advise board of directors on the following matters:

Whether the companys shares are currently fairly valued by the equity market (using the price earnings ratio and dividend yield methodologies);

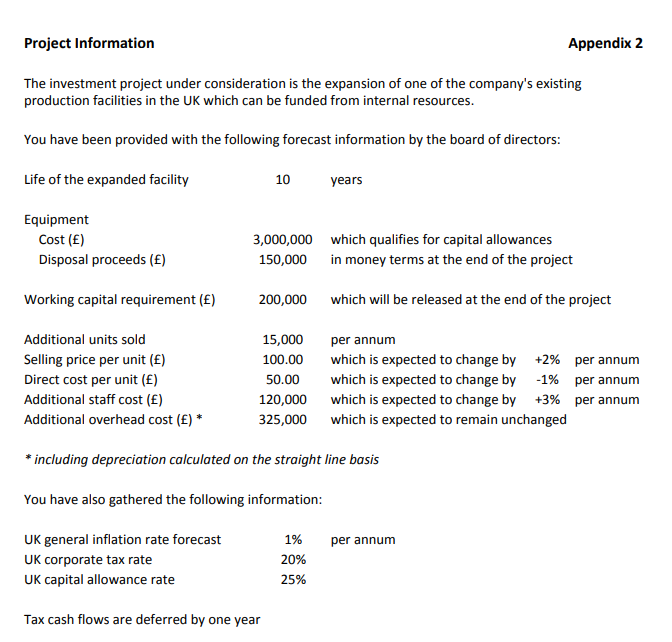

Whether the company should proceed with the expansion project which is under consideration by calculating its internal rate of return, payback period and net present value (using your estimate of its current weighted average cost of capital);

Whether the companys current capital structure is optimal and, if not, how it may be improved; and

Whether the companys dividend policy is optimal and, if not, how it may be improved.

Information about the company is provided below -

The company is a manufacturer whose shares and bonds trade on the London Stock Exchange.

Its shares are a constituent of the FTSE AllShare index.

It has historically only accepted projects with a payback period of less than 3 years.

You have the following data: (attached pics)

