Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Additional Tutorial Questions for Unit 6- Employee Benefits Question 1 A company has a fortnightly payroll of $200,000. On average, 50% of the employees

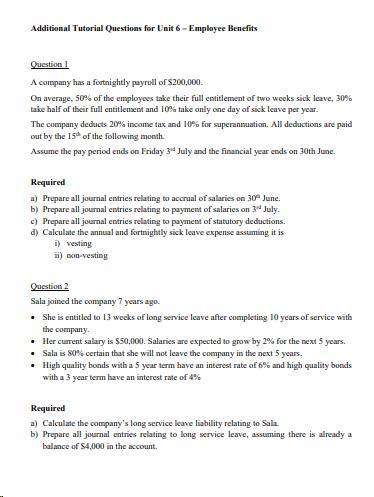

Additional Tutorial Questions for Unit 6- Employee Benefits Question 1 A company has a fortnightly payroll of $200,000. On average, 50% of the employees take their full entitlement of two weeks sick leave, 30% take half of their full entitlement and 10% take only one day of sick leave per year. The company deducts 20% income tax and 10% for superannuation. All deductions are paid out by the 15th of the following month. Assume the pay period ends on Friday 34 July and the financial year ends on 30th June. Required a) Prepare all journal entries relating to accrual of salaries on 30 June. b) Prepare all journal entries relating to payment of salaries on 3rd July. c) Prepare all journal entries relating to payment of statutory deductions. d) Calculate the annual and fortnightly sick leave expense assuming it is i) vesting ii) non-vesting Question 2 Sala joined the company 7 years ago. She is entitled to 13 weeks of long service leave after completing 10 years of service with the company. Her current salary is $50,000. Salaries are expected to grow by 2% for the next 5 years. Sala is 80% certain that she will not leave the company in the next 5 years. High quality bonds with a 5 year term have an interest rate of 6% and high quality bonds with a 3 year term have an interest rate of 4% Required a) Calculate the company's long service leave liability relating to Sala b) Prepare all journal entries relating to long service leave, assuming there is already a balance of $4,000 in the account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started