Answered step by step

Verified Expert Solution

Question

1 Approved Answer

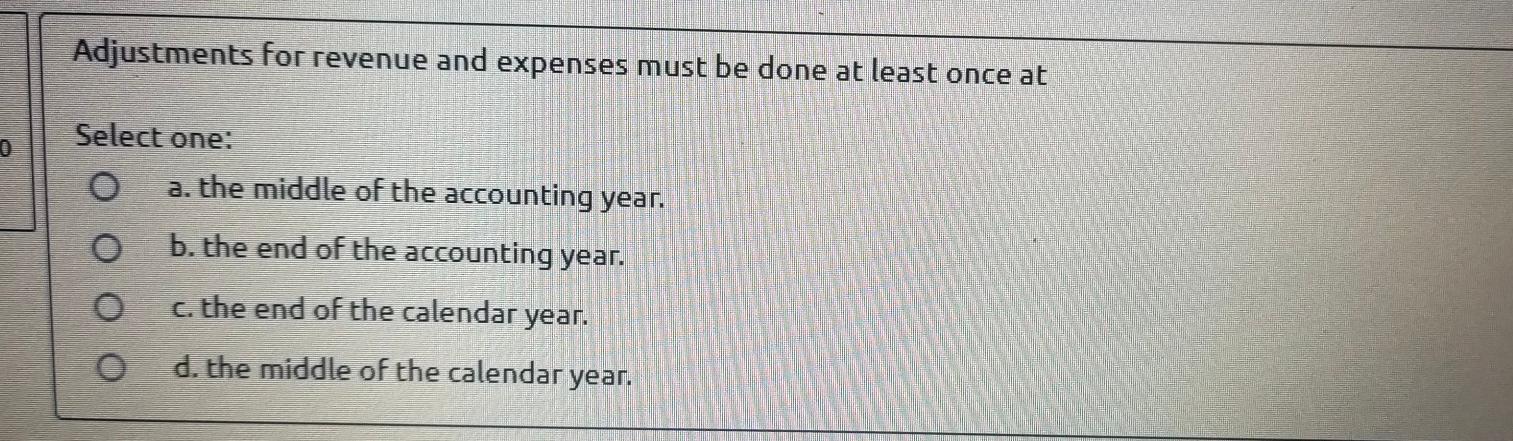

Adjustments for revenue and expenses must be done at least once at 0 Select one: O a. the middle of the accounting year. O b.

