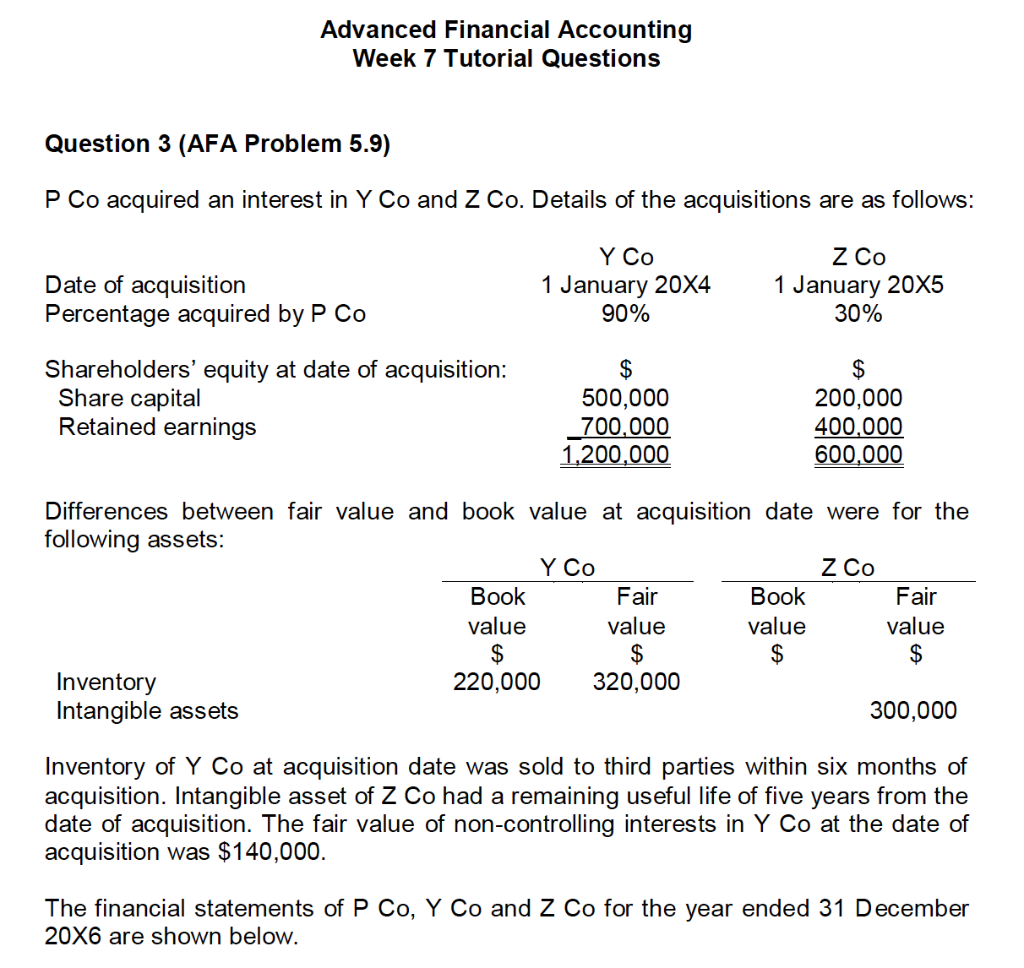

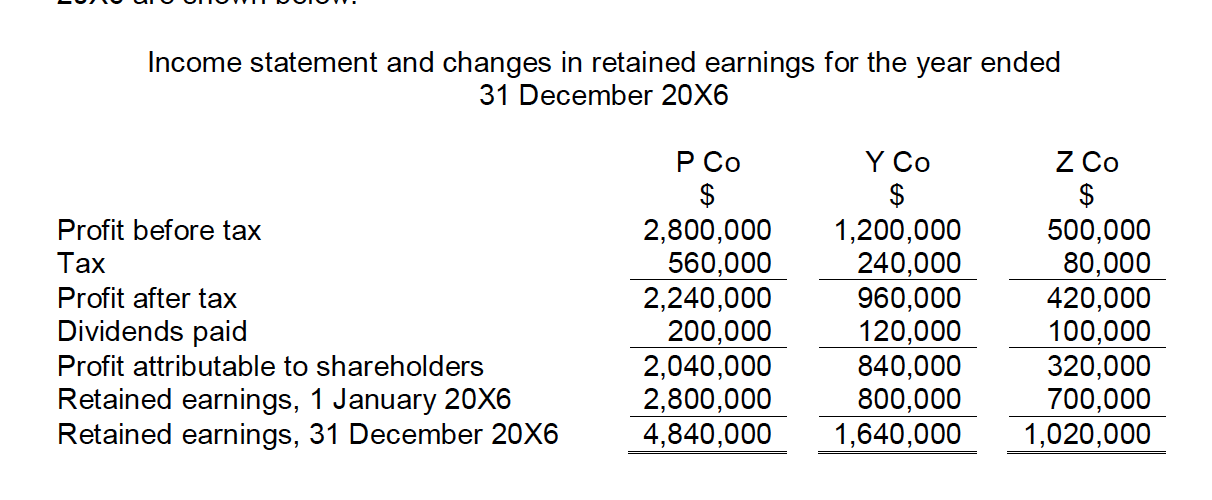

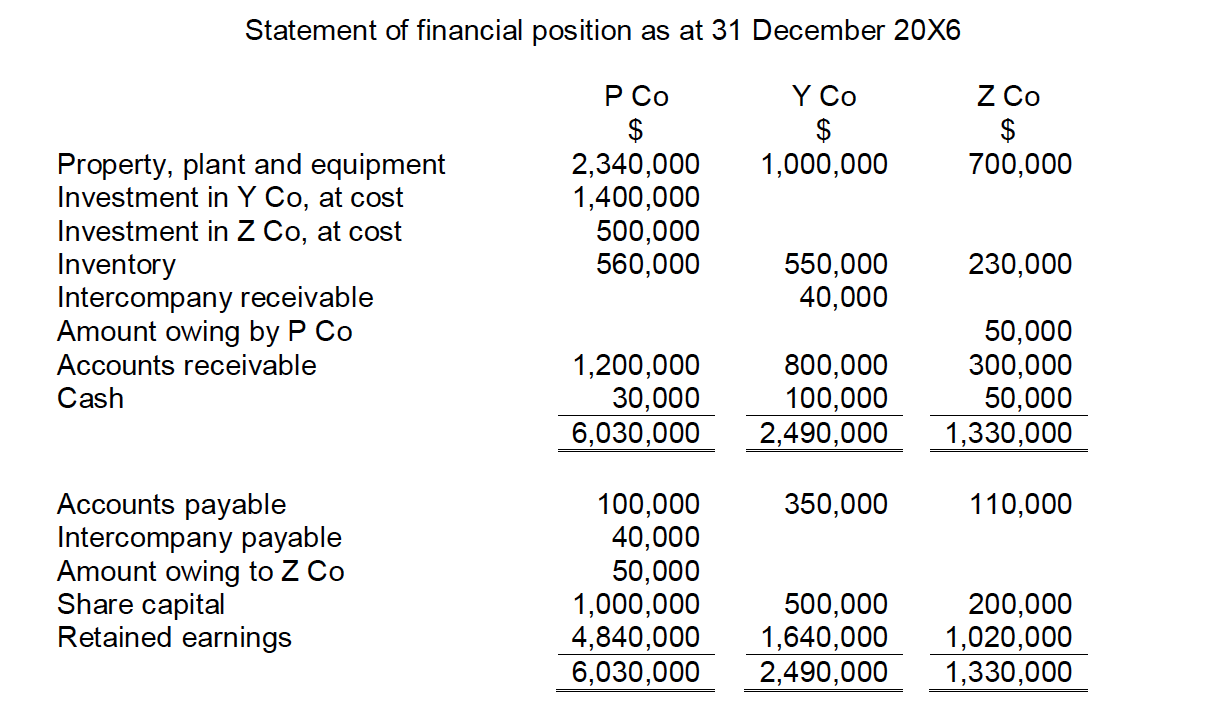

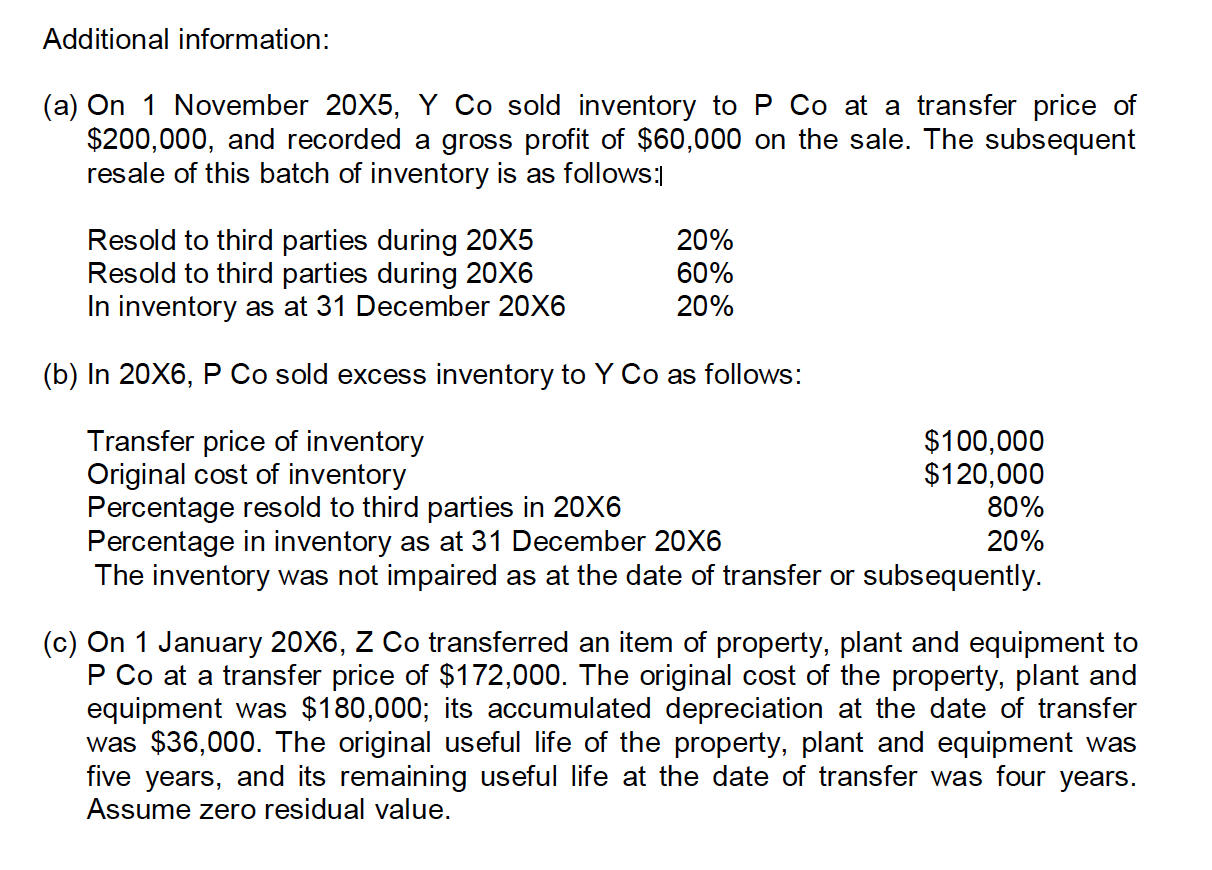

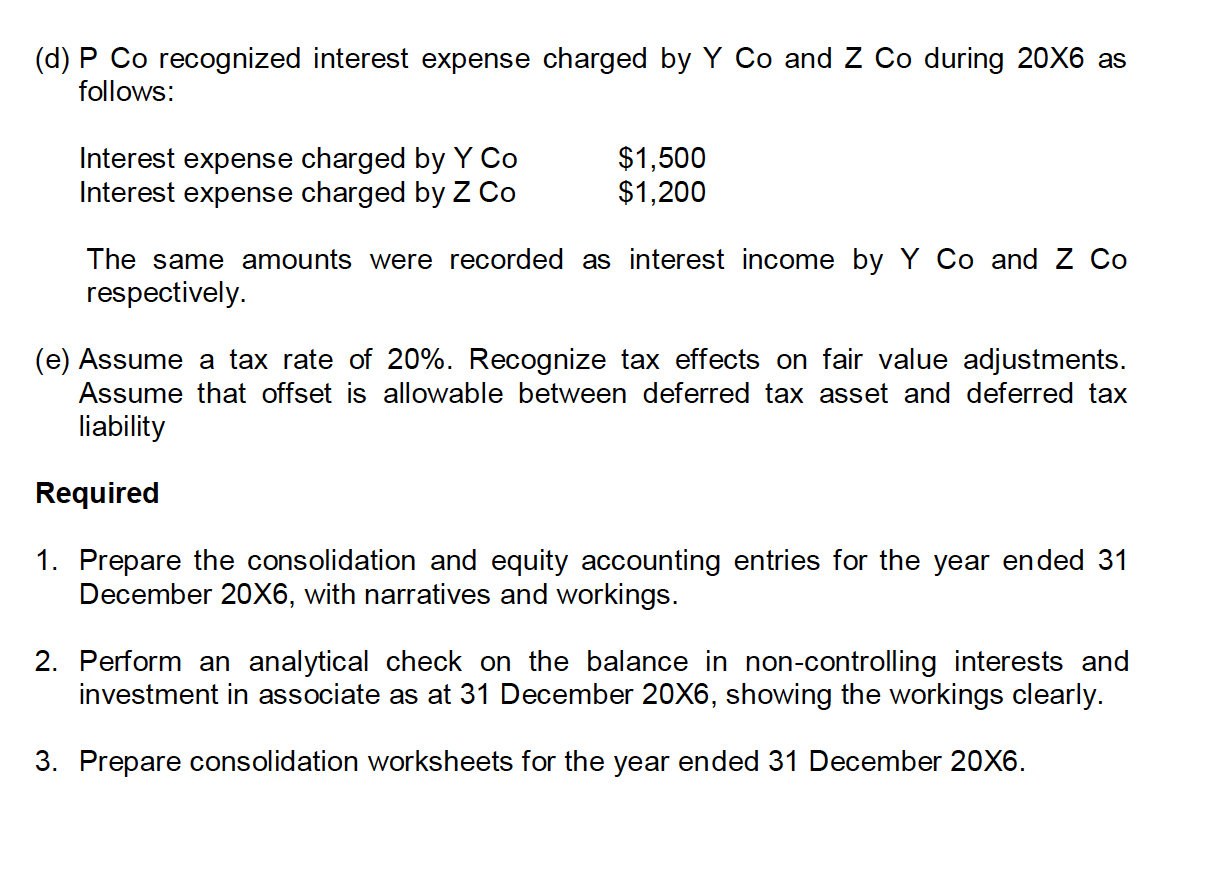

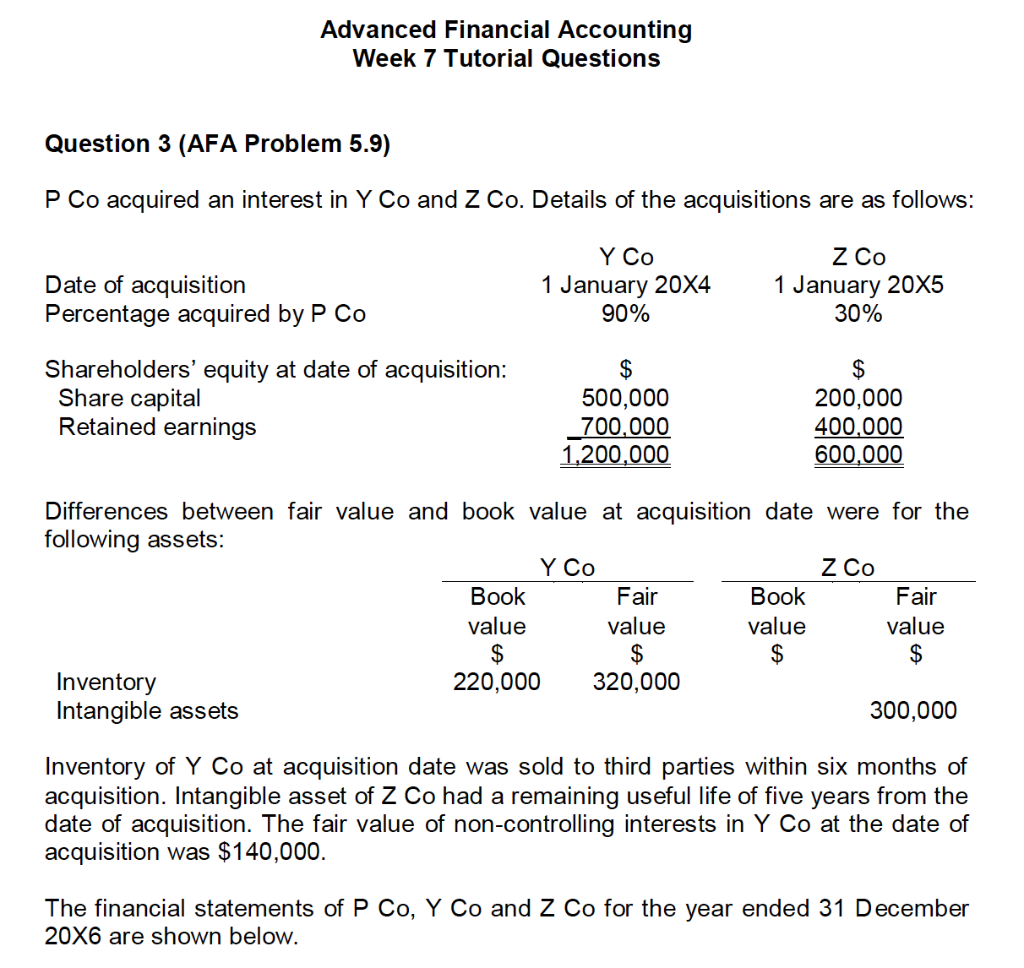

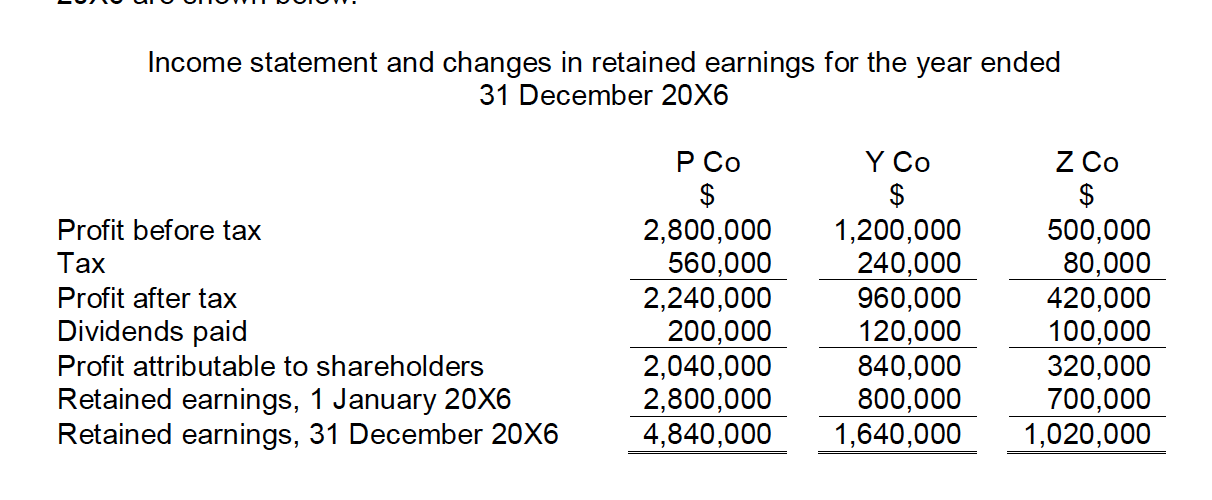

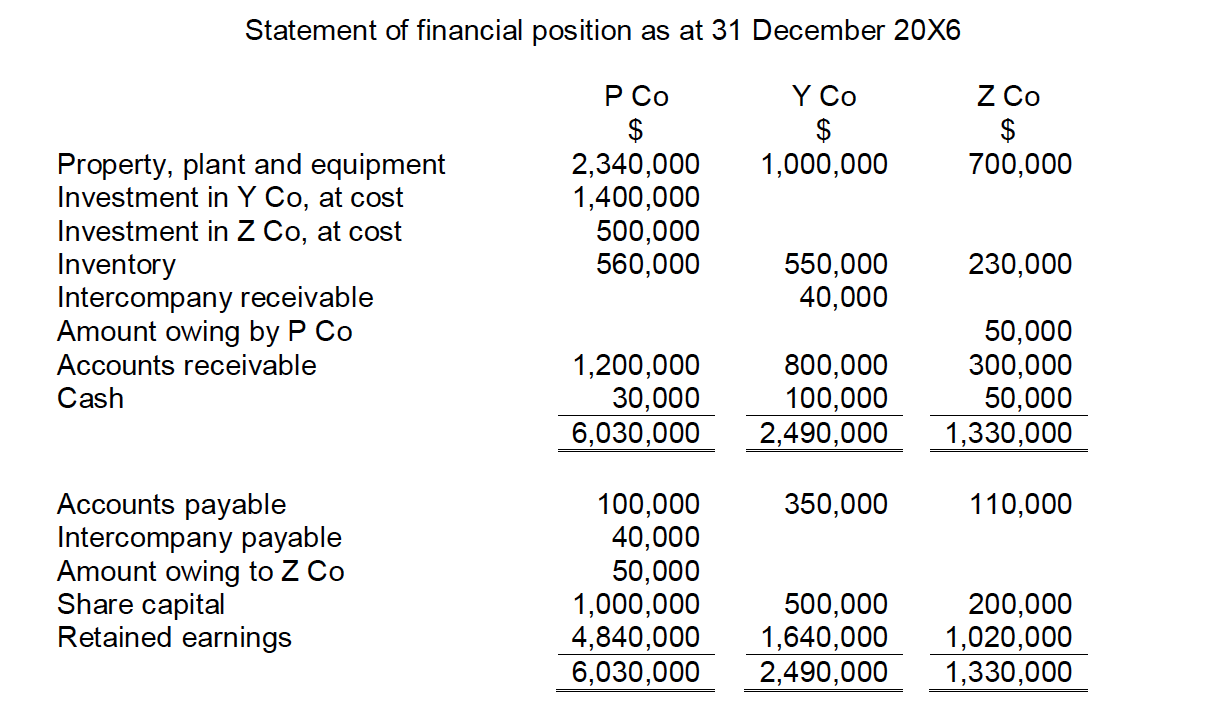

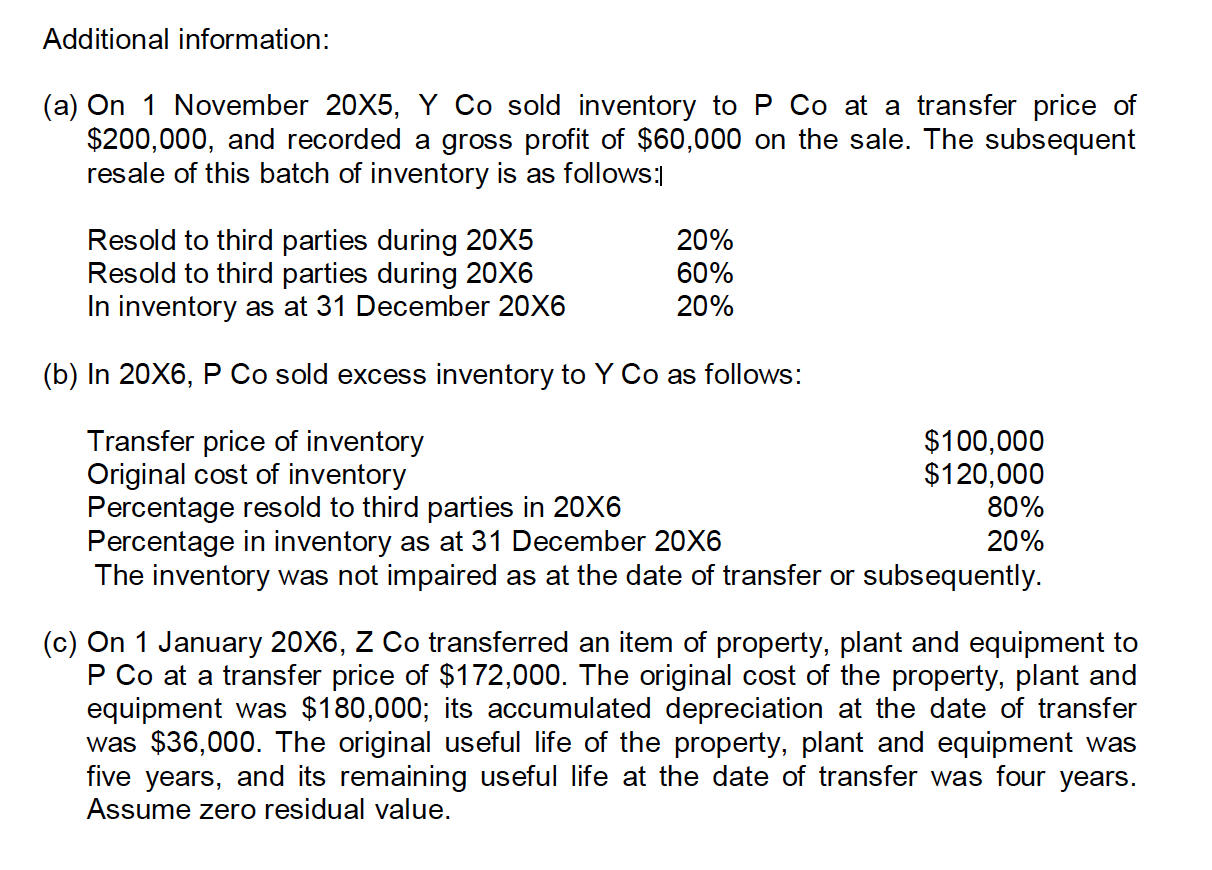

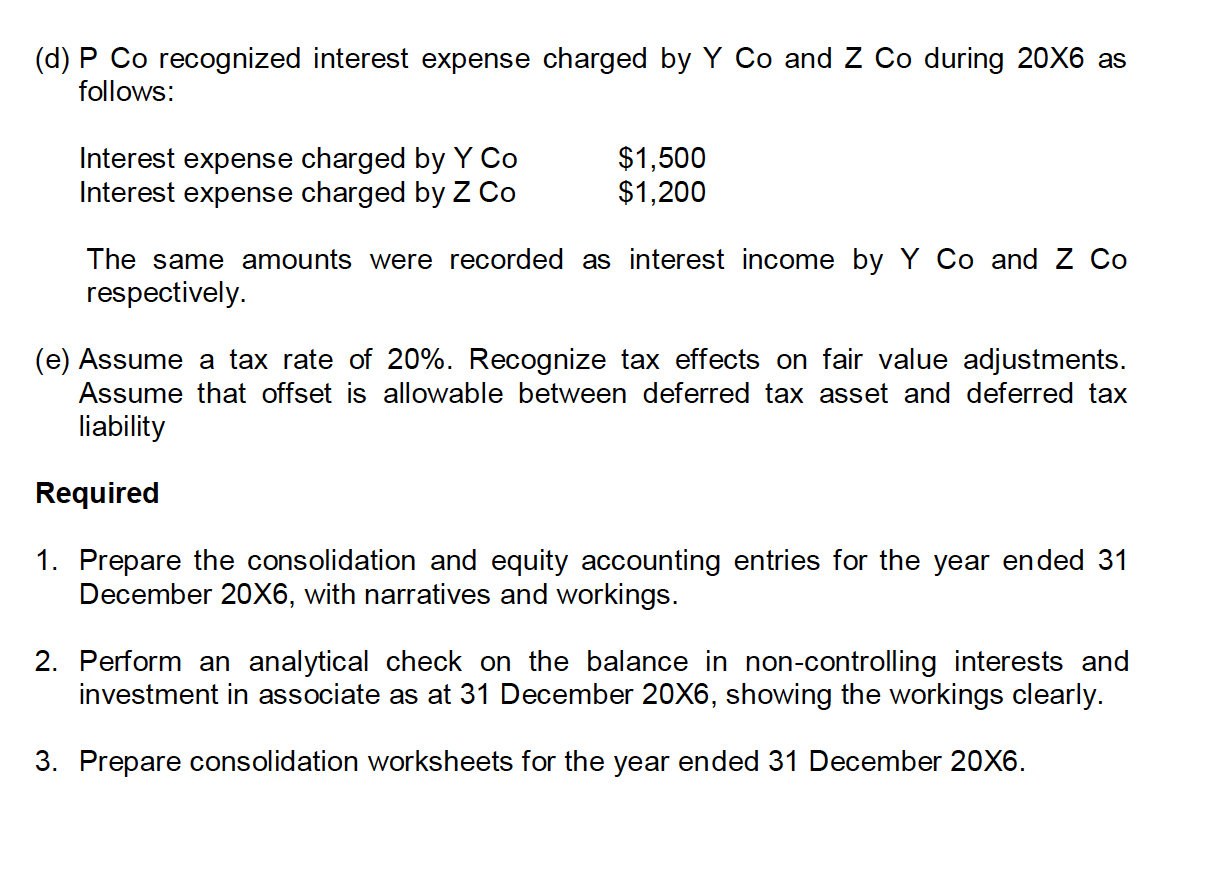

Advanced Financial Accounting Week 7 Tutorial Questions Question 3 (AFA Problem 5.9) P Co acquired an interest in Y Co and Z Co. Details of the acquisitions are as follows: Date of acquisition Percentage acquired by P Co Y Co 1 January 20X4 90% z Co 1 January 2005 30% Shareholders' equity at date of acquisition: Share capital Retained earnings 500,000 700.000 1,200,000 $ 200,000 400,000 600,000 Differences between fair value and book value at acquisition date were for the following assets: Y Co Z Co Book Fair Book Fair value value value value $ $ $ $ Inventory 220,000 320,000 Intangible assets 300,000 