Answered step by step

Verified Expert Solution

Question

1 Approved Answer

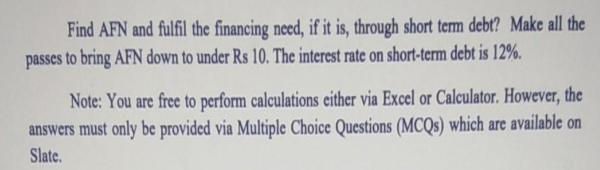

Find AFN and fulfil the financing need, if it is, through short term debt? Make all the passes to bring AFN down to under

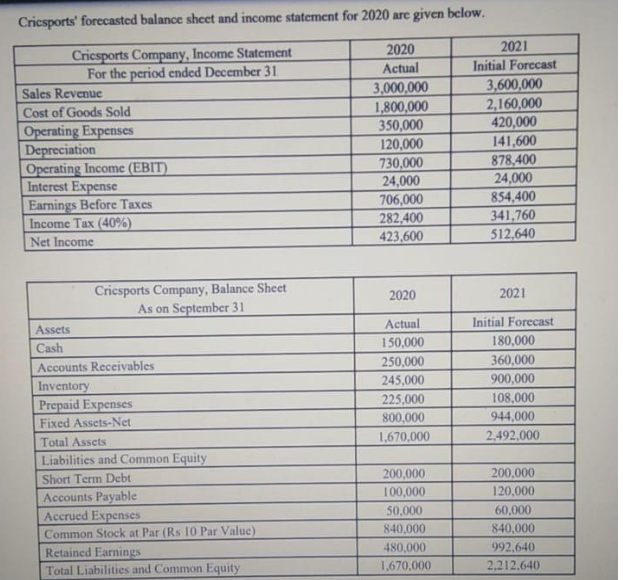

Find AFN and fulfil the financing need, if it is, through short term debt? Make all the passes to bring AFN down to under Rs 10. The interest rate on short-term debt is 12%. Note: You are free to perform calculations either via Excel or Calculator. However, the answers must only be provided via Multiple Choice Questions (MCQs) which are available on Slate. Cricsports' forecasted balance sheet and income statement for 2020 are given below. Cricsports Company, Income Statement For the period ended December 31 Sales Revenue Cost of Goods Sold Operating Expenses Depreciation Operating Income (EBIT) Interest Expense Earnings Before Taxes Income Tax (40%) Net Income Assets Cash Cricsports Company, Balance Sheet As on September 31 Accounts Receivables Inventory Prepaid Expenses Fixed Assets-Net Total Assets Liabilities and Common Equity Short Term Debt Accounts Payable Accrued Expenses Common Stock at Par (Rs 10 Par Value) Retained Earnings Total Liabilities and Common Equity 2020 Actual 3,000,000 1,800,000 350,000 120,000 730,000 24,000 706,000 282,400 423,600 2020 Actual 150,000 250,000 245,000 225,000 800,000 1,670,000 200,000 100,000 50,000 840,000 480,000 1,670,000 2021 Initial Forecast 3,600,000 2,160,000 420,000 141,600 878,400 24,000 854,400 341,760 512,640 2021 Initial Forecast 180,000 360,000 900,000 108,000 944,000 2,492,000 200,000 120,000 60,000 840,000 992,640 2,212,640

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Answer AFN Total Assets Total Liabilities For 2020 AFN 944000 992640 48640 For 2021 AFN 1670000 2212...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started