Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Adventure Luggage Company makes two types of airline carry-on bags. One bag type designed to meet mass-market needs is constructed of durable polyester. The other

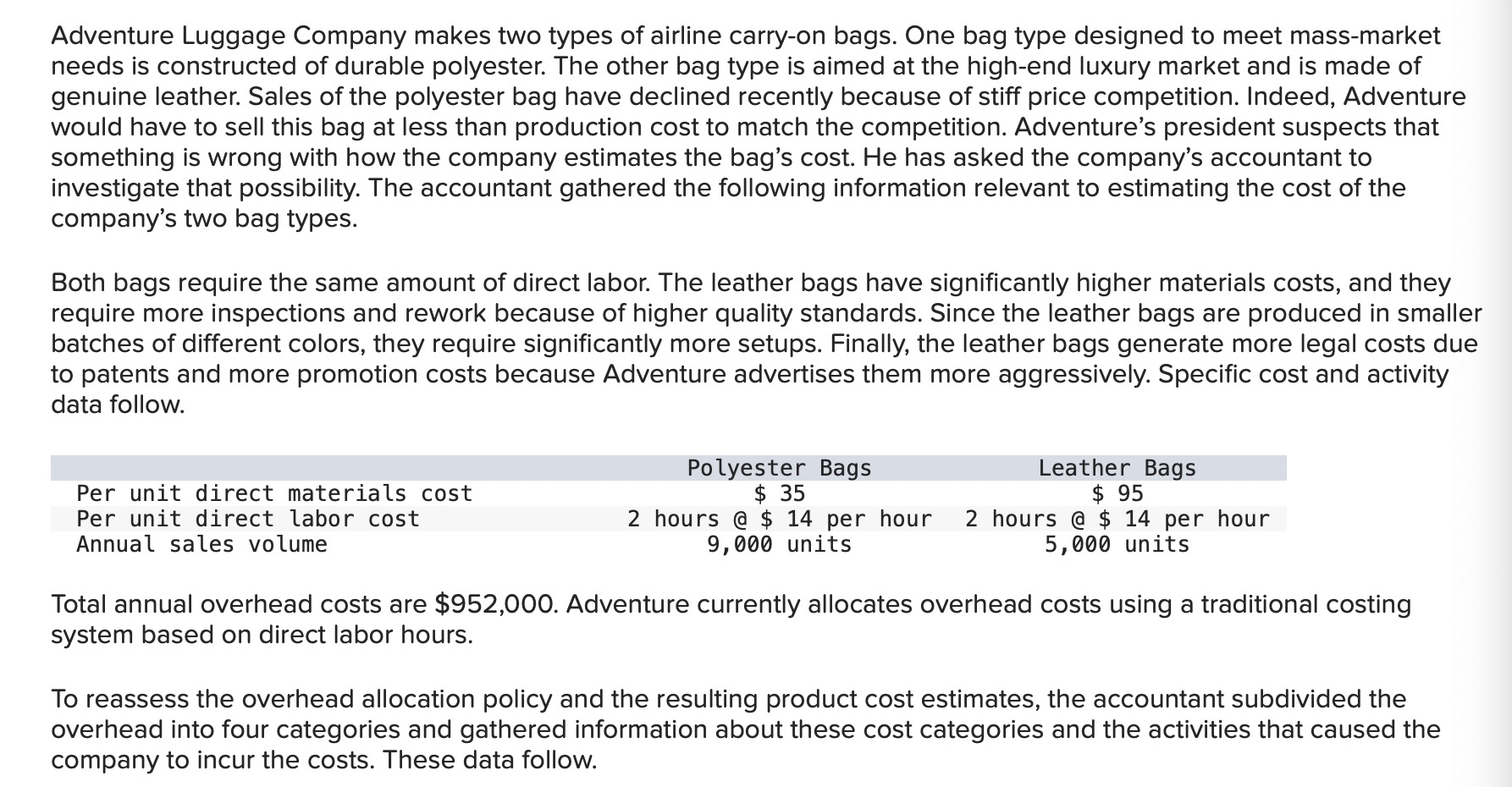

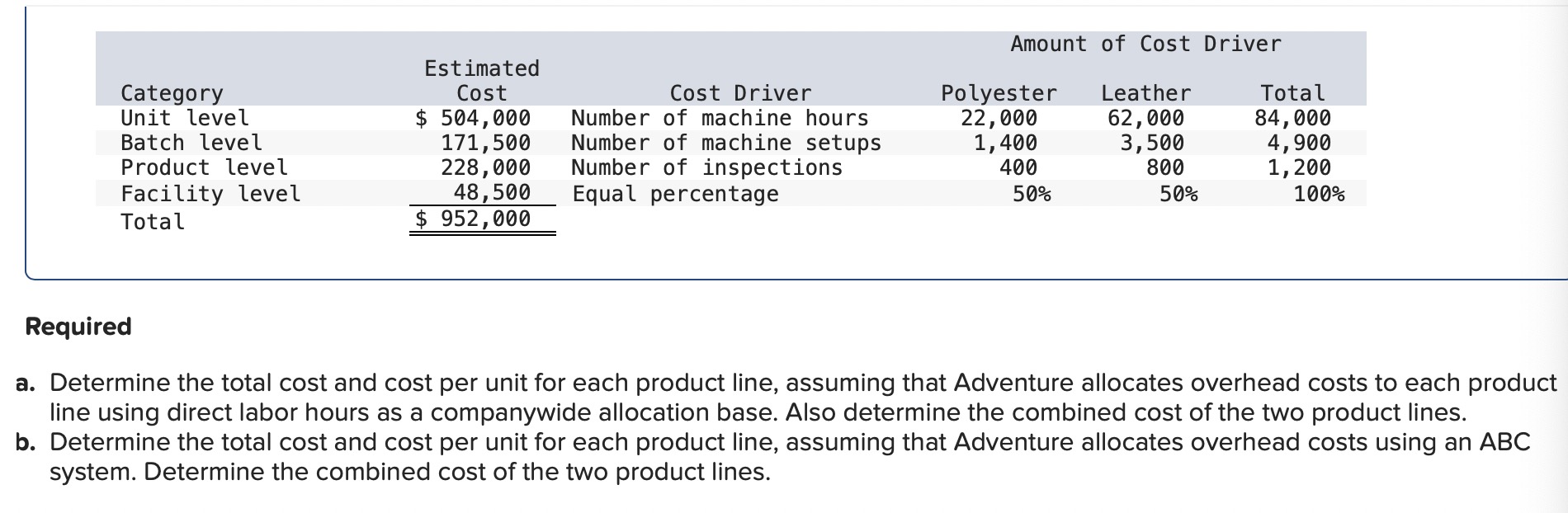

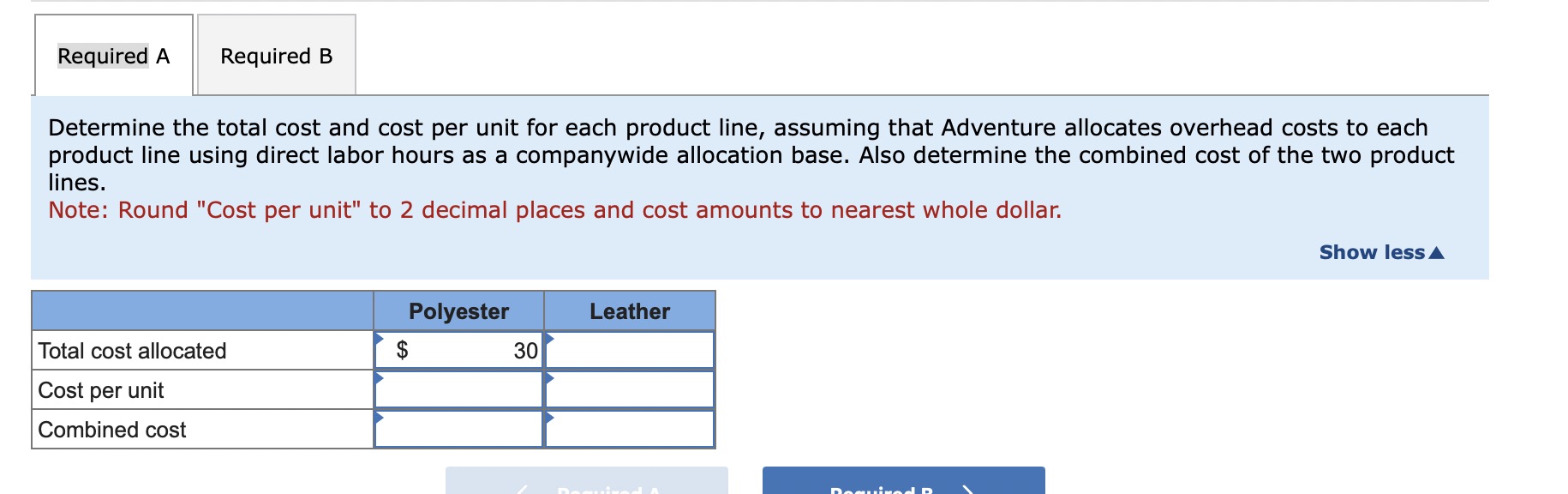

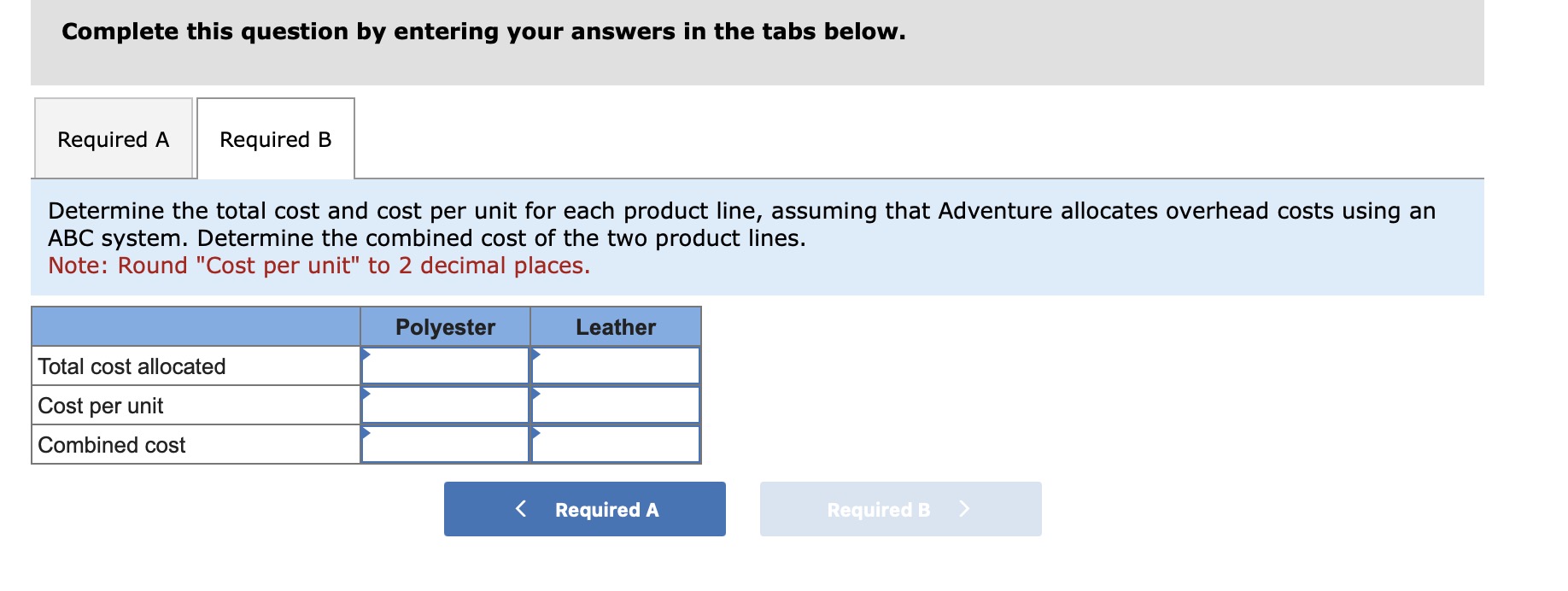

Adventure Luggage Company makes two types of airline carry-on bags. One bag type designed to meet mass-market needs is constructed of durable polyester. The other bag type is aimed at the high-end luxury market and is made of genuine leather. Sales of the polyester bag have declined recently because of stiff price competition. Indeed, Adventure would have to sell this bag at less than production cost to match the competition. Adventure's president suspects that something is wrong with how the company estimates the bag's cost. He has asked the company's accountant to investigate that possibility. The accountant gathered the following information relevant to estimating the cost of the company's two bag types. Both bags require the same amount of direct labor. The leather bags have significantly higher materials costs, and they require more inspections and rework because of higher quality standards. Since the leather bags are produced in smaller batches of different colors, they require significantly more setups. Finally, the leather bags generate more legal costs due to patents and more promotion costs because Adventure advertises them more aggressively. Specific cost and activity data follow. Total annual overhead costs are $952,000. Adventure currently allocates overhead costs using a traditional costing system based on direct labor hours. To reassess the overhead allocation policy and the resulting product cost estimates, the accountant subdivided the overhead into four categories and gathered information about these cost categories and the activities that caused the company to incur the costs. These data follow. Determine the total cost and cost per unit for each product line, assuming that Adventure allocates overhead costs to each product line using direct labor hours as a companywide allocation base. Also determine the combined cost of the two product