Answered step by step

Verified Expert Solution

Question

1 Approved Answer

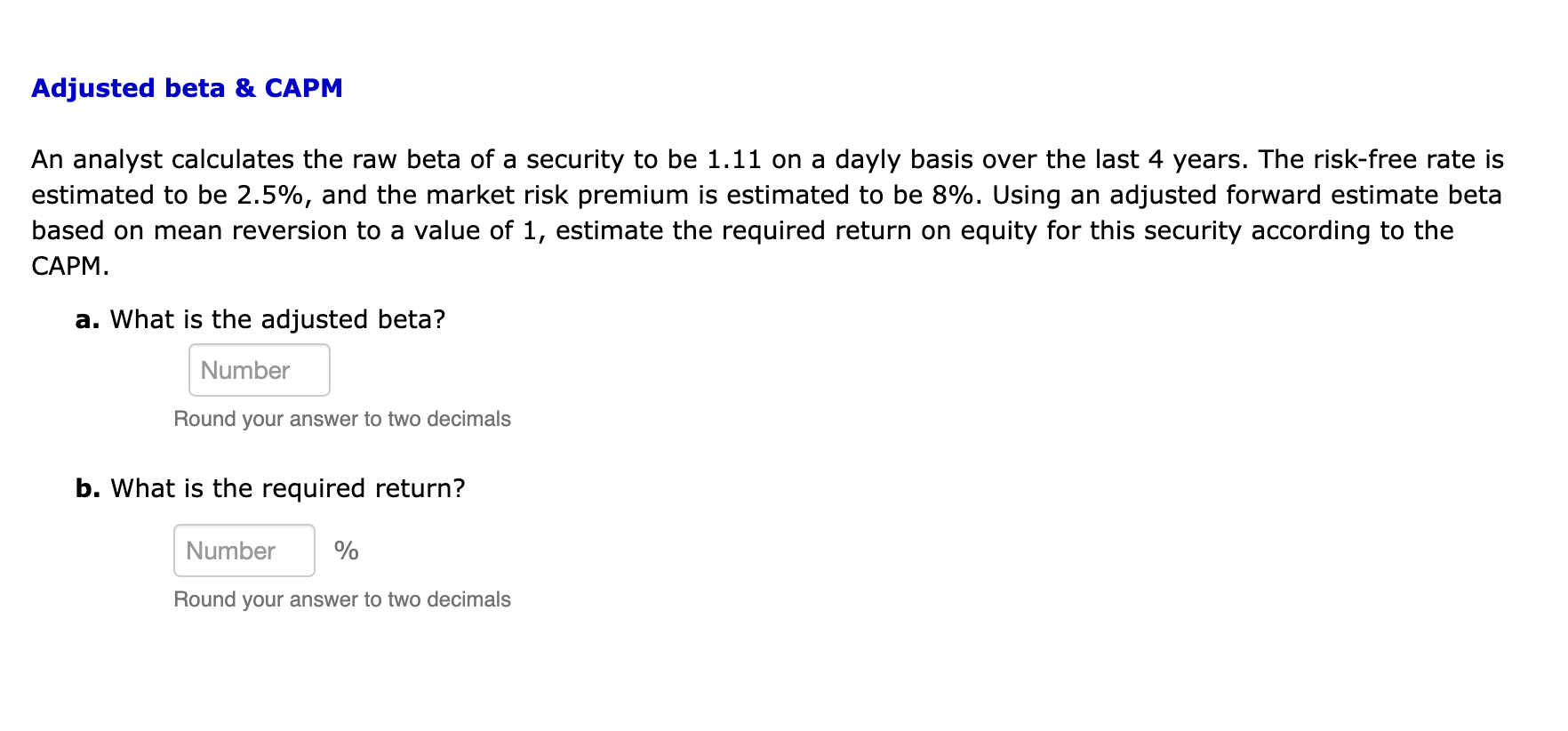

Adjusted beta & CAPM An analyst calculates the raw beta of a security to be 1.11 on a dayly basis over the last 4

