ADVANCED FINANCIAL DECISION MAKING

THERE IS ONLY ONE QUESTION HERE TO SOLVE HERE PLEASE

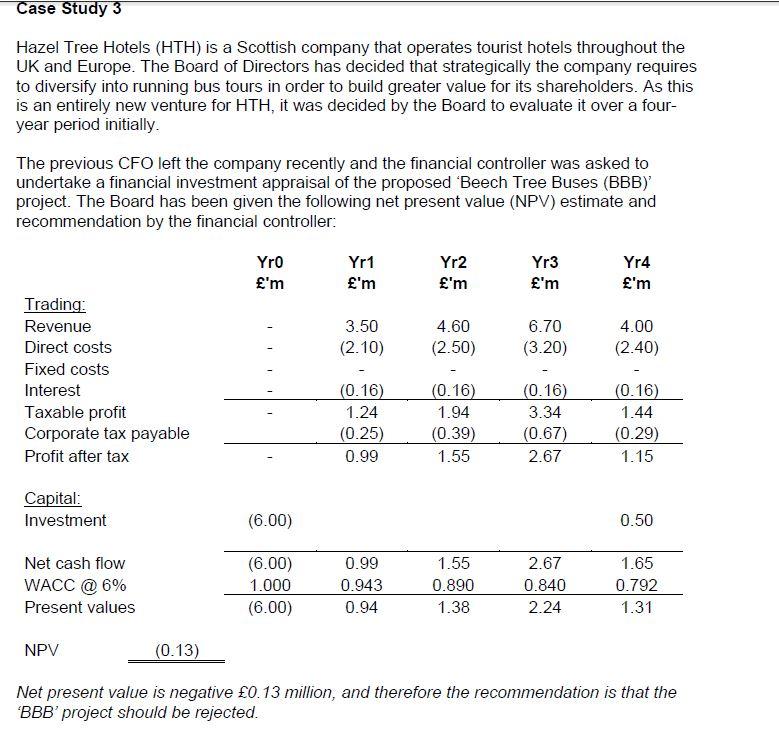

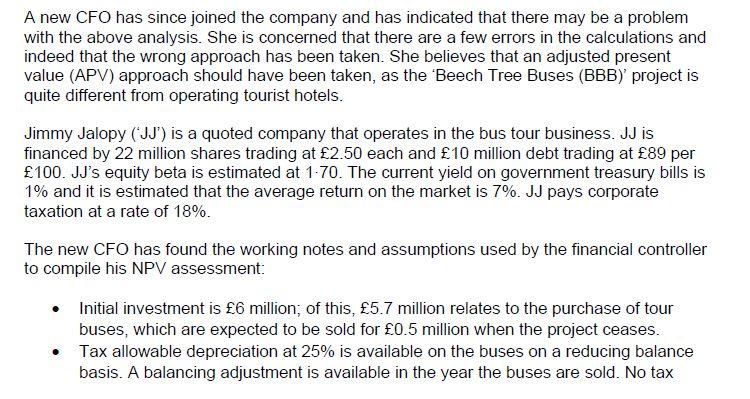

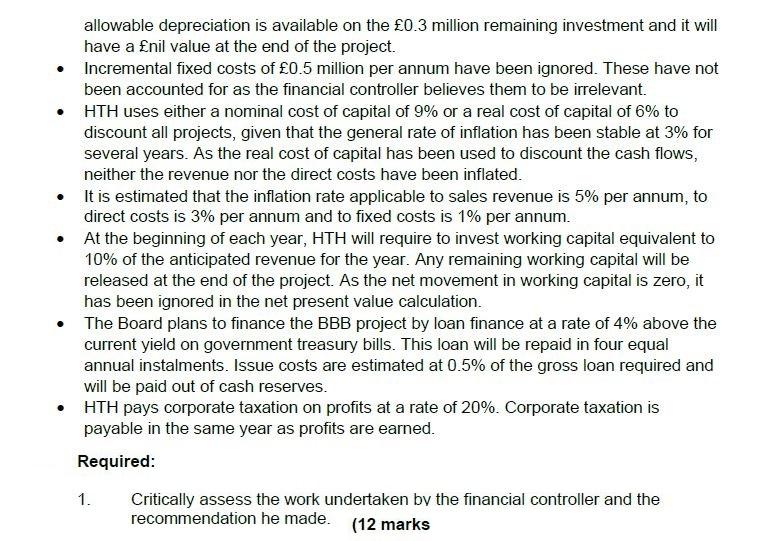

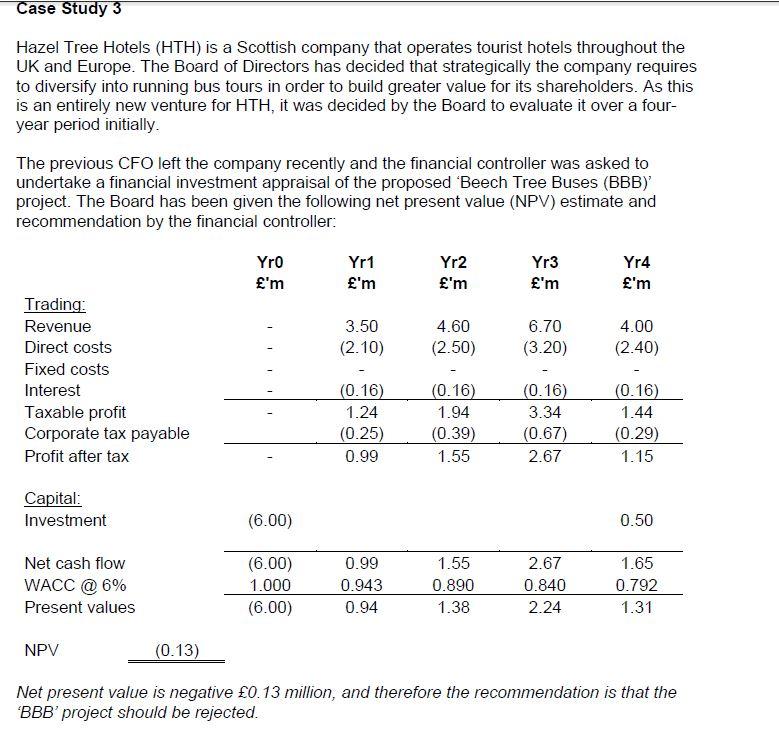

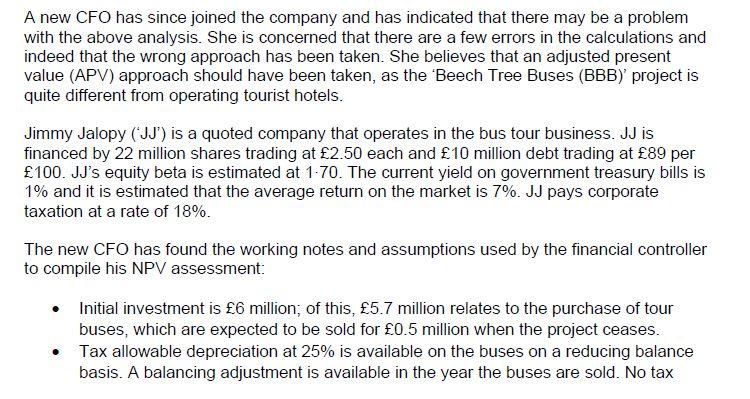

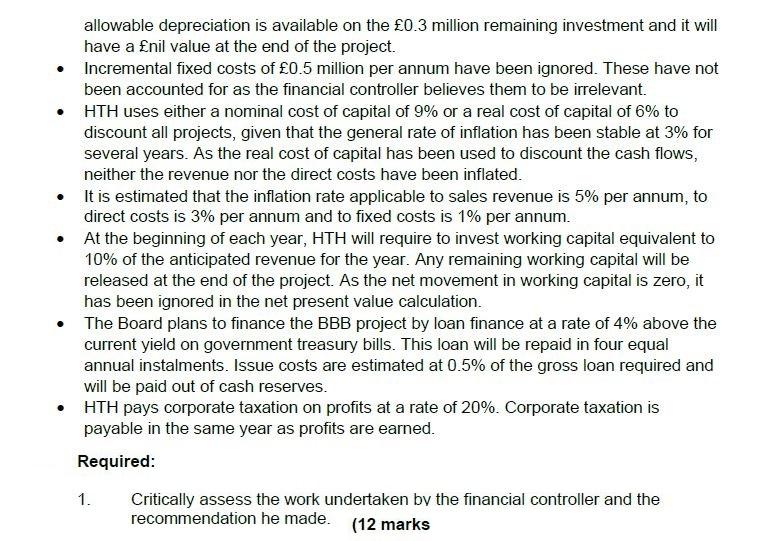

Case Study 3 Hazel Tree Hotels (HTH) is a Scottish company that operates tourist hotels throughout the UK and Europe. The Board of Directors has decided that strategically the company requires to diversify into running bus tours in order to build greater value for its shareholders. As this is an entirely new venture for HTH, it was decided by the Board to evaluate it over a four- year period initially. The previous CFO left the company recently and the financial controller was asked to undertake a financial investment appraisal of the proposed Beech Tree Buses (BBB) project. The Board has been given the following net present value (NPV) estimate and recommendation by the financial controller: Yro 'm Yr1 'm Yr2 'm Yr3 'm Yr4 'm 3.50 (2.10) 4.60 (2.50) 6.70 (3.20) 4.00 (2.40) Trading: Revenue Direct costs Fixed costs Interest Taxable profit Corporate tax payable Profit after tax (0.16) 1.24 (0.25) 0.99 (0.16) 1.94 (0.39) 1.55 (0.16) 3.34 (0.67) 2.67 (0.16) 1.44 (0.29) 1.15 Capital: Investment (6.00) 0.50 Net cash flow WACC @ 6% Present values (6.00) 1.000 (6.00) 0.99 0.943 0.94 1.55 0.890 1.38 2.67 0.840 2.24 1.65 0.792 1.31 NPV (0.13) Net present value is negative 0.13 million, and therefore the recommendation is that the BBB' project should be rejected. A new CFO has since joined the company and has indicated that there may be a problem with the above analysis. She is concerned that there are a few errors in the calculations and indeed that the wrong approach has been taken. She believes that an adjusted present value (APV) approach should have been taken, as the 'Beech Tree Buses (BBB) project is quite different from operating tourist hotels. Jimmy Jalopy (JJ') is a quoted company that operates in the bus tour business. JJ is financed by 22 million shares trading at 2.50 