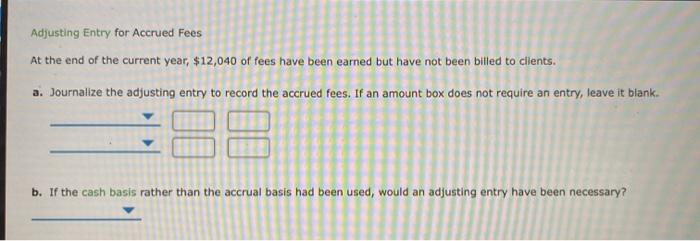

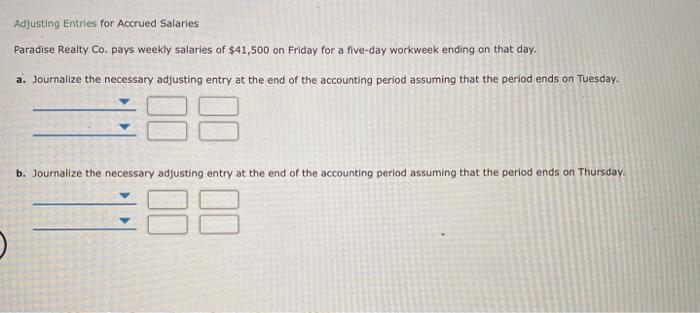

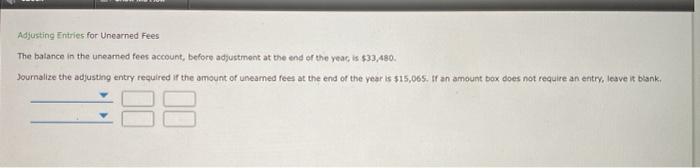

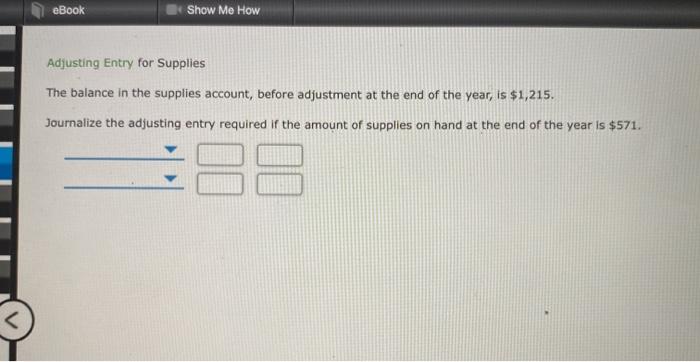

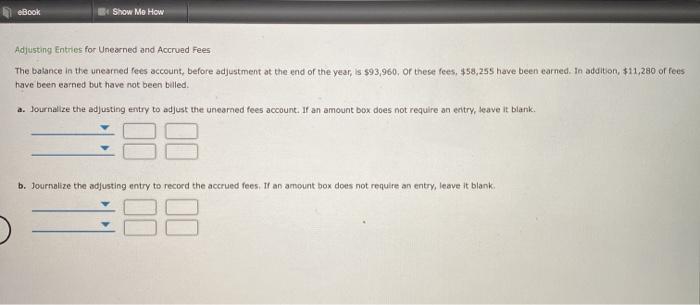

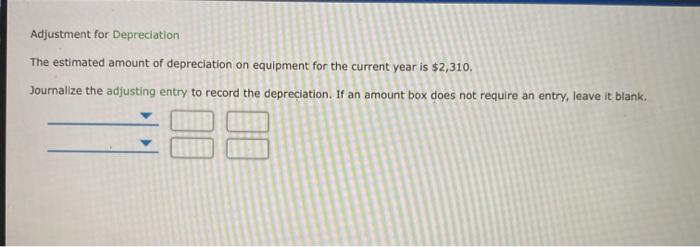

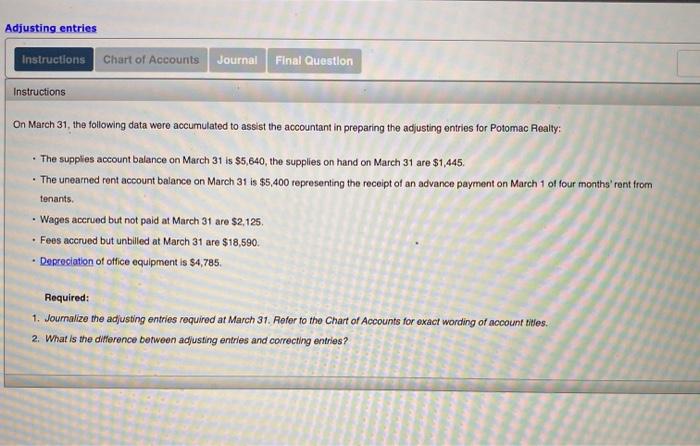

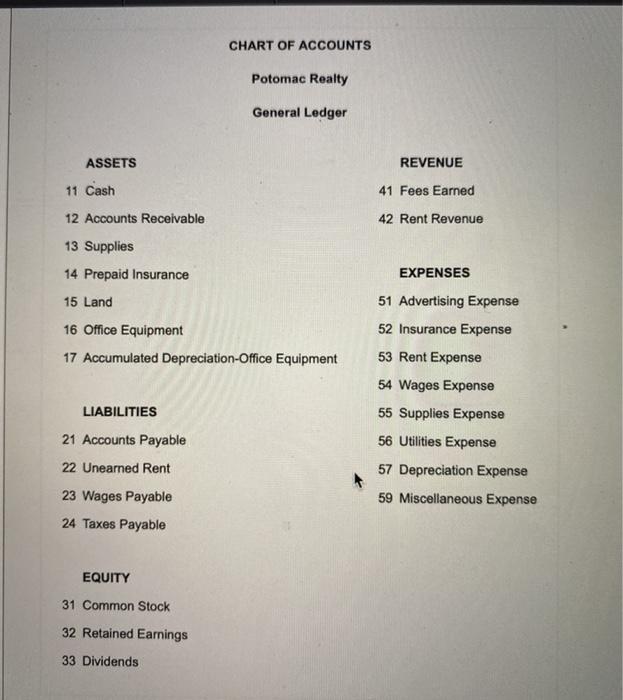

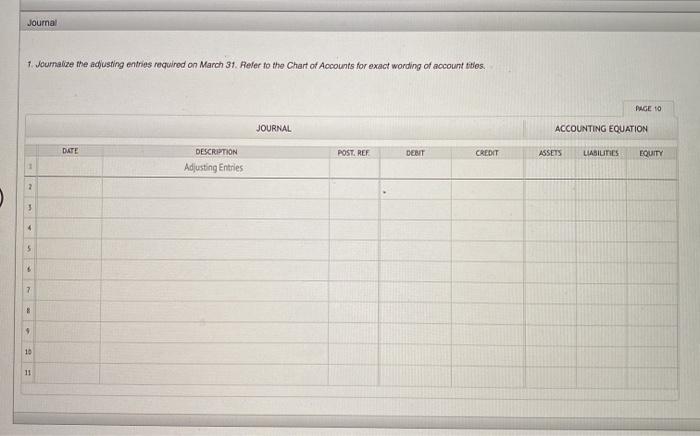

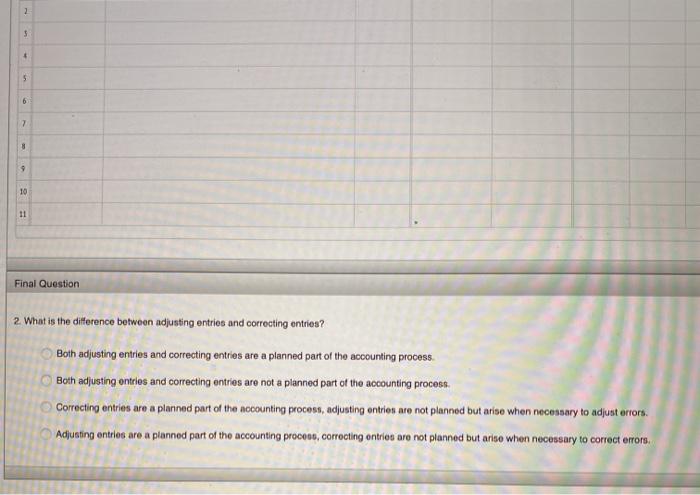

Adjusting Entry for Accrued Fees At the end of the current year, $12,040 of fees have been earned but have not been billed to clients. a. Journalize the adjusting entry to record the accrued fees. If an amount box does not require an entry, leave it blank. b. If the cash basis rather than the accrual basis had been used, would an adjusting entry have been necessary? Adjusting Entries for Accrued Salaries Paradise Realty Co. pays weekly salaries of $41,500 on Friday for a five-day workweek ending on that day. a. Journalize the necessary adjusting entry at the end of the accounting period assuming that the period ends on Tuesday. b. Journalize the necessary adjusting entry at the end of the accounting period assuming that the period ends on Thursday. Adjusting Entries for Unearned Fees The balance in the neared fees account, before adjustment at the end of the year, is $33,480. Journalize the adjusting entry required if the amount of uneamed fees at the end of the year is $15,065, tf an amount box does not require an entry, leave it blank eBook Show Me How Adjusting Entry for Supplies The balance in the supplies account, before