Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. Address the tax consequences of the transfer for both Cho (shareholder) and Patten (corporation). Focus on all aspects of the fact pattern (i.e.,

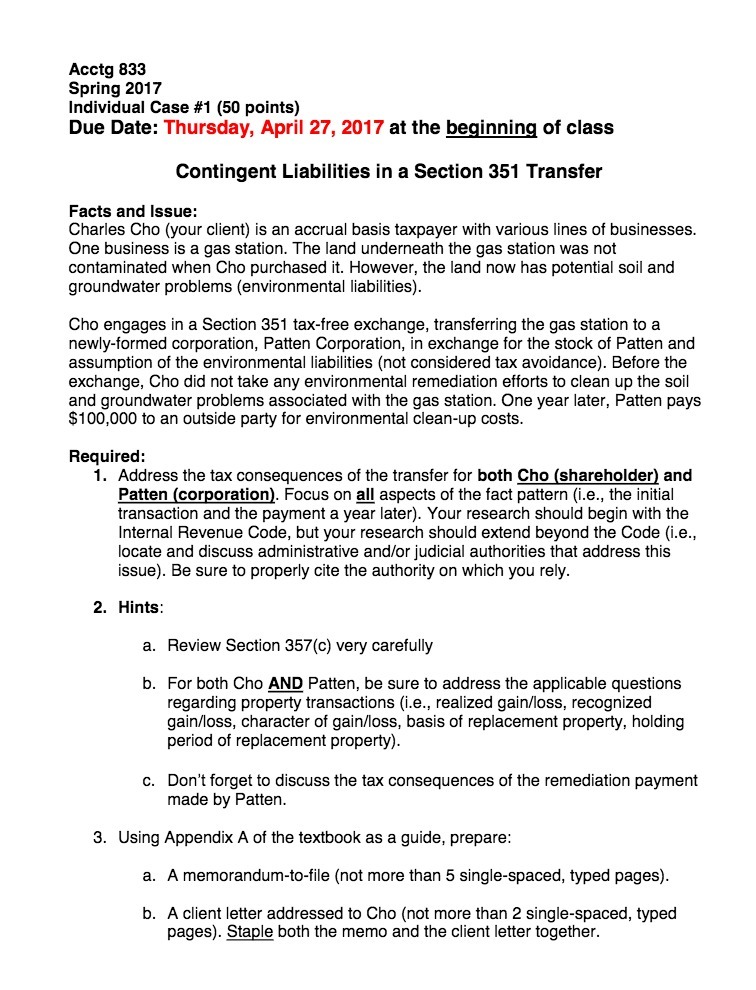

. Address the tax consequences of the transfer for both Cho (shareholder) and Patten (corporation). Focus on all aspects of the fact pattern (i.e., the initial transaction and the payment a year later). Your research should begin with the Internal Revenue Code, but your research should extend beyond the Code (i.e., locate and discuss administrative and/or judicial authorities that address this issue). Be sure to properly cite the authority on which you rely. Acctg 833 Spring 2017 Individual Case #1 (50 points) Due Date: Thursday, April 27, 2017 at the beginning of class Contingent Liabilities in a Section 351 Transfer Facts and Issue: Charles Cho (your client) is an accrual basis taxpayer with various lines of businesses. One business is a gas station. The land underneath the gas station was not contaminated when Cho purchased it. However, the land now has potential soil and groundwater problems (environmental liabilities). Cho engages in a Section 351 tax-free exchange, transferring the gas station to a newly-formed corporation, Patten Corporation, in exchange for the stock of Patten and assumption of the environmental liabilities (not considered tax avoidance). Before the exchange, Cho did not take any environmental remediation efforts to clean up the soil and groundwater problems associated with the gas station. One year later, Patten pays $100,000 to an outside party for environmental clean-up costs. Required: 1. Address the tax consequences of the transfer for both Cho (shareholder) and Patten (corporation). Focus on all aspects of the fact pattern (i.e., the initial transaction and the payment a year later). Your research should begin with the Internal Revenue Code, but your research should extend beyond the Code (i.e., locate and discuss administrative and/or judicial authorities that address this issue). Be sure to properly cite the authority on which you rely. 2. Hints: a. Review Section 357(c) very carefully b. For both Cho AND Patten, be sure to address the applicable questions regarding property transactions (i.e., realized gain/loss, recognized gain/loss, character of gain/loss, basis of replacement property, holding period of replacement property). C. Don't forget to discuss the tax consequences of the remediation payment made by Patten. 3. Using Appendix A of the textbook as a guide, prepare: a. A memorandum-to-file (not more than 5 single-spaced, typed pages). b. A client letter addressed to Cho (not more than 2 single-spaced, typed pages). Staple both the memo and the client letter together.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started