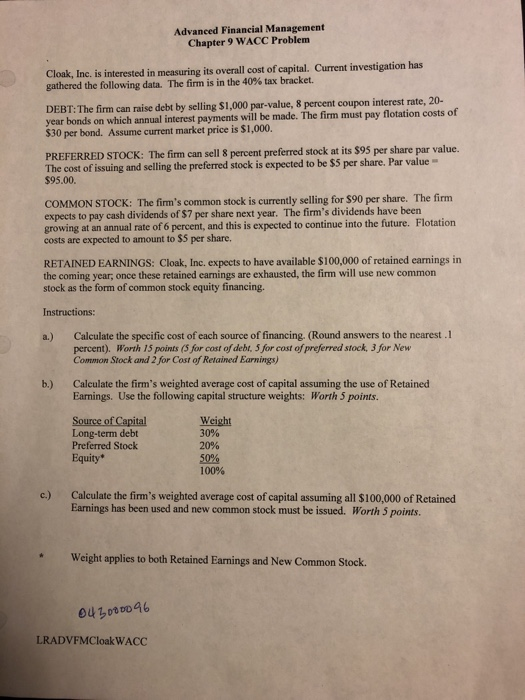

Advanced Financial Management Chapter 9 WACC Problem Cloak, Inc. is interested in measuring its overall cost of capital. Current investigation has gathered the following data. The firm is in the 40% tax bracket. DEBT: The firm can raise debt by selling $1,000 par-value, 8 percent coupon interest rate, 20- year bonds on which annual interest payments will be made. The firm must pay flotation costs of $30 per bond. Assume current market price is $1,000. PREFERRED STOCK: The firm can sell 8 percent preferred stock at its $95 per share par value. The cost of issuing and selling the preferred stock is expected to be $5 per share. Par value $95.00. COMMON STOCK: The firm's common stock is currently selling for $90 per share. The firm expects to pay cash dividends of $7 per share next year. The firm's dividends have been growing at an annual rate of 6 percent, and this is expected to continue into the future. Flotation costs are expected to amount to $5 per share. RETAINED EARNINGS: Cloak, Inc. expects to have available $100,000 of retained earnings in the coming year, once these retained earnings are exhausted, the firm will use new common stock as the form of common stock equity financing. Instructions: a.) Calculate the specific cost of each source of financing. (Round answers to the nearest .1 percent). Worth 15 points (5 for cost of debt. 5 for cost of preferred stock, 3 for New Common Stock and 2 for Cost of Retained Earnings) b.) Calculate the firm's weighted average cost of capital assuming the use of Retained Earnings. Use the following capital structure weights: Worth 5 points. Source of Capital Long-term debt Preferred Stock Equity Weight 30% 20% 50% 100% c.) Calculate the firm's weighted average cost of capital assuming all $100,000 of Retained Earnings has been used and new common stock must be issued. Worth 5 points. Weight applies to both Retained Earnings and New Common Stock. 643080096 LRADVFMCloak WACC Advanced Financial Management Chapter 9 WACC Problem Cloak, Inc. is interested in measuring its overall cost of capital. Current investigation has gathered the following data. The firm is in the 40% tax bracket. DEBT: The firm can raise debt by selling $1,000 par-value, 8 percent coupon interest rate, 20- year bonds on which annual interest payments will be made. The firm must pay flotation costs of $30 per bond. Assume current market price is $1,000. PREFERRED STOCK: The firm can sell 8 percent preferred stock at its $95 per share par value. The cost of issuing and selling the preferred stock is expected to be $5 per share. Par value $95.00. COMMON STOCK: The firm's common stock is currently selling for $90 per share. The firm expects to pay cash dividends of $7 per share next year. The firm's dividends have been growing at an annual rate of 6 percent, and this is expected to continue into the future. Flotation costs are expected to amount to $5 per share. RETAINED EARNINGS: Cloak, Inc. expects to have available $100,000 of retained earnings in the coming year, once these retained earnings are exhausted, the firm will use new common stock as the form of common stock equity financing. Instructions: a.) Calculate the specific cost of each source of financing. (Round answers to the nearest .1 percent). Worth 15 points (5 for cost of debt. 5 for cost of preferred stock, 3 for New Common Stock and 2 for Cost of Retained Earnings) b.) Calculate the firm's weighted average cost of capital assuming the use of Retained Earnings. Use the following capital structure weights: Worth 5 points. Source of Capital Long-term debt Preferred Stock Equity Weight 30% 20% 50% 100% c.) Calculate the firm's weighted average cost of capital assuming all $100,000 of Retained Earnings has been used and new common stock must be issued. Worth 5 points. Weight applies to both Retained Earnings and New Common Stock. 643080096 LRADVFMCloak WACC