lines. Determine the total cost and cost per unit for each product line, assuming that Adventure allocates overhead costs using an ABC system. Determine the combined cost of the two product lines. Determine the total cost and cost per unit for each product line, assuming that Adventure allocates overhead costs to each product line using direct labor hours as a companywide allocation base. Also determine the combined cost of the two product lines. Note: Round "Cost per unit" to 2 decimal places and cost amounts to nearest whole dollar. Complete this question by entering your answers in the tabs below. Determine the total cost and cost per unit for each product line, assuming that Adventure allocates overhead costs using an ABC system. Determine the combined cost of the two product lines. Note: Round "Cost per unit" to 2 decimal places. Adventure Luggage Company makes two types of airline carry-on bags. One bag type designed to meet mass-market needs is constructed of durable polyester. The other bag type is aimed at the high-end luxury market and is made of genuine leather. Sales of the polyester bag have declined recently because of stiff price competition. Indeed, Adventure would have to sell this bag at less than production cost to match the competition. Adventure's president suspects that something is wrong with how the company estimates the bag's cost. He has asked the company's accountant to investigate that possibility. The accountant gathered the following information relevant to estimating the cost of the company's two bag types. Both bags require the same amount of direct labor. The leather bags have significantly higher materials costs, and they require more inspections and rework because of higher quality standards. Since the leather bags are produced in smaller batches of different colors, they require significantly more setups. Finally, the leather bags generate more legal costs due to patents and more promotion costs because Adventure advertises them more aggressively. Specific cost and activity data follow. Total annual overhead costs are $952,000. Adventure currently allocates overhead costs using a traditional costing system based on direct labor hours. To reassess the overhead allocation policy and the resulting product cost