Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ADVANCED MANAGEMENT ACCOUNTING Page 13 of 28 Question 3: Tipso Ltd. Is a company based in Poole. The company specialises in the manufacture of Sandwiches.

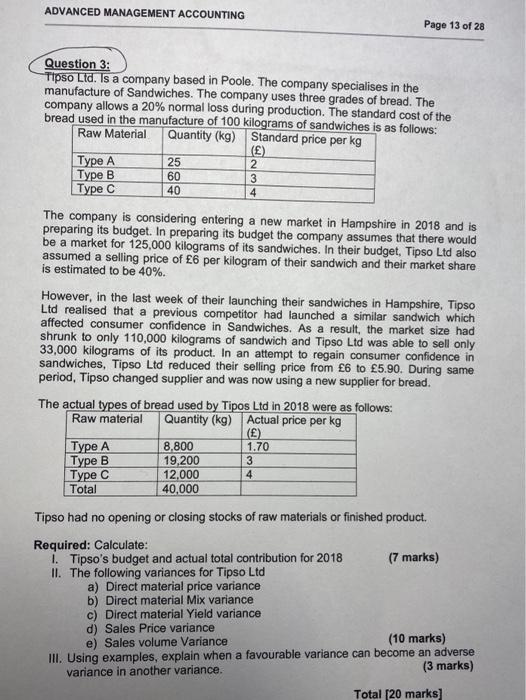

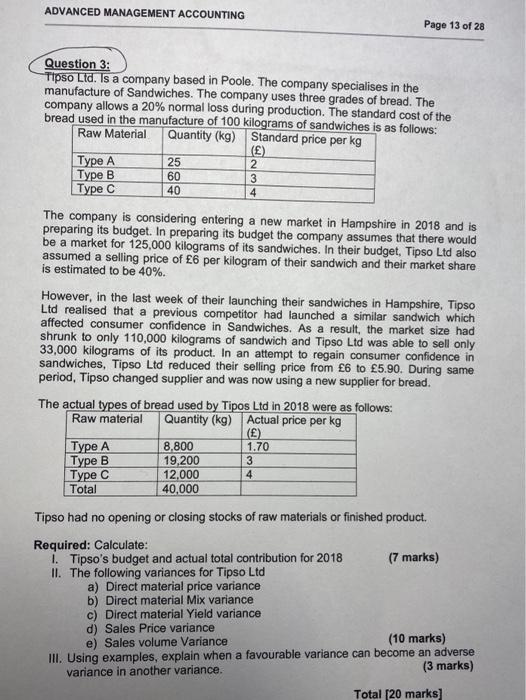

ADVANCED MANAGEMENT ACCOUNTING Page 13 of 28 Question 3: Tipso Ltd. Is a company based in Poole. The company specialises in the manufacture of Sandwiches. The company uses three grades of bread. The company allows a 20% normal loss during production. The standard cost of the bread used in the manufacture of 100 kilograms of sandwiches is as follows: Raw Material Quantity (kg) Standard price per kg () Type A 25 2 Type B 60 3 Type C 40 4 The company is considering entering a new market in Hampshire in 2018 and is preparing its budget. In preparing its budget the company assumes that there would be a market for 125,000 kilograms of its sandwiches. In their budget. Tipso Ltd also assumed a selling price of 6 per kilogram of their sandwich and their market share is estimated to be 40%. However, in the last week of their launching their sandwiches in Hampshire, Tipso Ltd realised that a previous competitor had launched a similar sandwich which affected consumer confidence in Sandwiches. As a result, the market size had shrunk to only 110,000 kilograms of sandwich and Tipso Ltd was able to sell only 33,000 kilograms of its product. In an attempt to regain consumer confidence in sandwiches, Tipso Ltd reduced their selling price from 6 to 5.90. During same period, Tipso changed supplier and was now using a new supplier for bread. The actual types of bread used by Tipos Ltd in 2018 were as follows: Raw material Quantity (kg) Actual price per kg () Type A 8.800 1.70 19,200 3 Type C 12.000 Total 40,000 | Type B 4 Tipso had no opening or closing stocks of raw materials or finished product. Required: Calculate: 1. Tipso's budget and actual total contribution for 2018 (7 marks) II. The following variances for Tipso Ltd a) Direct material price variance b) Direct material Mix variance c) Direct material Yield variance d) Sales Price variance e) Sales volume Variance (10 marks) III. Using examples, explain when a favourable variance can become an adverse variance in another variance. (3 marks) Total [20 marks]

ADVANCED MANAGEMENT ACCOUNTING Page 13 of 28 Question 3: Tipso Ltd. Is a company based in Poole. The company specialises in the manufacture of Sandwiches. The company uses three grades of bread. The company allows a 20% normal loss during production. The standard cost of the bread used in the manufacture of 100 kilograms of sandwiches is as follows: Raw Material Quantity (kg) Standard price per kg () Type A 25 2 Type B 60 3 Type C 40 4 The company is considering entering a new market in Hampshire in 2018 and is preparing its budget. In preparing its budget the company assumes that there would be a market for 125,000 kilograms of its sandwiches. In their budget. Tipso Ltd also assumed a selling price of 6 per kilogram of their sandwich and their market share is estimated to be 40%. However, in the last week of their launching their sandwiches in Hampshire, Tipso Ltd realised that a previous competitor had launched a similar sandwich which affected consumer confidence in Sandwiches. As a result, the market size had shrunk to only 110,000 kilograms of sandwich and Tipso Ltd was able to sell only 33,000 kilograms of its product. In an attempt to regain consumer confidence in sandwiches, Tipso Ltd reduced their selling price from 6 to 5.90. During same period, Tipso changed supplier and was now using a new supplier for bread. The actual types of bread used by Tipos Ltd in 2018 were as follows: Raw material Quantity (kg) Actual price per kg () Type A 8.800 1.70 19,200 3 Type C 12.000 Total 40,000 | Type B 4 Tipso had no opening or closing stocks of raw materials or finished product. Required: Calculate: 1. Tipso's budget and actual total contribution for 2018 (7 marks) II. The following variances for Tipso Ltd a) Direct material price variance b) Direct material Mix variance c) Direct material Yield variance d) Sales Price variance e) Sales volume Variance (10 marks) III. Using examples, explain when a favourable variance can become an adverse variance in another variance. (3 marks) Total [20 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started