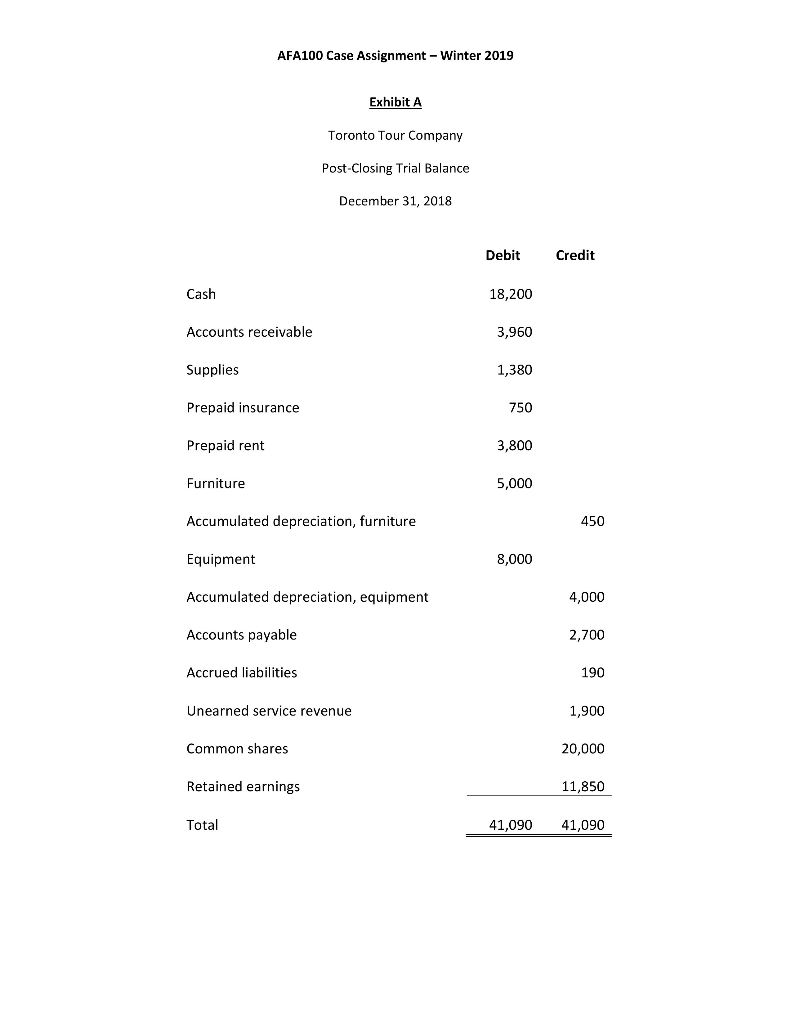

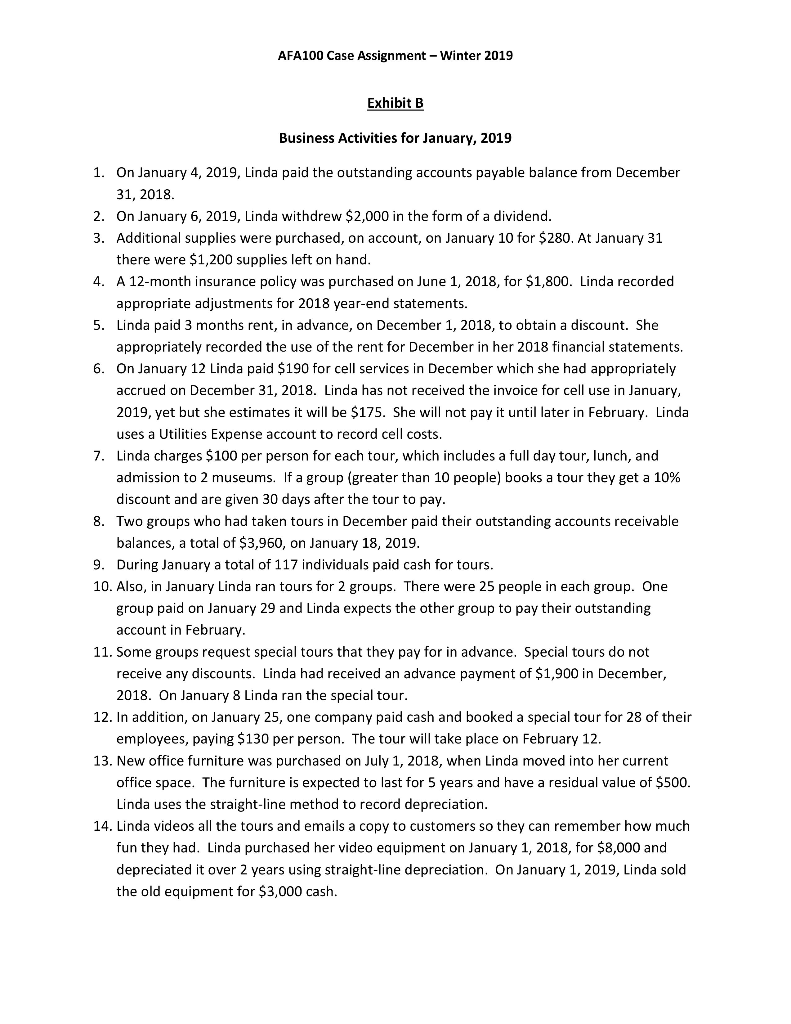

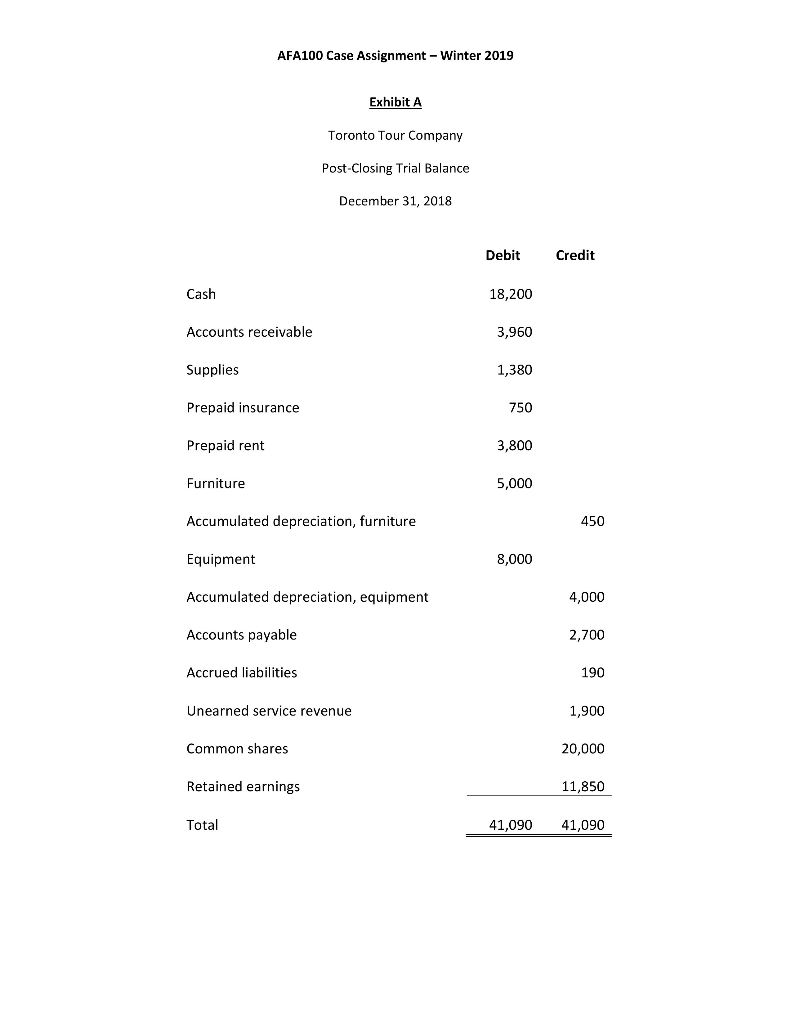

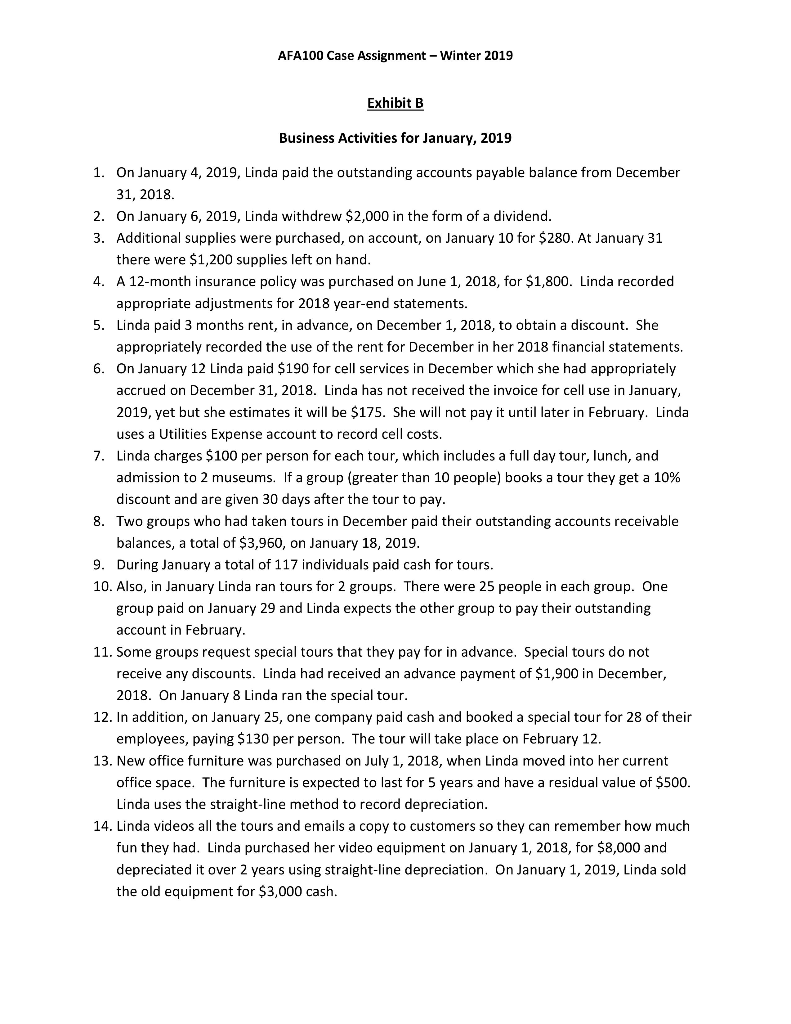

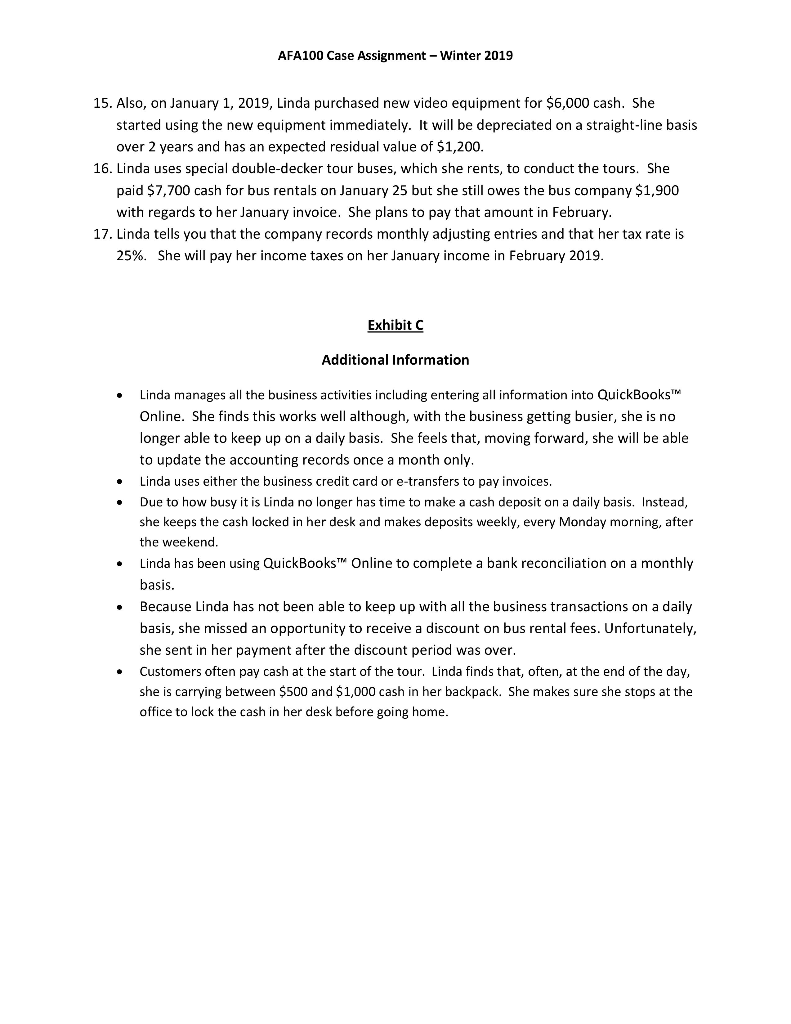

AFA100 Case Assignment-Winter 2019 The Toronto Tour Company (TTC) organizes tours of scenic and historic places of interest for visitors to Toronto, Ontario. The company was started by Linda Lee, whose parents moved from Shanghai, China, when Linda was 3 years old. Linda, as a teenager, was often responsible for taking her parent's friends, visiting from China, on tours of Toronto. Although Linda graduated from Ted Rogers' Marketing program in June, 2015, she was unable to find full time work. On January 1, 2018, Linda incorporated TTC as a private corporation. TTC has a December 31 year end and uses ASPE It is now February 4, 2019, and Linda would like to obtain a loan from the bank in order to expand. She knows that you are enrolled in AFA100 in Ted Rogers' School of Accounting and Finance and she asks you to prepare the financial statements for the month ended January 31, 2019. Linda did take accounting (she still remembers ACC100 from her 1st year at Ryerson!) so she has been keeping the accounting records up to December 31, 2018, but now she is too busy running the company to keep up. She provides you with her post-closing trial balance at December 31, 2018 (see Exhibit A). She has also provided a listing of business activities for January, 2019 (see Exhibit B) Linda is very confident about her 1st year of operations - she points out that she has $18,200 in the bank at December 31, 2018! She wants to keep her accounting system up to date so, in addition to the financial statements, she asks you to provide her with all your journal entries so that she can record them into QuickBooks Online. Finally, the bank is concerned that, as a small business, Linda may not have the necessary internal controls in place to protect the integrity of the financial information. Linda has provided you with some additional information (see Exhibit C) and asks that you prepare a memo to her which outlines any internal control weaknesses. This will help her get a better idea of how to improve her internal controls moving forward Required 1. Prepare the journal entries required for January, 2019, including any required adjusting