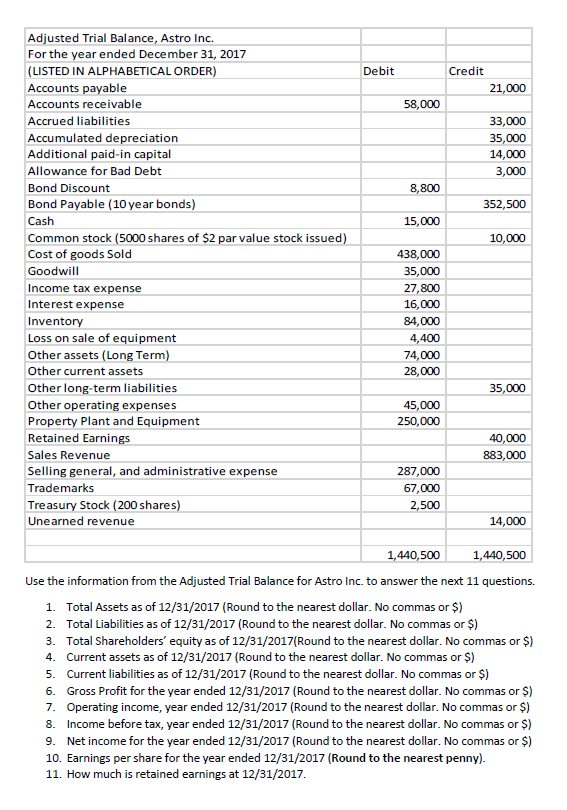

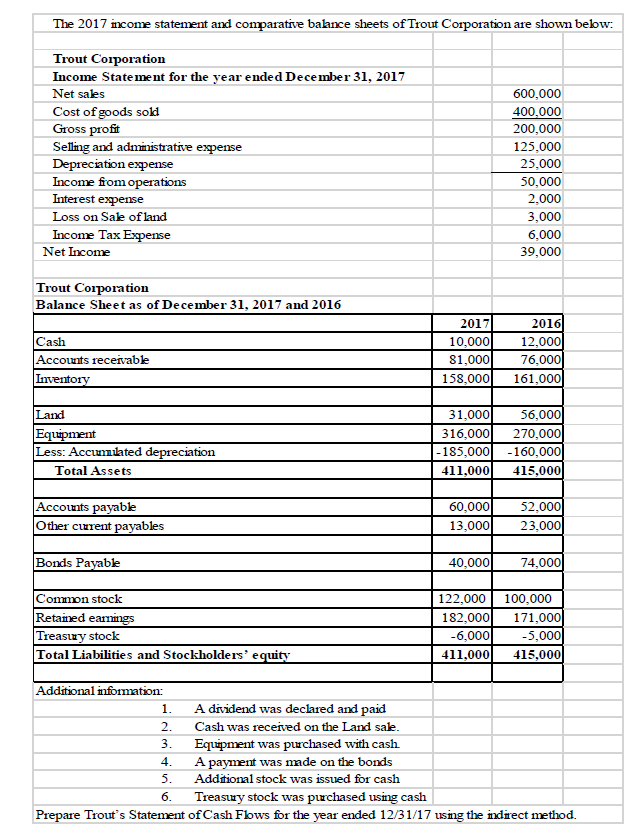

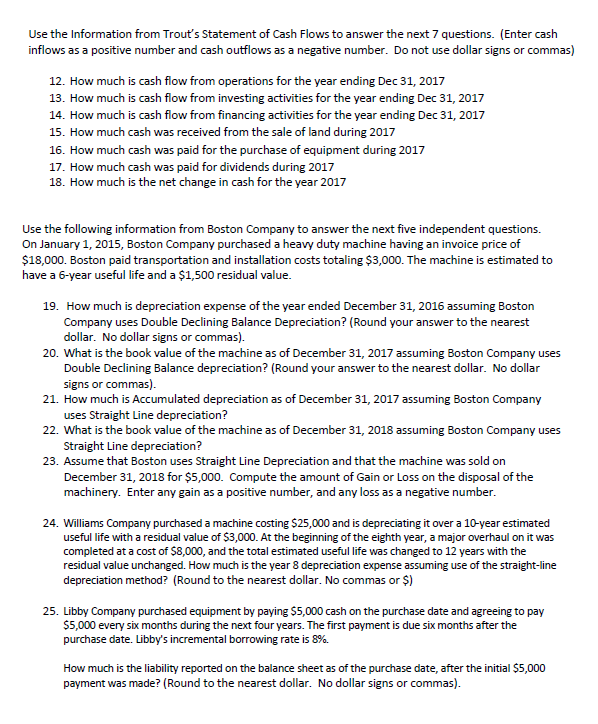

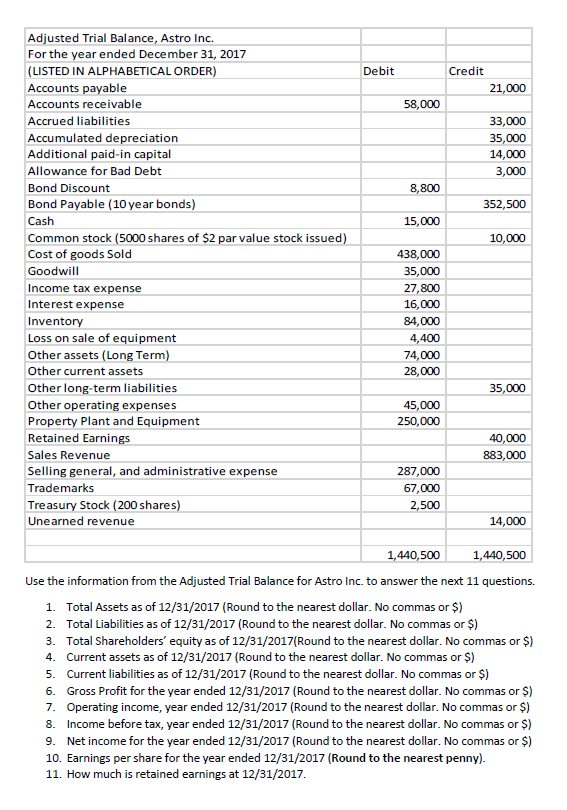

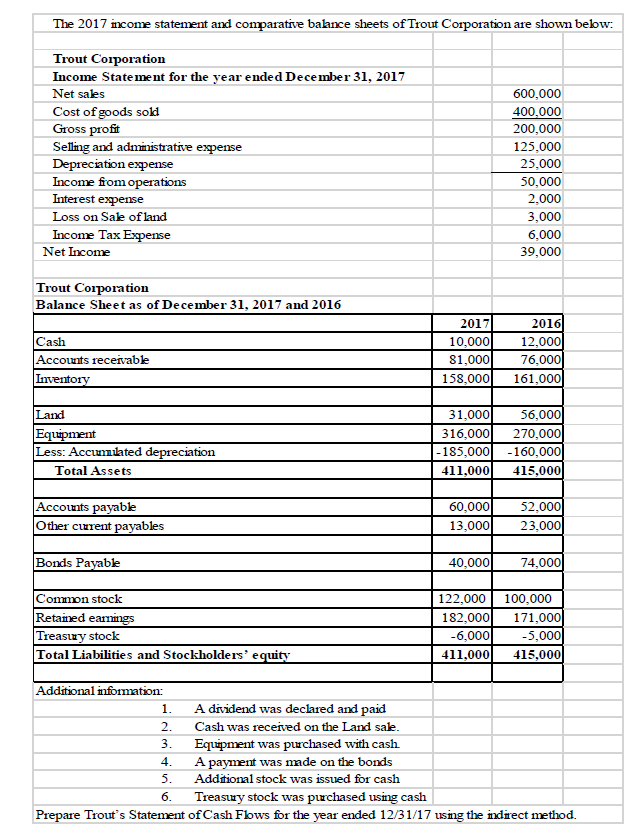

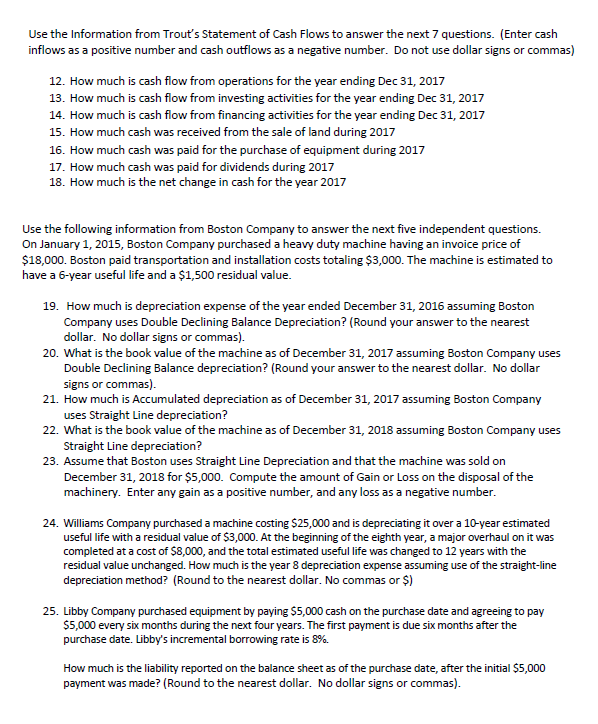

Adjusted Trial Balance, Astro Inc For the year ended December 31, 2017 (LISTED IN ALPHABETICAL ORDER) Credit Debit Accounts payable 21,000 Accounts receivable 58,000 Accrued liabilities 33,000 Accumulated depreciation Additional paid-in capital 35,000 14,000 Allowance for Bad Debt 3,000 Bond Discount 8,800 Bond Payable (10 ye ar bonds) 352,500 Cash 15,000 Common stock (5000 shares of $2 par value stock issued) Cost of goods Sold 10,000 438,000 Goodwill 35,000 Income tax expense 27,800 Interest expense 16,000 Inventory 84,000 Loss on sale of equipment 4,400 Other assets (Long Term) 74,000 Other current assets 28,000 Other long-term liabilities 35,000 Other operating expenses Property Plant and Equipment Retained Earnings 45,000 250,000 40,000 Sales Revenue 883,000 Selling general, and administrative expense 287,000 Trademarks 67,000 Treasury Stock (200 shares) 2,500 Unearned revenue 14,000 1,440,500 1,440,500 Use the information from the Adjusted Trial Balance for Astro Inc. to answer the next 11 questions. 1. Total Assets as of 12/31/2017 (Round to the nearest dollar. No commas or $) 2. Total Liabilities as of 12/31/2017 (Round to the nearest dollar. No commas or $) 3. Total Shareholders' equity as of 12/31/2017(Round to the nearest dollar. No commas or $) 4. Current assets as of 12/31/2017 (Round to the nearest dollar. No commas or $) Current liabilities as of 12/31/2017 (Round to the nearest dollar. No commas or $) 5. Gross Profit for the year ended 12/31/2017 (Round to the nearest dollar. No commas or $) Operating income, year ended 12/31/2017 (Round to the nearest dollar. No commas or $) 6. 7. 8 Income before tax, year ended 12/31/2017 (Round to the nearest dollar. No commas or $) 9 Net income for the year ended 12/31/2017 (Round to the nearest dollar. No commas or $) 10. Earnings per share for the year ended 12/31/2017 (Round to the nearest penny) 11. How much is retained earnings at 12/31/2017. The 2017 income statement and comparative bakance sheets of Trout Corporation are shown below Trout Corporation Income Statement for the year ended December 31, 2017 Net sales 600,000 400,000 Cost of goods sold Gross profit Selling and admimistrative expense Depreciation expense Income from operations Interest expense 200,000 125,000 25,000 50,000 2,000 Loss