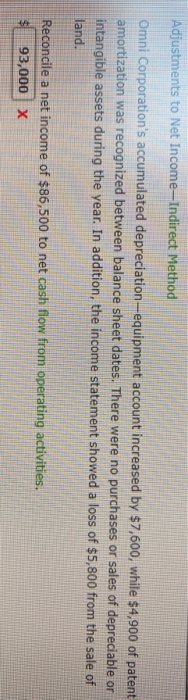

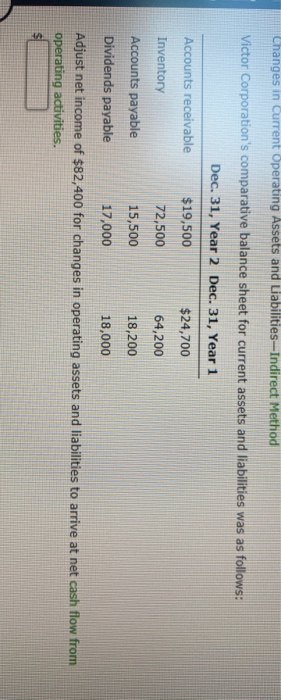

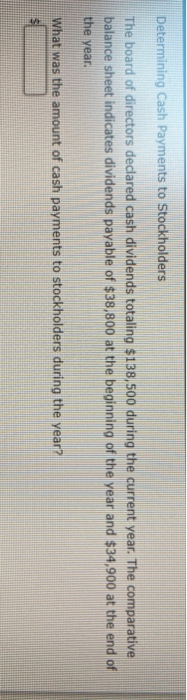

Adjustments to Net Income-Indirect Method Omni Corporation's accumulated depreciation-equipment account increased by $7,600, while $4,900 of patent amortization was recognized between balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In addition, the income statement showed a loss of $5,800 from the sale of land. Reconcile a net income of $86,500 to net cash flow from operating activities. $ 93,000 Changes in Current Operating Assets and Liabilities-Indirect Method Victor Corporation's comparative balance sheet for current assets and liabilities was as follows: Dec. 31, Year 2 Dec. 31, Year 1 Accounts receivable $19,500 $24,700 Inventory 72,500 64,200 Accounts payable 15,500 18,200 Dividends payable 17,000 18,000 Adjust net income of $82,400 for changes in operating assets and liabilities to arrive at net cash flow from operating activities. Determining Cash Payments to Stockholders The board of directors declared cash dividends totaling $138,500 during the current year. The comparative balance sheet indicates dividends payable of $38,800 at the beginning of the year and $34.900 at the end of the year. What was the amount of cash payments to stockholders during the year? Adjustments to Net Income-Indirect Method Omni Corporation's accumulated depreciation-equipment account increased by $7,600, while $4,900 of patent amortization was recognized between balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In addition, the income statement showed a loss of $5,800 from the sale of land. Reconcile a net income of $86,500 to net cash flow from operating activities. $ 93,000 Changes in Current Operating Assets and Liabilities-Indirect Method Victor Corporation's comparative balance sheet for current assets and liabilities was as follows: Dec. 31, Year 2 Dec. 31, Year 1 Accounts receivable $19,500 $24,700 Inventory 72,500 64,200 Accounts payable 15,500 18,200 Dividends payable 17,000 18,000 Adjust net income of $82,400 for changes in operating assets and liabilities to arrive at net cash flow from operating activities. Determining Cash Payments to Stockholders The board of directors declared cash dividends totaling $138,500 during the current year. The comparative balance sheet indicates dividends payable of $38,800 at the beginning of the year and $34.900 at the end of the year. What was the amount of cash payments to stockholders during the year