Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the first full week of 2019, the Payroll Department of Quigley Corporation is preparing the Forms W-2 for distribution to its employees along

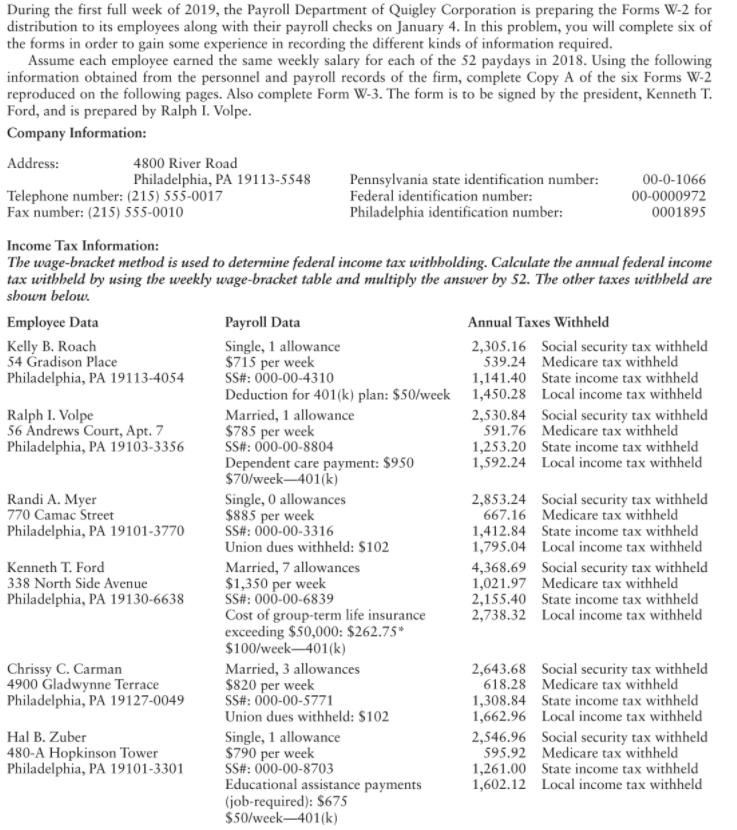

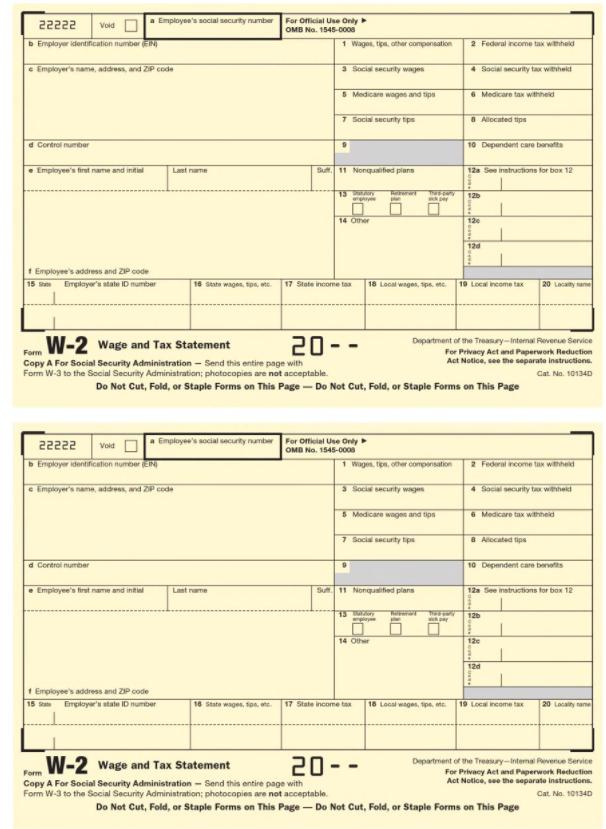

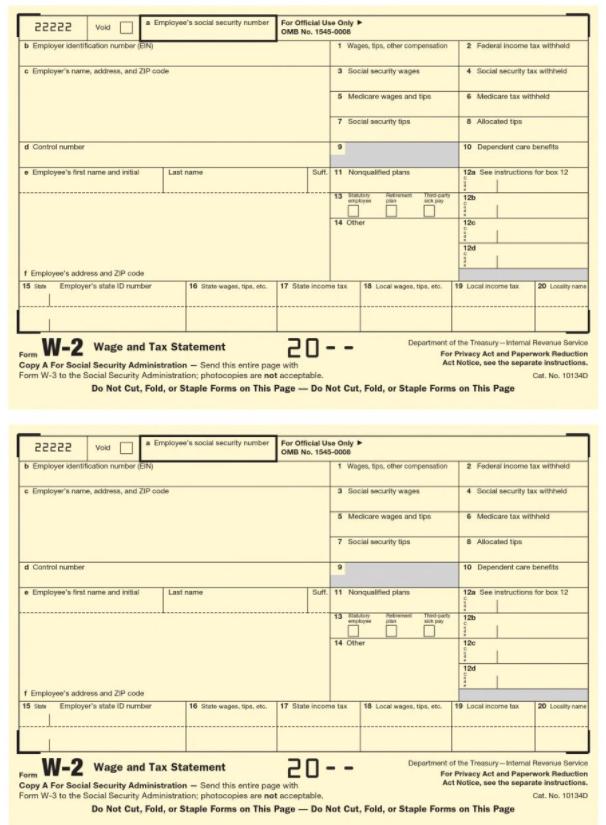

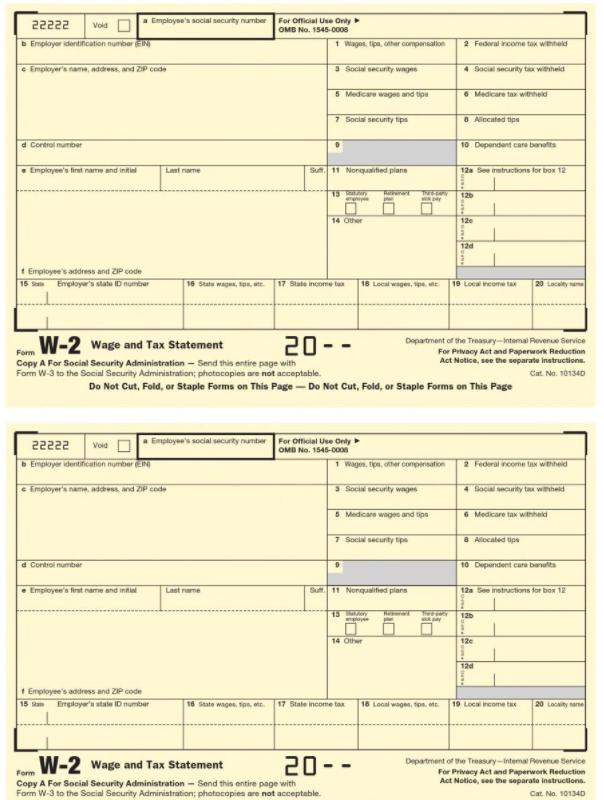

During the first full week of 2019, the Payroll Department of Quigley Corporation is preparing the Forms W-2 for distribution to its employees along with their payroll checks on January 4. In this problem, you will complete six of the forms in order to gain some experience in recording the different kinds of information required. Assume each employee earned the same weekly salary for each of the 52 paydays in 2018. Using the following information obtained from the personnel and payroll records of the firm, complete Copy A of the six Forms W-2 reproduced on the following pages. Also complete Form W-3. The form is to be signed by the president, Kenneth T. Ford, and is prepared by Ralph I. Volpe. Company Information: Address: 4800 River Road Philadelphia, PA 19113-5548 Pennsylvania state identification number: Federal identification number: 00-0-1066 Telephone number: (215) 555-0017 Fax number: (215) 555-0010 00-0000972 Philadelphia identification number: 0001895 Income Tax Information: The wage-bracket method is used to determine federal income tax withbolding. Calculate the annual federal income tax withheld by using the weekly wage-bracket table and multiply the answer by 52. The other taxes withbeld are shown below. Employee Data Payroll Data Annual Taxes Withheld Kelly B. Roach 54 Gradison Place Philadelphia, PA 19113-4054 Single, 1 allowance $715 per week SS#: 000-00-4310 Deduction for 401(k) plan: $50/week 1,450.28 Local income tax withheld 2,305.16 Social security tax withheld 539.24 Medicare tax withheld 1,141.40 State income tax withheld Ralph I. Volpe 56 Andrews Court, Apt. 7 Philadelphia, PA 19103-3356 Married, 1 allowance $785 per week SS#: 000-00-8804 Dependent care payment: $950 $70/week-401(k) 2,530.84 Social security tax withheld 591.76 Medicare tax withheld 1,253.20 State income tax withheld 1,592.24 Local income tax withheld Randi A. Myer 770 Camac Street Philadelphia, PA 19101-3770 Single, 0 allowances $885 per week SS#: 000-00-3316 Union dues withheld: $102 2,853.24 Social security tax withheld 667.16 Medicare tax withheld 1,412.84 State income tax withheld 1,795.04 Local income tax withheld Kenneth T. Ford 338 North