entries. Provide appropriate explanations below each entry. The company prepares monthly adjusting entries Prepare the Statement of Financial Position, The Statement of Retained Earnings, and Statement of Earnings for January 31, 2019 Prepare a professional memo to Linda Lee outlining 2 internal control weaknesses Include an explanation of what can go wrong as a result of each weakness, and make recommendations on changes Linda can make to improve her internal controls in the future. Use the format provided (see the next page) 2. 3. Consult the course textbook, pages 320- 325, for guidance on internal controls AFA100 Case Assignment- Winter 2019 REQUIRED MEMO FORMAT: TO: FROM: DATE: RE: Short introductory paragraph to Linda Lee. Internal Control Weakness 1 Description of weakness: Explanation of what can go wrong as a result of the weakness Recommended change Internal Control Weakness Description of weakness: Explanation of what can go wrong as a result of the weakness Recommended change Short closing paragraph to Linda Lee AFA100 Case Assignment-Winter 2019 Exhibit A Toronto Tour Company Post-Closing Trial Balance December 31, 2018 Debit Credit 18,200 3,960 1,380 750 3,800 5,000 Accounts receivable Supplies Prepaid insurance Prepaid rent Furniture Accumulated depreciation, furniture Equipment Accumulated depreciation, equipment Accounts payable Accrued liabilities Unearned service revenue Common shares 450 8,000 4,000 2,700 190 1,900 20,000 11,850 41,09041,090 Retained earnings AFA100 Case Assignment - Winter 2019 Exhibit B Business Activities for January, 2019 1. On January 4, 2019, Linda paid the outstanding accounts payable balance from December 31, 2018 On January 6, 2019, Linda withdrew $2,000 in the form of a dividend Additional supplies were purchased, on account, on January 10 for $280. At January 31 there were $1,200 supplies left on hand A 12-month insurance policy was purchased on June 1, 2018, for $1,800. Linda recorded appropriate adjustments for 2018 year-end statements. Linda paid 3 months rent, in advance, on December 1, 2018, to obtain a discount. She appropriately recorded the use of the rent for December in her 2018 financial statements. On January 12 Linda paid $190 for cell services in December which she had appropriately accrued on December 31, 2018. Linda has not received the invoice for cell use in January 