Answered step by step

Verified Expert Solution

Question

1 Approved Answer

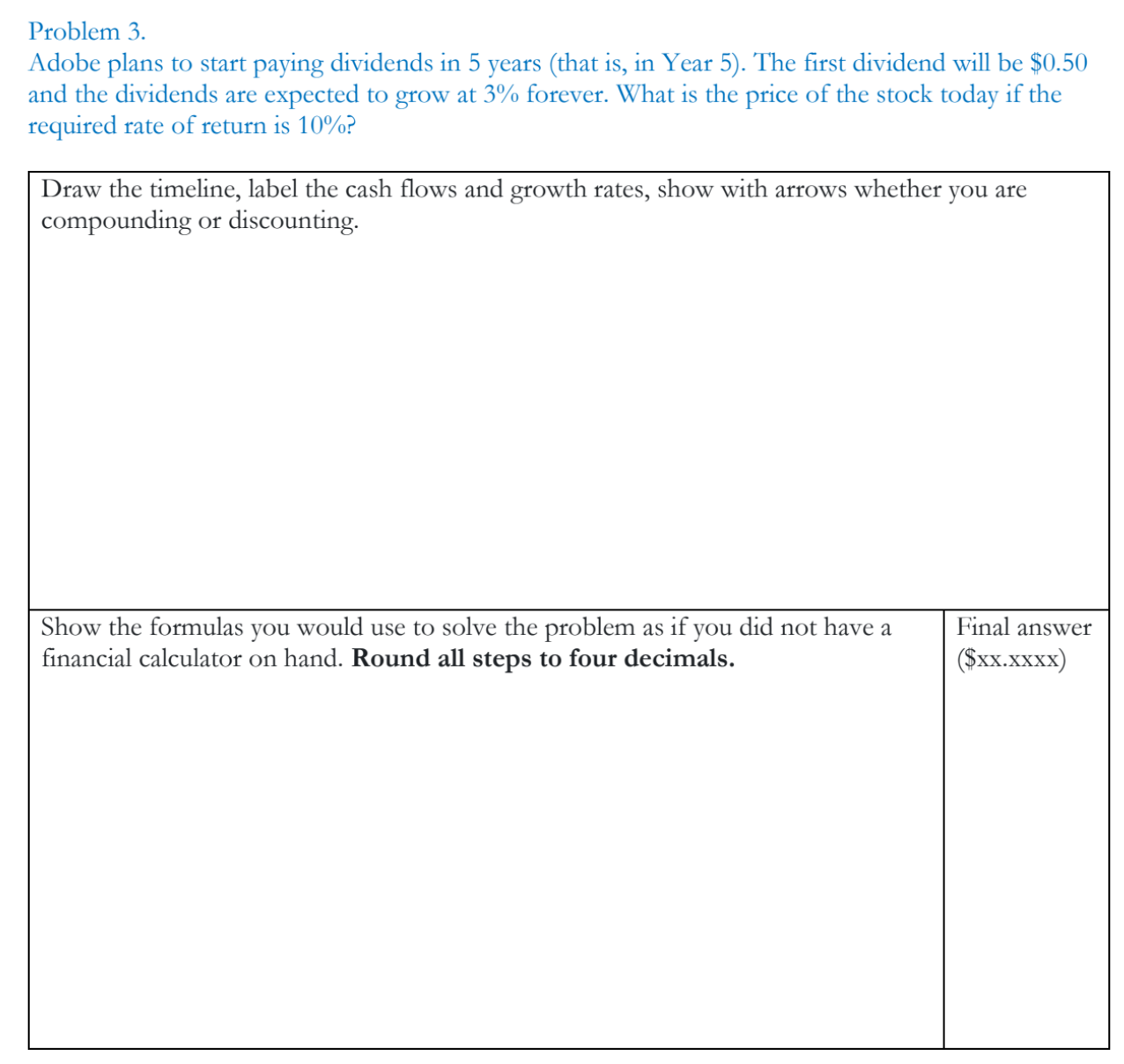

Adobe plans to start paying dividends in 5 years ( that is , in Year 5 ) . The first dividend will be $ 0

Adobe plans to start paying dividends in years that is in Year The first dividend will be $

and the dividends are expected to grow at forever. What is the price of the stock today if the

required rate of return is

Draw the timeline, label the cash flows and growth rates, show with arrows whether you are

compounding or discounting.

Show the formulas you would use to solve the problem as if you did not have a

financial calculator on hand. Round all steps to four decimals.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started