adjustment at the end of the year, is $1,215. Journalize the adjusting entry required if the amount of supplies on hand at the end of the year is $571. eBook Show Me How Adjusting Entries for Unearned and Accrued Fees The balance in the unearned fees account, before adjustment at the end of the year, is $93,960, or these fees, $58,25 have been earned. In addition, $11,280 or fees have been earned but have not been billed. a. Journalize the adjusting entry to adjust the unearned fees account. If an amount box does not require an entry, leave it blank 188 b. Journalize the adjusting entry to record the accrued fees. If an amount box does not require an entry, leave it blank Adjustment for Depreciation The estimated amount of depreciation on equipment for the current year is $2,310, Journalize the adjusting entry to record the depreciation. If an amount box does not require an entry, leave it blank. Adjusting entries Instructions Chart of Accounts Journal Final Question Instructions On March 31, the following data were accumulated to assist the accountant in preparing the adjusting entries for Potomac Realty: . The supplies account balance on March 31 is $5,640, the supplies on hand on March 31 are $1,445 . The unearned rent account balance on March 31 is $5,400 representing the receipt of an advance payment on March 1 of four months' rent from tenants Wages accrued but not paid at March 31 are $2,125 Fees accrued but unbilled at March 31 are $18,590 - Depreciation of office equipment is $4,785. . Required: 1. Journalize the adjusting entries required at March 31. Refer to the Chart of Accounts for exact wording of account titles. 