each and 10 million debt trading at 89 per 100. JJ's equity beta is estimated at 1-70. The current yield on government treasury bills is 1% and it is estimated that the average return on the market is 7%. JJ pays corporate taxation at a rate of 18%. The new CFO has found the working notes and assumptions used by the financial controller to compile his NPV assessment: Initial investment is 6 million; of this, 5.7 million relates to the purchase of tour buses, which are expected to be sold for 0.5 million when the project ceases. Tax allowable depreciation at 25% is available on the buses on a reducing balance basis. A balancing adjustment is available in the year the buses are sold. No tax allowable depreciation is available on the 0.3 million remaining investment and it will have a nil value at the end of the project. Incremental fixed costs of 0.5 million per annum have been ignored. These have not been accounted for as the financial controller believes them to be irrelevant. HTH uses either a nominal cost of capital of 9% or a real cost of capital of 6% to discount all projects, given that the general rate of inflation has been stable at 3% for several years. As the real cost of capital has been used to discount the cash flows, neither the revenue nor the direct costs have been inflated. It is estimated that the inflation rate applicable to sales revenue is 5% per annum, to direct costs is 3% per annum and to fixed costs is 1% per annum. At the beginning of each year, HTH will require to invest working capital equivalent to 10% of the anticipated revenue for the year. Any remaining working capital will be released at the end of the project. As the net movement in working capital is zero, it has been ignored in the net present value calculation. The Board plans to finance the BBB project by loan finance at a rate of 4% above the current yield on government treasury bills. This loan will be repaid in four equal annual instalments. Issue costs are estimated at 0.5% of the gross loan required and will be paid out of cash reserves. HTH pays corporate taxation on profits at a rate of 20%. Corporate taxation is payable in the same year as profits are earned. Required: . 