Question

1.1. 1.2. 1.3. 1.4. Consider the following four bonds given in the table below, where coupons are paid out once per year: Bond A

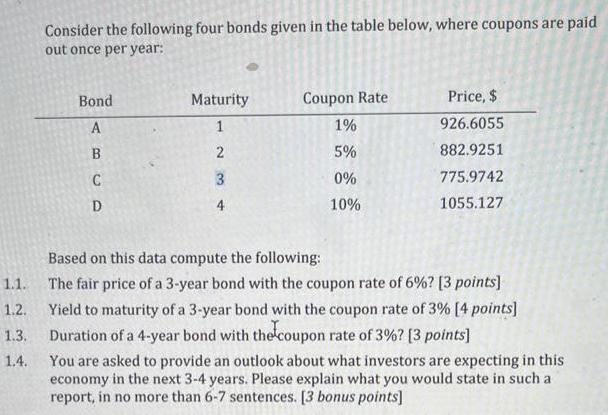

1.1. 1.2. 1.3. 1.4. Consider the following four bonds given in the table below, where coupons are paid out once per year: Bond A B C D Maturity 1 2 3 4 Coupon Rate 1% 5% 0% 10% Price, $ 926.6055 882.9251 775.9742 1055.127 Based on this data compute the following: The fair price of a 3-year bond with the coupon rate of 6%? [3 points] Yield to maturity of a 3-year bond with the coupon rate of 3% [4 points] Duration of a 4-year bond with the coupon rate of 3%? [3 points] You are asked to provide an outlook about what investors are expecting in this economy in the next 3-4 years. Please explain what you would state in such a report, in no more than 6-7 sentences. [3 bonus points]

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the fair price of a 3 year B...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction to Financial Accounting

Authors: Charles Horngren, Gary Sundem, John Elliott, Donna Philbrick

11th edition

978-0133251111, 013325111X, 0133251039, 978-0133251036

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App