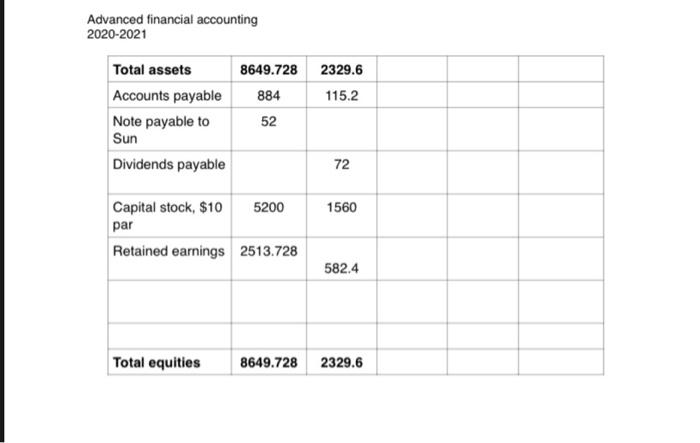

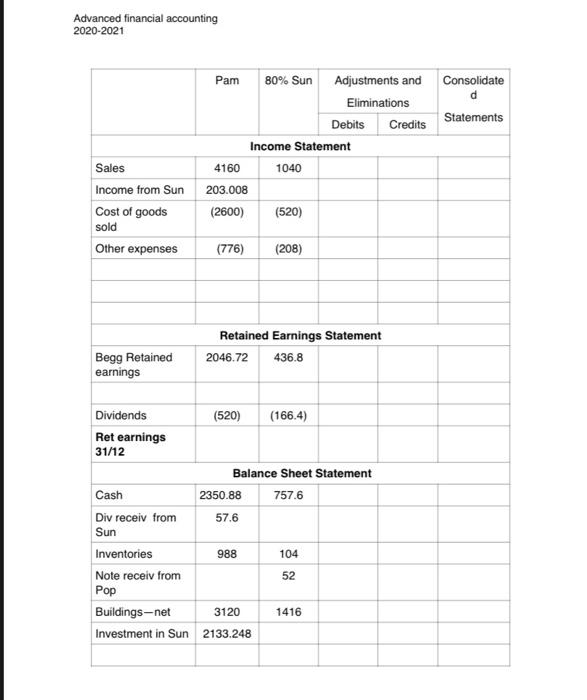

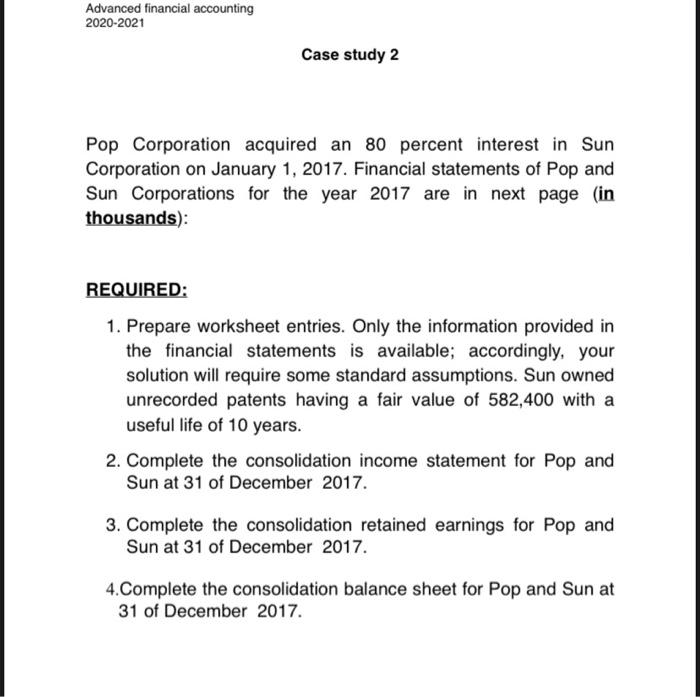

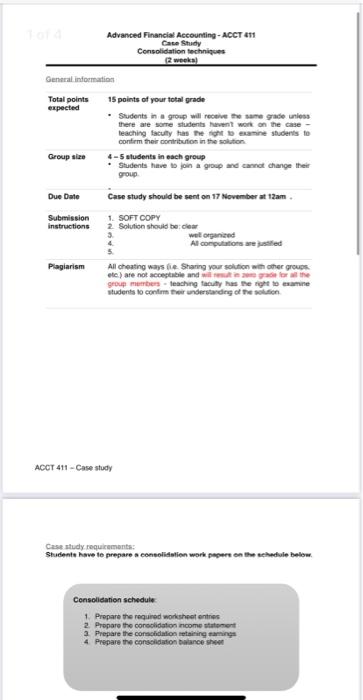

Advanced financial accounting 2020-2021 Total assets Accounts payable Note payable to Sun Dividends payable 8649.728 884 52 2329.6 115.2 72 1560 Capital stock, $10 5200 par Retained earnings 2513.728 582.4 Total equities 8649.728 2329.6 Advanced financial accounting 2020-2021 Pam 80% Sun Adjustments and Consolidate Eliminations Debits Credits Statements Income Statement 4160 1040 203.008 (2600) (520) Sales Income from Sun Cost of goods sold Other expenses (776) (208) Begg Retained earnings Retained Earnings Statement 2046.72 436.8 (520) (166.4) Dividends Ret earnings 31/12 Balance Sheet Statement 2350.88 757.6 57.6 Cash Div receiv from Sun Inventories Note receiv from 988 104 52 Pop 1416 Buildings-net 3120 Investment in Sun 2133.248 Advanced financial accounting 2020-2021 Case study 2 Pop Corporation acquired an 80 percent interest in Sun Corporation on January 1, 2017. Financial statements of Pop and Sun Corporations for the year 2017 are in next page (in thousands) REQUIRED: 1. Prepare worksheet entries. Only the information provided in the financial statements is available; accordingly, your solution will require some standard assumptions. Sun owned unrecorded patents having a fair value of 582,400 with a useful life of 10 years. 2. Complete the consolidation income statement for Pop and Sun at 31 of December 2017. 3. Complete the consolidation retained earnings for Pop and Sun at 31 of December 2017. 4. Complete the consolidation balance sheet for Pop and Sun at 31 of December 2017. Advanced Financial Accounting-ACCT 411 Case Study Consolidation techniques General information Total points 15 points of your total grade expected . Students in a group will receive the same grade unless there are some students haven't work on the case- teaching faculty as the examine students to confirm their contribution in the solution Group size 4-5 students in each group Students have son a group and cannot change the group Due Date Case study should be sent on 17 November at 12am. Submission 1. SOFT COPY instructions 2 Solution should be clear well organized Al computations are stilled Plagiarism All cheating ways be Sharing your solution with other groups etc.) are not acceptable and will do the group members teaching tauny has the right to examine students to confirmer understanding of the in ACCT 411 - Case study Case study requirements: Students have to prepare a consolidation work pere on the schedule below. Consolidation schedule 1 Propare the required worksheet entries 2. Prepare the consolidation income statement a