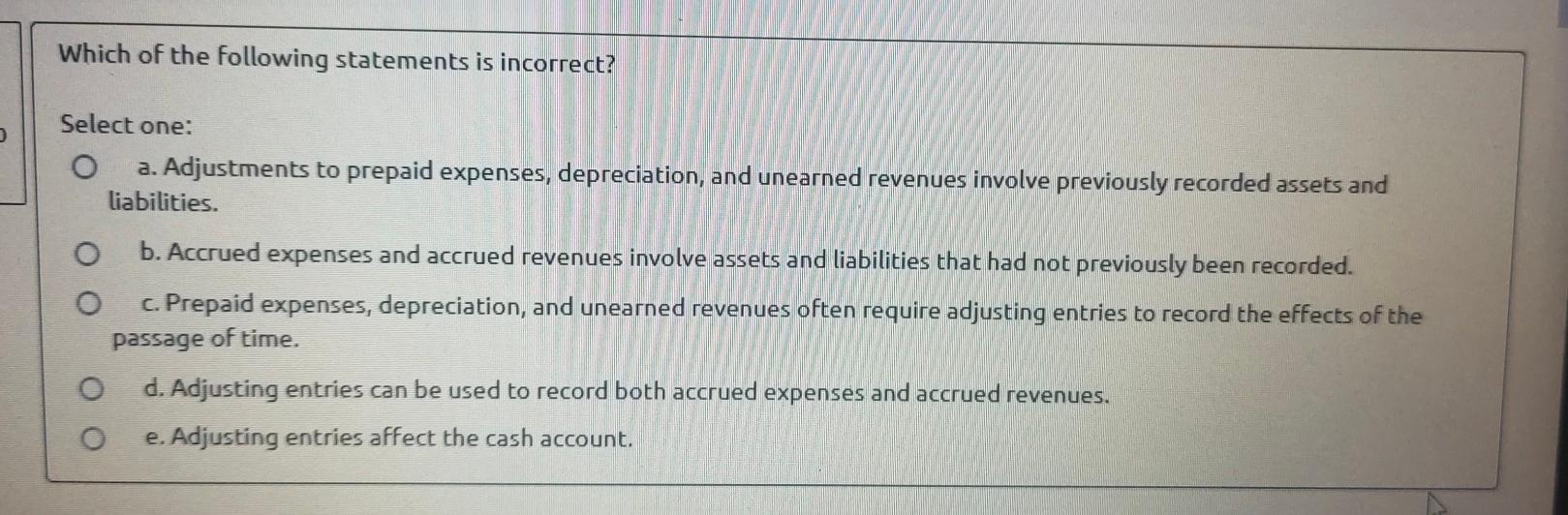

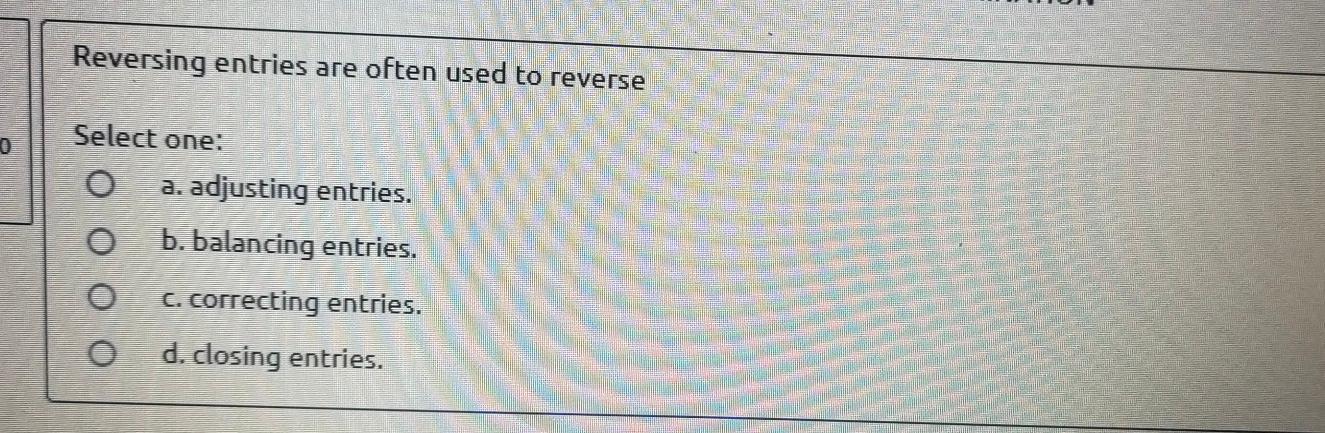

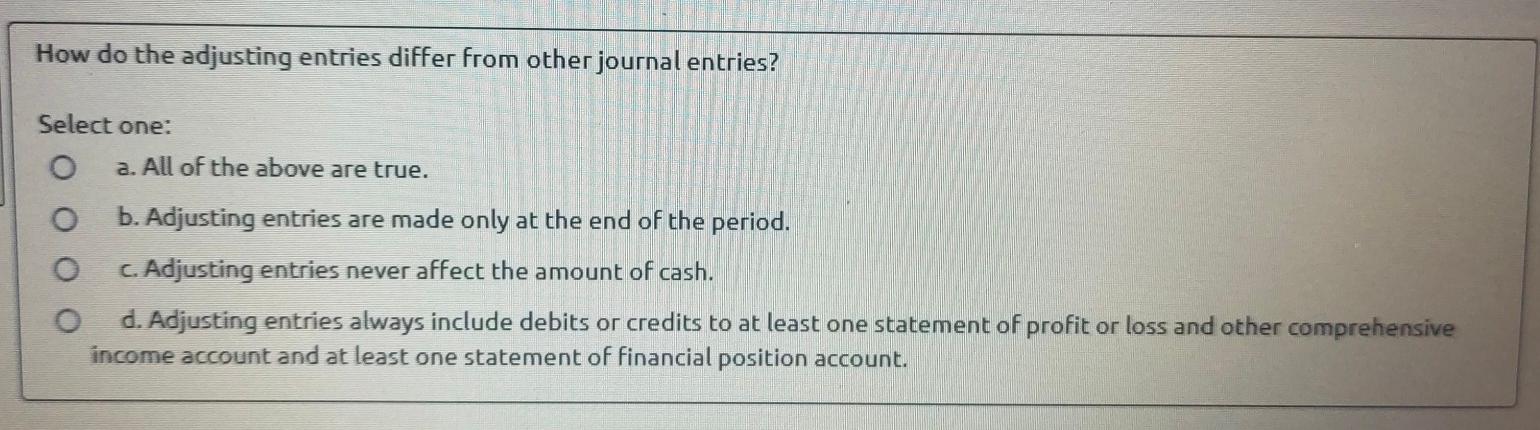

Adjustments for revenue and expenses must be done at least once at 0 Select one: O a. the middle of the accounting year. O b. the end of the accounting year. O c. the end of the calendar year. O d. the middle of the calendar year. Which of the following statements is incorrect? Select one: 0 a. Adjustments to prepaid expenses, depreciation, and unearned revenues involve previously recorded assets and liabilities. O b. Accrued expenses and accrued revenues involve assets and liabilities that had not previously been recorded. O c. Prepaid expenses, depreciation, and unearned revenues often require adjusting entries to record the effects of the passage of time. O d. Adjusting entries can be used to record both accrued expenses and accrued revenues. e. Adjusting entries affect the cash account. o Reversing entries are often used to reverse 0 Select one: O a. adjusting entries. o b. balancing entries. O C. correcting entries. O d. closing entries. How do the adjusting entries differ from other journal entries? Select one: O a. All of the above are true. o b. Adjusting entries are made only at the end of the period. c. Adjusting entries never affect the amount of cash. O d. Adjusting entries always include debits or credits to at least one statement of profit or loss and other comprehensive income account and at least one statement of financial position account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started