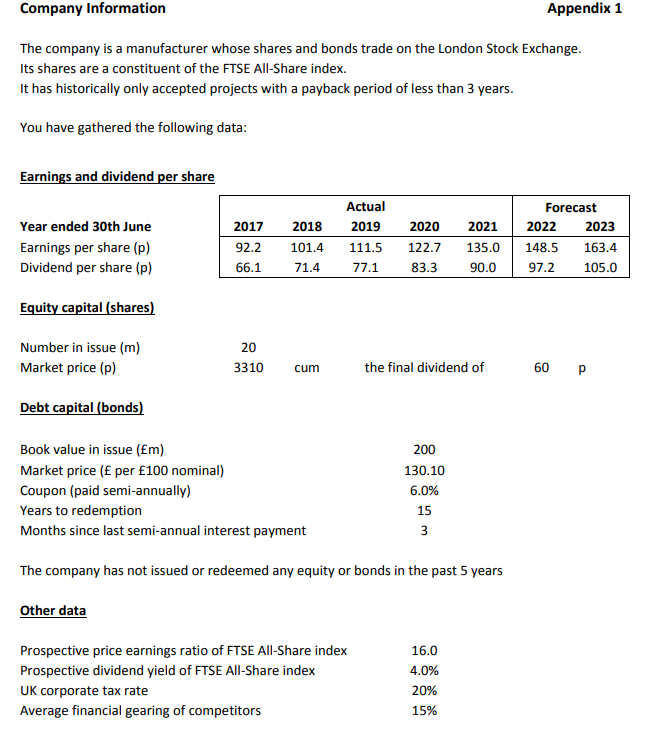

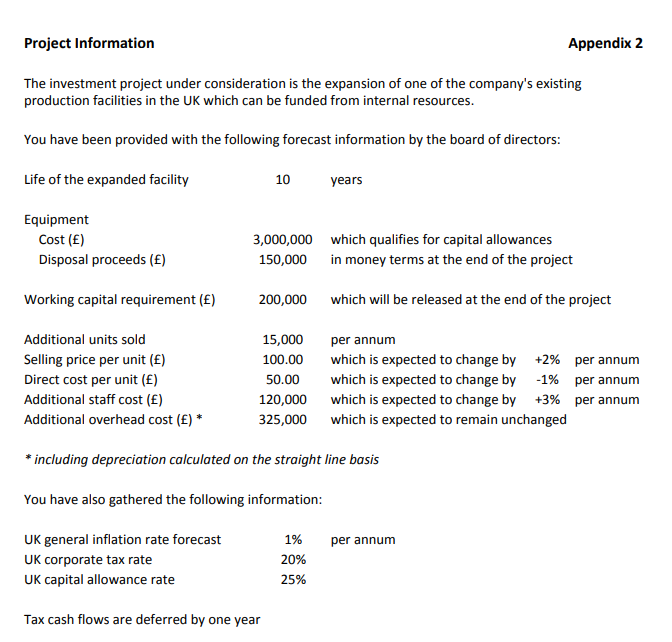

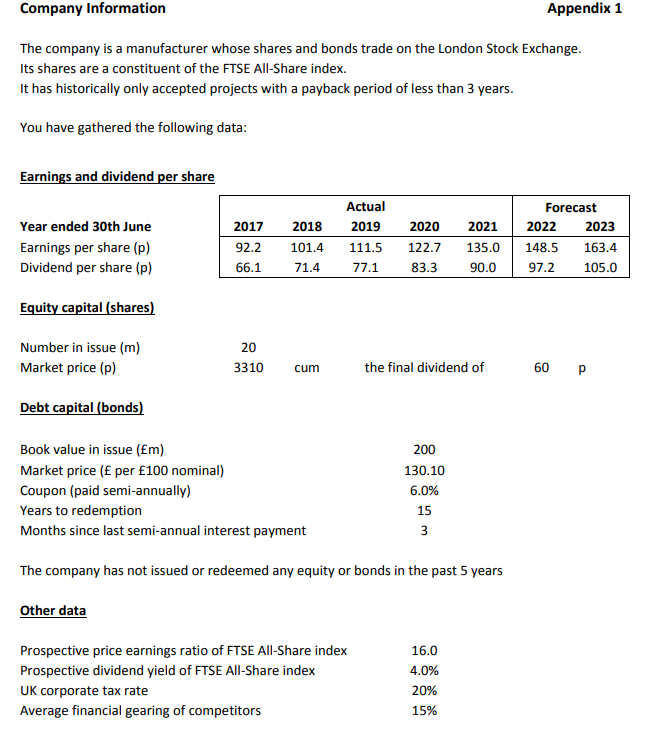

Company Information Appendix 1 The company is a manufacturer whose shares and bonds trade on the London Stock Exchange. Its shares are a constituent of the FTSE All-Share index. It has historically only accepted projects with a payback period of less than 3 years. You have gathered the following data: Earnings and dividend per share 2017 Year ended 30th June Earnings per share (p) Dividend per share (p) Actual 2019 111.5 77.1 2018 101.4 71.4 92.2 66.1 2020 122.7 83.3 Forecast 2022 2023 148.5 163.4 97.2 105.0 2021 135.0 90.0 Equity capital (shares) Number in issue (m) Market price (p) 20 3310 cum the final dividend of 60 Debt capital (bonds) Book value in issue (Em) Market price ( per 100 nominal) Coupon (paid semi-annually) Years to redemption Months since last semi-annual interest payment 200 130.10 6.0% 15 3 The company has not issued or redeemed any equity or bonds in the past 5 years Other data Prospective price earnings ratio of FTSE All-Share index Prospective dividend yield of FTSE All-Share index UK corporate tax rate Average financial gearing of competitors 16.0 4.0% 20% 15% Project Information Appendix 2 The investment project under consideration is the expansion of one of the company's existing production facilities in the UK which can be funded from internal resources. You have been provided with the following forecast information by the board of directors: Life of the expanded facility 10 years Equipment Cost () Disposal proceeds () 3,000,000 which qualifies for capital allowances 150,000 in money terms at the end of the project Working capital requirement (E) 200,000 which will be released at the end of the project Additional units sold Selling price per unit (E) Direct cost per unit (E) Additional staff cost () Additional overhead cost () * 15,000 per annum 100.00 which is expected to change by +2% per annum 50.00 which is expected to change by -1% per annum 120,000 which is expected to change by +3% per annum 325,000 which is expected to remain unchanged * including depreciation calculated on the straight line basis You have also gathered the following information: per annum UK general inflation rate forecast UK corporate tax rate UK capital allowance rate 1% 20% 25% Tax cash flows are deferred by one year Company Information Appendix 1 The company is a manufacturer whose shares and bonds trade on the London Stock Exchange. Its shares are a constituent of the FTSE All-Share index. It has historically only accepted projects with a payback period of less than 3 years. You have gathered the following data: Earnings and dividend per share 2017 Year ended 30th June Earnings per share (p) Dividend per share (p) Actual 2019 111.5 77.1 2018 101.4 71.4 92.2 66.1 2020 122.7 83.3 Forecast 2022 2023 148.5 163.4 97.2 105.0 2021 135.0 90.0 Equity capital (shares) Number in issue (m) Market price (p) 20 3310 cum the final dividend of 60 Debt capital (bonds) Book value in issue (Em) Market price ( per 100 nominal) Coupon (paid semi-annually) Years to redemption Months since last semi-annual interest payment 200 130.10 6.0% 15 3 The company has not issued or redeemed any equity or bonds in the past 5 years Other data Prospective price earnings ratio of FTSE All-Share index Prospective dividend yield of FTSE All-Share index UK corporate tax rate Average financial gearing of competitors 16.0 4.0% 20% 15% Project Information Appendix 2 The investment project under consideration is the expansion of one of the company's existing production facilities in the UK which can be funded from internal resources. You have been provided with the following forecast information by the board of directors: Life of the expanded facility 10 years Equipment Cost () Disposal proceeds () 3,000,000 which qualifies for capital allowances 150,000 in money terms at the end of the project Working capital requirement (E) 200,000 which will be released at the end of the project Additional units sold Selling price per unit (E) Direct cost per unit (E) Additional staff cost () Additional overhead cost () * 15,000 per annum 100.00 which is expected to change by +2% per annum 50.00 which is expected to change by -1% per annum 120,000 which is expected to change by +3% per annum 325,000 which is expected to remain unchanged * including depreciation calculated on the straight line basis You have also gathered the following information: per annum UK general inflation rate forecast UK corporate tax rate UK capital allowance rate 1% 20% 25% Tax cash flows are deferred by one year