Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Aerial Company acquired land containing natural resources on January 1 that it planned to extract for $6 million. The amount allocated to the land

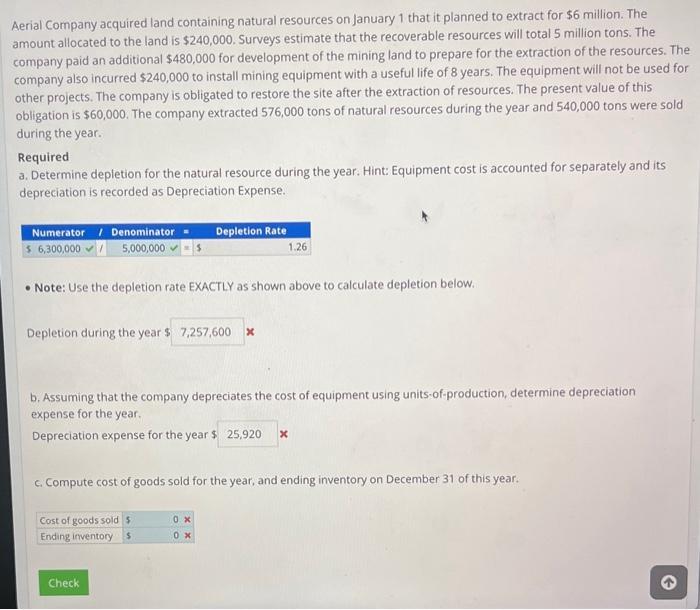

Aerial Company acquired land containing natural resources on January 1 that it planned to extract for $6 million. The amount allocated to the land is $240,000. Surveys estimate that the recoverable resources will total 5 million tons. The company paid an additional $480,000 for development of the mining land to prepare for the extraction of the resources. The company also incurred $240,000 to install mining equipment with a useful life of 8 years. The equipment will not be used for other projects. The company is obligated to restore the site after the extraction of resources. The present value of this obligation is $60,000. The company extracted 576,000 tons of natural resources during the year and 540,000 tons were sold during the year. Required a. Determine depletion for the natural resource during the year. Hint: Equipment cost is accounted for separately and its depreciation is recorded as Depreciation Expense. Numerator / Denominator = Depletion Rate $ 6,300,000 5,000,000 Note: Use the depletion rate EXACTLY as shown above to calculate depletion below. Depletion during the year $ 7,257,600 x b. Assuming that the company depreciates the cost of equipment using units-of-production, determine depreciation expense for the year. Depreciation expense for the year $ 25,920 x 1.26 c. Compute cost of goods sold for the year, and ending inventory on December 31 of this year. Cost of goods sold $ Ending inventory s Check ox 0x

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Depletion is a noncash expense that is used to allocate the cost of natural resources over the per...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started