estimates, the accountant subdivided the overhead into four categories and gathered information about these cost categories and the activities that caused the company to incur the costs. These data follow. Determine the total cost and cost per unit for each product line, assuming that Adventure allocates overhead costs to each product line using direct labor hours as a companywide allocation base. Also determine the combined cost of the two product lines. Determine the total cost and cost per unit for each product line, assuming that Adventure allocates overhead costs using an ABC system. Determine the combined cost of the two product lines. Determine the total cost and cost per unit for each product line, assuming that Adventure allocates overhead costs to each product line using direct labor hours as a companywide allocation base. Also determine the combined cost of the two product lines. Note: Round "Cost per unit" to 2 decimal places and cost amounts to nearest whole dollar. Complete this question by entering your answers in the tabs below. Determine the total cost and cost per unit for each product line, assuming that Adventure allocates overhead costs using an ABC system. Determine the combined cost of the two product lines. Note: Round "Cost per unit" to 2 decimal places

Adventure Luggage Company makes two types of airline carry-on bags. One bag type designed to meet mass-market needs is constructed of durable polyester. The other bag type is aimed at the high-end luxury market and is made of genuine leather. Sales of the polyester bag have declined recently because of stiff price competition. Indeed, Adventure would have to sell this bag at less than production cost to match the competition. Adventure's president suspects that something is wrong with how the company estimates the bag's cost. He has asked the company's accountant to investigate that possibility. The accountant gathered the following information relevant to estimating the cost of the company's two bag types. Both bags require the same amount of direct labor. The leather bags have significantly higher materials costs, and they require more inspections and rework because of higher quality standards. Since the leather bags are produced in smaller batches of different