Answered step by step

Verified Expert Solution

Question

1 Approved Answer

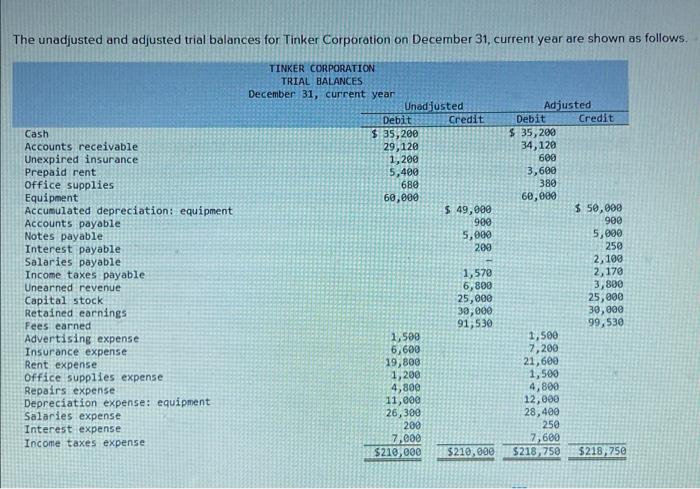

adjustment entries included The unadjusted and adjusted trial balances for Tinker Corporation on December 31, current year are shown as follows. TINKER CORPORATION TRIAL BALANCES