on Sale of land 3,000 Income Tax Expense 6,000 Net Income 39,000 Trout Corporation Balance Sheet as of Dece mber 31, 2017 and 2016 2016 2017 10,000 81,000 158,000 12,000 76,000 161,000 Cash Accounts receivable Inventory 56,000 Land 31,000 Equipment Less: Accumlated depreciation 316,000 -185,000 411,000 270,000 -160,000 415,000 Total Assets Accounts payable Other current payables 52,000 23,000 60,000 13,000 Bonds Payable 40,000 74,000 122,000 100,000 Common stock Retained eamings Treasury stock Total Liabilities and Stockholde rs' equity 171,000 -5,000 415,000 182,000 -6,000 411.000 Additional information: A dividend was declared and paid 1 Cash was received on the Land sale Equipment was purchased with cash A payment was made on the bonds 5. 2. 3. 4 Additional stock was issued for cash Treasury stock was purchased using cash Prepare Trout's Statement ofCash Fows for the year ended 12/31/17 using the indrect method 6. 26. Rice Corporation's attorney has provided the following summaries of three lawsuits against Rice: Lawsuit A: The loss is probable, but the loss cannot be reasonably estimated. Lawsuit B: The loss is reasonably possible, but the loss cannot be reasonably estimated. Lawsuit C: The loss is reasonably possible and can be reasonably estimated Which of the following statements is incorrect? A. A disclosure note is required for lawsuit A. B. A disclosure note is required for lawsuit B. C. A disclosure note is required for lawsuit C. D. Lawsuit A is reported on the balance sheet as a liability. 27. Which of the following would not be a result of the adjusting entry to record accrued interest on a note payable? A. A decrease in net income. B. A decrease in stockholders' equity C. An increase in liabilities D. A decrease in current assets 28. Mission Corp. borrowed $50,000 cash on April 1, 2016, and signed a one-year 12 %, interest-bearing note payable. The interest and principal are both due on March 31, 2017. Assume that the appropriate adjusting entry was made on December 31, 2016 and that no adjusting entries have been made during 2017. What is the amount of interest expense to be recorded when the interest and principal are paid on March 31, 2017? (Round to the nearest dollar. No dollar signs or commas) Use the following information about Tonika Company to answer the next 4 questions On January 1, 2016, Tonika Company issued a four-year, $10,000, 7 % bond. The interest is payable semi-annually each June 30 and December 31. The market rate of interest on January 1, 2016 is 8 %. Tonika uses the effective- interest amortization method. 