Answered step by step

Verified Expert Solution

Question

1 Approved Answer

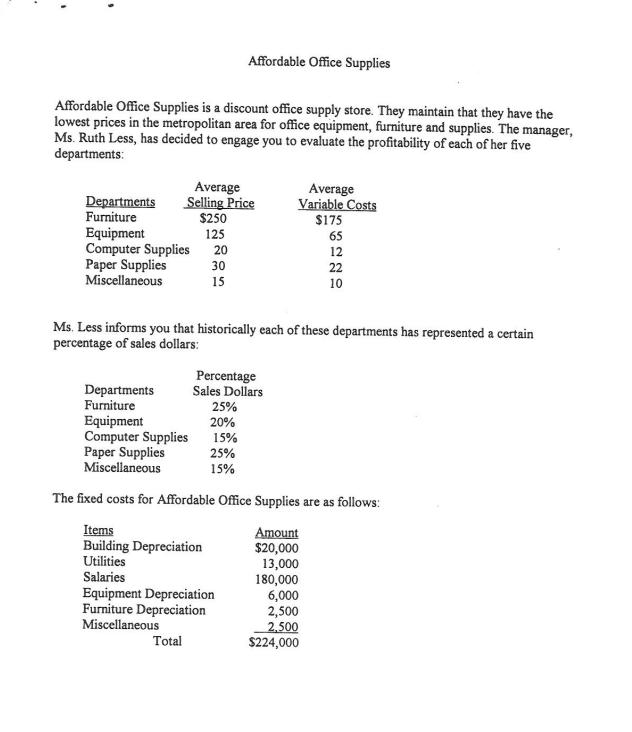

Affordable Office Supplies Affordable Office Supplies is a discount office supply store. They maintain that they have the lowest prices in the metropolitan area