colors, they require significantly more setups. Finally, the leather bags generate more legal costs due to patents and more promotion costs because Adventure advertises them more aggressively. Specific cost and activity data follow. Total annual overhead costs are $952,000. Adventure currently allocates overhead costs using a traditional costing system based on direct labor hours. To reassess the overhead allocation policy and the resulting product cost estimates, the accountant subdivided the overhead into four categories and gathered information about these cost categories and the activities that caused the company to incur the costs. These data follow. Determine the total cost and cost per unit for each product line, assuming that Adventure allocates overhead costs to each product line using direct labor hours as a companywide allocation base. Also determine the combined cost of the two product lines. Determine the total cost and cost per unit for each product line, assuming that Adventure allocates overhead costs using an ABC system. Determine the combined cost of the two product lines. Determine the total cost and cost per unit for each product line, assuming that Adventure allocates overhead costs to each product line using direct labor hours as a companywide allocation base. Also determine the combined cost of the two product lines. Note: Round "Cost per unit" to 2 decimal places and cost amounts to nearest whole dollar. Complete this question by entering your answers in the tabs below. Determine the total cost and cost per unit for each product line, assuming that Adventure allocates overhead costs using an ABC system. Determine the combined cost of the two product lines. Note: Round "Cost per unit" to 2 decimal places. Adventure Luggage Company makes two types of airline carry-on bags. One bag type designed to meet mass-market needs is constructed of durable polyester. The other bag type is aimed at the high-end luxury market and is made of genuine leather. Sales of the polyester bag have declined recently because of stiff price competition. Indeed, Adventure would have to sell this bag at less than production cost to match the competition. Adventure's president suspects that something is wrong with how the company estimates