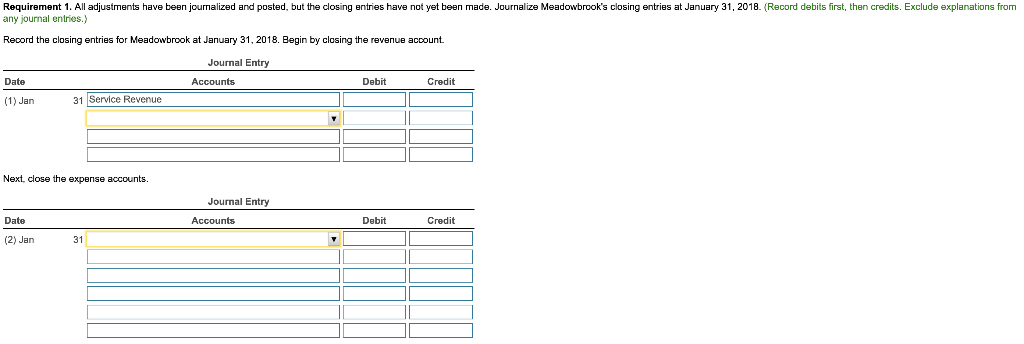

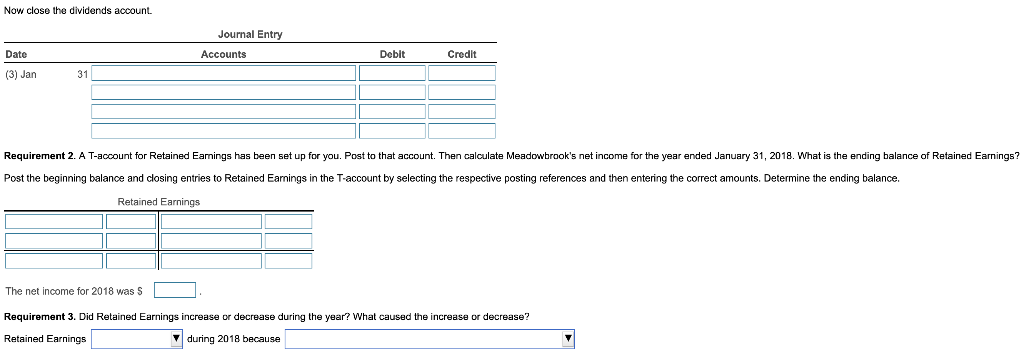

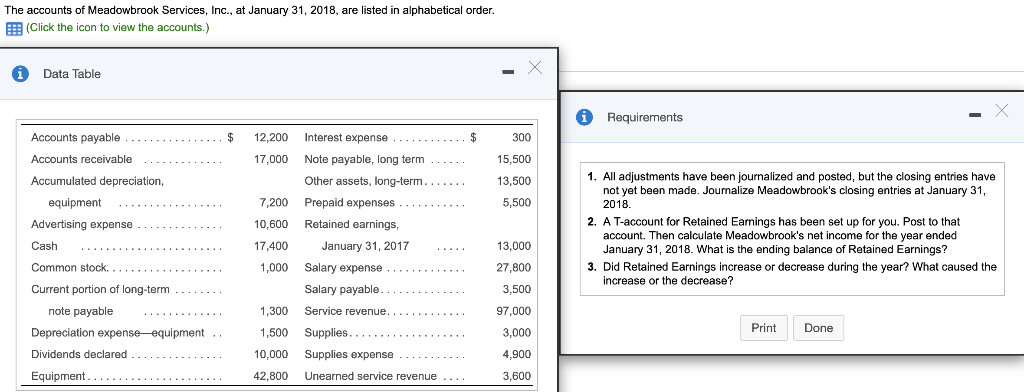

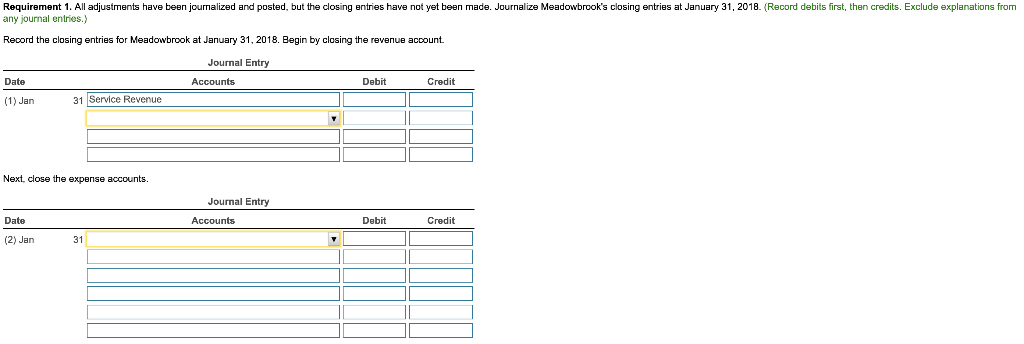

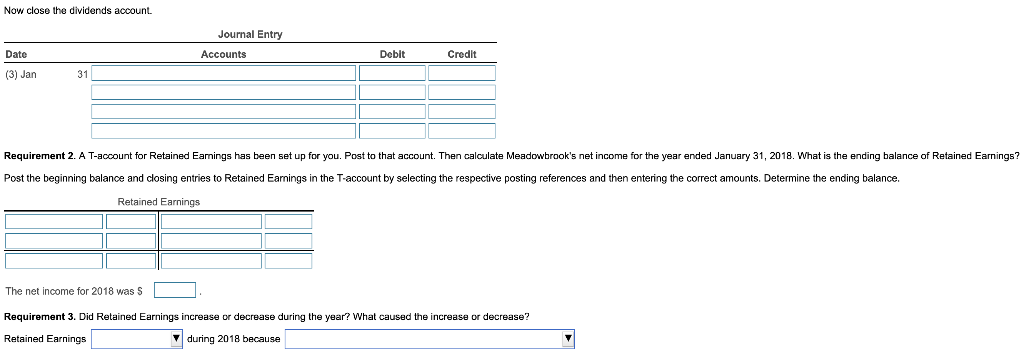

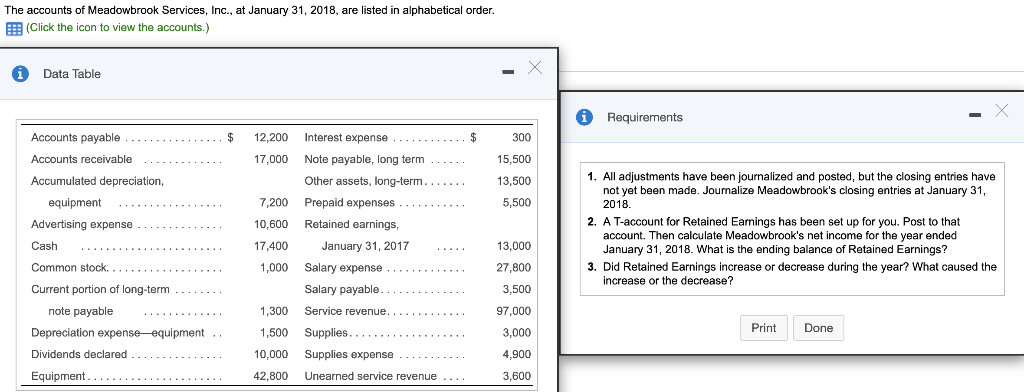

adjustments have been journalized and posted, but the closing entries have not yet been made. Journalize Meadowbrook's closing entries at January 31, 2018. (Record debits first, then credits. Exclude explanations from Re ar entries.) evenue aoount Repord the closing entries for Meadowbrook at January 31, 2018, BeginI closing th Journal Entry Credit Date Accounts Debit 31 Service Revenue (1) Jan Next, close the expense accounts Journal Entry Accounts Date Debit Credit (2) Jan 31 Now close the dividends account Journal Entry Date Accounts Debit Credit (3) Jan 31 Requirement 2. A T-account for Retained Eamings has been set p for you. Post to that account. Then calculate Meadowbrook's net income for the year ended January 31, 2018. What is the ending balance of Retained Earnings? Post the beginning balance and closing entries to Retained Earnings in the T-account by selecting the respective posting references and then entering the correct amounts. Determine the ending balance. Retained Earnings The net income for 2018 was S Requirement 3. Did Retained Earnings increase or decrease during the year? What caused the increase or decrease? during 2018 because Retained Earnings The accounts of Meadowbrook Services, Inc., at January 31, 2018, are listed in alphabetical order. EB(Click the icon to view the accounts.) Data Table iRequirements Accounts payable Interest expense 12,200 . ...... .. $ 300 Note payable, long term Accounts receivable 17,000 15,500 1. All adjustments have been journalized and posted, but the closing entries have been made. Jounalize Meadowbrook's closing entries at January 31, Other assets, long-term.. Accumulated depreciation, 13,500 Prepaid expenses 5,500 equipment 7,200 2. has been eccount. Then calculate Meadoubeeelde net income Post to January 31, 2018. What is the ending balance of Retained Earnings? Retained for ount Advertising expense Retained earnings, 10.600 Cash 17,400 January 31, 2017 13,000 during the year? Common stock. . 3. Did Retained Earnings increase increase or de caused the 1,000 Salary expense 27,800 decrease? Salary payable. 3.500 Current portion of long-term Service revenue. 97.000 note payable 1,300 Print Done Supplies Depreciation expense-equipment 1,500 3,000 Dividends declared Supplies expense 10,000 4,900 Unearned service revenue 3.600 Equipment 42.800