29. What is the issue price of the bonds on January 1, 2016? (Round to the nearest dollar. No dollar signs or commas) 30. What is the carrying value of the bonds on December 31, 2018? (Round to the nearest dollar. No dollar signs or commas) 31. How much interest expense would be recognized in the calendar year 2019 income statement? (Round to the nearest dollar. No dollar signs or commas). 32. How much cash would be paid to investors on June 30, 2016? (Round to the nearest dollar. No dollar signs or commas) 33. Wendell Company provided the following pertaining to its accounting year that ended December 31, 2016: Common stock with a $10,000 par value was sold for $50,000 cash Cash dividends totaling $20,000 were declared, of which $15,000 were paid Net income was $70,000 A 5% stock dividend resulted in a common stock distribution, which had a $5,000 par value and a $23,000 market value Treasury stock repurchased in a prior year for $9,000 was resold for $7,000 and in the journal entry to record the sale, Additional paid-in capital was debited for the amount of the difference between the repurchase price and the resale price What is the amount of net increase in Wendell's additional paid-in capital account during the year 2016? (Round to the nearest dollar. No commas or $) 34. CBA Company reported total stockholders equity of $85,000 on its balance sheet dated December 31, 2016. During the year ended December 31, 2017, CBA reported net income of $10,000, declared and paid a cash dividend of $2,000, and issued additional common stock for $20,000. What is total stockholders equity as of December 31, 2017? (Round to the nearest dollar. No commas or $) 35. A company reported the following asset and liability balances at the end of 2015 and 2016: 2015 2016 Total Assets $6,800,000 $7,600,000 Total Liabilities 3,200,000 3,600,000 During 2016, cash dividends of $50,000 were declared and paid, and common stock was issued for $100,000 What was the amount of net income for 2016? (Round to the nearest dollar. No commas or $) 36. On February 1, 2015, Cue Company acquired 1,000 shares of its $1 par value stock for $47 per share and held these shares in treasury. On April 10, 2016, Cue resold all the treasury shares for $50 per share. Which of the following entries would be recorded when Cue Company resells the shares of treasury stock? A. Cash 50,000 Treasury stock 47,000 3,000 Additional paid-in capital B. Cash 50,000 Treasury stock 47,000 Retained earnings 3,000 C.Cash 50,000 