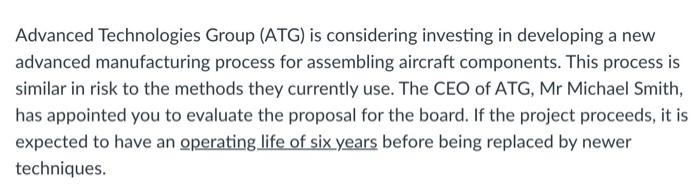

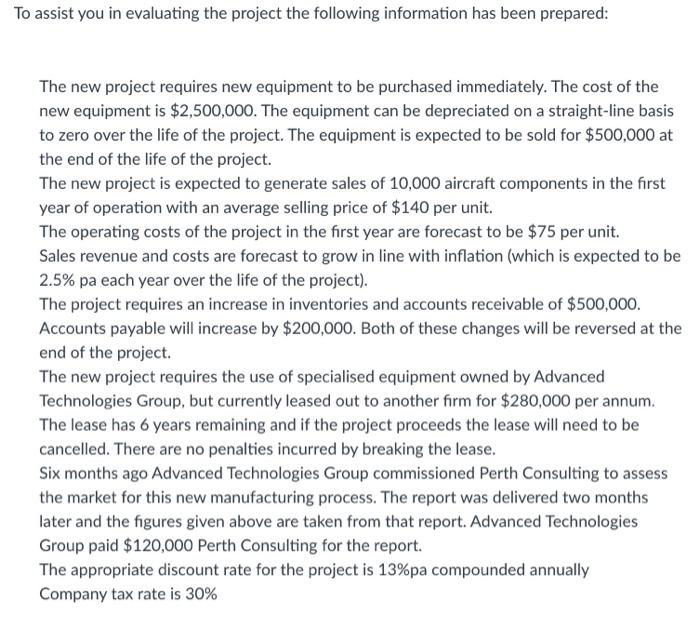

Advanced Technologies Group (ATG) is considering investing in developing a new advanced manufacturing process for assembling aircraft components. This process is similar in risk to the methods they currently use. The CEO of ATG, Mr Michael Smith, has appointed you to evaluate the proposal for the board. If the project proceeds, it is expected to have an operating life of six years before being replaced by newer techniques. To assist you in evaluating the project the following information has been prepared: The new project requires new equipment to be purchased immediately. The cost of the new equipment is $2,500,000. The equipment can be depreciated on a straight-line basis to zero over the life of the project. The equipment is expected to be sold for $500,000 at the end of the life of the project. The new project is expected to generate sales of 10,000 aircraft components in the first year of operation with an average selling price of $140 per unit. The operating costs of the project in the first year are forecast to be $75 per unit. Sales revenue and costs are forecast to grow in line with inflation (which is expected to be 2.5% pa each year over the life of the project). The project requires an increase in inventories and accounts receivable of $500,000. Accounts payable will increase by $200,000. Both of these changes will be reversed at the end of the project. The new project requires the use of specialised equipment owned by Advanced Technologies Group, but currently leased out to another form for $280,000 per annum. The lease has 6 years remaining and if the project proceeds the lease will need to be cancelled. There are no penalties incurred by breaking the lease. Six months ago Advanced Technologies Group commissioned Perth Consulting to assess the market for this new manufacturing process. The report was delivered two months later and the figures given above are taken from that report. Advanced Technologies Group paid $120,000 Perth Consulting for the report. The appropriate discount rate for the project is 13%pa compounded annually Company tax rate is 30% Question 1 10 pts Construct a table of the net cash flows for this project in Excel (being sure to label each column and row clearly). Make sure you also clearly show all the components of your cash flows. Note any items NOTE included in the cash flows. Once completed, cut and paste the table into the space below. Edit View Insert Format Tools Table 12ptParagraph A 2 > Tv : Question 2 2 pts What is the NPV of the project? Edit View Insert Format Tools Table Paragraph v BI U A U AVT ... Question 3 2 pts What is the IRR of the project? Edit View Insert Format Tools Table 12ptParagraph U A