Question

Aditionally, the auditors noted the following information: - STA rents space in an office building: Space in Building 1: 25,000 sq.ft. - On january 1,

Aditionally, the auditors noted the following information:

- STA rents space in an office building:

Space in Building 1: 25,000 sq.ft.

- On january 1, Year 2, the company added a second space:

Space in Building 2: 11,000 sq.ft.

- The balance of interest-bearing debt outstanding:

January 1, Year 2: $4,830,000

December 31, Year 2: $10,262,000

The company issued additional debt on July 1, Year 2

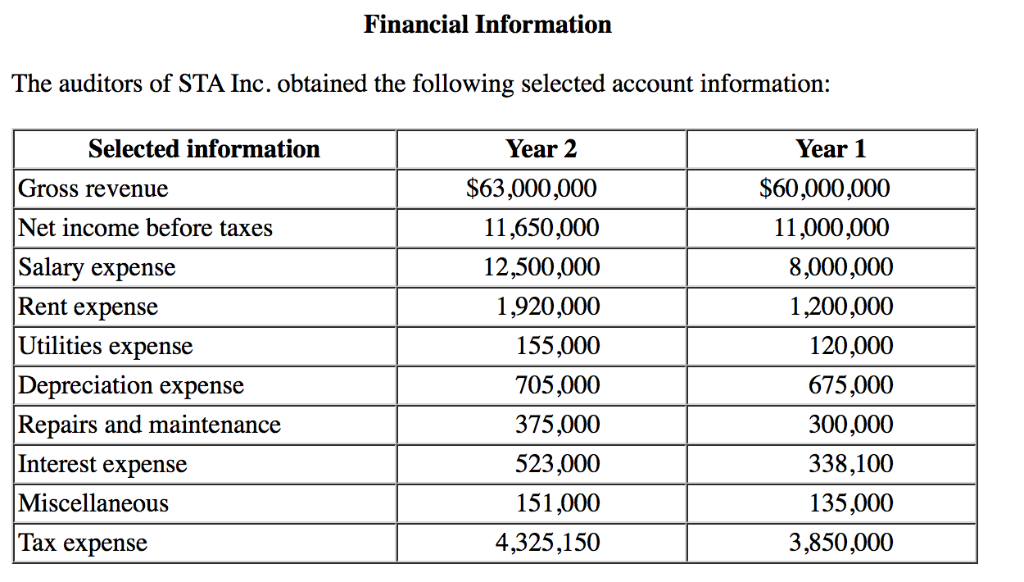

The auditors of STA Inc., a calendar-year corporation, obtained the selected information for Years 1 and 2, located in the exhibit above. The auditors are performing analytical procedures relative to the expectations of expenses for Year 2 and have established a materiality threshold of 5% of the auditor's expected Year 2 amount.

For each of the expenses in column A below, consider the additional notes in column B, and complete the following:

- In column C, enter the auditor's expectation of Year 2 expense.

- In column D, select the auditor's decision as to whether further testing is needed and why.

- Round all amounts to the nearest dollar.

- An option may be used once, more than once, or not at all.

- Consider each account independently.

| Expense | Additional Notes | Auditors Expectations | Auditor Decisions |

| Salary | Average salary increased 2% effective January 1, year 2. Average head count was 200 in Year 1 and 300 in Year 3. | ||

| Rent | Building 1: On July 1, Year 2, the company entered into a new lease agreement. Monthly rent expense was 5% higher than that of the prior lease. Building 2: The company began renting another facility on January 1, Year 2, for $45,000 a month, on a month to month basis. | ||

| Utilities | The utilities expense is based on square footage of each facility, the rate did not change from Year 1 to Year 2. | ||

| Miscellaneous | Calculation is based on 0.25% of gross revenue. | ||

| Repairs and Maintenance | Repairs and Maintenance expense is based on the average gross value of assets at cost: January 1, Year 1 : $2,700,000 January 1, Year 2: $ 3,300,000 January 1, Year 3 : $ 3,700,000 | ||

| Interest Expense | The average interest rate of STA's debt is 7% |

The decisions options are:

Above acceptable amount, further testing needed

Below acceptable amount, further testing needed

Within threshold, no further testing needed

Financial Information The auditors of STA Inc. obtained the following selected account information: Selected information Year 2 Year 1 $63,000,000 Gross revenue Net income before taxes Salary expense Rent expense Utilities expense Depreciation expense Repairs and maintenance Interest expense Miscellaneous Tax expense 11,650,000 12,500,000 1,920,000 155,000 705,000 375,000 523,000 151,000 4,325,150 $60,000,000 11,000,000 8,000,000 1,200,000 120,000 675,000 300,000 338,100 135,000 3,850,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started