2019, yet but she estimates it will be $175. She wil not pay it until later in February. Linda uses a Utilities Expense account to record cell costs. Linda charges $100 per person for each tour, which includes a full day tour, lunch, and admission to 2 museums. If a group (greater than 10 people) books a tour they get a 10% discount and are given 30 days after the tour to pay Two groups who had taken tours in December paid their outstanding accounts receivable balances, a total of $3,960, on January 18, 2019 2. 3. 4. 5. 6. 7. 8. 9. During January a total of 117 individuals paid cash for tours. 10. Also, in January Linda ran tours for 2 groups. There were 25 people in each group. One group paid on January 29 and Linda expects the other group to pay their outstanding account in February 11. Some groups request special tours that they pay for in advance. Special tours do not receive any discounts. Linda had received an advance payment of $1,900 in December, 2018. On January 8 Linda ran the special tour 12. In addition, on January 25, one company paid cash and booked a special tour for 28 of their employees, paying $130 per person. The tour will take place on February 12 13. New office furniture was purchased on July 1, 2018, when Linda moved into her current office space. The furniture is expected to last for 5 years and have a residual value of $500 Linda uses the straight-line method to record depreciation 14. Linda videos all the tours and emails a copy to customers so they can remember how much fun they had. Linda purchased her video equipment on January 1, 2018, for $8,000 and depreciated it over 2 years using straight-line depreciation. On January 1, 2019, Linda sold the old equipment for $3,000 cash AFA100 Case Assignment -Winter 2019 15. Also, on January 1, 2019, Linda purchased new video equipment for $6,000 cash. She started using the new equipment immediately. It will be depreciated on a straight-line basis over 2 years and has an expected residual value of $1,200. 16. Linda uses special double-decker tour buses, which she rents, to conduct the tours. She paid $7,700 cash for bus rentals on January 25 but she still owes the bus company $1,900 with regards to her January invoice. She plans to pay that amount in February. 