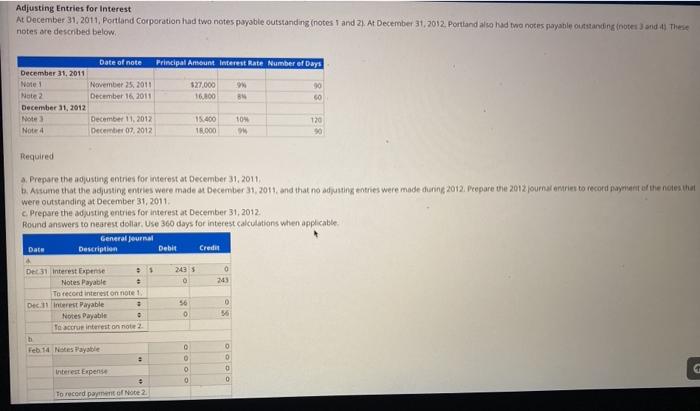

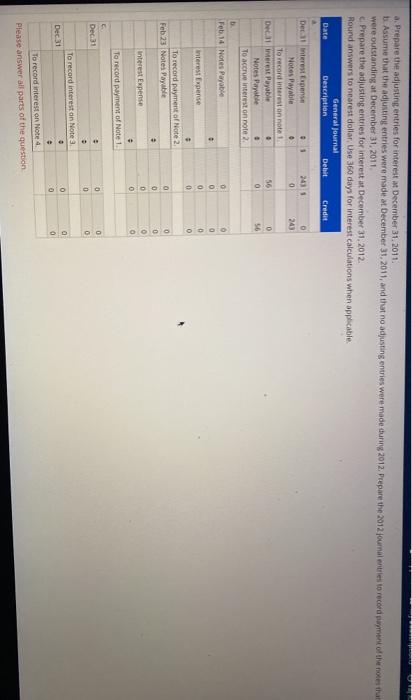

Adjusting Entries for interest At December 31, 2011, Portland Corporation had two notes payable outstanding notes and 2). At December 31, 2012. Portland also had twa notes payable outstanding notes and 41 These notes are described below. Principal Amount interest Rate Number of Days Date of note December 31, 2011 Note November 25, 2011 Note 2 December 16, 2011 December 31, 2012 Notes December 11, 2012 Note 4 December 02, 2012 $27.000 16.800 9 4 S8 120 15.400 18.000 10 9 Required a. Prepare the adjusting entries for interest at December 31, 2011 1. Assume that the adjusting entries were made at December 31, 2011, and that no adjusting entries were made during 2012. Prepare the 2012 journantries to record payment of the notes that were outstanding at December 31, 2011 c. Prepare the adjusting entries for interest at December 31, 2012 Round answers to nearest dollar. Use 360 days for interest calculations when applicable General Journal Description Debit Credit Date 2435 0 243 Det:31 Interest Expense Notes Payable To record interest on note 1 De Interest Payable 2 Notes Payable . Teace interest on note 2 0 56 0 0 Feb 14 Notes Payable 0 0 O interest Expense G G 0 0 To record payment of Note 2 a. Prepare the adjusting entries for interest at December 31, 2011 Assume that the adjusting entries were made at December 31, 2011, and that no adjusting entries were made during 2012. Prepare the 2012 journal entries to record payment of the note that were outstanding at December 31, 2011 Prepare the adjusting entries for interest at December 31, 2012 Round answers to nearest dollar Use 360 days for interest calculations when applicable General Journal Date Description Credit bebit 2411 243 Der interest Expense . Notes Payable To record interest on nota De Imerest Payable Notes Payable To accrue interest on note 2 D 56 0 56 Feb 14 Notes Payable 0 0 0 0 OOOO interest Expense To record payment of Note 2 Feb 23 Notes Payable . Interest Expense 0 0 0 0 OOOO To record payment of Note 1 0 0 0 0 Dec. 31 . To record interest on Note 3 Dec 31 . 0 a 0 0 To record interest on Note 4 Please answer all parts of the