2. What is the difference between adjusting entries and correcting entries? CHART OF ACCOUNTS Potomac Realty General Ledger ASSETS REVENUE 11 Cash 41 Fees Earned 42 Rent Revenue 12 Accounts Receivable 13 Supplies 14 Prepaid Insurance 15 Land EXPENSES 16 Office Equipment 17 Accumulated Depreciation Office Equipment 51 Advertising Expense 52 Insurance Expense 53 Rent Expense 54 Wages Expense 55 Supplies Expense 56 Utilities Expense LIABILITIES 57 Depreciation Expense 21 Accounts Payable 22 Unearned Rent 23 Wages Payable 24 Taxes Payable 59 Miscellaneous Expense EQUITY 31 Common Stock 32 Retained Earnings 33 Dividends Journal 1. Journalize the adjusting entries required on March 31. Refer to the Chart of Accounts for exact wording of account titles. PAGE 10 JOURNAL ACCOUNTING EQUATION DUTE POST. REF DEBIT CREDIT ASSETS LIABILITIES EQUITY DESCRIPTION Adjusting Entries 2 3 4 5 7 3 9 10 11 2 5 + 5 6 7 8 9 10 11 Final Question 2 What is the difference between adjusting entries and correcting entries? Both adjusting entries and correcting entries are a planned part of the accounting process Both adjusting entries and correcting entries are not a planned part of the accounting process. Correcting entries are a planned part of the accounting process, adjusting entries are not planned but arise when necessary to adjust errors. Adjusting entries are a planned part of the accounting proceso, correcting entries are not planned but arise when necessary to correct errors