Answered step by step

Verified Expert Solution

Question

1 Approved Answer

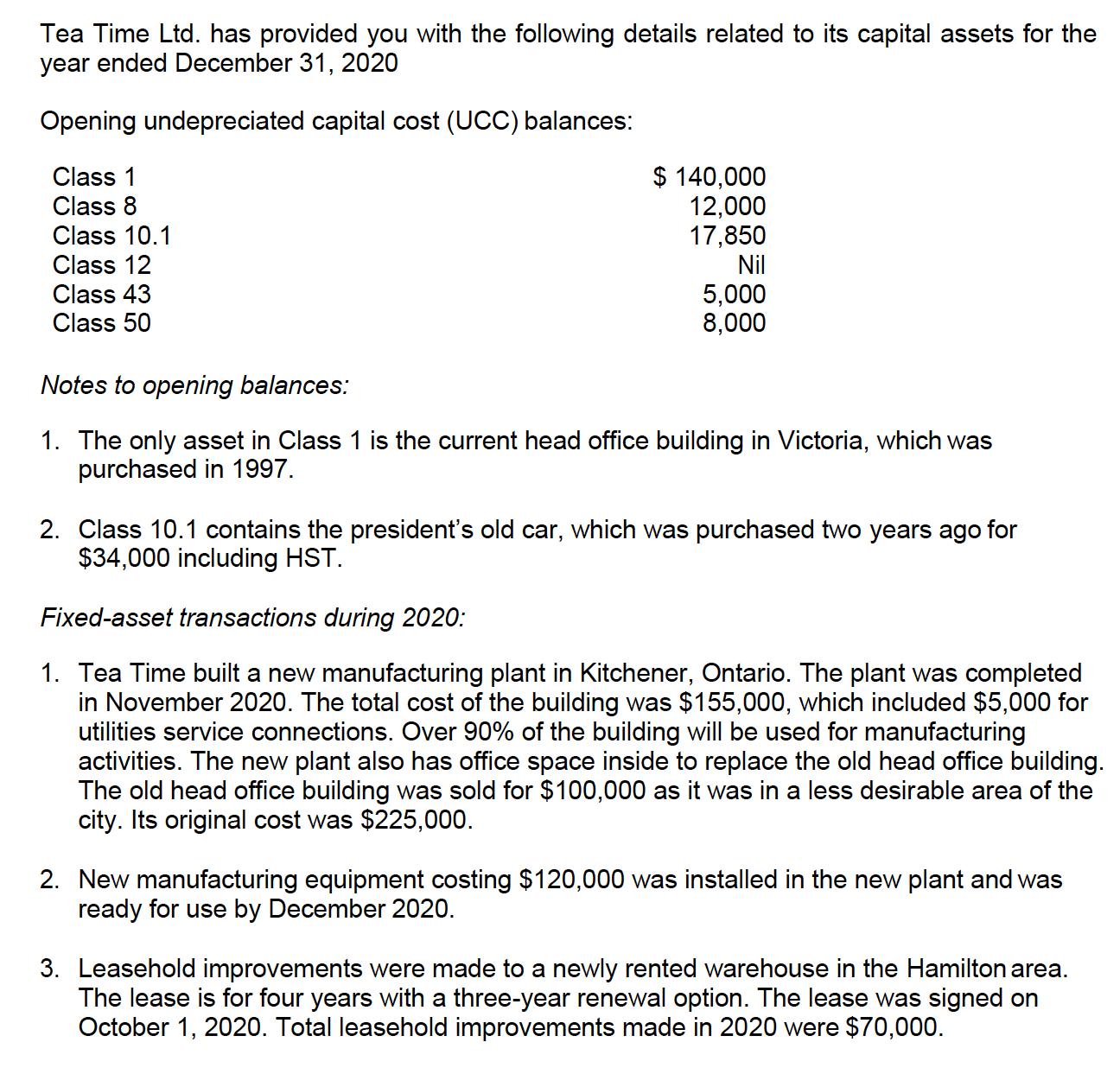

Tea Time Ltd. has provided you with the following details related to its capital assets for the year ended December 31, 2020 Opening undepreciated