Inventory of Y Co at acquisition date was sold to third parties within six months of acquisition. Intangible asset of Z Co had a remaining useful life of five years from the date of acquisition. The fair value of non-controlling interests in Y Co at the date of acquisition was $140,000. The financial statements of P Co, Y Co and Z Co for the year ended 31 December 20x6 are shown below. Income statement and changes in retained earnings for the year ended 31 December 20X6 z co Profit before tax Tax Profit after tax Dividends paid Profit attributable to shareholders Retained earnings, 1 January 20X6 Retained earnings, 31 December 20X6 $ 2,800,000 560,000 2,240,000 200,000 2,040,000 2,800,000 4,840,000 Y Co $ 1,200,000 240,000 960,000 120,000 840,000 800,000 1,640,000 $ 500,000 80,000 420,000 100,000 320,000 700,000 1,020,000 Statement of financial position as at 31 December 20X6 Y Co $ 1,000,000 z Co $ 700,000 $ 2,340,000 1,400,000 500,000 560,000 230,000 Property, plant and equipment Investment in Y Co, at cost Investment in Z Co, at cost Inventory Intercompany receivable Amount owing by P Co Accounts receivable Cash 550,000 40,000 1,200,000 30,000 6,030,000 800,000 100,000 2,490,000 50,000 300,000 50,000 1,330,000 350,000 110,000 Accounts payable Intercompany payable Amount owing to Z Co Share capital Retained earnings 100,000 40,000 50,000 1,000,000 4,840,000 6,030,000 500,000 1,640,000 2,490,000 200,000 1,020,000 1,330,000 Additional information: (a) On 1 November 20X5, Y Co sold inventory to P Co at a transfer price of $200,000, and recorded a gross profit of $60,000 on the sale. The subsequent resale of this batch of inventory is as follows: Resold to third parties during 20X5 Resold to third parties during 20X6 In inventory as at 31 December 20X6 20% 60% 20% (b) In 20X6, P Co sold excess inventory to Y Co as follows: Transfer price of inventory $100,000 Original cost of inventory $120,000 Percentage resold to third parties in 20X6 80% Percentage in inventory as at 31 December 20X6 20% The inventory was not impaired as at the