Answered step by step

Verified Expert Solution

Question

1 Approved Answer

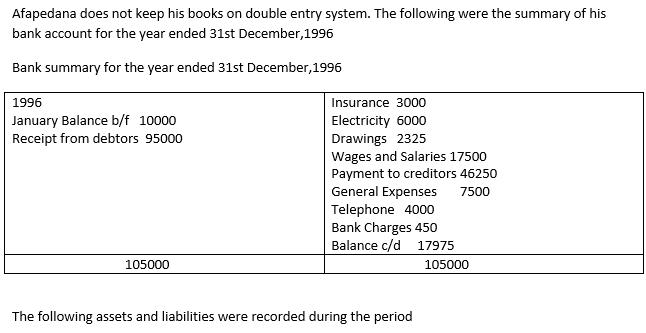

Afapedana does not keep his books on double entry system. The following were the summary of his bank account for the year ended 31st

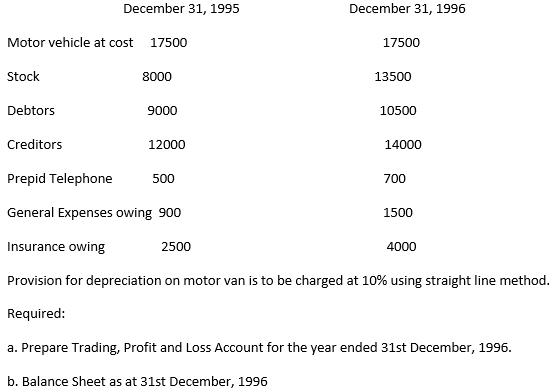

Afapedana does not keep his books on double entry system. The following were the summary of his bank account for the year ended 31st December, 1996 Bank summary for the year ended 31st December, 1996 1996 January Balance b/f 10000 Receipt from debtors 95000 105000 Insurance 3000 Electricity 6000 Drawings 2325 Wages and Salaries 17500 Payment to creditors 46250 General Expenses 7500 Telephone 4000 Bank Charges 450 Balance c/d 17975 The following assets and liabilities were recorded during the period 105000 Motor vehicle at cost 17500 Stock Debtors December 31, 1995 Creditors 8000 9000 12000 December 31, 1996 2500 17500 13500 10500 14000 Prepid Telephone 500 General Expenses owing 900 Insurance owing Provision for depreciation on motor van is to be charged at 10% using straight line method. Required: a. Prepare Trading, Profit and Loss Account for the year ended 31st December, 1996. b. Balance Sheet as at 31st December, 1996 700 1500 4000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started