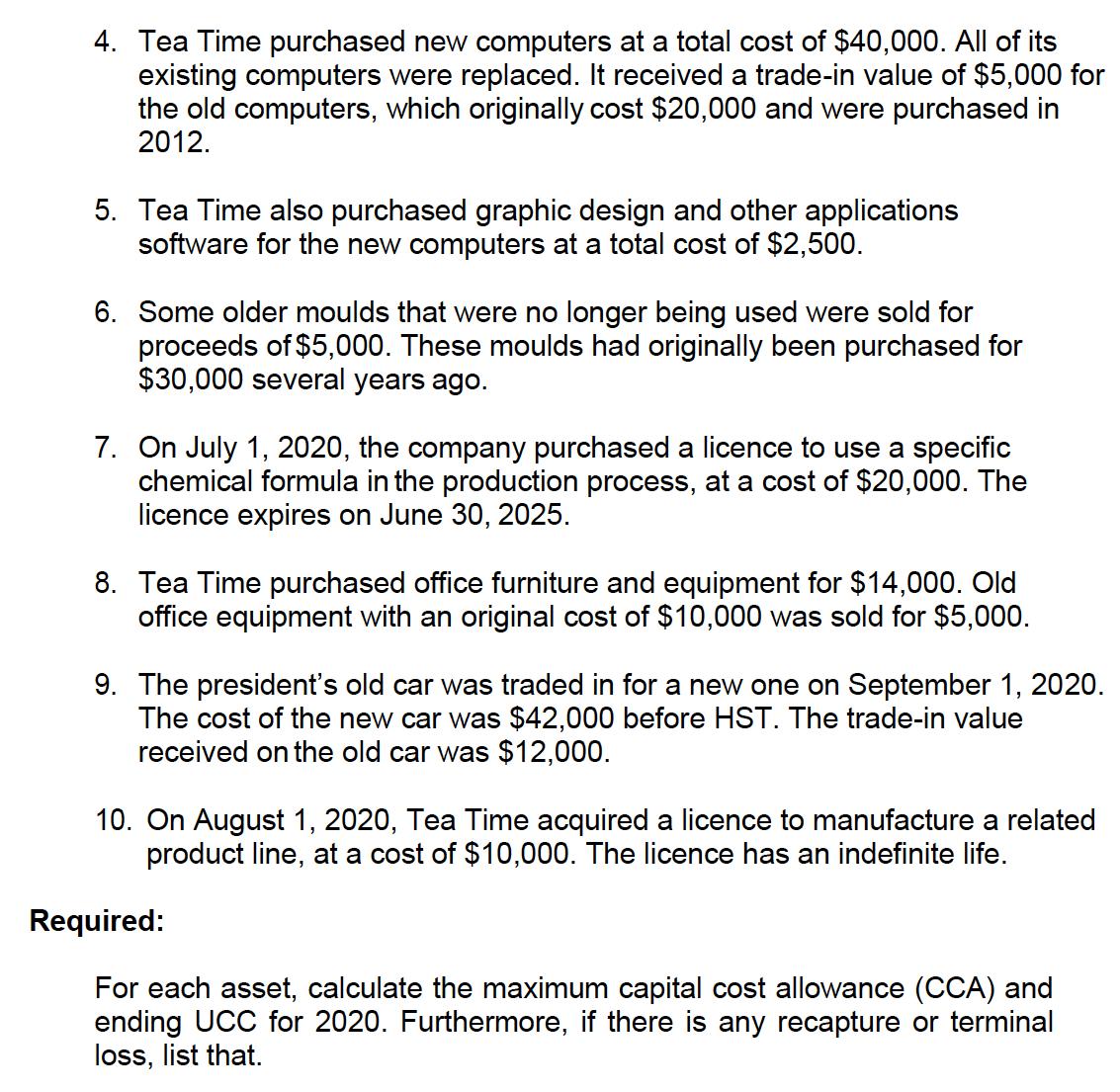

Tea Time Ltd. has provided you with the following details related to its capital assets for the year ended December 31, 2020 Opening undepreciated capital cost (UCC) balances: Class 1 Class 8 Class 10.1 Class 12 Class 43 Class 50 $ 140,000 12,000 17,850 Nil 5,000 8,000 Notes to opening balances: 1. The only asset in Class 1 is the current head office building in Victoria, which was purchased in 1997. 2. Class 10.1 contains the president's old car, which was purchased two years ago for $34,000 including HST. Fixed-asset transactions during 2020: 1. Tea Time built a new manufacturing plant in Kitchener, Ontario. The plant was completed in November 2020. The total cost of the building was $155,000, which included $5,000 for utilities service connections. Over 90% of the building will be used for manufacturing activities. The new plant also has office space inside to replace the old head office building. The old head office building was sold for $100,000 as it was in a less desirable area of the city. Its original cost was $225,000. 2. New manufacturing equipment costing $120,000 was installed in the new plant and was ready for use by December 2020. 3. Leasehold improvements were made to a newly rented warehouse in the Hamilton area. The lease is for four years with a three-year renewal option. The lease was signed on October 1, 2020. Total leasehold improvements made in 2020 were $70,000. 4. Tea Time purchased new computers at a total cost of $40,000. All of its existing computers were replaced. It received a trade-in value of $5,000 for the old computers, which originally cost $20,000 and were purchased in 2012. 5. Tea Time also purchased graphic design and other applications software for the new computers at a total cost of $2,500. 6. Some older moulds that were no longer being used were sold for proceeds of $5,000. These moulds had originally been purchased for $30,000 several years ago. 7. On July 1, 2020, the company purchased a licence to use a specific chemical formula in the production process, at a cost of $20,000. The licence expires on June 30, 2025. 8. Tea Time purchased office furniture and equipment for $14,000. Old office equipment with an original cost of $10,000 was sold for $5,000. 9. The president's old car was traded in for a new one on September 1, 2020. The cost of the new car was $42,000 before HST. The trade-in value received on the old car was $12,000. 10. On August 1, 2020, Tea Time acquired a licence to manufacture a related product line, at a cost of $10,000. The licence has an indefinite life. Required: For each asset, calculate the maximum capital cost allowance (CCA) and ending UCC for 2020. Furthermore, if there is any recapture or terminal loss, list that.

Step by Step Solution

★★★★★

3.57 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Class 1 Maximum CCA 5000 Ending UCC 135000 There is no recapture or terminal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started