the bag's cost. He has asked the company's accountant to investigate that possibility. The accountant gathered the following information relevant to estimating the cost of the company's two bag types. Both bags require the same amount of direct labor. The leather bags have significantly higher materials costs, and they require more inspections and rework because of higher quality standards. Since the leather bags are produced in smaller batches of different colors, they require significantly more setups. Finally, the leather bags generate more legal costs due to patents and more promotion costs because Adventure advertises them more aggressively. Specific cost and activity data follow. Total annual overhead costs are $952,000. Adventure currently allocates overhead costs using a traditional costing system based on direct labor hours. To reassess the overhead allocation policy and the resulting product cost estimates, the accountant subdivided the overhead into four categories and gathered information about these cost categories and the activities that caused the company to incur the costs. These data follow. Determine the total cost and cost per unit for each product line, assuming that Adventure allocates overhead costs to each product line using direct labor hours as a companywide allocation base. Also determine the combined cost of the two product lines. Determine the total cost and cost per unit for each product line, assuming that Adventure allocates overhead costs using an ABC system. Determine the combined cost of the two product lines. Determine the total cost and cost per unit for each product line, assuming that Adventure allocates overhead costs to each product line using direct labor hours as a companywide allocation base. Also determine the combined cost of the two product lines. Note: Round "Cost per unit" to 2 decimal places and cost amounts to nearest whole dollar. Complete this question by entering your answers in the tabs below. Determine the total cost and cost per unit for each product line, assuming that Adventure allocates overhead costs using an ABC system. Determine the combined cost of the two product lines. Note: Round "Cost per unit" to 2 decimal places Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started