Answered step by step

Verified Expert Solution

Question

1 Approved Answer

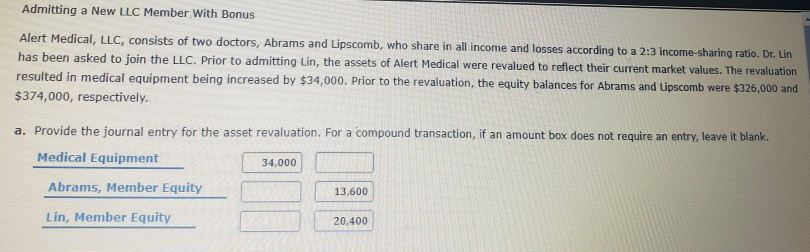

Admitting a New LLC Member With Bonus Alert Medical, LLC, consists of two doctors, Abrams and Lipscomb, who share in all income and losses according

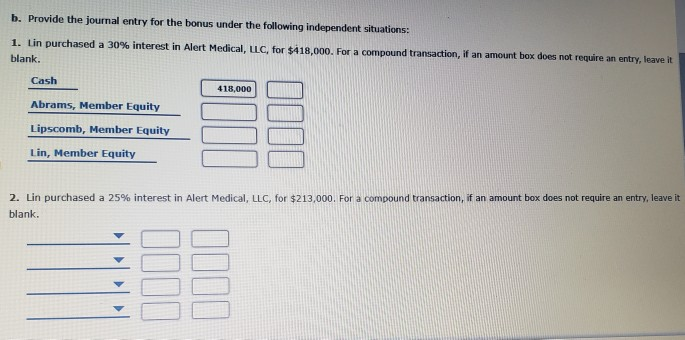

Admitting a New LLC Member With Bonus Alert Medical, LLC, consists of two doctors, Abrams and Lipscomb, who share in all income and losses according to a 2:3 income-sharing ratio. Dr. Lin has been asked to join the LLC. Prior to admitting Lin, the assets of Alert Medical were revalued to reflect their current market values. The revaluation resulted in medical equipment being increased by $34,000. Prior to the revaluation, the equity balances for Abrams and Lipscomb were $325,000 and $374,000, respectively. a. Provide the journal entry for the asset revaluation. For a compound transaction, if an amount box does not require an entry, leave it blank. Medical Equipment 34,000 Abrams, Member Equity 13,600 Lin, Member Equity 20,400 b. Provide the journal entry for the bonus under the following independent situations: 1. Lin purchased a 30% interest in Alert Medical, LLC, for $418,000. For a compound transaction, if an amount box does not require an entry, leave it blank. Cash 418,000 Abrams, Member Equity Lipscomb, Member Equity Lin, Member Equity 2. Lin purchased a 25% interest in Alert Medical, LLC, for $213,000. For a compound transaction, if an amount box does not require an entry, leave it blank. llll

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started