Prepare the consolidation retaining aming 4. Prepare the consolidation balance sheet Advanced financial accounting 2020-2021 Total assets Accounts payable Note payable to Sun Dividends payable 8649.728 884 52 2329.6 115.2 72 1560 Capital stock, $10 5200 par Retained earnings 2513.728 582.4 Total equities 8649.728 2329.6 Advanced financial accounting 2020-2021 Pam 80% Sun Adjustments and Consolidate Eliminations Debits Credits Statements Income Statement 4160 1040 203.008 (2600) (520) Sales Income from Sun Cost of goods sold Other expenses (776) (208) Begg Retained earnings Retained Earnings Statement 2046.72 436.8 (520) (166.4) Dividends Ret earnings 31/12 Balance Sheet Statement 2350.88 757.6 57.6 Cash Div receiv from Sun Inventories Note receiv from 988 104 52 Pop 1416 Buildings-net 3120 Investment in Sun 2133.248 Advanced financial accounting 2020-2021 Case study 2 Pop Corporation acquired an 80 percent interest in Sun Corporation on January 1, 2017. Financial statements of Pop and Sun Corporations for the year 2017 are in next page (in thousands) REQUIRED: 1. Prepare worksheet entries. Only the information provided in the financial statements is available; accordingly, your solution will require some standard assumptions. Sun owned unrecorded patents having a fair value of 582,400 with a useful life of 10 years. 2. Complete the consolidation income statement for Pop and Sun at 31 of December 2017. 3. Complete the consolidation retained earnings for Pop and Sun at 31 of December 2017. 4. Complete the consolidation balance sheet for Pop and Sun at 31 of December 2017. Advanced Financial Accounting-ACCT 411 Case Study Consolidation techniques General information Total points 15 points of your total grade expected . Students in a group will receive the same grade unless there are some students haven't work on the case- teaching faculty as the examine students to confirm their contribution in the solution Group size 4-5 students in each group Students have son a group and cannot change the group Due Date Case study should be sent on 17 November at 12am. Submission 1. SOFT COPY instructions 2 Solution should be clear well organized Al computations are stilled Plagiarism All cheating ways be Sharing your solution with other groups etc.) are not acceptable and will do the group members teaching tauny has the right to examine students to confirmer understanding of the in ACCT 411 - Case study Case study requirements: Students have to prepare a consolidation work pere on the schedule below. Consolidation schedule 1 Propare the required worksheet entries 2. Prepare the consolidation income statement a Prepare the consolidation retaining aming 4. Prepare the consolidation balance sheet