Answered step by step

Verified Expert Solution

Question

1 Approved Answer

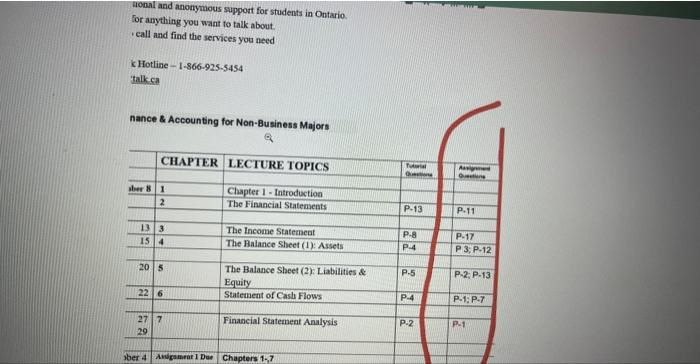

ADMN2556 Finance & Accounting for Non-Business Majors Fall 2022 Week CHAPTER LECTURE TOPICS Tutorial Questions Assignment Questions 1 September 8 1 Chapter 1 - Introduction

ADMN2556 Finance & Accounting for Non-Business Majors

Fall 2022

Week

CHAPTER

LECTURE TOPICS

Tutorial Questions

Assignment

Questions

1

September 8

1

Chapter 1 - Introduction

2

The Financial Statements

P-13

P-11

2

13

3

The Income Statement

P-8

P-17

15

4

The Balance Sheet (1): Assets

P-4

P 3; P-12

3

20

5

The Balance Sheet (2): Liabilities & Equity

P-5

P-2; P-13

22

6

Statement of Cash Flows

P-4

P-1; P-7

4

27

29

7

Financial Statement Analysis

P-2

P-1

5

October 4

Assignment 1 Due

Chapters 1-,7

an operating income of $1,500,000, and net income of $1,000,000.

Honal and anonymous support for students in Ontario. For anything you want to talk about. ' call and find the services you need Hotline - 1-866-925-5454 talkca nance \& Accounting for Non-Business Majors Honal and anonymous support for students in Ontario. For anything you want to talk about. ' call and find the services you need Hotline - 1-866-925-5454 talkca nance \& Accounting for Non-Business Majors Total assets were $20,000,000, and shareholders' equity was

$5,000,000. There were 2,000,000 shares in issue.

Required

Calculate the following:

(a)

Gross margin as % of sales

(b)

Operating income as % of sales

C)

Operating income as % of total assets

(d)

Return on shareholders' equity

(e)

Earnings per share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started