Answered step by step

Verified Expert Solution

Question

1 Approved Answer

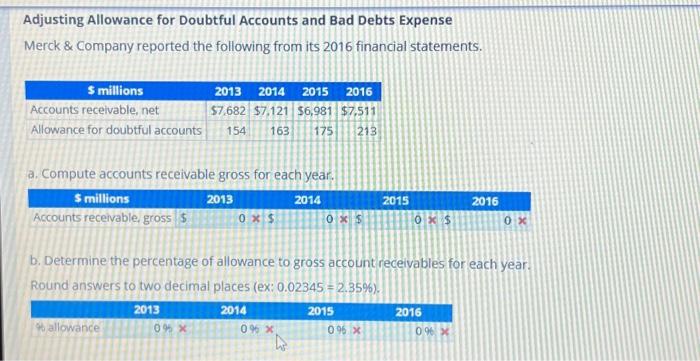

Adjusting Allowance for Doubtful Accounts and Bad Debts Expense Merck & Company reported the following from its 2016 financial statements. $ millions 2013 2014 2015

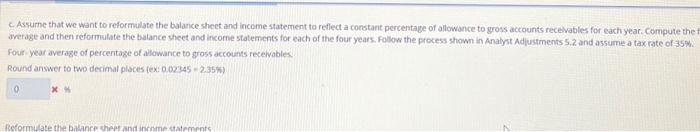

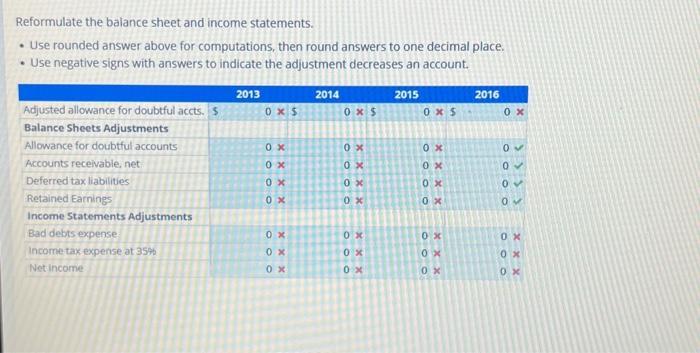

Adjusting Allowance for Doubtful Accounts and Bad Debts Expense Merck & Company reported the following from its 2016 financial statements. $ millions 2013 2014 2015 2016 Accounts receivable, net $7,682 $7,121 $6,981 $7,511 Allowance for doubtful accounts 154 163 175 213 a. Compute accounts receivable gross for each year. $ millions Accounts receivable, gross $ % allowance 2013 0% X 0 * $ 0% * 2014 W 0 x $ b. Determine the percentage of allowance to gross account receivables for each year. Round answers to two decimal places (ex: 0.02345 = 2.35%). 2013 2014 2015 2015 0% * 0x $ 2016 2016 0% * 0 x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started