1,000 Common stock Additional paid-in capital 49,000 D.ICash 50,000 47,000 Treasury stock Gain on sale of treasury stock 3,000 Adjusted Trial Balance, Astro Inc For the year ended December 31, 2017 (LISTED IN ALPHABETICAL ORDER) Credit Debit Accounts payable 21,000 Accounts receivable 58,000 Accrued liabilities 33,000 Accumulated depreciation Additional paid-in capital 35,000 14,000 Allowance for Bad Debt 3,000 Bond Discount 8,800 Bond Payable (10 ye ar bonds) 352,500 Cash 15,000 Common stock (5000 shares of $2 par value stock issued) Cost of goods Sold 10,000 438,000 Goodwill 35,000 Income tax expense 27,800 Interest expense 16,000 Inventory 84,000 Loss on sale of equipment 4,400 Other assets (Long Term) 74,000 Other current assets 28,000 Other long-term liabilities 35,000 Other operating expenses Property Plant and Equipment Retained Earnings 45,000 250,000 40,000 Sales Revenue 883,000 Selling general, and administrative expense 287,000 Trademarks 67,000 Treasury Stock (200 shares) 2,500 Unearned revenue 14,000 1,440,500 1,440,500 Use the information from the Adjusted Trial Balance for Astro Inc. to answer the next 11 questions. 1. Total Assets as of 12/31/2017 (Round to the nearest dollar. No commas or $) 2. Total Liabilities as of 12/31/2017 (Round to the nearest dollar. No commas or $) 3. Total Shareholders' equity as of 12/31/2017(Round to the nearest dollar. No commas or $) 4. Current assets as of 12/31/2017 (Round to the nearest dollar. No commas or $) Current liabilities as of 12/31/2017 (Round to the nearest dollar. No commas or $) 5. Gross Profit for the year ended 12/31/2017 (Round to the nearest dollar. No commas or $) Operating income, year ended 12/31/2017 (Round to the nearest dollar. No commas or $) 6. 7. 8 Income before tax, year ended 12/31/2017 (Round to the nearest dollar. No commas or $) 9 Net income for the year ended 12/31/2017 (Round to the nearest dollar. No commas or $) 10. Earnings per share for the year ended 12/31/2017 (Round to the nearest penny) 11. How much is retained earnings at 12/31/2017. The 2017 income statement and comparative bakance sheets of Trout Corporation are shown below Trout Corporation Income Statement for the year ended December 31, 2017 Net sales 600,000 400,000 Cost of goods sold Gross profit Selling and admimistrative expense Depreciation expense Income from operations Interest expense 200,000 125,000 25,000 50,000 2,000 Loss on Sale of land 3,000 Income Tax Expense 6,000 Net Income 39,000 Trout Corporation Balance Sheet as of Dece mber 31, 2017 and 