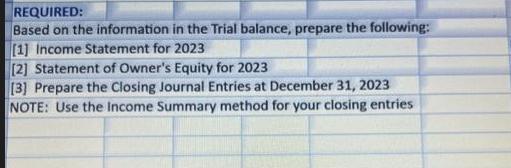

Question

Adjusted Trial balance of the company is given below Cash Accounts receivable Equipment Accumulated depreciation-equipment Accounts payable Unearned revenue Common shares Retained earnings Dividends Service

Adjusted Trial balance of the company is given below

Cash Accounts receivable Equipment Accumulated depreciation-equipment Accounts payable Unearned revenue Common shares Retained earnings Dividends Service revenue Adjusted Trial Balance December 31, 2023 Depreciation expense Insurance expense Rent expense Salaries and wages expense Total Debit 85,000 90,000 85,000 40,000 10,000 8,000 20,000 40,000 378,000 Credit 30,000 40,000 5,000 10,000 88,000 205.000 378,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Income Statement for 2023 Service revenue 85000 Less Expenses Depreciation expense 10000 Insurance expense 8000 Rent expense 20000 Salaries and wages expense 40000 Total expenses 78000 Net income 70...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Jeffrey Waybright, Liang Hsuan Chen, Rhonda Pyper

1st Canadian Edition

9780132147538, 132889714, 013214753X , 978-0132889711

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App