Question

a)Determine the earnings per share (EPSO)? b) What was the company's dividend per share (DPSO)? c) What was the dividend payout ratio? d) What was

a)Determine the earnings per share (EPSO)?

b) What was the company's dividend per share (DPSO)?

c) What was the dividend payout ratio?

d) What was Apollo's last declared profit after tax and total dividend payment made to its ordinary shareholders?

e) If analysts estimate that the company's earnings and dividends are expected to have a positive growth of 2% (g = 2% ); investors required of return is 8%; and using an industry PE of 13 times, what should be the estimated value of Apollo's stock using (i) Discounted cash flow model and (ii) Market Multiplier (PER)?

f) Is the stock over or undervalued? Explain.

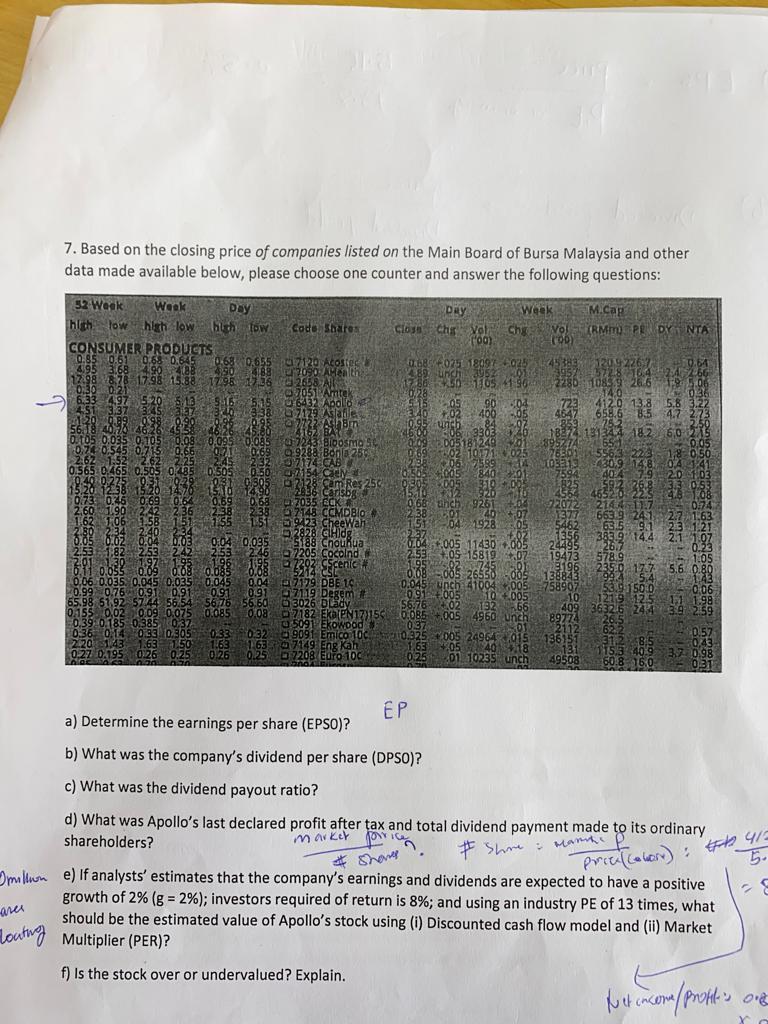

7. Based on the closing price of companies listed on the Main Board of Bursa Malaysia and other data made available below, please choose one counter and answer the following questions: Day 52 Week Week high low high low high low Day Week M.Cap Code Shares Close Chg Vol (RMM) PR DY NTA CONSUMER PRODUCTS (100) 4.95 3.68 12.98 878 17.98 0.68 0.645 0.68 0.655 4.90 4186 488 0.68 -075 18097 4.89 unch 17.98 17.36 C17120 Acosted C2090- AHealth24 2658 All 7051 Amtek 6432 Apalio 17 86 -3.50 1805 41 6.33 4.97 0,28 16 5.15 5.15 3.38 7129 As alle. 3.40 099 098 090 985 0.25 10.9. SUPA Funch 46:00 0.085 20smo 0.09.005 0.69 CCMDBlo 9423 CheeWah gHidg 5188 Chouhua Cocolnd # 392 SScenic # 2.53 17179 DBE 10 0.045 0.91+ Degem # D7182 Eka(PN17)15 2016 0.085 +.005 5091 Ekowood 0.37 7149 Eng Kah Emico10C 1325 11.63 6.100 EP a) Determine the earnings per share (EPSO)? b) What was the company's dividend per share (DPSO)? c) What was the dividend payout ratio? d) What was Apollo's last declared profit after tax and total dividend payment made to its ordinary shareholders? market price #412 5. #Shanes # Shore: Manhe campi (ber): mille) If analysts' estimates that the company's earnings and dividends are expected to have a positive growth of 2% (g = 2%); investors required of return is 8%; and using an industry PE of 13 times, what should be the estimated value of Apollo's stock using (i) Discounted cash flow model and (ii) Market Multiplier (PER)? aree Louting f) Is the stock over or undervalued? Explain. Net income ~/proft's Ove 2903888888888888 01 10235 Chg Vo! (90) 45383 120.9-226) 12286 1083.9 723 4120 4647 1837 7. Based on the closing price of companies listed on the Main Board of Bursa Malaysia and other data made available below, please choose one counter and answer the following questions: Day 52 Week Week high low high low high low Day Week M.Cap Code Shares Close Chg Vol (RMM) PR DY NTA CONSUMER PRODUCTS (100) 4.95 3.68 12.98 878 17.98 0.68 0.645 0.68 0.655 4.90 4186 488 0.68 -075 18097 4.89 unch 17.98 17.36 C17120 Acosted C2090- AHealth24 2658 All 7051 Amtek 6432 Apalio 17 86 -3.50 1805 41 6.33 4.97 0,28 16 5.15 5.15 3.38 7129 As alle. 3.40 099 098 090 985 0.25 10.9. SUPA Funch 46:00 0.085 20smo 0.09.005 0.69 CCMDBlo 9423 CheeWah gHidg 5188 Chouhua Cocolnd # 392 SScenic # 2.53 17179 DBE 10 0.045 0.91+ Degem # D7182 Eka(PN17)15 2016 0.085 +.005 5091 Ekowood 0.37 7149 Eng Kah Emico10C 1325 11.63 6.100 EP a) Determine the earnings per share (EPSO)? b) What was the company's dividend per share (DPSO)? c) What was the dividend payout ratio? d) What was Apollo's last declared profit after tax and total dividend payment made to its ordinary shareholders? market price #412 5. #Shanes # Shore: Manhe campi (ber): mille) If analysts' estimates that the company's earnings and dividends are expected to have a positive growth of 2% (g = 2%); investors required of return is 8%; and using an industry PE of 13 times, what should be the estimated value of Apollo's stock using (i) Discounted cash flow model and (ii) Market Multiplier (PER)? aree Louting f) Is the stock over or undervalued? Explain. Net income ~/proft's Ove 2903888888888888 01 10235 Chg Vo! (90) 45383 120.9-226) 12286 1083.9 723 4120 4647 1837Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started