term liabilities were undervalued by $500,000. The accountants identified the following possible intangible assets attributed to Sully but not currently recorded on it balance sheet: Skilled workforce Favorable leases RHINE Developed technology Prospective customer contracts Synergies on future projects Fair Value $7,000,000 5,000,000 2,000,000 1,500,000 3.000.000 Required: a. Provide the journal entry Pronto makes to record the merger. b. If Pronto had acquired 100% of the stock of Sully, how would your journal entry change? Attach File Browse My Computer Browse Content Collection Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save AIA