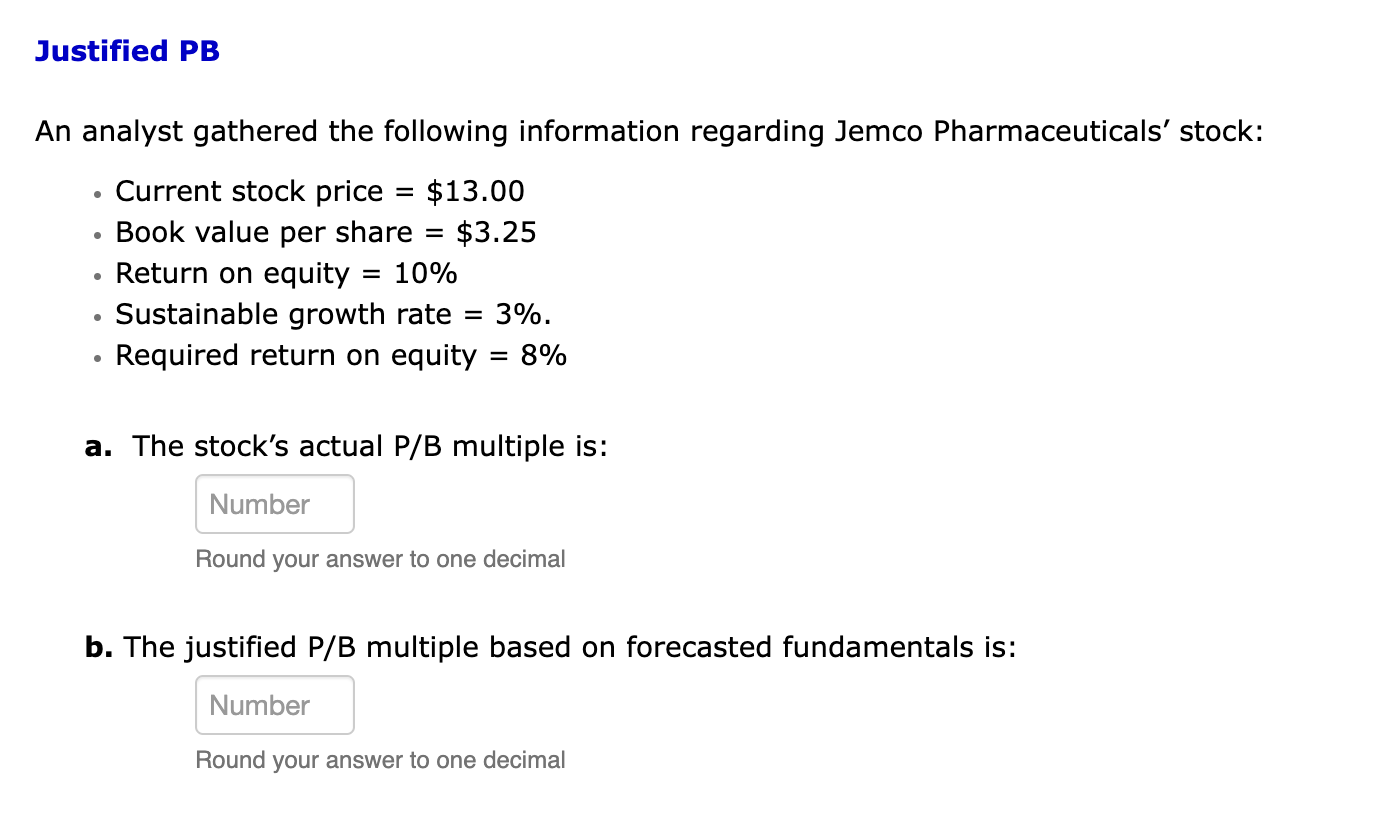

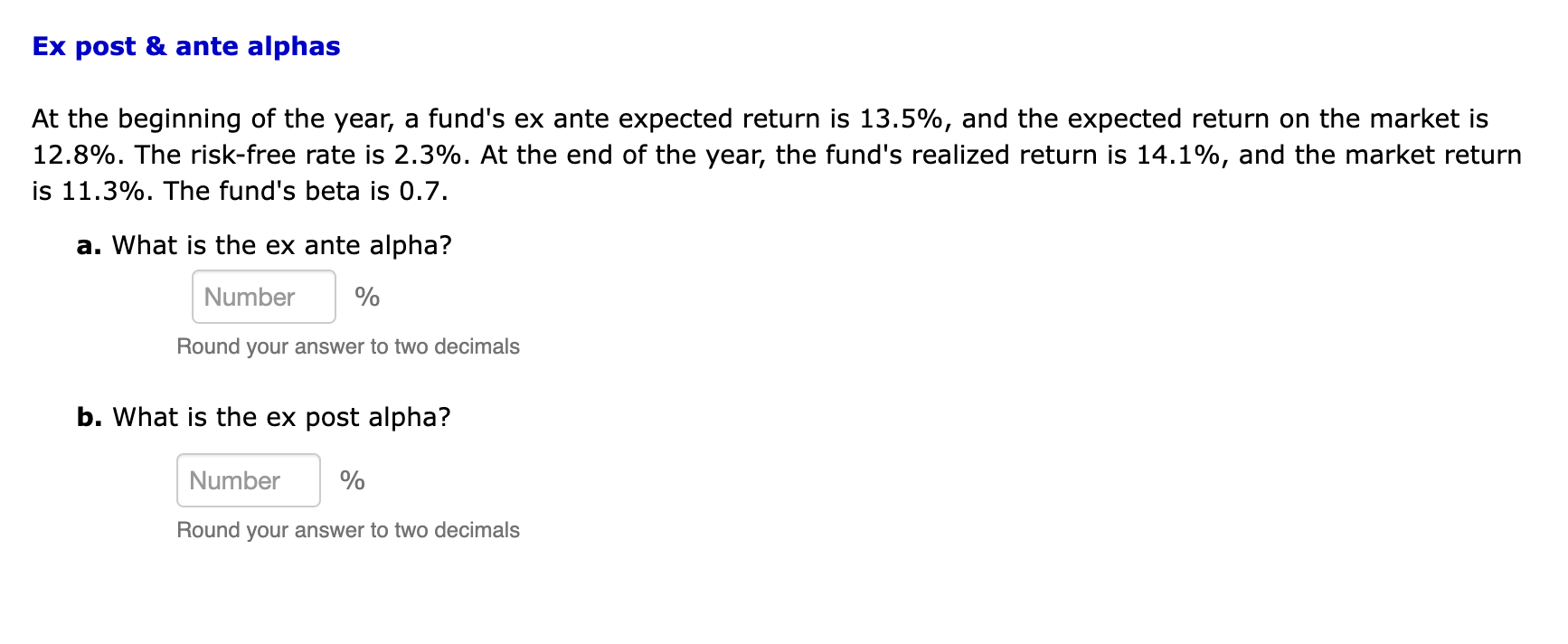

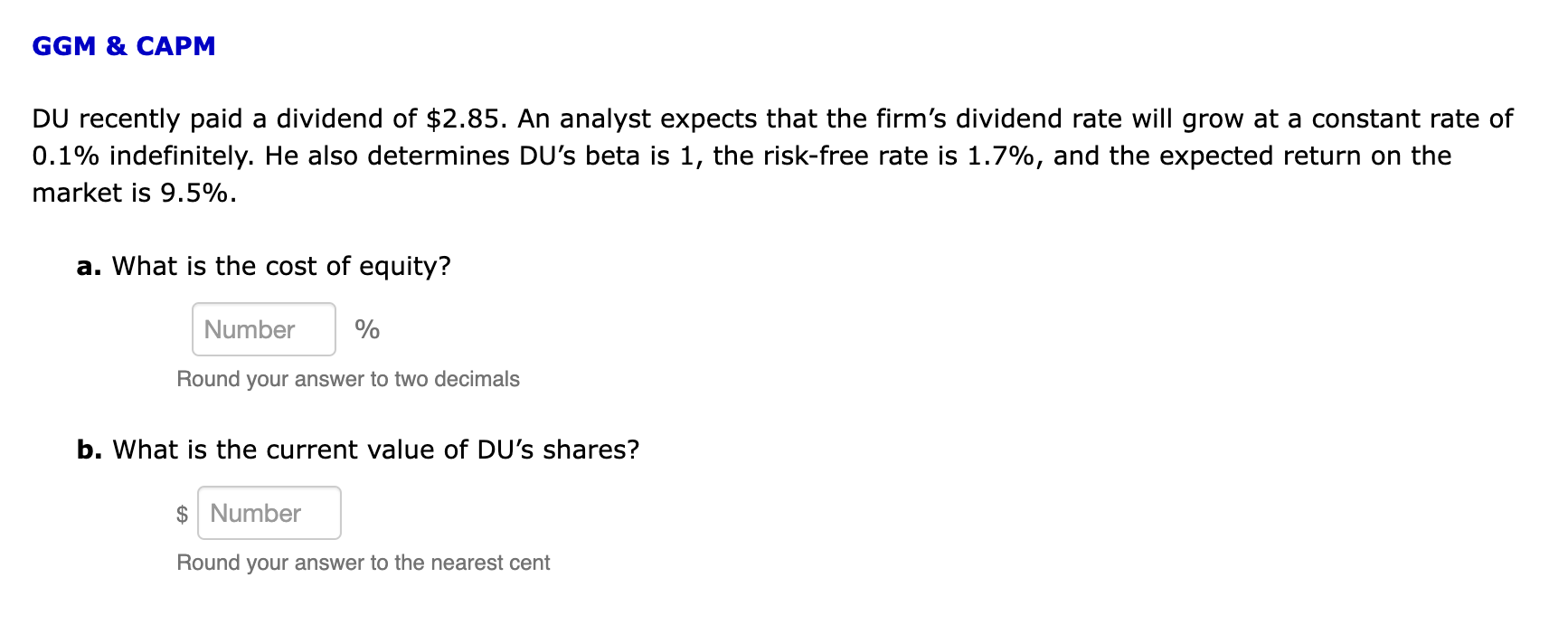

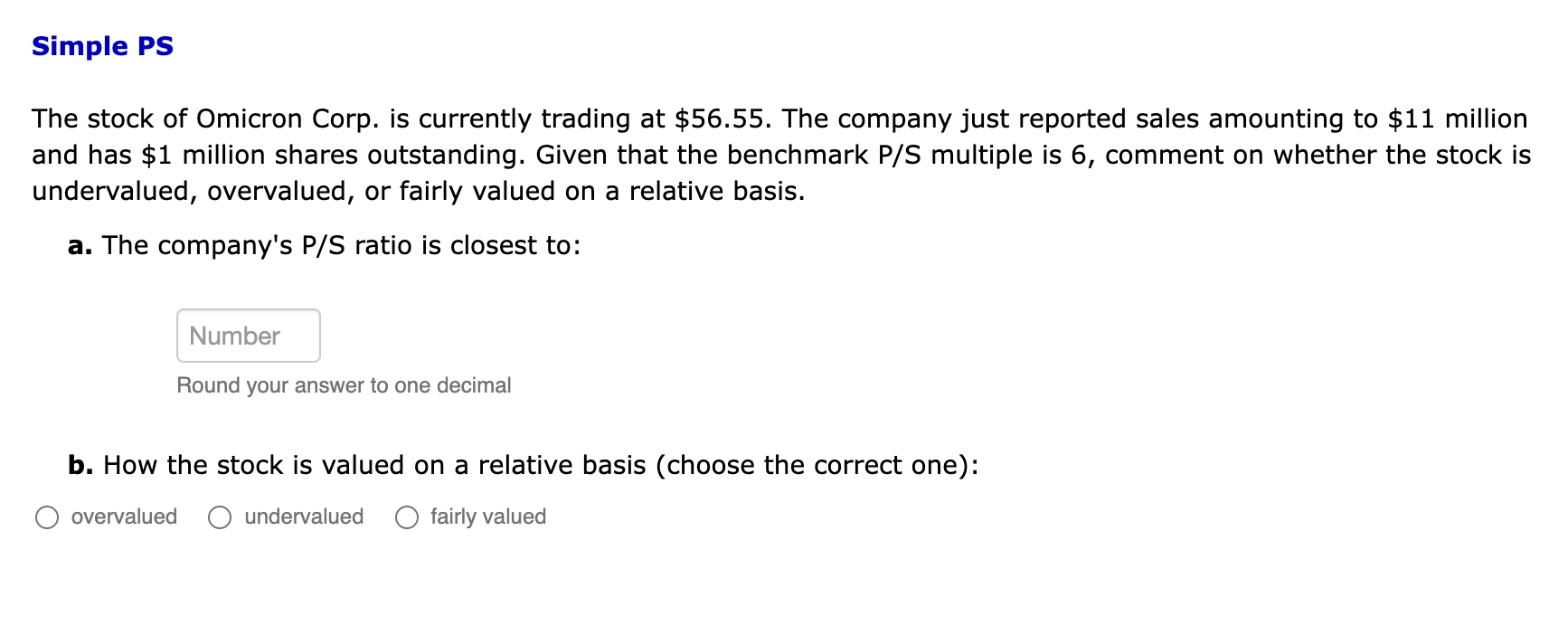

Adjusted beta & CAPM An analyst calculates the raw beta of a security to be 1.11 on a dayly basis over the last 4 years. The risk-free rate is estimated to be 2.5%, and the market risk premium is estimated to be 8%. Using an adjusted forward estimate beta based on mean reversion to a value of 1, estimate the required return on equity for this security according to the CAPM. a. What is the adjusted beta? Number Round your answer to two decimals b. What is the