Aeron Inc. purchased a 10-year bond from Beedle Company on 1/1/20X6. The bonds have a 6% annual interest rate and pay interest semi-annually on

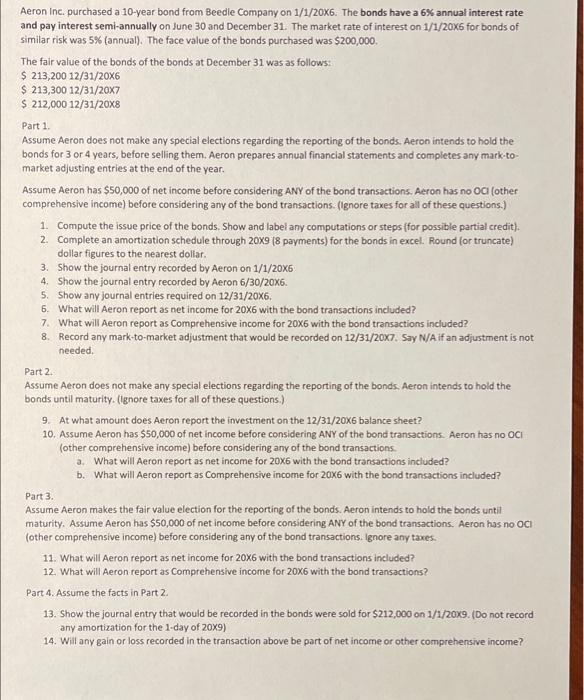

Aeron Inc. purchased a 10-year bond from Beedle Company on 1/1/20X6. The bonds have a 6% annual interest rate and pay interest semi-annually on June 30 and December 31. The market rate of interest on 1/1/20x6 for bonds of similar risk was 5% (annual). The face value of the bonds purchased was $200,000. The fair value of the bonds of the bonds at December 31 was as follows: $ 213,200 12/31/20x6 $ 213,300 12/31/20X7 $ 212,000 12/31/20x8 Part 1. Assume Aeron does not make any special elections regarding the reporting of the bonds. Aeron intends to hold the bonds for 3 or 4 years, before selling them. Aeron prepares annual financial statements and completes any mark-to- market adjusting entries at the end of the year. Assume Aeron has $50,000 of net income before considering ANY of the bond transactions. Aeron has no OCI (other comprehensive income) before considering any of the bond transactions. (Ignore taxes for all of these questions.) 1. Compute the issue price of the bonds. Show and label any computations or steps (for possible partial credit). 2. Complete an amortization schedule through 20X9 (8 payments) for the bonds in excel. Round (or truncate) dollar figures to the nearest dollar. 3. Show the journal entry recorded by Aeron on 1/1/20X6 4. Show the journal entry recorded by Aeron 6/30/20x6. 5. Show any journal entries required on 12/31/20x6. 6. What will Aeron report as net income for 20X6 with the bond transactions included? 7. What will Aeron report as Comprehensive income for 20X6 with the bond transactions included? 8. Record any mark-to-market adjustment that would be recorded on 12/31/2007. Say N/A if an adjustment is not needed. Part 2. Assume Aeron does not make any special elections regarding the reporting of the bonds. Aeron intends to hold the bonds until maturity. (Ignore taxes for all of these questions.) 9. At what amount does Aeron report the investment on the 12/31/20x6 balance sheet? 10. Assume Aeron has $50,000 of net income before considering ANY of the bond transactions. Aeron has no OCI (other comprehensive income) before considering any of the bond transactions. a. What will Aeron report as net income for 20x6 with the bond transactions included? b. What will Aeron report as Comprehensive income for 20X6 with the bond transactions included? Part 3. Assume Aeron makes the fair value election for the reporting of the bonds. Aeron intends to hold the bonds until maturity. Assume Aeron has $50,000 of net income before considering ANY of the bond transactions. Aeron has no OCI (other comprehensive income) before considering any of the bond transactions. Ignore any taxes. 11. What will Aeron report as net income for 20X6 with the bond transactions included? 12. What will Aeron report as Comprehensive income for 20X6 with the bond transactions? Part 4. Assume the facts in Part 2. 13. Show the journal entry that would be recorded in the bonds were sold for $212,000 on 1/1/20x9. (Do not record any amortization for the 1-day of 20X9) 14. Will any gain or loss recorded in the transaction above be part of net income or other comprehensive income?

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Depreciation Expense of Subsidary Cost 160000 087 vreful life Salavage value Straight line dep...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started