adjustment entries included

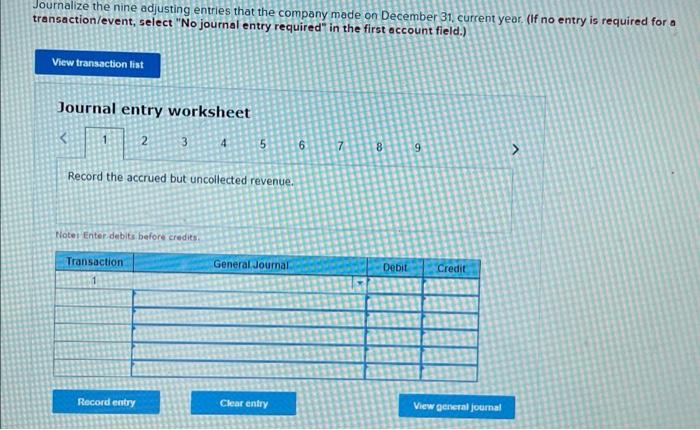

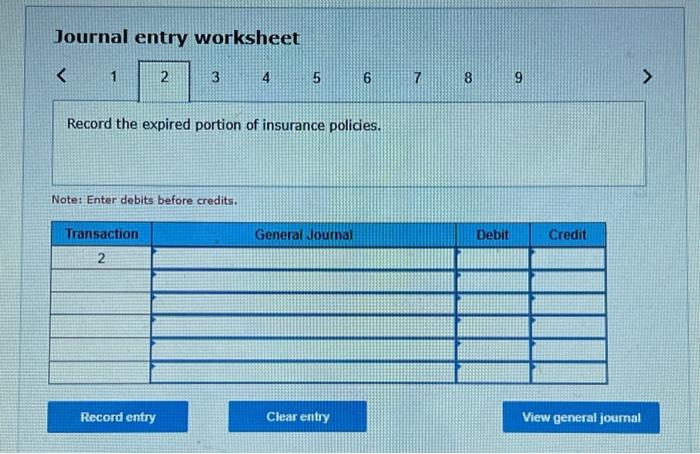

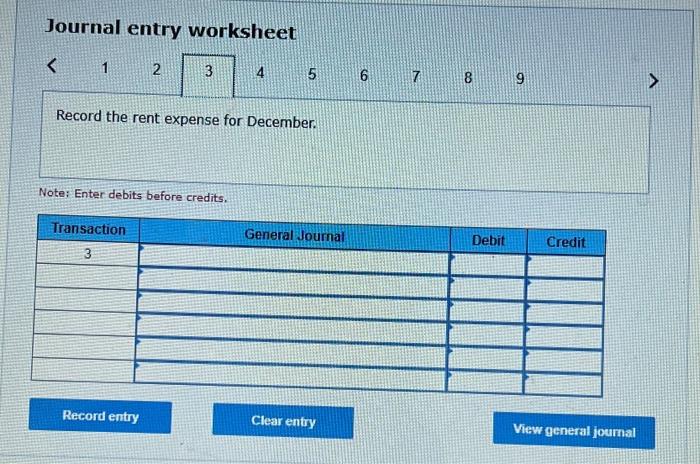

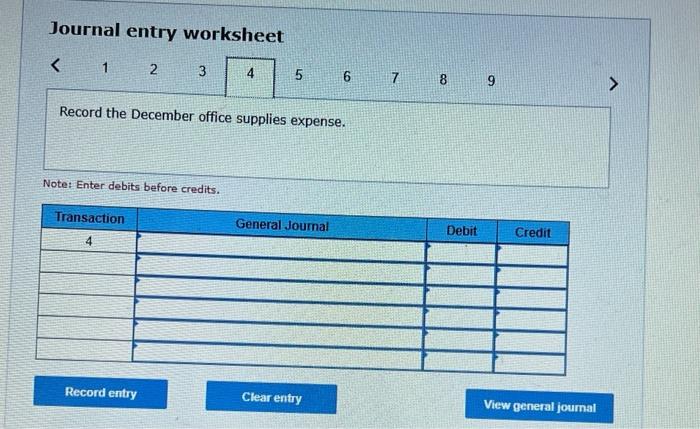

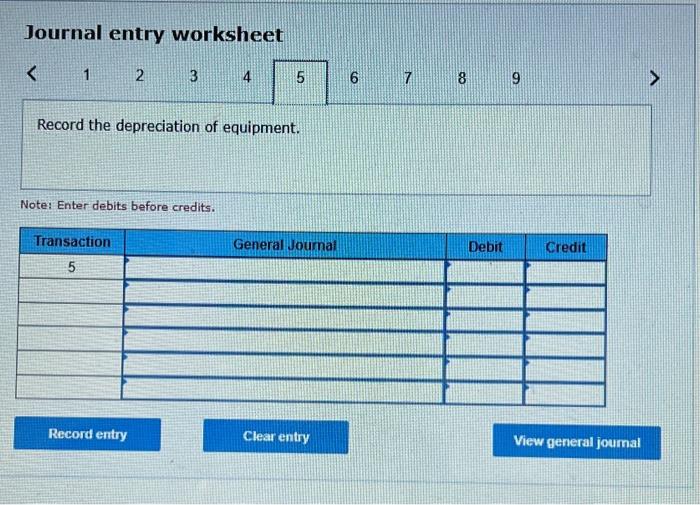

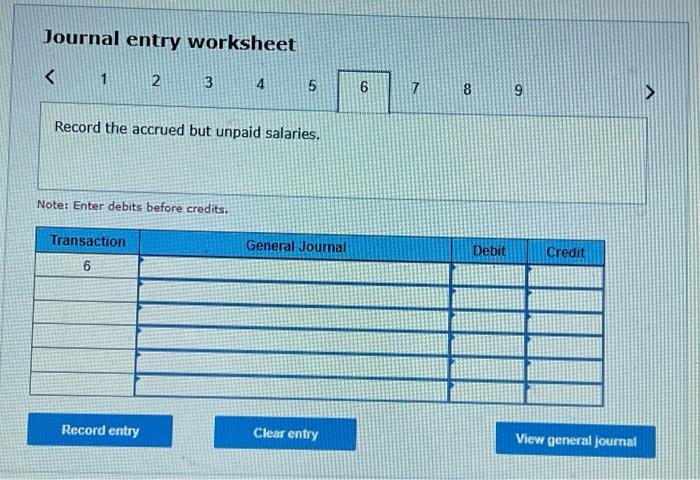

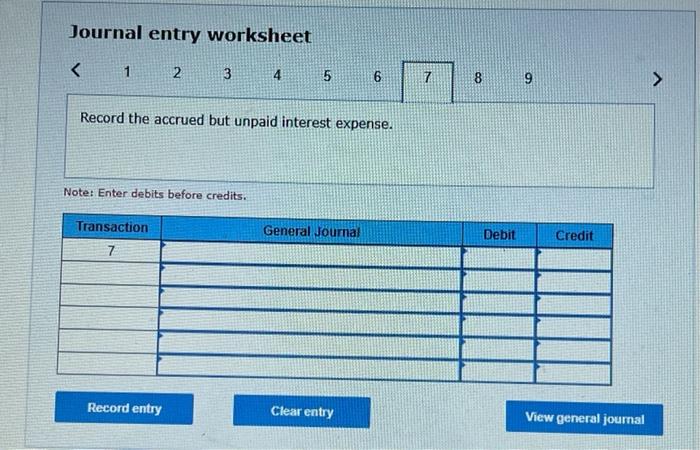

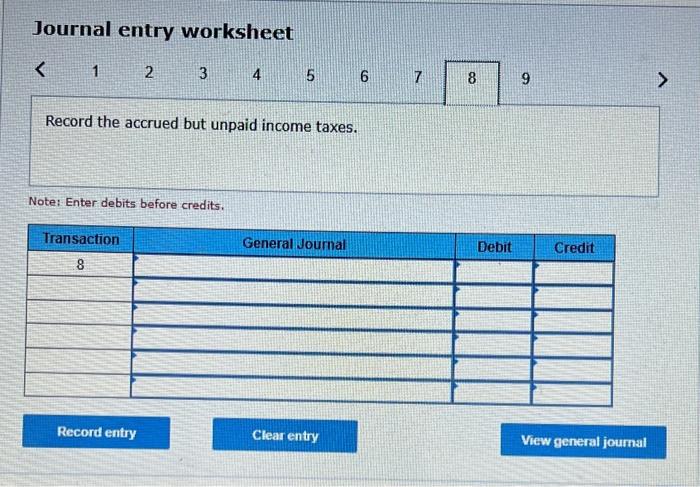

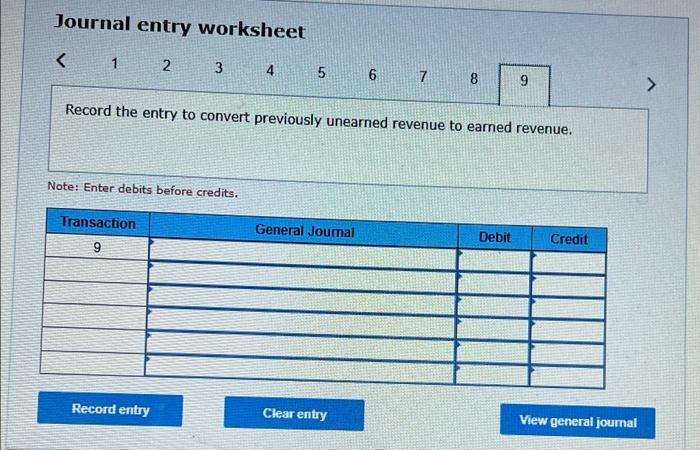

The unadjusted and adjusted trial balances for Tinker Corporation on December 31, current year are shown as follows. TINKER CORPORATION TRIAL BALANCES December 31, current year Unadjusted Debit Credit $ 35,200 29,120 1,200 5,400 680 60,000 $ 49,900 900 5,000 209 Cash Accounts receivable Unexpired insurance Prepaid rent Office supplies Equipment Accumulated depreciation equipment Accounts payable Notes payable Interest payable Salaries payable Income taxes payable Unearned revenue Capital stock Retained earnings Fees earned Advertising expense Insurance expense Rent expense Office supplies expense Repairs expense Depreciation expense: equipment Salaries expense Interest expense Income taxes expense 1,579 6,800 25,000 30,000 91,530 Adjusted Debit Credit $ 35,200 34, 120 600 3,600 380 60,000 $ 50,000 900 5,090 250 2,100 2,170 3,800 25,000 30,000 99,530 1,500 7,200 21,600 1,500 4,800 12,000 28,400 250 7,680 $218,750 $218,750 1,500 6,600 19,800 1,200 4,800 11,000 26,300 200 7.000 $210,000 $210,000 Journalize the nine adjusting entries that the company made on December 31, current year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 3 1 5 6 7 8 9 > Record the accrued but uncollected revenue. Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general journal Journal entry worksheet Record the expired portion of insurance policies. Note: Enter debits before credits. General Journal Debit Credit Transaction 2 Record entry Clear entry View general joumal Journal entry worksheet Record the accrued but unpaid salaries. Note: Enter debits before credits. Transaction General Joumal Debit Credit 6 Record entry Clear entry View general journal Journal entry worksheet Record the accrued but unpaid income taxes. Note: Enter debits before credits Transaction General Journal Debit Credit 8 Record entry Clear entry View general journal Journal entry worksheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started