Answered step by step

Verified Expert Solution

Question

1 Approved Answer

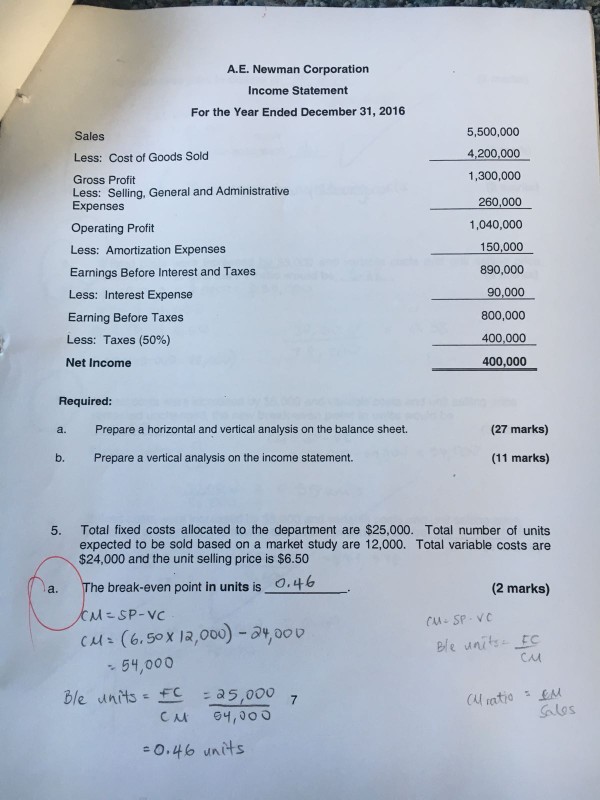

A.E. Newman Corporation Income Statement For the Year Ended December 31, 2016 5,500,000 4,200,000 1,300,000 Sales Less: Cost of Goods Sold Gross Profit Less: Selling,

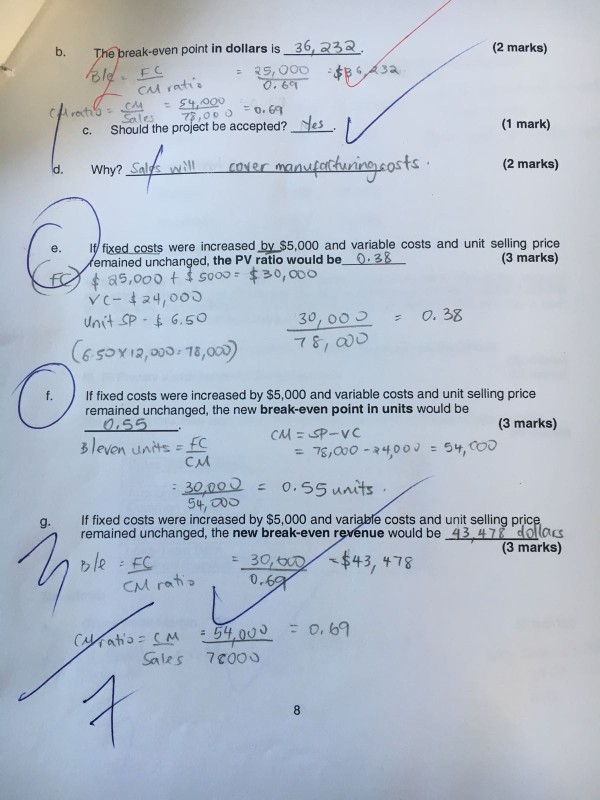

A.E. Newman Corporation Income Statement For the Year Ended December 31, 2016 5,500,000 4,200,000 1,300,000 Sales Less: Cost of Goods Sold Gross Profit Less: Selling, General and Administrative Expenses 1,040,000 Operating Profit Less: Amortization Expenses Earnings Before Interest and Taxes Less: Interest Expense Earning Before Taxes Less: Taxes (50%) Net Income 890,000 90,000 800,000 400,000 400,000 Required: a. Prepare a horizontal and vertical analysis on the balance sheet. b. Prepare a vertical analysis on the income statement. (27 marks) (11 marks) Total fixed costs allocated to the department are $25,000. Total number of units expected to be sold based on a market study are 12,000. Total variable costs are $24,000 and the unit selling price is $6.50 5. The break-even point in units is 0,46- (2 marks) a. SP-vc cu (6. 50x 12,000) %,000 C- SP VC CAu 54,000 ble units 5,000 7 alos e 0.46 units

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started