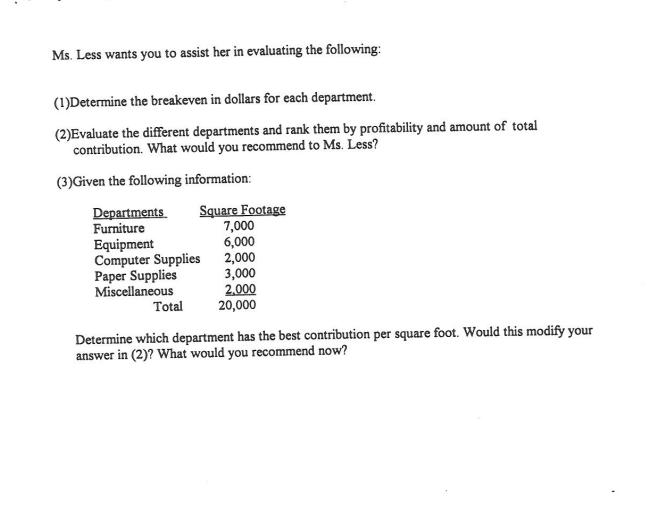

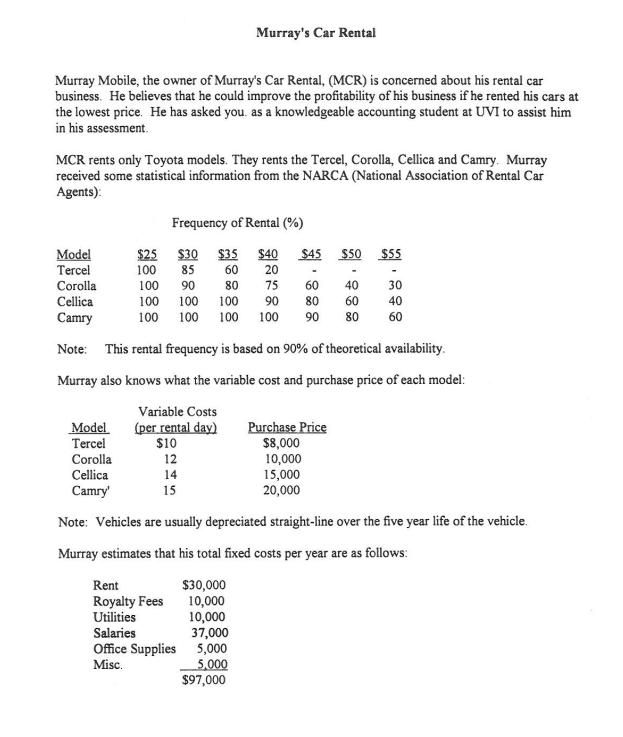

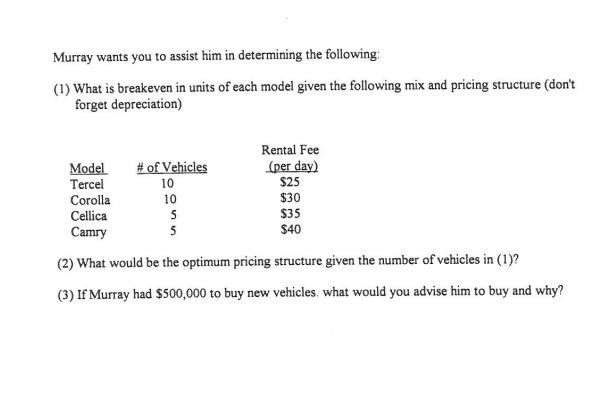

Affordable Office Supplies Affordable Office Supplies is a discount office supply store. They maintain that they have the lowest prices in the metropolitan area for office equipment, furniture and supplies. The manager, Ms. Ruth Less, has decided to engage you to evaluate the profitability of each of her five departments: Average Selling Price $250 125 Departments Furniture Equipment Computer Supplies Paper Supplies Miscellaneous 20 30 15 Ms. Less informs you that historically each of these departments has represented a certain percentage of sales dollars: Percentage Sales Dollars Items Building Depreciation Utilities Salaries Departments Furniture Equipment Computer Supplies Paper Supplies Miscellaneous The fixed costs for Affordable Office Supplies are as follows: Amount $20,000 Average Variable Costs $175 65 12 22 10 25% 20% 15% 25% 15% Equipment Depreciation Furniture Depreciation Miscellaneous Total 13,000 180,000 6,000 2,500 2,500 $224,000 Ms. Less wants you to assist her in evaluating the following: (1)Determine the breakeven in dollars for each department. (2)Evaluate the different departments and rank them by profitability and amount of total contribution. What would you recommend to Ms. Less? (3) Given the following information: Departments Furniture Square Footage 7,000 6,000 2,000 Equipment Computer Supplies Paper Supplies Miscellaneous 3,000 2.000 20,000 Total Determine which department has the best contribution per square foot. Would this modify your answer in (2)? What would you recommend now? Murray Mobile, the owner of Murray's Car Rental, (MCR) is concerned about his rental car business. He believes that he could improve the profitability of his business if he rented his cars at the lowest price. He has asked you. as a knowledgeable accounting student at UVI to assist him in his assessment. MCR rents only Toyota models. They rents the Tercel, Corolla, Cellica and Camry. Murray received some statistical information from the NARCA (National Association of Rental Car Agents): Corolla Cellica Camry' Frequency of Rental (%) $25 $30 $35 $40 $45 $50 $55 100 85 60 20 100 90 80 75 60 40 30 100 100 100 90 80 60 40 100 100 100 100 90 80 60 Model Tercel Corolla Cellica Camry Note: This rental frequency is based on 90% of theoretical availability. Murray also knows what the variable cost and purchase price of each model: Variable Costs Model (per rental day) Tercel $10 12 14 15 Murray's Car Rental Rent Royalty Fees Utilities Salaries Note: Vehicles are usually depreciated straight-line over the five year life of the vehicle. Murray estimates that his total fixed costs per year are as follows: Office Supplies Misc. $30,000 10,000 10,000 37,000 5,000 5,000 $97,000 Purchase Price $8,000 10,000 15,000 20,000 Murray wants you to assist him in determining the following: (1) What is breakeven in units of each model given the following mix and pricing structure (don't forget depreciation) Model Tercel Corolla Cellica Camry # of Vehicles 10 10 5 5 Rental Fee (per day) $25 $30 $35 $40 (2) What would be the optimum pricing structure given the number of vehicles in (1)? (3) If Murray had $500,000 to buy new vehicles, what would you advise him to buy and why?

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 The breakeven point for each department can be calculated using the following formula Breakeven po...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started