Side Avenue Philadelphia, PA 19130-6638 Married, 7 allowances $1,350 per week SS#: 000-00-6839 Cost of group-term life insurance exceeding $50,000: $262.75* $100/week-401(k) 4,368.69 Social security tax withheld 1,021.97 Medicare tax withheld 2,155.40 State income tax withheld 2,738.32 Local income tax withheld Chrissy C. Carman 4900 Gladwynne Terrace Philadelphia, PA 19127-0049 Married, 3 allowances $820 per week SS#: 000-00-5771 Union dues withheld: $102 2,643.68 Social security tax withheld 618.28 Medicare tax withheld 1,308.84 State income tax withheld 1,662.96 Local income tax withheld Hal B. Zuber Single, 1 allowance $790 per week SS#: 000-00-8703 Educational assistance payments (job-required): $675 $50/week-401(k) 2,546.96 Social security tax withheld 595.92 Medicare tax withheld 1,261.00 State income tax withheld 1,602.12 Local income tax withheld 480-A Hopkinson Tower Philadelphia, PA 19101-3301 a Employee's social security number For Official Use Only Void OMB Na. 1545-0008 b Employer identification number EN 1 Wagon, tips, othar compansation 2 Federal ncome tax withheld e Employer's name, address, and ZIP code 3 Social secunty wages 4 Social security tax witheit S Medicare wages and tips 6 Medicare tax withheid 7 Socia secunity tips 8 Alocated tips e Control mumber 10 Dependent care tnatta Employee's firet name and intil Sut. 11 Nonqusited plane Lant name 12s See instructions for box 12 13 A 12b per 14 Other 12 12d * Employee's address and ZIP code 15 s Erplayer's atate ID mumber 16 State wages, tos, t 17 State income tas 18 Local wnges, pe e 10 Local income tax 20 Lecaty ame W-2 wage and Tax Statement 20- Department of the Treasry-Intemal Revenue Service For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Form Copy A For Social Security Administration - Send this entire page with Form W-3 to the Social Security Administration; photocopies are not acceptable. Cat No. 10134D Do Not Cut, Fold, or Staple Forms on This Page - Do Not Cut, Fold, or Staple Forms on This Page Employee's social security namber For official Use Only OMB No. 1545-0008 22222 Vold bEmployer dentification number EN Wagen. tien, other oompensation 2 Federal income tax withheid e Employer's name, addres, nd ZP code 3 Socis security wages 4 Socal security tax withheid S Medicare wages and tipn 6 Medicare tax withheid 7 Socia secunty tips 8 Alocated tips a Control number 10 Dependent care benetts Employee's firut name and int Su 11 Nonquifed plans 12a See instructions for box 12 Last name 12b 14 Other 12e 12d 1 