Question

Adjusting entries: 1)The supplies available at the end of fiscal year 2011 had a cost of $3,200. 2)The cost of expired insurance for the fiscal

Adjusting entries: 1)The supplies available at the end of fiscal year 2011 had a cost of $3,200.

2)The cost of expired insurance for the fiscal year is $3,900

3)Annual depreciation on equipment is $8,500.

4)The companys employees have eraned $1,600 of accrued wages at fiscal year end.

5)The rent expense incurred and not yet paid or recorded at fiscal year end is $200.

Required: Journalize adjusting entries and closing entries

component: Analyze the following correction impact on income statement,balance sheet and Owners equity whether the aforementioned statements will be overstated or understated

a)Assume that the adjustment for supplies used consisted of a credit to supplies and a debit to supplies Expensefor $3200,when the corrected amount was $5,700.

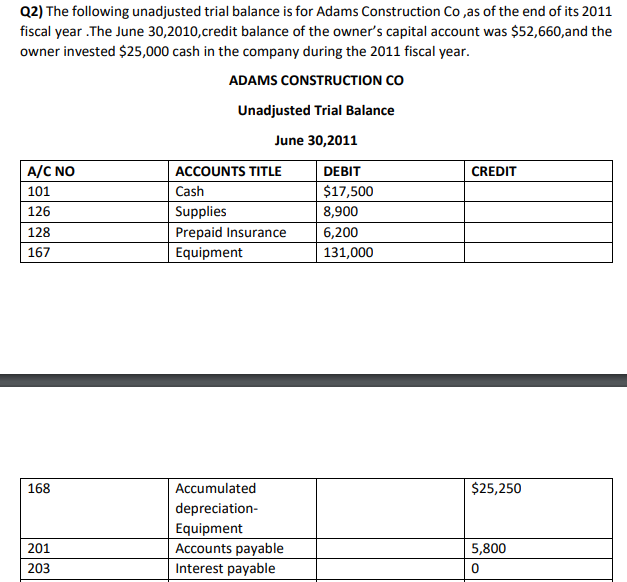

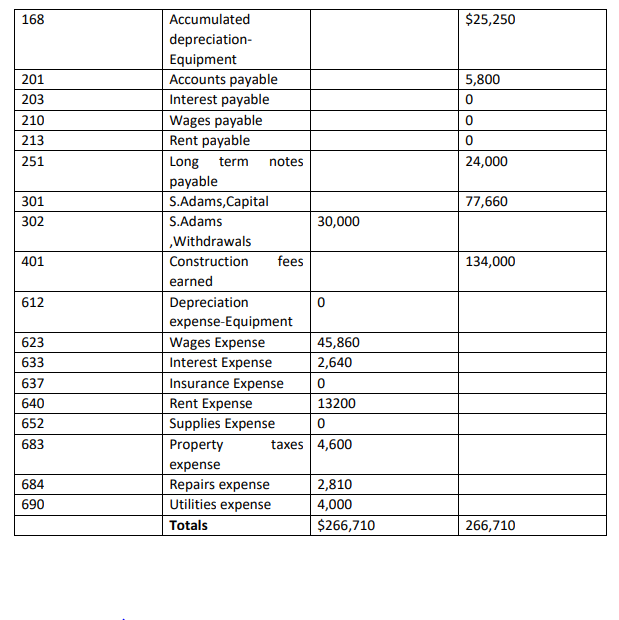

Q2) The following unadjusted trial balance is for Adams Construction Co, as of the end of its 2011 fiscal year. The June 30,2010, credit balance of the owner's capital account was $52,660, and the owner invested $25,000 cash in the company during the 2011 fiscal year. ADAMS CONSTRUCTION CO Unadjusted Trial Balance June 30, 2011 A/C NO ACCOUNTS TITLE DEBIT 101 Cash $17,500 Supplies 8,900 Prepaid Insurance 6,200 Equipment 131,000 CREDIT 126 128 167 168 $25,250 Accumulated depreciation- Equipment Accounts payable Interest payable 201 5,800 0 203 168 $25,250 5,800 0 201 203 210 213 251 0 0 24,000 77,660 301 302 401 134,000 Accumulated depreciation- Equipment Accounts payable Interest payable Wages payable Rent payable Long term notes payable S.Adams, Capital S.Adams 30,000 Withdrawals Construction fees earned Depreciation 0 expense-Equipment Wages Expense 45,860 Interest Expense 2,640 Insurance Expense 0 Rent Expense 13200 Supplies Expense 0 Property taxes 4,600 expense Repairs expense 2,810 Utilities expense 4,000 Totals $266,710 612 623 633 637 640 652 683 684 690 266,710

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started