17. Linda tells you that the company records monthly adjusting entries and that her tax rate is 25%. She will pay her income taxes on her January income in February 2019. Exhibit C Additional Information Linda manages all the business activities including entering all information into QuickBooks1" Online. She finds this works well although, with the business getting busier, she is no longer able to keep up on a daily basis. She feels that, moving forward, she wll be able to update the accounting records once a month only Linda uses either the business credit card or e-transfers to pay invoices Due to how busy it is Linda no longer has time to make a cash deposit on a daily basis. Instead she keeps the cash locked in her desk and makes deposits weekly, every Monday morning, after the weekend Linda has been using QuickBooksT" Online to complete a bank reconciliation on a monthly basis. Because Linda has not been able to keep up with all the business transactions on a daily basis, she missed an opportunity to receive a discount on bus rental fees. Unfortunately, she sent in her payment after the discount period was over Customers often pay cash at the start of the tour. Linda finds that, often, at the end of the day, she is carrying between $500 and $1,000 cash in her backpack. She makes sure she stops at the office to lock the cash in her desk before going home. AFA100 Case Assignment-Winter 2019 The Toronto Tour Company (TTC) organizes tours of scenic and historic places of interest for visitors to Toronto, Ontario. The company was started by Linda Lee, whose parents moved from Shanghai, China, when Linda was 3 years old. Linda, as a teenager, was often responsible for taking her parent's friends, visiting from China, on tours of Toronto. Although Linda graduated from Ted Rogers' Marketing program in June, 2015, she was unable to find full time work. On January 1, 2018, Linda incorporated TTC as a private corporation. TTC has a December 31 year end and uses ASPE It is now February 4, 2019, and Linda would like to obtain a loan from the bank in order to expand. She knows that you are enrolled in AFA100 in Ted Rogers' School of Accounting and Finance and she asks you to prepare the financial statements for the month ended January 31, 2019. Linda did take accounting (she still remembers ACC100 from her 1st year at Ryerson!) so she has been keeping the accounting records up to December 31, 2018, but now she is too busy