Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Advanved Accounting, Ch. 10, #38 (LO 10-3, 10-4 8. Millager Company is a U.S.based multinational corporation with the U.S. dollar (USD) as its reporting currency.

Advanved Accounting, Ch. 10, #38 (LO 10-3, 10-4

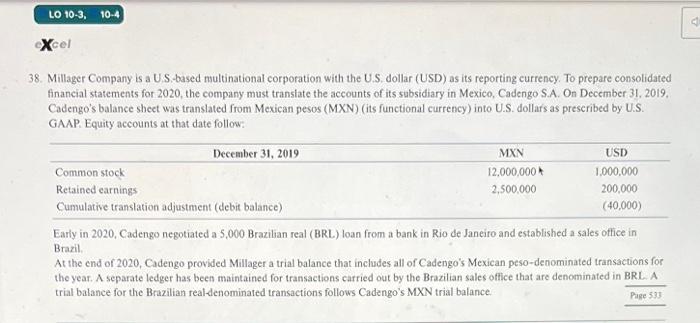

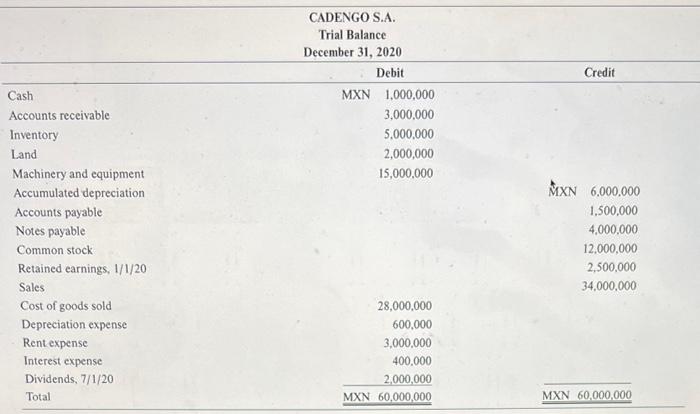

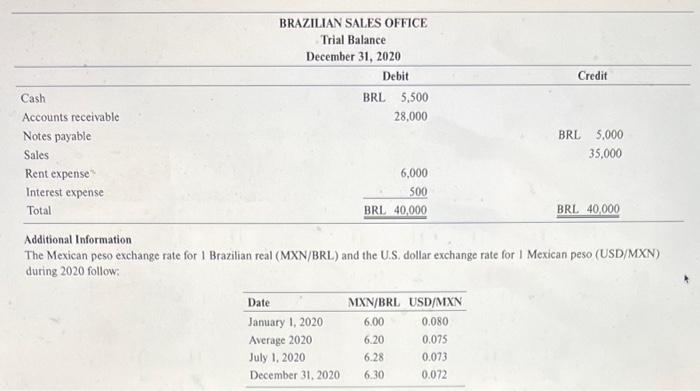

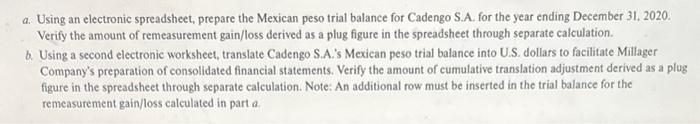

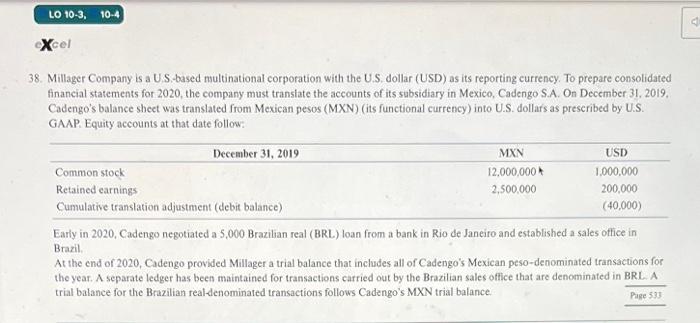

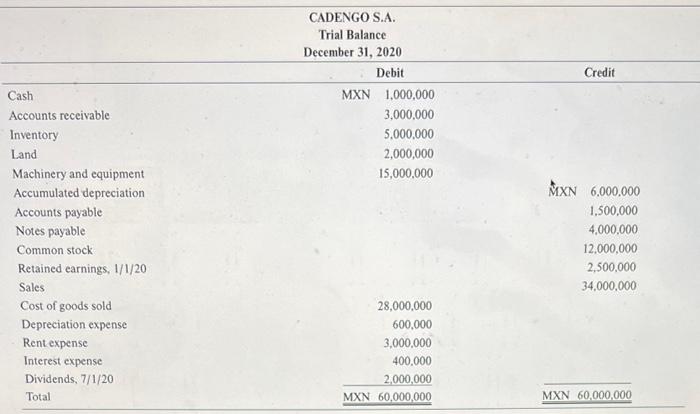

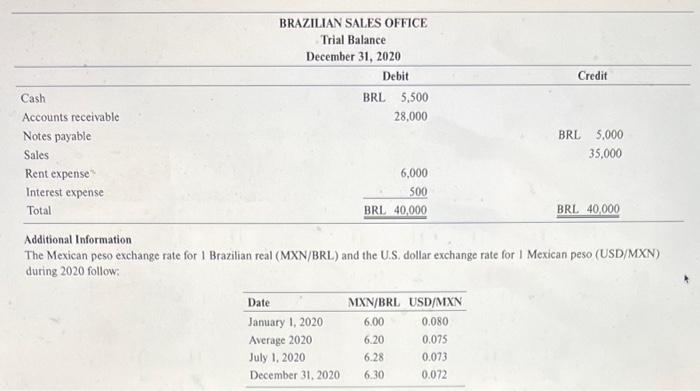

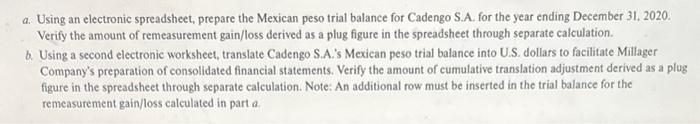

8. Millager Company is a U.S.based multinational corporation with the U.S. dollar (USD) as its reporting currency. To prepare consolidated financial statements for 2020, the company must translate the accounts of its subsidiary in Mexico, Cadengo S.A. On December 31. 2019. Cadengo's balance sheet was translated from Mexican pesos (MXN) (its functional currency) into U.S. dollars as prescribed by U.S. GAAP. Equity accounts at that date follow: Early in 2020, Cadengo negotiated a 5,000 Brazilian real (BRL) loan from a bank in Rio de Janeiro and established a sales office in Brazil. At the end of 2020, Cadengo provided Millager a trial balance that includes all of Cadengo's Mexican peso-denominated transactions for the year. A separate ledger has been maintained for transactions carried out by the Brazilian sales office that are denominated in BRL. A trial balance for the Brazilian real-denominated transactions follows Cadengo's MXN trial balance. Additional Information The Mexican peso exchange rate for I Brazilian real (MXN/BRL) and the U.S. dollar exchange rate for I Mexican peso (USD/MXN) during 2020 follow: a. Using an electronic spreadsheet, prepare the Mexican peso trial balance for Cadengo S.A. for the year ending December 31 . 2020 . Verify the amount of remeasurement gain/loss derived as a plug figure in the spreadsheet through separate calculation. b. Using a second electronic worksheet, translate Cadengo S.A.'s Mexican peso trial balance into U.S. dollars to facilitate Millager Company's preparation of consolidated financial statements. Verify the amount of cumulative translation adjustment derived as a plug figure in the spreadsheet through separate calculation. Note: An additional row must be inserted in the trial balance for the remeasurement gain/loss calculated in part a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started