date of transfer or subsequently. (c) On 1 January 20X6, Z Co transferred an item of property, plant and equipment to P Co at a transfer price of $172,000. The original cost of the property, plant and equipment was $180,000; its accumulated depreciation at the date of transfer was $36,000. The original useful life of the property, plant and equipment was five years, and its remaining useful life at the date of transfer was four years. Assume zero residual value. (d) P Co recognized interest expense charged by Y Co and Z Co during 20X6 as follows: Interest expense charged by Y Co Interest expense charged by Z Co $1,500 $1,200 The same amounts were recorded as interest income by Y Co and Z Co respectively. (e) Assume a tax rate of 20%. Recognize tax effects on fair value adjustments. Assume that offset is allowable between deferred tax asset and deferred tax liability Required 1. Prepare the consolidation and equity accounting entries for the year ended 31 December 20X6, with narratives and workings. 2. Perform an analytical check on the balance in non-controlling interests and investment in associate as at 31 December 20X6, showing the workings clearly. 3. Prepare consolidation worksheets for the year ended 31 December 20X6. Advanced Financial Accounting Week 7 Tutorial Questions Question 3 (AFA Problem 5.9) P Co acquired an interest in Y Co and Z Co. Details of the acquisitions are as follows: Date of acquisition Percentage acquired by P Co Y Co 1 January 20X4 90% z Co 1 January 2005 30% Shareholders' equity at date of acquisition: Share capital Retained earnings 500,000 700.000 1,200,000 $ 200,000 400,000 600,000 Differences between fair value and book value at acquisition date were for the following assets: Y Co Z Co Book Fair Book Fair value value value value $ $ $ $ Inventory 220,000 320,000 Intangible assets 300,000 Inventory of Y Co at acquisition date was sold to third parties within six months of acquisition. Intangible asset of Z Co had a remaining useful life of five years from the date of acquisition. The fair value of