Answered step by step

Verified Expert Solution

Question

1 Approved Answer

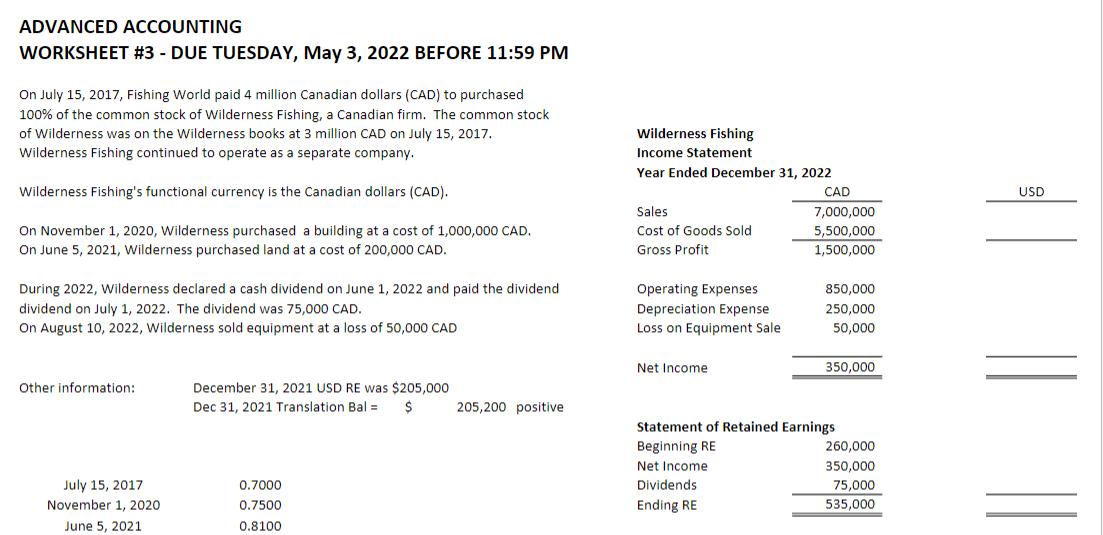

ADVANCED ACCOUNTING WORKSHEET #3 - DUE TUESDAY, May 3, 2022 BEFORE 11:59 PM On July 15, 2017, Fishing World paid 4 million Canadian dollars

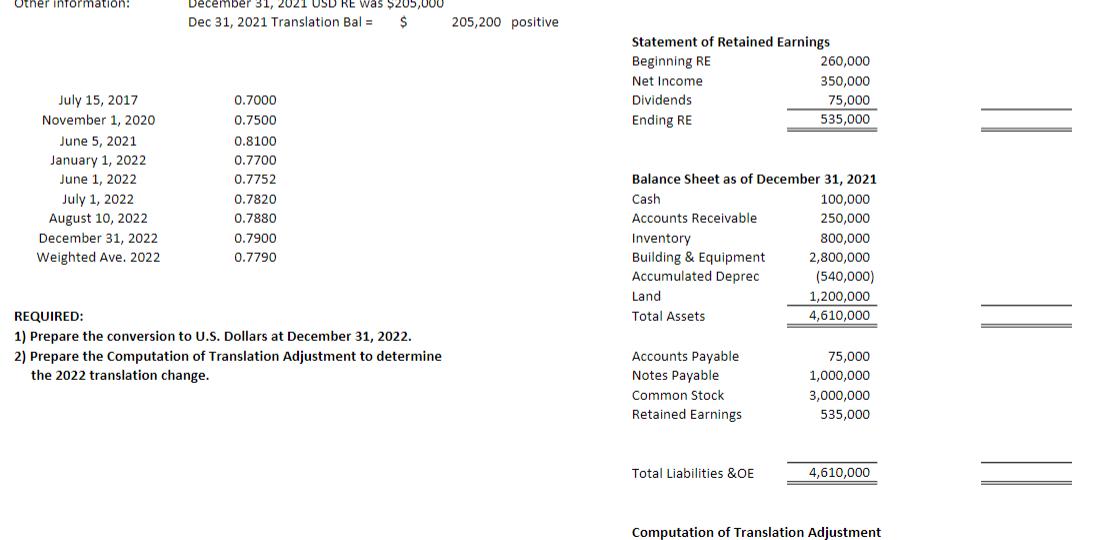

ADVANCED ACCOUNTING WORKSHEET #3 - DUE TUESDAY, May 3, 2022 BEFORE 11:59 PM On July 15, 2017, Fishing World paid 4 million Canadian dollars (CAD) to purchased 100% of the common stock of Wilderness Fishing, a Canadian firm. The common stock of Wilderness was on the Wilderness books at 3 million CAD on July 15, 2017. Wilderness Fishing continued to operate as a separate company. Wilderness Fishing's functional currency is the Canadian dollars (CAD). On November 1, 2020, Wilderness purchased a building at a cost of 1,000,000 CAD. On June 5, 2021, Wilderness purchased land at a cost of 200,000 CAD. During 2022, Wilderness declared a cash dividend on June 1, 2022 and paid the dividend. dividend on July 1, 2022. The dividend was 75,000 CAD. On August 10, 2022, Wilderness sold equipment at a loss of 50,000 CAD Other information: July 15, 2017 November 1, 2020 June 5, 2021 December 31, 2021 USD RE was $205,000 Dec 31, 2021 Translation Bal= $ 0.7000 0.7500 0.8100 205,200 positive Wilderness Fishing Income Statement Year Ended December 31, 2022 Sales Cost of Goods Sold Gross Profit Operating Expenses Depreciation Expense Loss on Equipment Sale Net Income CAD 7,000,000 5,500,000 1,500,000 Dividends. Ending RE 850,000 250,000 50,000 350,000 Statement of Retained Earnings Beginning RE Net Income 260,000 350,000 75,000 535,000 USD Other information: July 15, 2017 November 1, 2020 June 5, 2021 January 1, 2022 June 1, 2022 July 1, 2022 August 10, 2022 December 31, 2022 Weighted Ave. 2022 December 31, 2021 USD RE was $205,000 Dec 31, 2021 Translation Bal= $ 0.7000 0.7500 0.8100 0.7700 0.7752 0.7820 0.7880 0.7900 0.7790 REQUIRED: 1) Prepare the conversion to U.S. Dollars at December 31, 2022. 2) Prepare the Computation of Translation Adjustment to determine the 2022 translation change. 205,200 positive Statement of Retained Earnings Beginning RE Net Income Dividends Ending RE Balance Sheet as of December 31, 2021 Cash Accounts Receivable. Inventory Building & Equipment Accumulated Deprec Land Total Assets Accounts Payable Notes Payable Common Stock Retained Earnings 260,000 350,000 75,000 535,000 Total Liabilities &OE 100,000 250,000 800,000 2,800,000 (540,000) 1,200,000 4,610,000 75,000 1,000,000 3,000,000 535,000 4,610,000 Computation of Translation Adjustment

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Wilderness Fishing Income Statement Year end 2022 Particulars Sales Cost of Good sold Gross Profit O...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started