Employee's address and ZP code 15 s Employar' atate ID number 16 State wages, fon, ete. 17 State income te 18 Local wagen, tpe, te 19 Loca income tax 20 Lacaity name W-2 Wage and Tax Statement 20 Department of the Treasury-Intemal Pevene Service For Privacy Aet and Paperwork Recuetion Act Notice, see the separate instructions. Form Copy A For Social Security Administration - Send this entire page with Form W-3 to the Social Security Administration; photocopies are not acceptable. Cat. No. 101340 Do Not Cut, Fold, or Staple Forms on This Page - Do Not Cut, Fold, or Staple Forms on This Page For Official Use Only OMB No. 1545-0008 Empioyee's social security number 22222 Vold b Empioyer identitication number EN 1 Wagen, tips, other compensation 2 Faderal inoome tax withheld e Empleyer's nae, re, and ZIP code 3 Social secatty wages 4 Social security tax withed S Medcare wages and tipe 6 Medicare tax withheld 7 Socal securty tips 8 Allocated tps d Control number 10 Dependernt care benefta Employee's fret name nd ntia Suft. 11 Nonqualitied plans 12a See instructions for box 12 Last name 13 12b 14 Other 120 12d t Employoe's address and ZP code Employer's state ID number 16 State wage, tpn, et 17 State income tas Local wage, pa. et 19 Local income tax 20 Loaty nane W-2 Wage and Tax Statement 20-- Department af the Treanury-ntemal Revanue Service For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Form Copy A For Social Security Administration - Send this entire page with Form W-3 to the Social Security Administration; photocopies are not acceptabie. Cat. No. 101340 Do Not Cut, Fold, or Staple Forms on This Page - Do Not Cut, Fold, or Staple Forms on This Page Empioyee's social security number For Official Use Only 22222 Void OMB No. 1545-0008 b Empioyer dentifioation number EN 1 Wages, tps, ofhe compensation 2 Federal inome tax withheld e Employer's name, addresa, and ZIP oode 3 Social rity wage 4 Social securty tax withewid S Mecicare wagen and tips Medicare tax withheld 7 Social curity tips 8 Allocated tips d Cantrol number 10 Dependent care benetits Employee's first name and ita Last name Suft. 11 Nonqunied plam 12a See inetructionm for box 12 12b 14 Other 12 12d f Employee's address and ZP code 15 se Employer's state D number 16 State wages, p, et 17 State income tax 18 Local wages, tipe, etc 19 Local income tax 20 Locsty name W-2 Wage and Tax Statement 20-- Department of the Treasury-temal Reverue Service For Privacy Act end Paperwork Reduction Act Notice, see the separate instructions. Form