advanced accounting help resolving these problems please

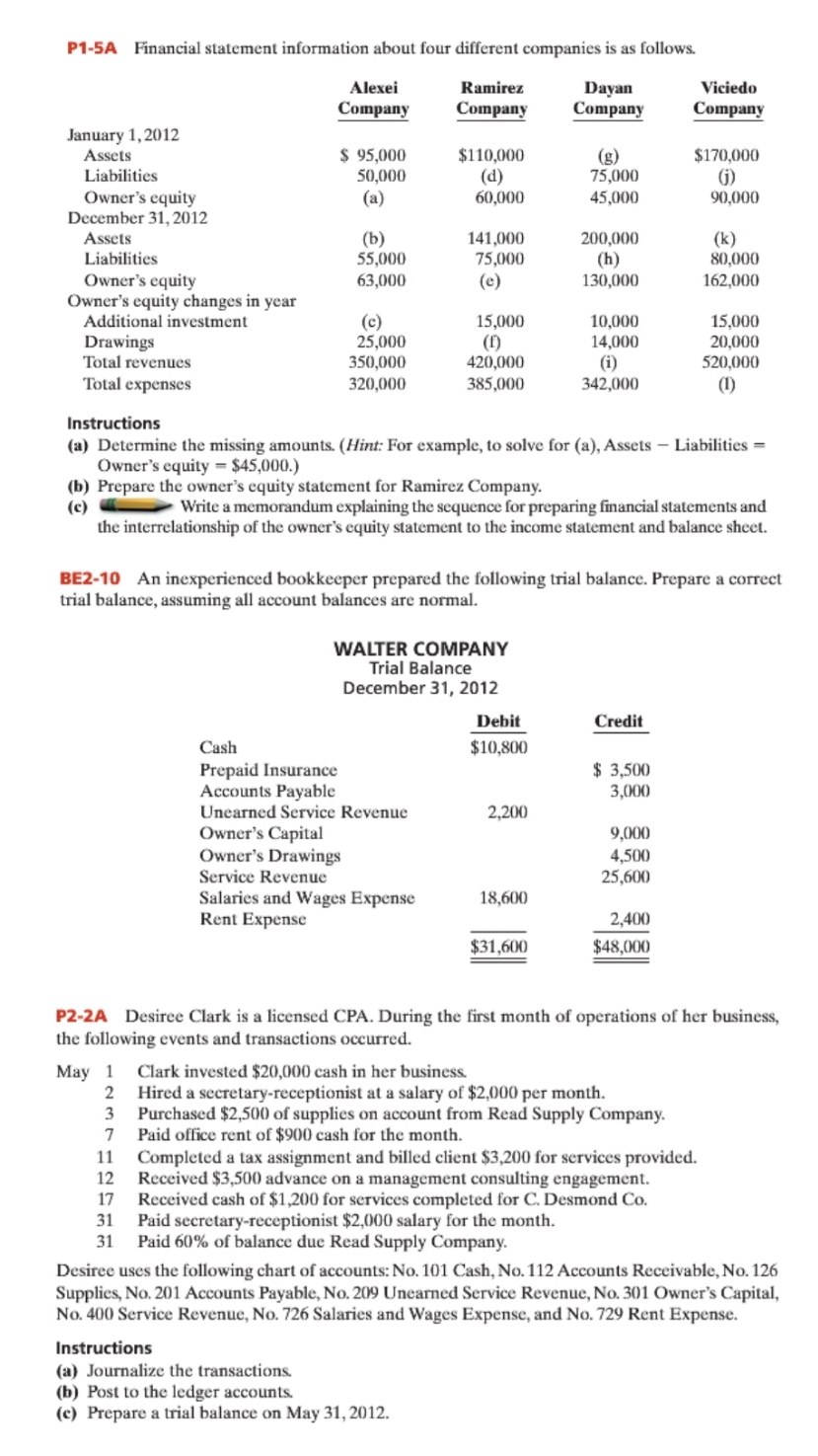

P1-5A Financial statement information about four different companies is as follows. Alexei Ramirez Dayan Viciedo Company Company Company Company January 1, 2012 Assets $ 95,000 $110,000 (g) $170,000 Liabilities 50,000 (d) 75,000 () Owner's equity (a) 60,000 45,000 90,000 December 31, 2012 Assets (b) 141,000 200,000 (k) Liabilities 55,000 75,000 (h) 80,000 Owner's equity 63,000 (e) 130,000 162,000 Owner's equity changes in year Additional investment (c) 15,000 10,000 15,000 Drawings 25,000 (1) 14,000 20,000 Total revenues 350,000 420,000 (i) 520,000 Total expenses 320,000 385,000 342,000 (1) Instructions (a) Determine the missing amounts. (Hint: For example, to solve for (a), Assets - Liabilities = Owner's equity = $45,000.) (b) Prepare the owner's equity statement for Ramirez Company. (c) Write a memorandum explaining the sequence for preparing financial statements and the interrelationship of the owner's equity statement to the income statement and balance sheet. BE2-10 An inexperienced bookkeeper prepared the following trial balance. Prepare a correct trial balance, assuming all account balances are normal. WALTER COMPANY Trial Balance December 31, 2012 Debit Credit Cash $10,800 Prepaid Insurance $ 3,500 Accounts Payable 3,000 Unearned Service Revenue 2,200 Owner's Capital 9,000 Owner's Drawings 4,500 Service Revenue 25,600 Salaries and Wages Expense 18,600 Rent Expense 2,400 $31,600 $48,000 P2-2A Desiree Clark is a licensed CPA. During the first month of operations of her business, the following events and transactions occurred. May 1 Clark invested $20,000 cash in her business. WN Hired a secretary-receptionist at a salary of $2,000 per month. 7 Purchased $2,500 of supplies on account from Read Supply Company. Paid office rent of $900 cash for the month. 11 Completed a tax assignment and billed client $3,200 for services provided. 12 Received $3,500 advance on a management consulting engagement. 17 Received cash of $1,200 for services completed for C. Desmond Co. 31 Paid secretary-receptionist $2,000 salary for the month. 31 Paid 60% of balance due Read Supply Company. Desiree uses the following chart of accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 126 Supplies, No. 201 Accounts Payable, No. 209 Unearned Service Revenue, No. 301 Owner's Capital, No. 400 Service Revenue, No. 726 Salaries and Wages Expense, and No. 729 Rent Expense. Instructions (a) Journalize the transactions. (b) Post to the ledger accounts. (c) Prepare a trial balance on May 31, 2012