non-controlling interests in Y Co at the date of acquisition was $140,000. The financial statements of P Co, Y Co and Z Co for the year ended 31 December 20x6 are shown below. Income statement and changes in retained earnings for the year ended 31 December 20X6 z co Profit before tax Tax Profit after tax Dividends paid Profit attributable to shareholders Retained earnings, 1 January 20X6 Retained earnings, 31 December 20X6 $ 2,800,000 560,000 2,240,000 200,000 2,040,000 2,800,000 4,840,000 Y Co $ 1,200,000 240,000 960,000 120,000 840,000 800,000 1,640,000 $ 500,000 80,000 420,000 100,000 320,000 700,000 1,020,000 Statement of financial position as at 31 December 20X6 Y Co $ 1,000,000 z Co $ 700,000 $ 2,340,000 1,400,000 500,000 560,000 230,000 Property, plant and equipment Investment in Y Co, at cost Investment in Z Co, at cost Inventory Intercompany receivable Amount owing by P Co Accounts receivable Cash 550,000 40,000 1,200,000 30,000 6,030,000 800,000 100,000 2,490,000 50,000 300,000 50,000 1,330,000 350,000 110,000 Accounts payable Intercompany payable Amount owing to Z Co Share capital Retained earnings 100,000 40,000 50,000 1,000,000 4,840,000 6,030,000 500,000 1,640,000 2,490,000 200,000 1,020,000 1,330,000 Additional information: (a) On 1 November 20X5, Y Co sold inventory to P Co at a transfer price of $200,000, and recorded a gross profit of $60,000 on the sale. The subsequent resale of this batch of inventory is as follows: Resold to third parties during 20X5 Resold to third parties during 20X6 In inventory as at 31 December 20X6 20% 60% 20% (b) In 20X6, P Co sold excess inventory to Y Co as follows: Transfer price of inventory $100,000 Original cost of inventory $120,000 Percentage resold to third parties in 20X6 80% Percentage in inventory as at 31 December 20X6 20% The inventory was not impaired as at the date of transfer or subsequently. (c) On 1 January 20X6, Z Co transferred an item of property, plant and equipment to P Co at a transfer price of $172,000. The original cost of the property, plant and equipment was $180,000; its accumulated depreciation at the date of transfer was $36,000. The original useful life of the property, plant and equipment was five years, and its remaining useful life at the date of transfer was four years. Assume zero residual value. (d) P Co recognized interest expense charged by Y Co and Z Co during 20X6 as follows: Interest expense charged by Y Co Interest expense charged by Z Co $1,500 $1,200 The same amounts were recorded as interest income by Y Co and Z Co respectively. (e) Assume a tax rate of 20%. Recognize tax effects on fair value adjustments. Assume that offset is allowable between deferred tax asset and deferred tax liability Required 1. Prepare the consolidation and equity accounting entries for the year ended 31 December 20X6, with narratives and workings. 2. Perform an analytical check on the balance in non-controlling interests and investment in associate as at 31 December 20X6, showing the workings clearly. 3. Prepare consolidation worksheets for the year ended 31 December 20X6