running the company to keep up. She provides you with her post-closing trial balance at December 31, 2018 (see Exhibit A). She has also provided a listing of business activities for January, 2019 (see Exhibit B) Linda is very confident about her 1st year of operations - she points out that she has $18,200 in the bank at December 31, 2018! She wants to keep her accounting system up to date so, in addition to the financial statements, she asks you to provide her with all your journal entries so that she can record them into QuickBooks Online. Finally, the bank is concerned that, as a small business, Linda may not have the necessary internal controls in place to protect the integrity of the financial information. Linda has provided you with some additional information (see Exhibit C) and asks that you prepare a memo to her which outlines any internal control weaknesses. This will help her get a better idea of how to improve her internal controls moving forward Required 1. Prepare the journal entries required for January, 2019, including any required adjusting entries. Provide appropriate explanations below each entry. The company prepares monthly adjusting entries Prepare the Statement of Financial Position, The Statement of Retained Earnings, and Statement of Earnings for January 31, 2019 Prepare a professional memo to Linda Lee outlining 2 internal control weaknesses Include an explanation of what can go wrong as a result of each weakness, and make recommendations on changes Linda can make to improve her internal controls in the future. Use the format provided (see the next page) 2. 3. Consult the course textbook, pages 320- 325, for guidance on internal controls AFA100 Case Assignment- Winter 2019 REQUIRED MEMO FORMAT: TO: FROM: DATE: RE: Short introductory paragraph to Linda Lee. Internal Control Weakness 1 Description of weakness: Explanation of what can go wrong as a result of the weakness Recommended change Internal Control Weakness Description of weakness: Explanation of what can go wrong as a result of the weakness Recommended change Short closing paragraph to Linda Lee AFA100 Case Assignment-Winter 2019 Exhibit A Toronto Tour Company Post-Closing Trial Balance December 31, 2018 Debit Credit 18,200 3,960 1,380 750 3,800 5,000 Accounts receivable Supplies Prepaid insurance Prepaid rent Furniture Accumulated