Question

Admiral Foods Corporation is a diversified food processing and distributing company that has shown excellent growth over the past 10 years as a result of

Admiral Foods Corporation is a diversified food processing and distributing company that has shown excellent growth over the past 10 years as a result of a balanced program of acquisitions and internal growth.

One segment of the food business in which Admiral has only recently begun to compete, however, is the fast-food business. The present top management of Admiral Foods feels that good future growth in the fast-food business is still possible, regardless of the rapid expansion of the last two decades. During the past year, members of the Admiral staff have examined and analyzed a number of independent fast-food firms. One company that the analysis indicated as potentially suitable for acquisition by Admiral is Favorite Food Systems Inc.

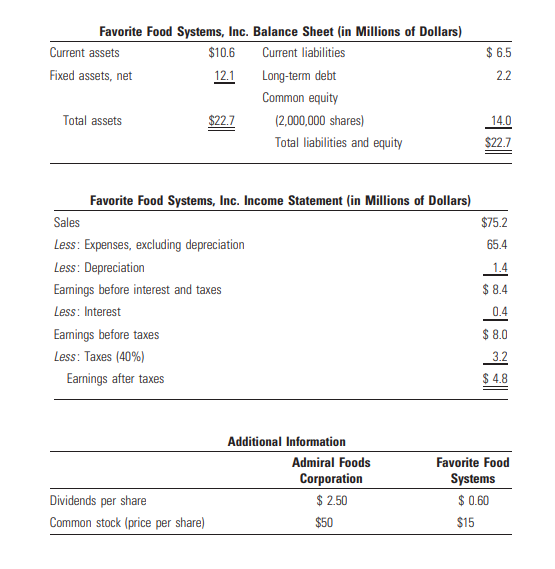

Favorite Food Systems Inc. which was founded by John Favorite in 1994, is a West Coast chain with current annual sales of approximately $75 million. Favorites history can best be described as up and down, with the general trend up. The company survived several brief shaky periods during the late 1990s. In 2003, the company went public. (The Favorite family now controls about 57 percent of the common stock.) By 2006, Favorite Foods was recommended by two brokerage firms and was touted by one investment service as another potential McDonalds. This and other predictions never came true. In fact, Favorite Food Systems growth rate has slowed appreciably during the past 5 years. One reason frequently given in the trade for Favorites growth slowdown is Mr. Favorites apparent indecision regarding expansion. As a result, the competition has increasingly gotten the jump on Favorite with the best locations in new residential growth areas.

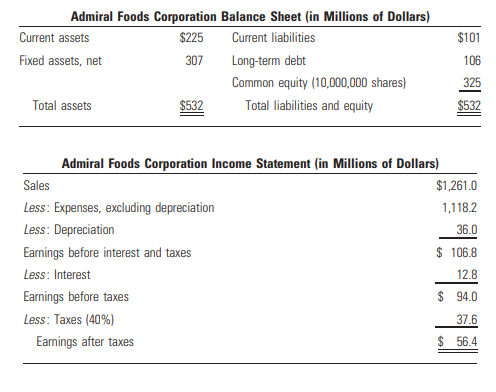

The following table shows last years balance sheets and income statements for both Admiral and Favorite.

Exchange Ratio

|

| Admiral | Favorite |

| Price per share | $50.00 | $15.00 |

| Exchange ratio | 0.3 |

|

Exchange Ratios with Premium Prices

Explain the exchange ratios using the premium prices paid for Favorite. (1-3 sentences in one paragraph).

Table

Exchange Ratios with Premium Prices

| Favorite price per share | $15.00 | $15.00 | $15.00 |

| Premium | 15% | 20% | 25% |

| Favorite premium price per share |

|

|

|

| Admiral price per share | $50.00 | $50.00 | $50.00 |

| Exchange ratio based on premium prices |

|

|

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started