Copy A For Social Security Administration - Send this entire page with Form W-3 to the Social Security Administration: photacopies are not acceptable, Cat. No. 10134D Do Not Cut, Fold, or Staple Forms on This Page - Do Not Cut, Fold, or Staple Forms on This Page a Employee's social security number For Official Use Only OMB No. 1546-0008 22222 Vold b Employer identification number IN 1 Wages, tipa, other compensation 2 Federal income tax withheld e Employer's name, address and ZP code 3 Social security wages 4 Sacial security tx withheid 5 Medicare wages and tips 6 Medicare tax withheld 7 Social secunty tips 8 Alecated tips d Control mumber 10 Dependent care banafts Employee's finst name and initial Last name Suft. 11 Nonquified plane 12a See mstructions for box 12 Terat 126 14 Other 120 124 * Employee's address and ZIP code 15 S Employar's state ID number 16 State wages, o, t 17 Stute income ta 18 Local wages, ee 19 Local eorme lax 20 W-2 Wage and Tax Statement 20- Department of the Treasury-Intemal Revenue Service For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Form Copy A For Socinl Security Administration - Send this entire page with Form W-3 to the Social Security Administration; photocopies are not acceptable. Cat. No. 101340 Do Not Cut, Fold, or Staple Forms on This Page - Do Not Cut, Fold, or Staple Forms on This Page Employee's social securty number For official Use Only OMB No. 1546-0oos 22222 Void b Empkoyer identification number EIN 2 Federal incorne tan wthheid Wages, tipe, ofher compensation e Employer's name, addess and ZIP code 3 Socia security wages 4 Sacial security tax wiheid 5 Medicare wages and tipe 6 Medicare tax withheld 7 Social securty tipe 8 Alocated tips d Cortrol number 10 Dependent caru banufta Empioyee's first name and inti Sut 11 Nonqulited plans Last name 12a See instructions for box 12 13 y lay 12b 14 Other 12e 124 t Employee's address and ZIP code 15 am Erployera state D number 16 State wagee, fpn, ete 17 State income taa 18 Local wages, pe te 19 Local income ta 20 Lacty nane W-2 Wage and Tax Statement 20- Department of the Treasury-Intemal Pevenue Service For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Form Copy A For Social Security Administration - Send this entire page with Form W-3 to the Social Security Administration; photocopies are not acceptable. Cat. No. 10134D

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation Part 1 34580 Box 1 includes income subject to federal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started