required return? Number % Round your answer to two decimals Justified PB An analyst gathered the following information regarding Jemco Pharmaceuticals' stock: Current stock price = $13.00 Book value per share = $3.25 Return on equity = 10% = Sustainable growth rate : 3%. Required return on equity = 8% a. The stock's actual P/B multiple is: Number Round your answer to one decimal b. The justified P/B multiple based on forecasted fundamentals is: Number Round your answer to one decimal Ex post & ante alphas At the beginning of the year, a fund's ex ante expected return is 13.5%, and the expected return on the market is 12.8%. The risk-free rate is 2.3%. At the end of the year, the fund's realized return is 14.1%, and the market return is 11.3%. The fund's beta is 0.7. a. What is the ex ante alpha? Number % Round your answer to two decimals b. What is the ex post alpha? Number % Round your answer to two decimals GGM & CAPM DU recently paid a dividend of $2.85. An analyst expects that the firm's dividend rate will grow at a constant rate of 0.1% indefinitely. He also determines DU's beta is 1, the risk-free rate is 1.7%, and the expected return on the market is 9.5%. a. What is the cost of equity? Number % Round your answer to two decimals b. What is the current value of DU's shares? $ Number Round your answer to the nearest cent Simple PS The stock of Omicron Corp. is currently trading at $56.55. The company just reported sales amounting to $11 million and has $1 million shares outstanding. Given that the benchmark P/S multiple is 6, comment on whether the stock is undervalued, overvalued, or fairly valued on a relative basis. a. The company's P/S ratio is closest to: Number Round your answer to one decimal b. How the stock is valued on a relative basis (choose the correct one): overvalued O undervalued fairly valued

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started