2016 2016 2017 10,000 81,000 158,000 12,000 76,000 161,000 Cash Accounts receivable Inventory 56,000 Land 31,000 Equipment Less: Accumlated depreciation 316,000 -185,000 411,000 270,000 -160,000 415,000 Total Assets Accounts payable Other current payables 52,000 23,000 60,000 13,000 Bonds Payable 40,000 74,000 122,000 100,000 Common stock Retained eamings Treasury stock Total Liabilities and Stockholde rs' equity 171,000 -5,000 415,000 182,000 -6,000 411.000 Additional information: A dividend was declared and paid 1 Cash was received on the Land sale Equipment was purchased with cash A payment was made on the bonds 5. 2. 3. 4 Additional stock was issued for cash Treasury stock was purchased using cash Prepare Trout's Statement ofCash Fows for the year ended 12/31/17 using the indrect method 6. 26. Rice Corporation's attorney has provided the following summaries of three lawsuits against Rice: Lawsuit A: The loss is probable, but the loss cannot be reasonably estimated. Lawsuit B: The loss is reasonably possible, but the loss cannot be reasonably estimated. Lawsuit C: The loss is reasonably possible and can be reasonably estimated Which of the following statements is incorrect? A. A disclosure note is required for lawsuit A. B. A disclosure note is required for lawsuit B. C. A disclosure note is required for lawsuit C. D. Lawsuit A is reported on the balance sheet as a liability. 27. Which of the following would not be a result of the adjusting entry to record accrued interest on a note payable? A. A decrease in net income. B. A decrease in stockholders' equity C. An increase in liabilities D. A decrease in current assets 28. Mission Corp. borrowed $50,000 cash on April 1, 2016, and signed a one-year 12 %, interest-bearing note payable. The interest and principal are both due on March 31, 2017. Assume that the appropriate adjusting entry was made on December 31, 2016 and that no adjusting entries have been made during 2017. What is the amount of interest expense to be recorded when the interest and principal are paid on March 31, 2017? (Round to the nearest dollar. No dollar signs or commas) Use the following information about Tonika Company to answer the next 4 questions On January 1, 2016, Tonika Company issued a four-year, $10,000, 7 % bond. The interest is payable semi-annually each June 30 and December 31. The market rate of interest on January 1, 2016 is 8 %. Tonika uses the effective- interest amortization method. 