depreciation, furniture Equipment Accumulated depreciation, equipment Accounts payable Accrued liabilities Unearned service revenue Common shares 450 8,000 4,000 2,700 190 1,900 20,000 11,850 41,09041,090 Retained earnings AFA100 Case Assignment - Winter 2019 Exhibit B Business Activities for January, 2019 1. On January 4, 2019, Linda paid the outstanding accounts payable balance from December 31, 2018 On January 6, 2019, Linda withdrew $2,000 in the form of a dividend Additional supplies were purchased, on account, on January 10 for $280. At January 31 there were $1,200 supplies left on hand A 12-month insurance policy was purchased on June 1, 2018, for $1,800. Linda recorded appropriate adjustments for 2018 year-end statements. Linda paid 3 months rent, in advance, on December 1, 2018, to obtain a discount. She appropriately recorded the use of the rent for December in her 2018 financial statements. On January 12 Linda paid $190 for cell services in December which she had appropriately accrued on December 31, 2018. Linda has not received the invoice for cell use in January 2019, yet but she estimates it will be $175. She wil not pay it until later in February. Linda uses a Utilities Expense account to record cell costs. Linda charges $100 per person for each tour, which includes a full day tour, lunch, and admission to 2 museums. If a group (greater than 10 people) books a tour they get a 10% discount and are given 30 days after the tour to pay Two groups who had taken tours in December paid their outstanding accounts receivable balances, a total of $3,960, on January 18, 2019 2. 3. 4. 5. 6. 7. 8. 9. During January a total of 117 individuals paid cash for tours. 10. Also, in January Linda ran tours for 2 groups. There were 25 people in each group. One group paid on January 29 and Linda expects the other group to pay their outstanding account in February 11. Some groups request special tours that they pay for in advance. Special tours do not receive any discounts. Linda had received an advance payment of $1,900 in December, 2018. On January 8 Linda ran the special tour 12. In addition, on January 25, one company paid cash and booked a special tour for 28 of their employees, paying $130 per person. The tour will take place on February 12 13. New office furniture was purchased on July 1, 2018, when Linda moved into her current office