1. Critically assess the work undertaken by the financial controller and the recommendation he made. (12 marks Case Study 3 Hazel Tree Hotels (HTH) is a Scottish company that operates tourist hotels throughout the UK and Europe. The Board of Directors has decided that strategically the company requires to diversify into running bus tours in order to build greater value for its shareholders. As this is an entirely new venture for HTH, it was decided by the Board to evaluate it over a four- year period initially. The previous CFO left the company recently and the financial controller was asked to undertake a financial investment appraisal of the proposed Beech Tree Buses (BBB) project. The Board has been given the following net present value (NPV) estimate and recommendation by the financial controller: Yro 'm Yr1 'm Yr2 'm Yr3 'm Yr4 'm 3.50 (2.10) 4.60 (2.50) 6.70 (3.20) 4.00 (2.40) Trading: Revenue Direct costs Fixed costs Interest Taxable profit Corporate tax payable Profit after tax (0.16) 1.24 (0.25) 0.99 (0.16) 1.94 (0.39) 1.55 (0.16) 3.34 (0.67) 2.67 (0.16) 1.44 (0.29) 1.15 Capital: Investment (6.00) 0.50 Net cash flow WACC @ 6% Present values (6.00) 1.000 (6.00) 0.99 0.943 0.94 1.55 0.890 1.38 2.67 0.840 2.24 1.65 0.792 1.31 NPV (0.13) Net present value is negative 0.13 million, and therefore the recommendation is that the BBB' project should be rejected. A new CFO has since joined the company and has indicated that there may be a problem with the above analysis. She is concerned that there are a few errors in the calculations and indeed that the wrong approach has been taken. She believes that an adjusted present value (APV) approach should have been taken, as the 'Beech Tree Buses (BBB) project is quite different from operating tourist hotels. Jimmy Jalopy (JJ') is a quoted company that operates in the bus tour business. JJ is financed by 22 million shares trading at 2.50 each and 10 million debt trading at 89 per 100. JJ's equity beta is estimated at 1-70. The current yield on government treasury bills is 1% and it is estimated that the