29. What is the issue price of the bonds on January 1, 2016? (Round to the nearest dollar. No dollar signs or commas) 30. What is the carrying value of the bonds on December 31, 2018? (Round to the nearest dollar. No dollar signs or commas) 31. How much interest expense would be recognized in the calendar year 2019 income statement? (Round to the nearest dollar. No dollar signs or commas). 32. How much cash would be paid to investors on June 30, 2016? (Round to the nearest dollar. No dollar signs or commas) 33. Wendell Company provided the following pertaining to its accounting year that ended December 31, 2016: Common stock with a $10,000 par value was sold for $50,000 cash Cash dividends totaling $20,000 were declared, of which $15,000 were paid Net income was $70,000 A 5% stock dividend resulted in a common stock distribution, which had a $5,000 par value and a $23,000 market value Treasury stock repurchased in a prior year for $9,000 was resold for $7,000 and in the journal entry to record the sale, Additional paid-in capital was debited for the amount of the difference between the repurchase price and the resale price What is the amount of net increase in Wendell's additional paid-in capital account during the year 2016? (Round to the nearest dollar. No commas or $) 34. CBA Company reported total stockholders equity of $85,000 on its balance sheet dated December 31, 2016. During the year ended December 31, 2017, CBA reported net income of $10,000, declared and paid a cash dividend of $2,000, and issued additional common stock for $20,000. What is total stockholders equity as of December 31, 2017? (Round to the nearest dollar. No commas or $) 35. A company reported the following asset and liability balances at the end of 2015 and 2016: 2015 2016 Total Assets $6,800,000 $7,600,000 Total Liabilities 3,200,000 3,600,000 During 2016, cash dividends of $50,000 were declared and paid, and common stock was issued for $100,000 What was the amount of net income for 2016? (Round to the nearest dollar. No commas or $) 36. On February 1, 2015, Cue Company acquired 1,000 shares of its $1 par value stock for $47 per share and held these shares in treasury. On April 10, 2016, Cue resold all the treasury shares for $50 per share. Which of the following entries would be recorded when Cue Company resells the shares of treasury stock? A. Cash 50,000 Treasury stock 47,000 3,000 Additional paid-in capital B. Cash 50,000 Treasury stock 47,000 Retained earnings 3,000 C.Cash 50,000 1,000 Common stock Additional paid-in capital 49,000 D.ICash 50,000 47,000 Treasury stock Gain on sale of treasury stock 3,000