space. The furniture is expected to last for 5 years and have a residual value of $500 Linda uses the straight-line method to record depreciation 14. Linda videos all the tours and emails a copy to customers so they can remember how much fun they had. Linda purchased her video equipment on January 1, 2018, for $8,000 and depreciated it over 2 years using straight-line depreciation. On January 1, 2019, Linda sold the old equipment for $3,000 cash AFA100 Case Assignment -Winter 2019 15. Also, on January 1, 2019, Linda purchased new video equipment for $6,000 cash. She started using the new equipment immediately. It will be depreciated on a straight-line basis over 2 years and has an expected residual value of $1,200. 16. Linda uses special double-decker tour buses, which she rents, to conduct the tours. She paid $7,700 cash for bus rentals on January 25 but she still owes the bus company $1,900 with regards to her January invoice. She plans to pay that amount in February. 17. Linda tells you that the company records monthly adjusting entries and that her tax rate is 25%. She will pay her income taxes on her January income in February 2019. Exhibit C Additional Information Linda manages all the business activities including entering all information into QuickBooks1" Online. She finds this works well although, with the business getting busier, she is no longer able to keep up on a daily basis. She feels that, moving forward, she wll be able to update the accounting records once a month only Linda uses either the business credit card or e-transfers to pay invoices Due to how busy it is Linda no longer has time to make a cash deposit on a daily basis. Instead she keeps the cash locked in her desk and makes deposits weekly, every Monday morning, after the weekend Linda has been using QuickBooksT" Online to complete a bank reconciliation on a monthly basis. Because Linda has not been able to keep up with all the business transactions on a daily basis, she missed an opportunity to receive a discount on bus rental fees. Unfortunately, she sent in her payment after the discount period was over Customers often pay cash at the start of the tour. Linda finds that, often, at the end of the day, she is carrying between $500 and $1,000 cash in her backpack. She makes sure she stops at the office to lock the cash in her desk before going home