average return on the market is 7%. JJ pays corporate taxation at a rate of 18%. The new CFO has found the working notes and assumptions used by the financial controller to compile his NPV assessment: Initial investment is 6 million; of this, 5.7 million relates to the purchase of tour buses, which are expected to be sold for 0.5 million when the project ceases. Tax allowable depreciation at 25% is available on the buses on a reducing balance basis. A balancing adjustment is available in the year the buses are sold. No tax allowable depreciation is available on the 0.3 million remaining investment and it will have a nil value at the end of the project. Incremental fixed costs of 0.5 million per annum have been ignored. These have not been accounted for as the financial controller believes them to be irrelevant. HTH uses either a nominal cost of capital of 9% or a real cost of capital of 6% to discount all projects, given that the general rate of inflation has been stable at 3% for several years. As the real cost of capital has been used to discount the cash flows, neither the revenue nor the direct costs have been inflated. It is estimated that the inflation rate applicable to sales revenue is 5% per annum, to direct costs is 3% per annum and to fixed costs is 1% per annum. At the beginning of each year, HTH will require to invest working capital equivalent to 10% of the anticipated revenue for the year. Any remaining working capital will be released at the end of the project. As the net movement in working capital is zero, it has been ignored in the net present value calculation. The Board plans to finance the BBB project by loan finance at a rate of 4% above the current yield on government treasury bills. This loan will be repaid in four equal annual instalments. Issue costs are estimated at 0.5% of the gross loan required and will be paid out of cash reserves. HTH pays corporate taxation on profits at a rate of 20%. Corporate taxation is payable in the same year as profits are earned. Required: . 1. Critically assess the work undertaken by the financial controller and the recommendation he made. (12 marks