Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Adele Brothers Contracting reports a $1,220,000 bi-weekly payroll. Adele and its employees must pay Social Security (federal insurance contribution act, or FICA) taxes, and

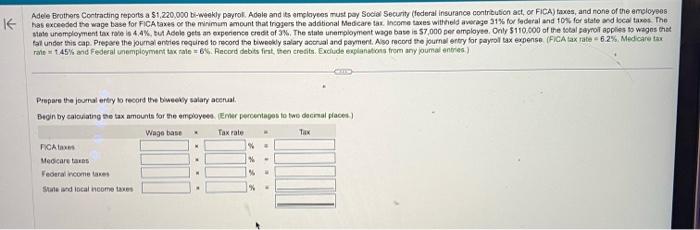

Adele Brothers Contracting reports a $1,220,000 bi-weekly payroll. Adele and its employees must pay Social Security (federal insurance contribution act, or FICA) taxes, and none of the employees Khas exceeded the wage base for FICA taxes or the minimum amount that triggers the additional Medicare tax income taxes withheld average 31% for federal and 10% for state and local taxes. The state unemployment tax rate is 4.4%, but Adele gets an experience credit of 3%. The state unemployment wage base is $7,000 per employee. Only $110,000 of the total payroll applies to wages that fall under this cap. Prepare the journal entries required to record the biweekly salary accrual and payment. Also record the journal entry for payroll tax expense (FICA tax rate 6.2%. Medicare tax rate 1.45% and Federal unemployment tax rate 6%. Record debits first, then credits. Exclude explanations from any joumal entries.) Prepare the journal entry to record the biweekly salary accrual. Begin by calculating the tax amounts for the employees. (Enter percentages to two decimal places.)) FICA Taxes Medicare taxes Federal income taxes State and local income taxes Wage base Tax rate % " % . Tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started